Business Update - Sea Limited: First Full-Year of GAAP Income

Exceptional execution in Garena, Shopee and 'Monee'. Group grew revenue and Adj. EBITDA by 30% and 136% to an annualized level of ~$20B and ~$3.6B. EV: $93B

Hi, sleep-well investors,

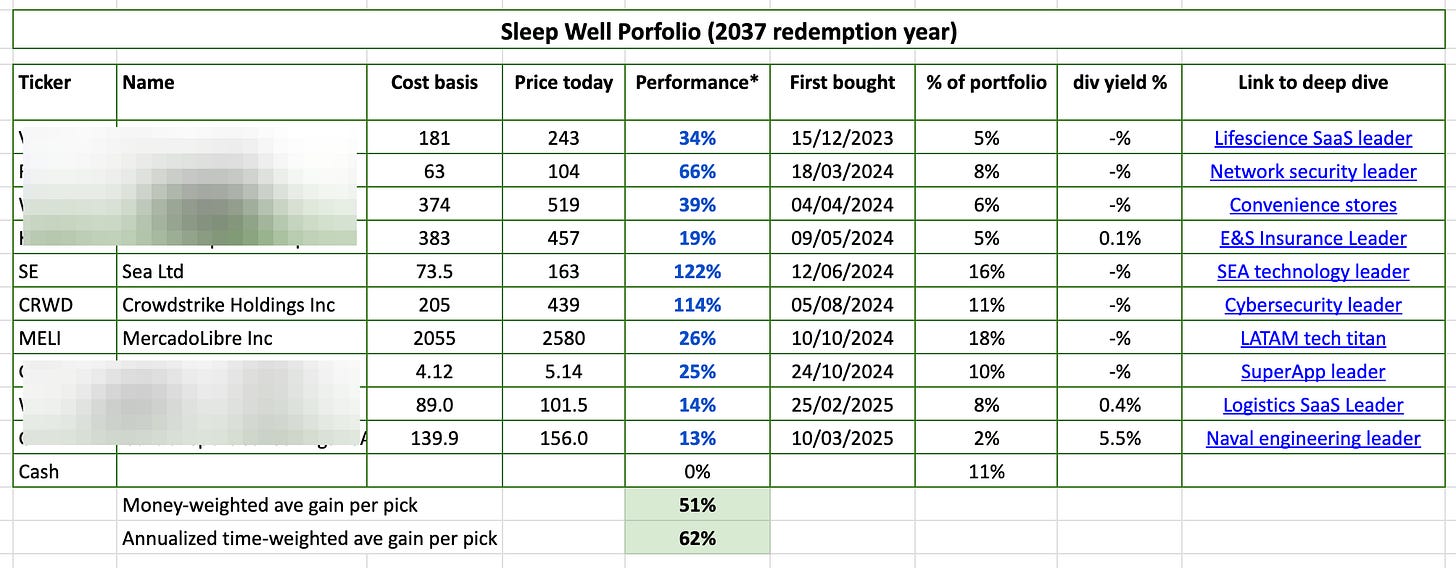

Sea Limited (SE) is the largest holding in my PA (55%) and 2nd second-largest holding in the Sleep Well Portfolio (17%) after Mercado Libre (MELI).

I have owned the business for over five years (the same as Meli) and have experienced euphoria, hell, and now pure joy as I see the business execute everything to the ‘T’ from the founder and CEO, Forrest Li’s ‘sea change’ memo to employees.

I encourage you to re-read it if you want to know Sea. I document the pivot in detail in my deep dive - Overcoming Sea Change Challenges, Time To Own The Business

Sea Limited readings - deep dive, buy alert 2, buy alert 1, Q4’24, Q3’24, Q2’24 update

We’ll talk Q1, but let’s skim through when Sea has accomplished:

2018-2021: Sea posted >130% CAGR revenue growth. Shopee became the no.1 in Southeast Asia after 3 years of operation. Shares rose from $10 to $340/share, and I tripled my money with a 10% allocation. Happy days.

Q3’2022: Sea lost $500M per quarter as it expanded to Europe, India, and Latin America. A sea change was needed! Shares melted to $40/share. I lost 50%!!

Q2’2024: All three segments turned around with growth in all three segments and posted $500M free cash flow per quarter ($2B run rate) [Q2’24 review]. Announced from Q3’24, Shopee would be profitable after 10 years of operation. Shares moved above $70/share.

Q1’2025: Garena was back to 8% revenue growth and 51% bookings growth. The group posted a $3B+ free cash flow run rate ($3.6B Adj.EBITDA). Shares rallied to ~$160/share, up ~300% from the bottom two years ago. Management reiterated a 20% GMV growth for FY2025. Enterprise value is $93B as of writing, or 27x Adj.EBITDA.

The crazy thing is, Sea Limited’s today is still 55% below its previous peak during Covid ($340/share).

You could call it luck, but the profound pain I experienced for the past three years led me to create Sleep Well Investments. I, too, needed a ‘sea change’ like Sea Limited.

Since the results have been life-changing.

Sleep Well Investments has had no losers and outperformed the S&P 500 considerably.

23/24 buy and sell transactions have been correct, averaging a 62% annualized return.

Okay, let's review what happened in Q1 and whether Sea is still a good buy at the 3-year high.

Q1'25 Sea Limited - the first four consecutive quarters of GAAP net income.

I’ll review the numbers very briefly and move on to discuss where they could be going next.

Group level

Revenue up 29.6% YoY to $4.8B

Gross profit up 44% YoY to $2.2B

Net income was $411M, the fourth consecutive quarter of profitability and the first full year of GAAP profit !!

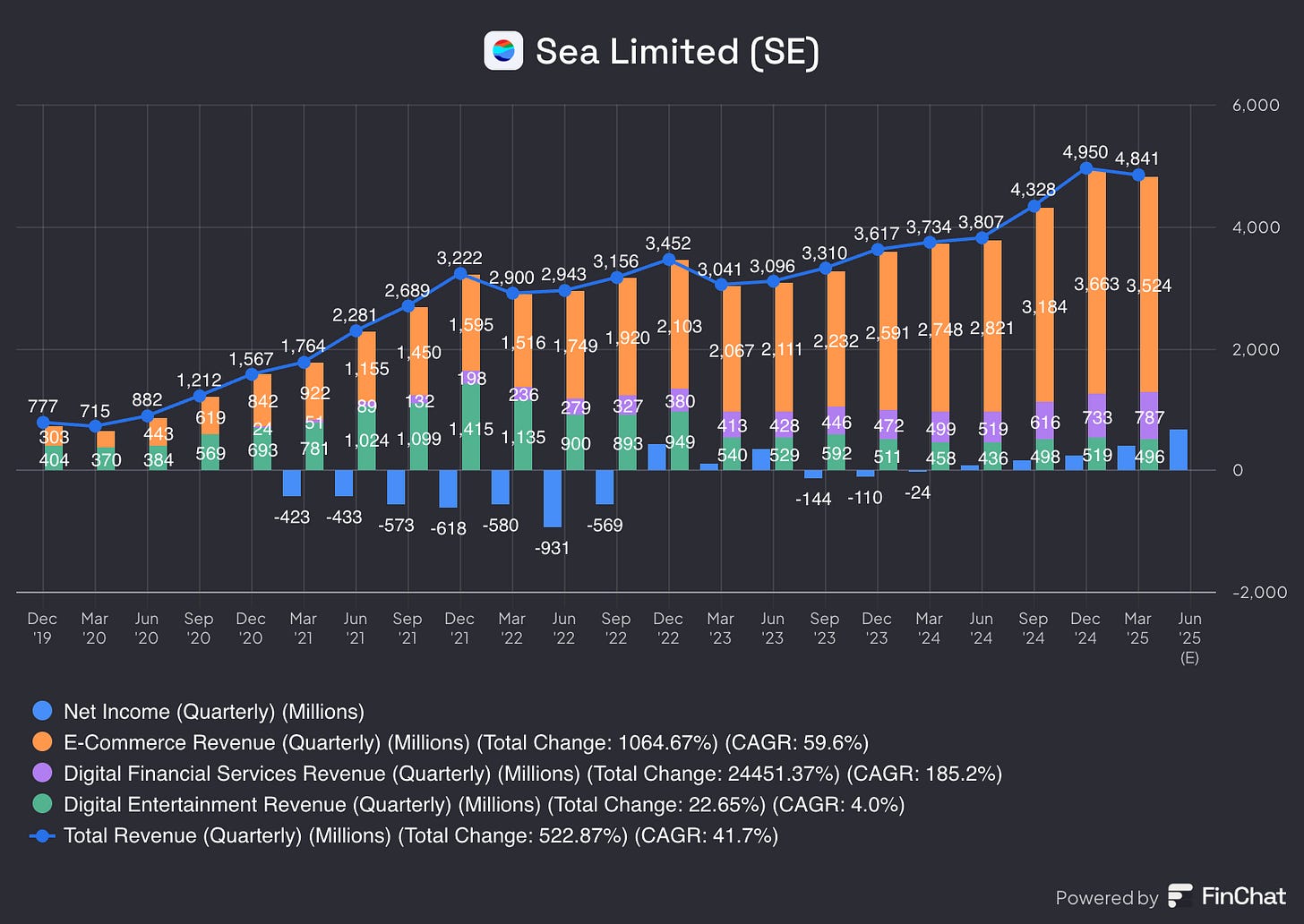

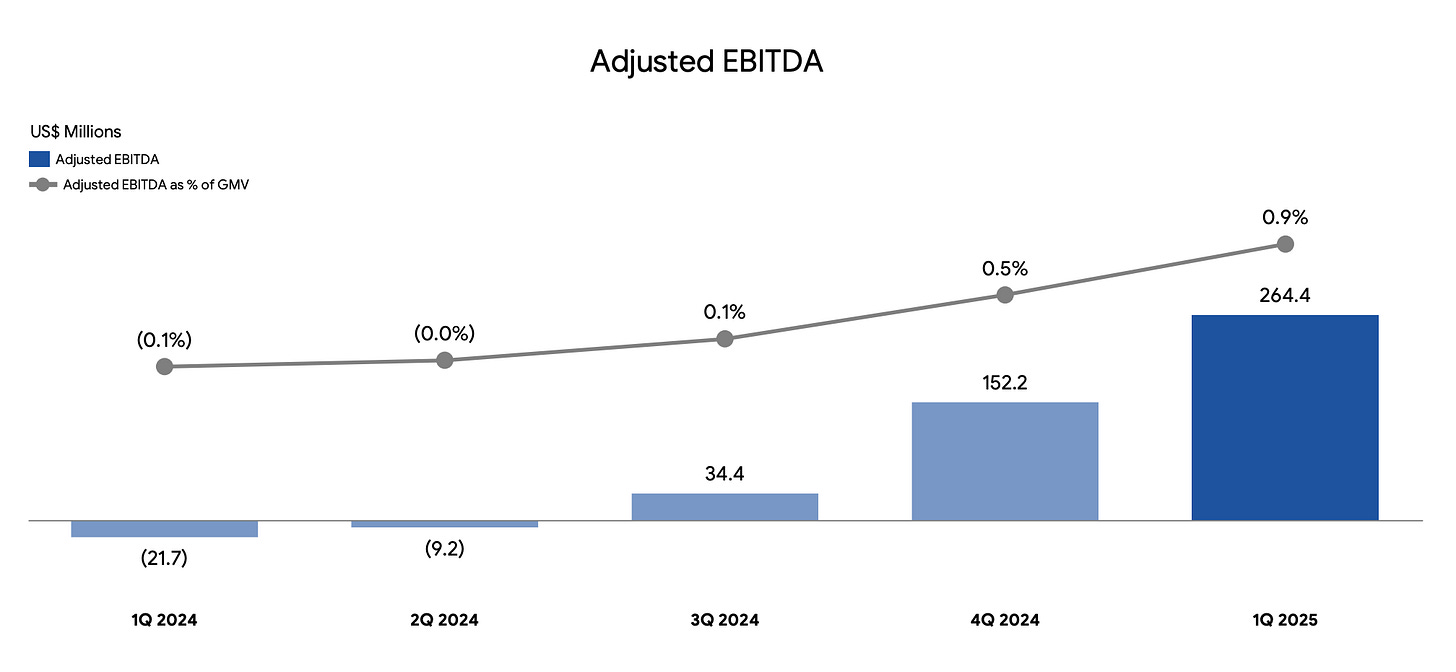

Adj. EBITDA up 136% YoY to $947M (Finchat figures aren’t adjusted to Garena's deferred income), so the precise number isn’t important. The trend is up to the right. Q4’24: +$590M, Q3’24: +$521M, +$200M in FY2023, and -$1.6B in FY2022.

The chart above shows a vital trend! GAAP net income has been positive for the past 4 quarters, a full year. If Sea continues to post positive GAAP net profit, it will be eligible for funds with strict mandates to only invest in GAAP profitable companies.

And that Adj. EBITDA for the quarter is epic! Nearly the $1 billion mark.

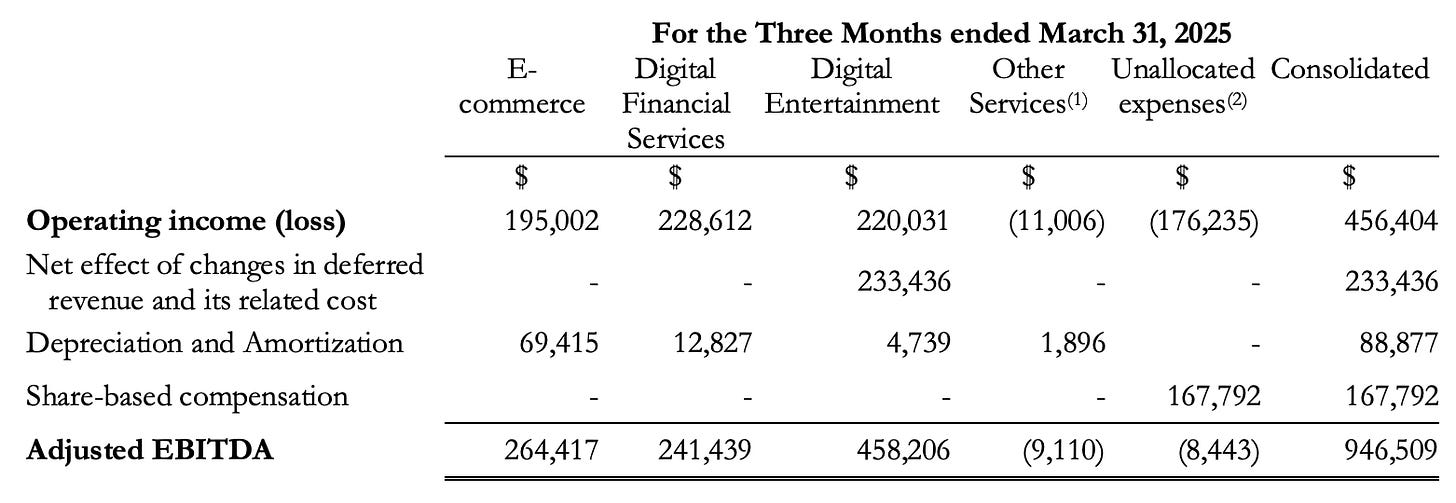

Yes, stock-based compensation (SBC) is $167M, but that’s the nature of business in a growing company that needs the best talent to make sure it’s the ‘Amazon’ of Southeast Asia. If it makes you feel better, SBC has dropped from $181M last year. Meanwhile, revenue and Adj EBITDA grew by 30% and 136% respectively.

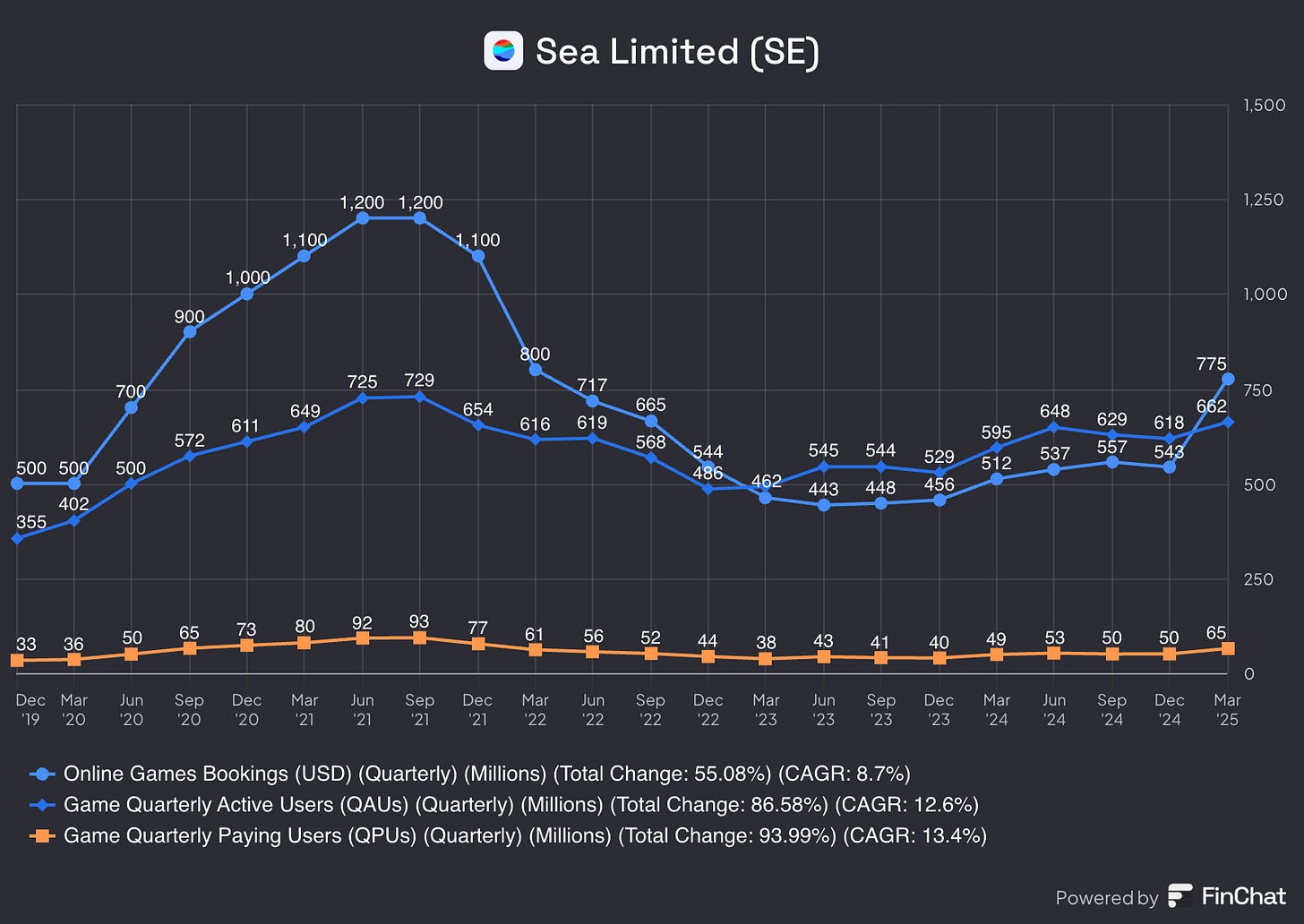

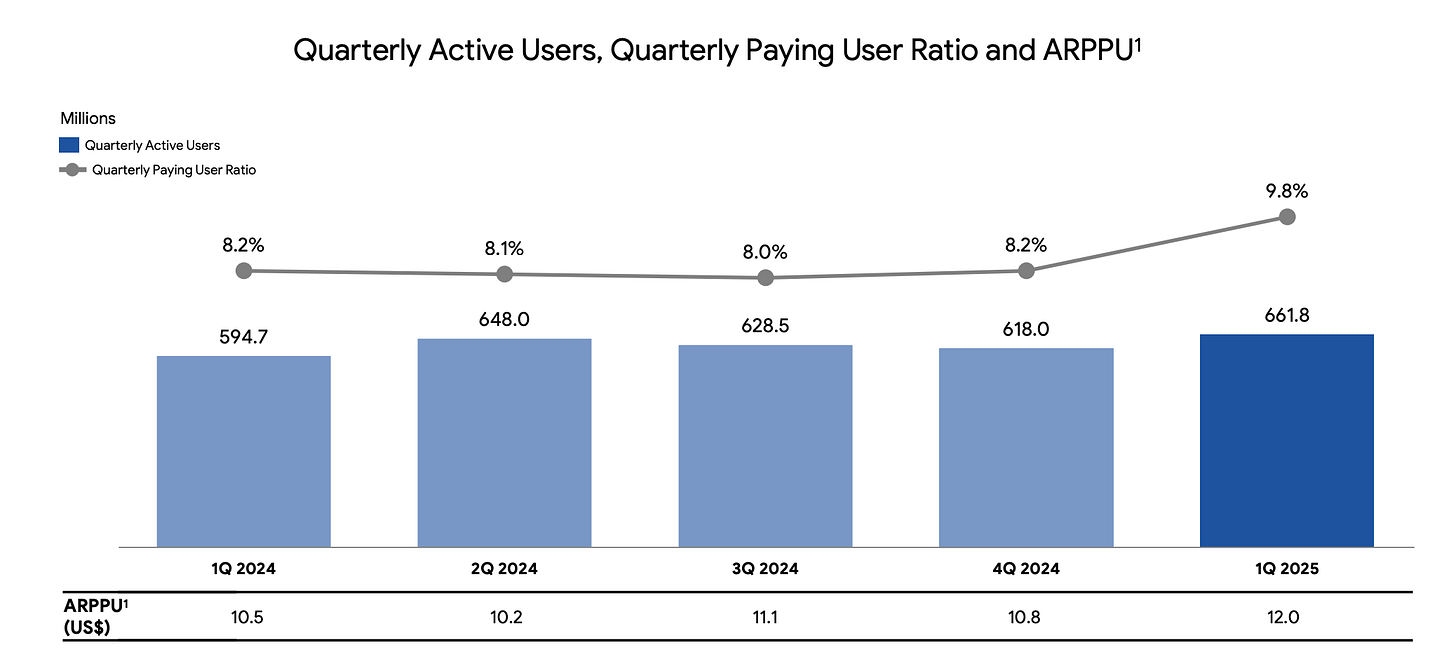

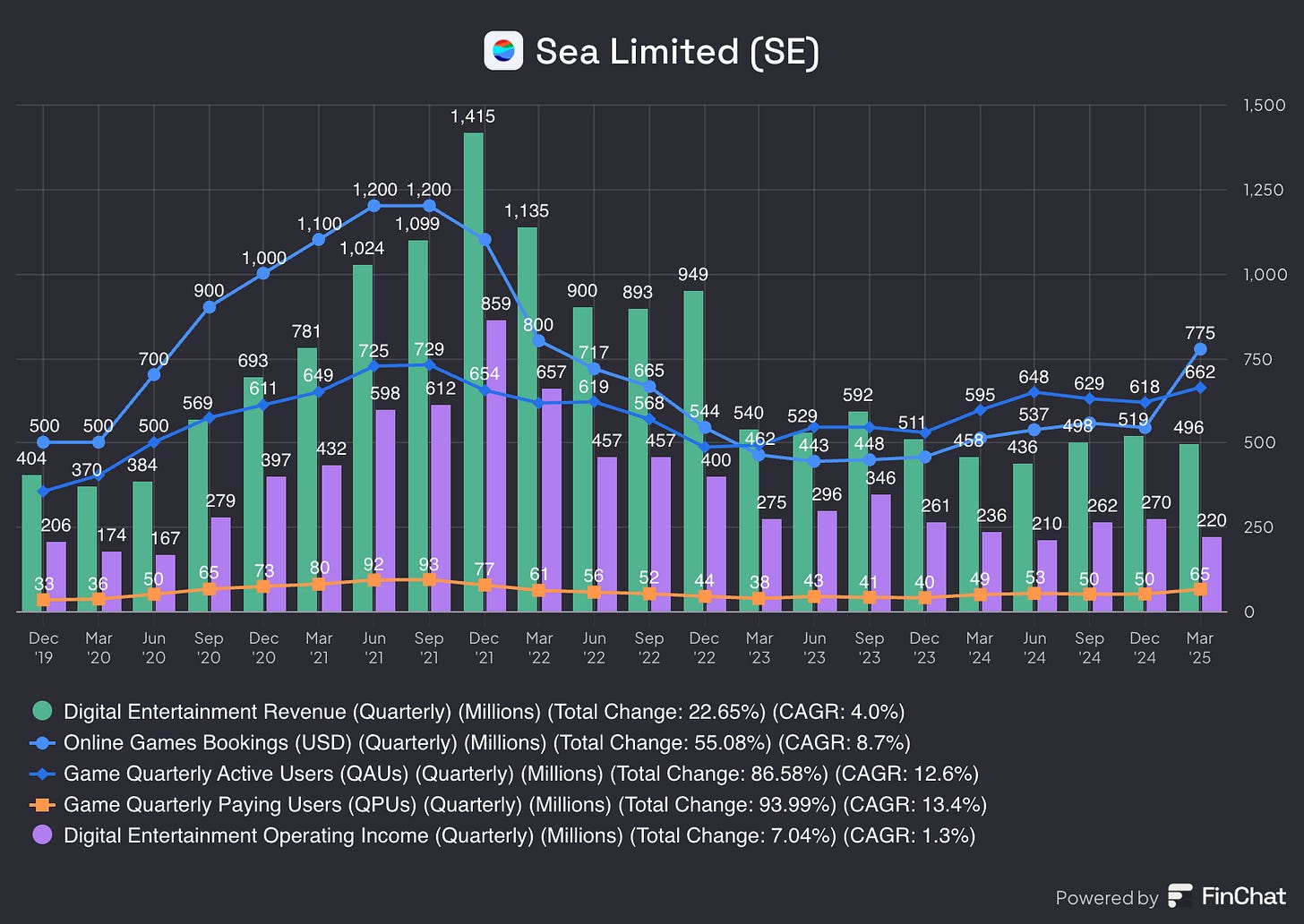

Garena - 65M paying users, 662M QA, $458M Adj.EBITDA

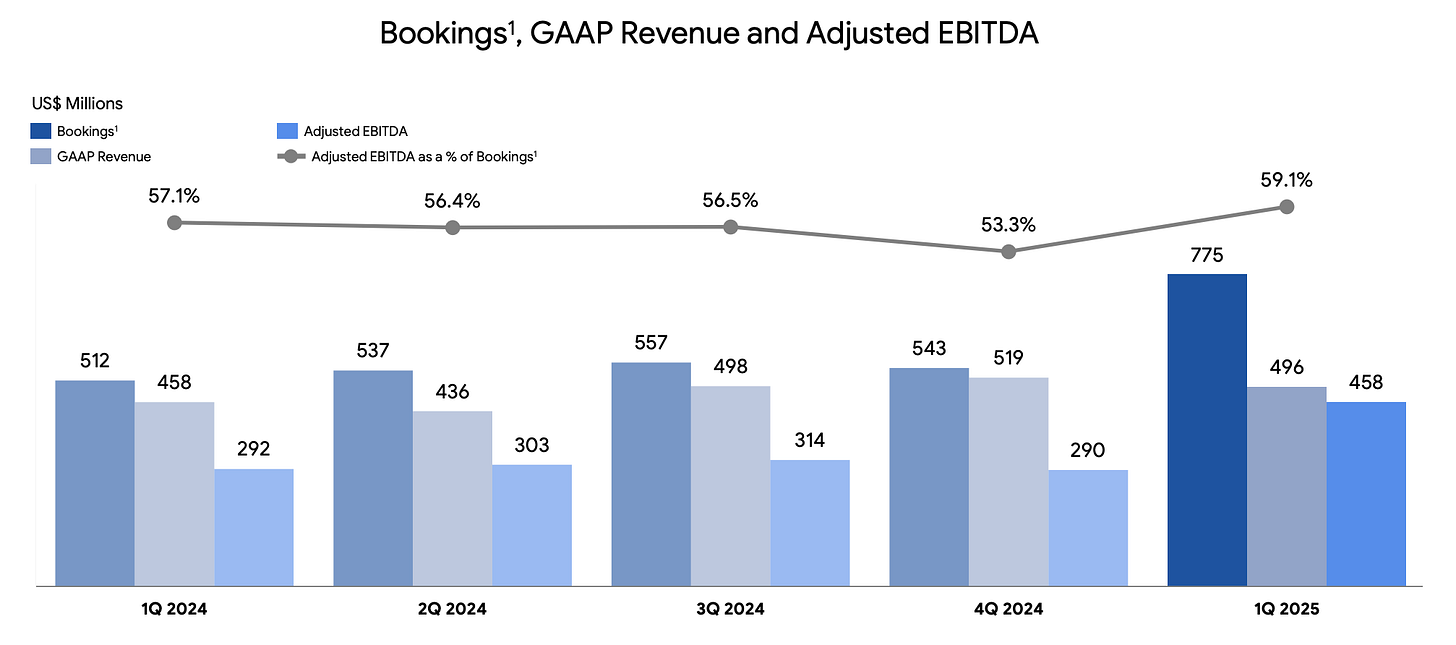

Bookings up 51.4% YoY to $775M

Revenue up 8% to $496M

Adjusted EBITDA up 57% YoY to $458M, 59% margin !! Highest.

Quarterly active users up 11% YoY to 662M

Quarterly paying users up 32% to 65M. The paying user ratio was 9.8%, compared to 8.2% for the first quarter 2024.

The star of the quarter was Garena.

Since last year's deep dive, I have tried to explain why Garena was a sustainable enterprise. I even named my Q2’24 review Building An Evergreen Franchise, as Free Fire, its flagship game, continued to have over 648M QAU and 100M DAU on Free Fire daily throughout that quarter.

In Q1’25, quarterly active users continued to increase to 662M globally, only lower than the peak of COVID (725M+ in Q2 and Q3’2021). It’s incredible, as Free Fire has been around since December 2017. To put that in context, that’s almost the population of Southeast Asia.

65M people pay $12 on average for various things (skins, items) in-game. That's not a lot, but with 65M paying customers, a 10-cent increase in price or a viral skin in the game can change the economics. That happened: Firefire introduced the Naruto theme into the game in January 2025, leading to a 51% booking growth in Q1.

Will the rapid growth last? I don’t know, but Free Fire remained the world’s largest mobile game by average DAU and downloads. The platform is there for Sea to leverage the distribution.

Management reiterated double-digit growth in bookings and user growth for 2025.

We remain confident of delivering our guidance of double-digit growth YoY for Garena’s user base and bookings in 2025

One exciting piece of news is that Free City, another self-developed game like Free Fire, has been in beta for almost a year and will now have soft launches in various countries. Sea has quietly built communities in countries with a strong base, gathering feedback. The rating of 4.7 stars so far on Google Play is very encouraging.

Any success here will cement Garena’s status as an evergreen franchise. This will be a good year to observe how Free City performs, particularly since GTA 6 has been delayed till next year.

As a reminder, both Free Fire and Free City are games made for lower-performance phones, so the graphics are not the best, but the upside is that it is open to more players, the game is faster, cheaper to make, and can be more action-packed.

To close, Garena is stronger than before COVID, with higher bookings, revenue, operating income, and paying users.

Shopee - GMV up 20% YoY, profitable for 2 quarters, $246M Adj.EBITDA.

In 2025, Ramadan occurred earlier, from March 1 to 29, compared to 2024, from March 9 to April 7. So, in this context, Shopee has had a week of extra festivities during which people often shop online more.

Gross orders up 20.5% YoY, totaled 3.1B for the quarter.

GMV up 21.5% to $28.6B

Revenue up 28.3% YoY to $3.5B, of which core marketplace revenue (transaction-based fees and advertising revenue was up 39% to $2.4B. ~300M was 1P revenue. The remainder was value-added services (logistics), up 4.1% to $752M.

Adjusted EBITDA was $264M, compared to -$21.7M for the first quarter of 2024.

Brazil was profitable for the second quarter, and Asia's profitability improved.

Advertising revenue grew 50% YoY, on par with Q4’24 growth.

So, Shopee is now profitable after reaching a $13B annual revenue run rate. It took 10 years to reach this point, about the same amount of time as Amazon (1994-2003). And we know what happened after that! Amazon used every excess penny to start AWS in 2006.

Garena, has funded Shopee since 2015, and now that Shopee is profitable, everything is being put to work in SeaMoney and SPXpress - Shopee's own logistics network. More on this later.

Returning to Shopee, the tailwind of Ramadan might have added 1-2% to GMV and revenue growth. Still, profitability wouldn’t have been impacted as much as advertising grew by 50% YoY! This is on par with Meli’s growth rate over the last nine quarters and Grab’s last few quarters. Our trio’s future revenue stream is doing great in their respective regions.

Shopee was ranked as best-in-market across Asia and Brazil for offering good product prices. It was also ranked top for cheap logistics and safe payment. In 1Q 2025, Shopee’s overall logistics cost-per-order reduced by 6% YoY in Asia and 21% YoY in Brazil while continuing to improve delivery times and expand network coverage. This was a significant contribution to Shopee's unit economics.

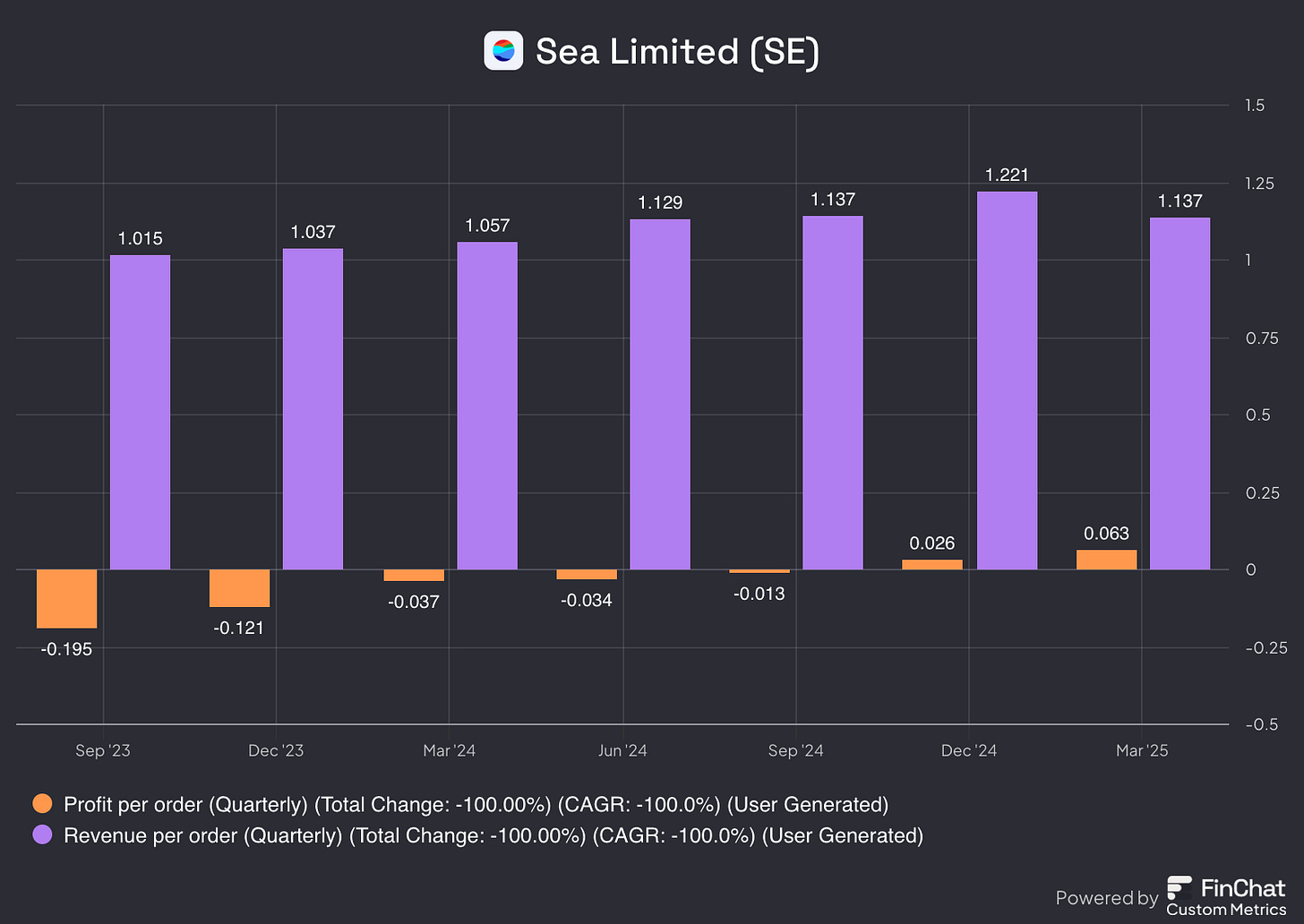

Since Q4, every order has contributed profit.

Another positive was Shopee Live, which was thriving alongside TikTok. In Q1 2025, content-driven orders accounted for ~20% of physical goods order volume (~15% in Q4’24), and as of March, 4 million YouTube videos had Shopee product links embedded. So, Shopee Live is growing 30% QoQ or 120% YoY. The collaboration with YouTube last September must have been an enormous success, as users can shop seamlessly on YouTube.

With YouTube, I believe Shopee Live is likely doing better than TikTok. How?

I discovered that JT Express, the largest 3PL in Asia, suffers a little as Shopee has gradually shifted delivery in-house. And with the growth of Temu and TikTok, they are only partially offsetting the loss of business from Shopee's departure.

Advertising

Shopee's current advertising take rate is hard to guess, but the potential is enormous. If you take Amazon's 5% of GMV as the ceiling and 2.1% of GMV for Meli (still in the early stages; advertising grew ~40% in Q1’25 and 41% in Q4’24), plenty of growth remains. Meanwhile, GMV will continue to increase by 10% + for 10 years.

In Q1, not much was said about advertising, but management shared that it grew 50% yearly, on par with Q4’24. So if the advertising take rate can increase by just 0.5% of GMV, that means a cool $500M revenue (or $250M of free cash flow). A 5% take rate brings Shopee $5B in revenue at the current GMV.

I will discuss Monee, a core and predictable growth of Sea, and then discuss TikTok, Temu, Lazada, and Meli, all of which have the potential to derail Sea’s momentum. Finally, I discuss whether $93 EV is still worth adding, even at 55% and 17% allocation.

Remember:

Sleep Well Investments is about avoiding losers (we have had none, so far).

Join us! The most you can lose is….nothing!

Monee (rebranded from SeaMoney)

Revenue was up 58% YoY to $787M,

Adj. EBITDA was up 62% YoY to $241.4M, 31% margin

Loans' principal was up by 77% to $5.8B, consisting of $4.9B on-book and $0.9B off-book loans ($0.6 in Q1’24).

Monee active users were up 55% YoY to 28M (18M in Q1’24).