Business Update - Sea Limited (SE) Q2'25: 'The Best Is Yet to Come' - Profitable Growth In All Segments

E-com GMV +29% YoY, Gaming +23%, Financial Services Loan Book up 90% (1% non-performing). Group revenue up 38%, operating profit ~$2B, FCF >$3B annualised. Cheap at ~26xEV/FCF for 20%+ LT growth.

Sea Limited (SE), a 23% position in the Sleep Well Portfolio and a 55% position in my PA, has consistently seen the most additions to the portfolio whenever the market throws a discount [Jun 2024, Mar 2025, April 2025, July 2025].

After another solid quarter, I still see myself adding on the way up!

Sea Limited is clutch!

A tennis saying for high performance under pressure.

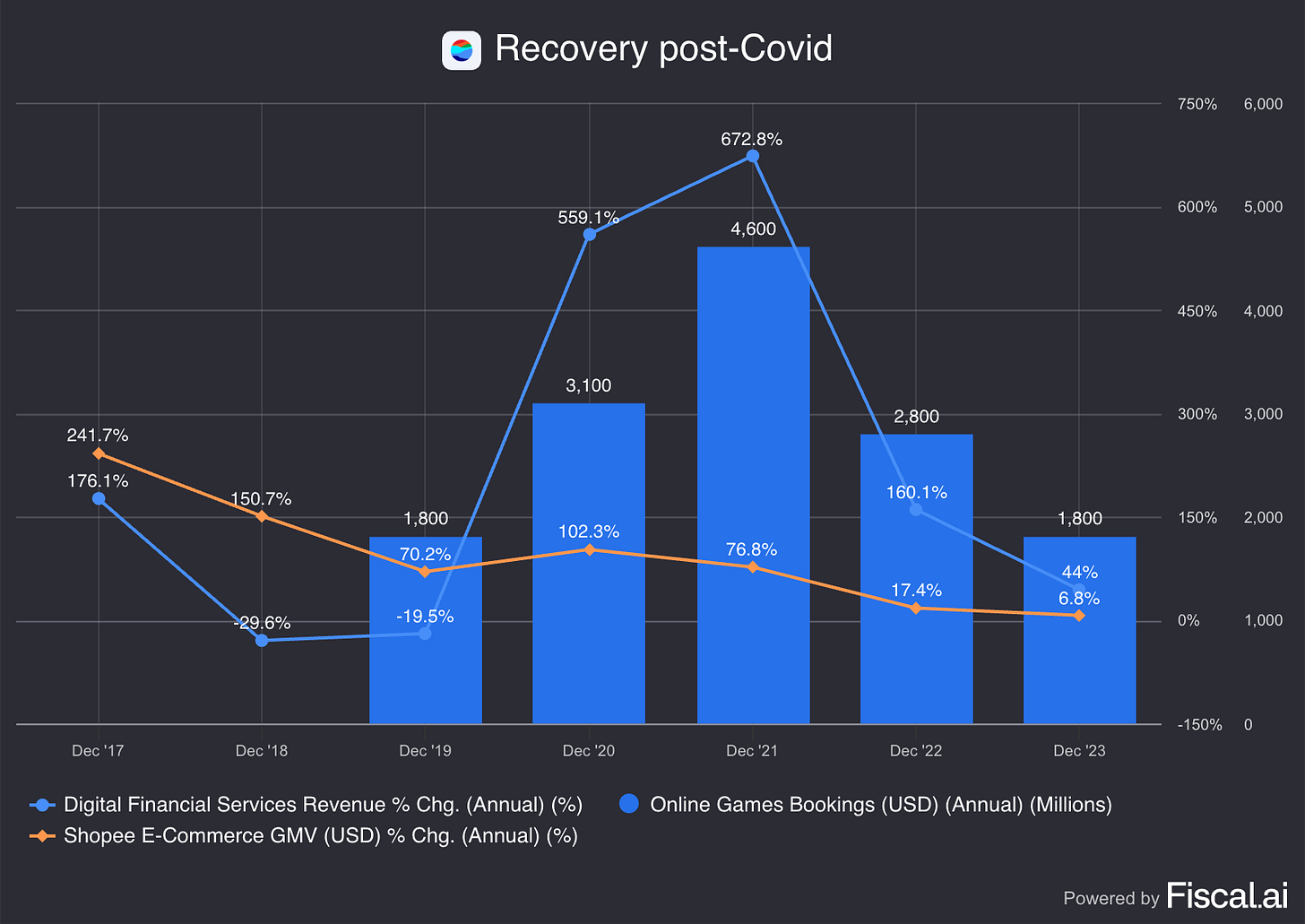

I first recommended Sea when it was in the middle of a challenging reorganization after the post-COVID hangover. Its cash cow gaming division saw bookings contract to $1.8B from $4.6B. Its hyper-growth e-commerce division, Shopee, saw GMV growth slow from 85% in 2021 to 28% YoY, and the promising financial services segment, now ‘Monee’, also slowed growth to ~40% from triple digits.

On top of that, new competition was making headlines (TikTok Shop and Temu).

But the investment thesis, when picked in Q1 2024, was that Sea Limited was performing despite pressures both inside and outside.

Recall, Sea was already in the 6th quarter of its ‘balanced growth’ plan (rallied by the founder-CEO, Forest Li, in September 2022).

Positive signs were apparent to me.

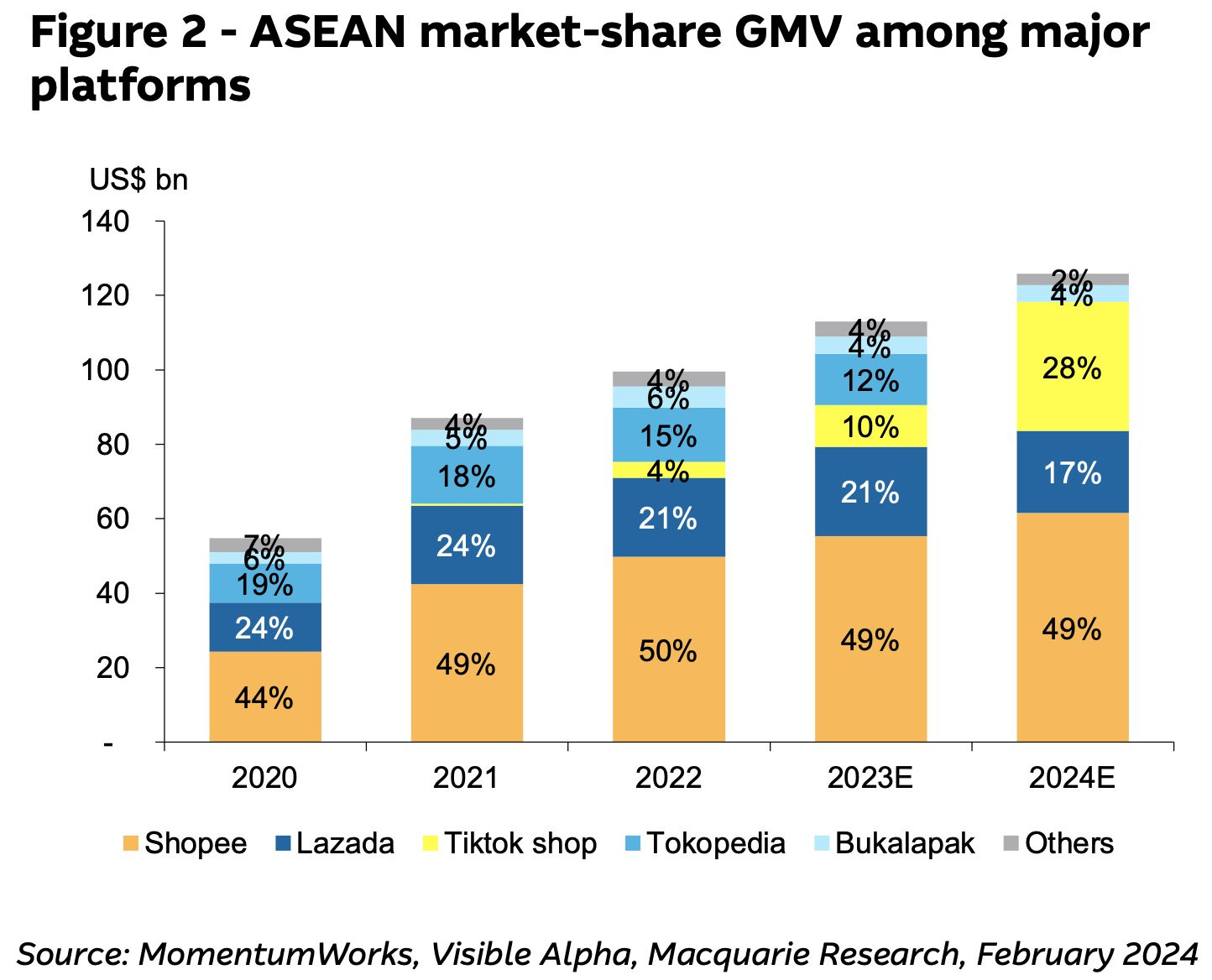

Core markets (Southeast Asia and Brazil) have stabilized Shopee’s market leadership share at ~50%.

The home-grown logistics arm, SPX Express, saw continued investments and rapid growth in the background. It became the 3rd largest logistics provider in Southeast Asia after just 4 years of operation (today 2nd largest). It remained competitive even in Brazil with its low capex strategy.

No peer matched Shopee’s advantages in low-cost wide-coverage logistics, broader SKUs, and somewhat cleaner UI/UX. Sea’s take rates increased despite competition buying market shares (promotions and acquisitions).

The scale and dominance also provided Sea’s first-party data advantage, which led to my higher conviction in a fourth pillar of growth - advertising.

Today, external pressure remains intense, particularly from Mercado Libre and TikTok Shop. This is perhaps why Sea Limited is still trading at ~25x free cash flow (and that’s good for long-term investors), despite the 140% rise in the stock.

To begin the Q2’25 review, I'd like to walk you through the progress of each division from Q4 2022 to Q2 2025, highlighting the impressive execution.

Then I’ll discuss a few key points.

Monee vs Grab vs Meli

Shopee in Brazil vs Meli

Logistics

Advertising - the fourth pillar of growth

Sea limited reading: deep dive, 4th Buy, 3rd buy, 2nd buy, 1st buy, tariff review, Q1’25, Q4’24, Q3’24, Q2’24 update

Master Execution since 2022

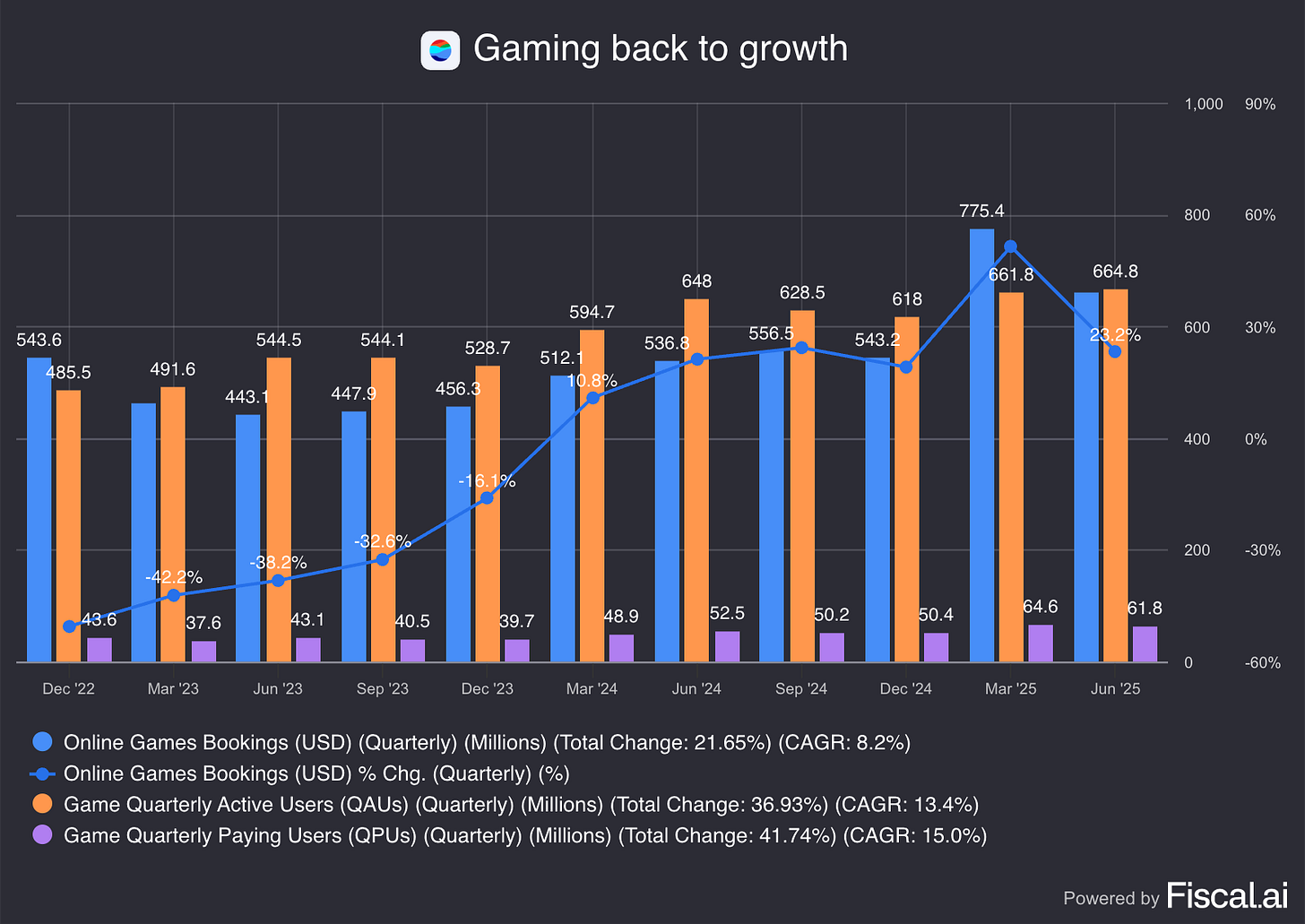

Gaming - Garena is back to sustainable growth.

In the past, Free Fire, a first-person shooting team game, played by over 600M people quarterly, was everything to Sea Limited as a whole.

Post-COVID, as gamers took a hike, investors were rightly concerned about whether it would come back to print money for investments in Shopee and Monee reliably. In my deep dive and subsequent updates, we saw that Free Fire, after 8 years, still had multiple levers for growth.

Today, the game remained at the top of the download charts, and those growth levers materialized. We saw faster development of new maps, features, and successful partnerships with global names Naruto, and Squid Game. Operationally, AI helped Free Fire to generate arts / maps quicker, customize experience quicker, engage solo players, and retain them better. Meanwhile, other promising games are starting to surface (Delta Force and Free City).

So, to me, the question mark on the durability of Garena is sufficiently answered.

Above, if you take the COVID period out, bookings and quarterly paying users have both grown by 5% and 11% CAGR.

Zooming in from post-COVID between December 2022 and Q2’25, everything looks to be back to steady growth between 8-15%.

In 2025, management expects bookings to grow by 30% driven by sustained success in Free Fire, a huge inversion from a 50% drop back in 2022, and much faster than the 8% CAGR in the past 3 years.

Quarterly active, daily active, and paying users were 660M, 100M, and 62M. Many of whom are Shopee and Monee users, so sustaining Garena is a massive advantage to Sea Limited as a whole, explicitly, the first-party data goldmine over its peers (hence the prudent risk management metric of 1% non-performing loan despite growing the loan book at 90%).

On promising new games, Free City—a GTA light version for lower-performing phones — has passed the initial demo phase, and reviews from professional gamers were good. The timing is excellent as the newest GTA 6 game release has been delayed until May 2026. We also haven’t heard much about the relaunch of Fire Fire in India.

Overall, this segment is contributing $1.2B EBITDA annualized, and I’d be happy with a 5-10% growth going forward.

E-commerce - Shopee is starting to contribute

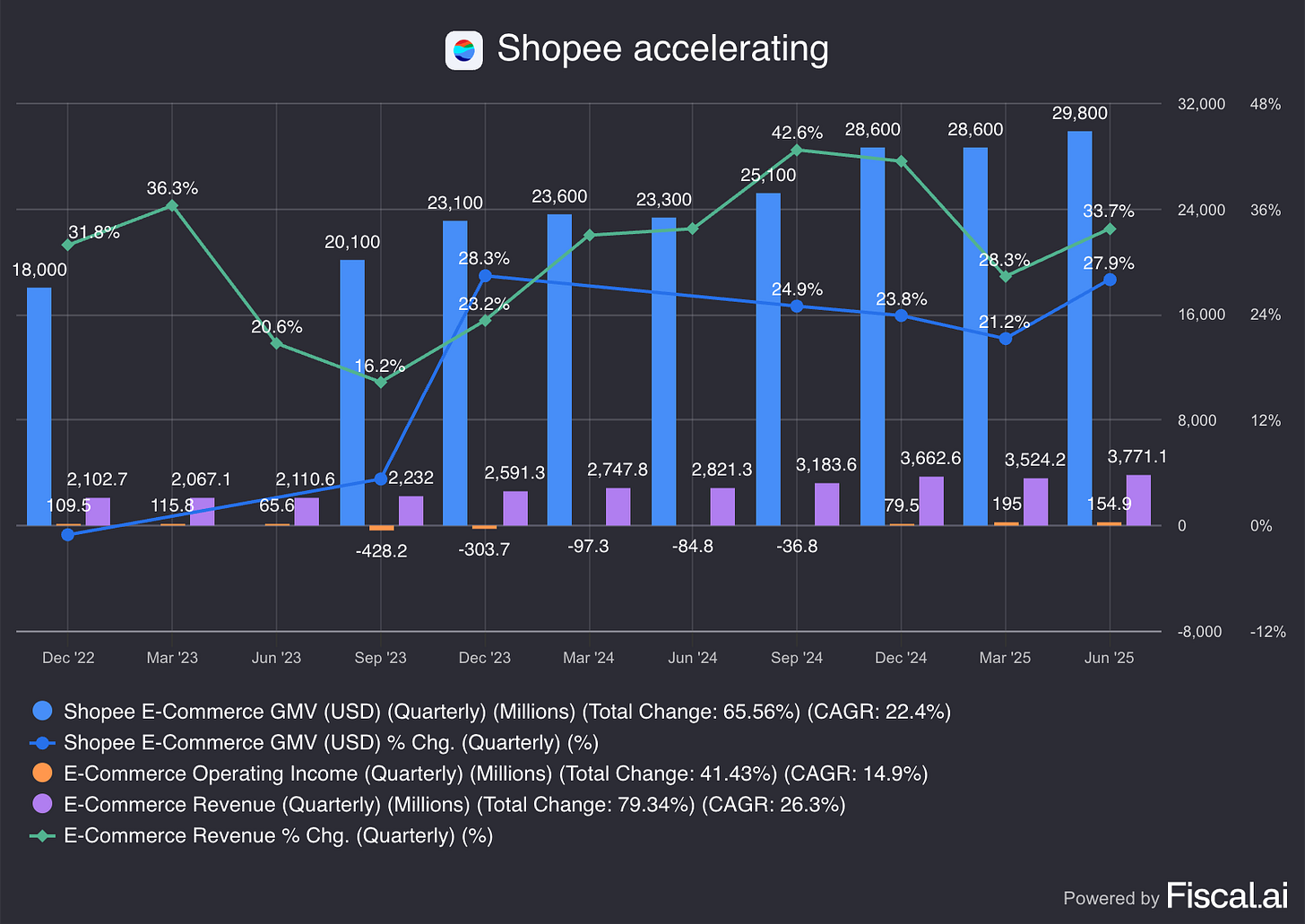

Shopee is now 10 and a half years old (inception date: Feb 2015). Taking out the peak Covid period, Q2’25 marked the 3rd consecutive quarter of positive GAAP income! For almost 10 years, it was a cash-burning segment.

The current streak is going to change how the market views Sea Limited. Previously, Sea Limited relied on the gaming division to fund Shopee and Monee. Now, Shopee has everything set up, all the while successfully countered the pressures from TikTok shop (YouTube partnership and Shopee Live) and Temu (better cost structure, UX/UI, and broader assortments.

Above is why I remain excited about Sea Limited, despite the current price of $175/share, up from $73/share last year. As Shopee now contributes positively to the bottom line, there is no reason why Sea Limited can’t deliver bottom-line growth rates much higher than the 20% rate that I penciled down.

For Q2’25, what I like about Shopee are:

Revenue was growing faster, at 34%, than GMV at 28% YoY.

Sellers still flocked to Shopee despite the heightened take rate.

Advertising revenue was contributing more significantly and has lots of room to grow (number of sellers x revenue per seller, more on this later).

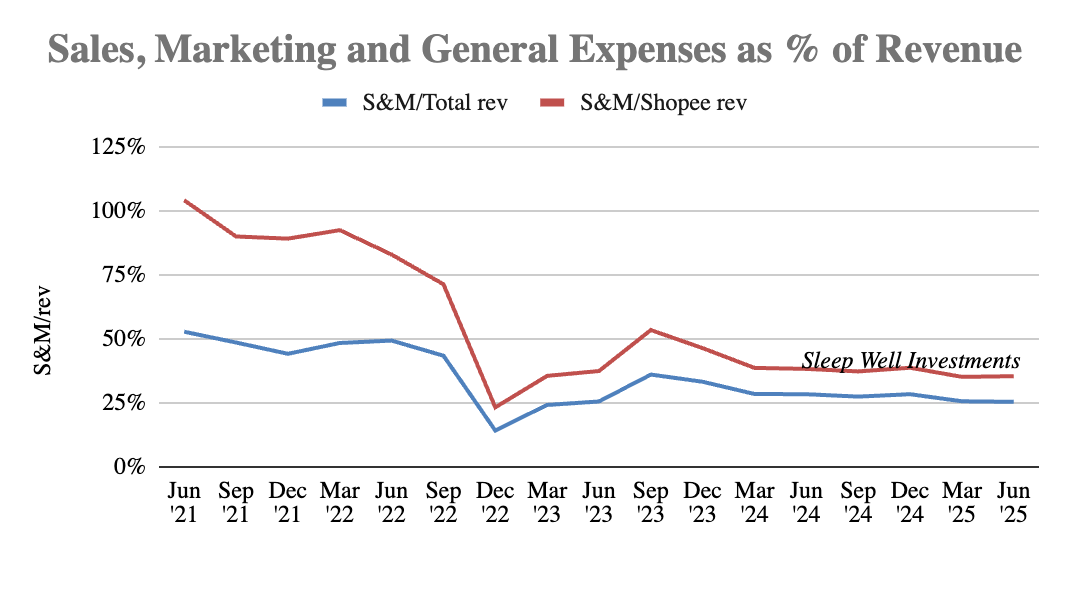

Sales and marketing continued to grow more slowly than revenue, despite operating in an intensely competitive environment. Now at 25% and 35% of Shopee’s revenue and the Group’s revenue.

Hint of a Prime / Costco membership program in the future.

Shopee shared that they had 2 million VIP members (mainly in Indonesia, and started in June 2025 in Thailand, and Vietnam), where VIP members spent 30% more and were 20% more likely to stay (retention rate).

Total GMV from VIP members there grew nearly 50% quarter-on-quarter and VIP members bought a monthly average of around 30% more after subscribing. VIP members have also shown a roughly 20% higher retention rate compared to nonmembers.

I am unsure how much VIP members were charged monthly/yearly to have exclusive benefits (gifts and rewards for spending more), but commentary points toward a pathway to a subscription service? Such as Prime at Amazon or Costco's premium tiers, enhancing customer value and loyalty.

Our Shopee VIP membership program, a paid subscription service giving buyers exclusive benefits has shown very good momentum in Indonesia.

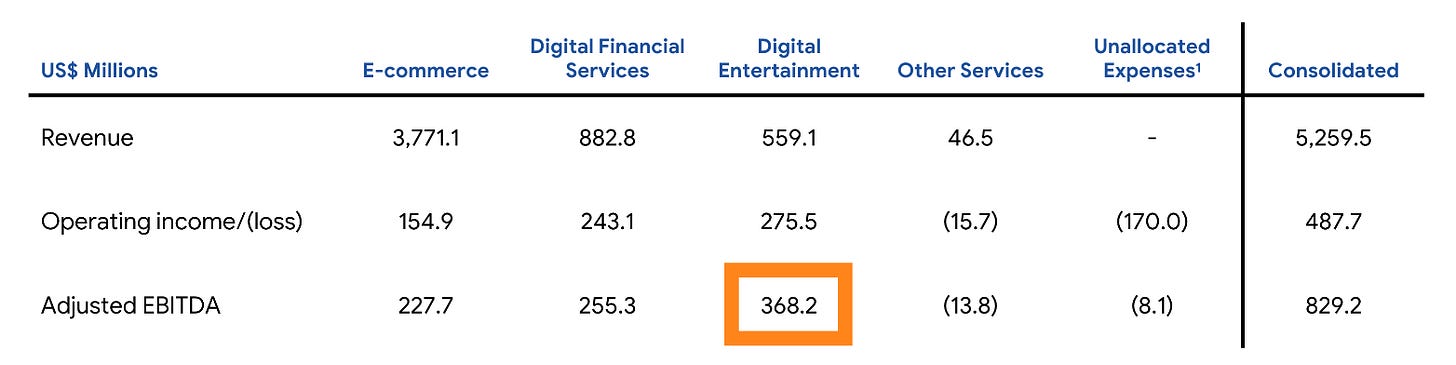

For Q2’25, Adj. EBITDA (~free cash flow) was $227M or ~$1B annualized. GMV grew by 28%, 6% faster than the last 3-year CAGR of 22% and revenue grew by 34%, 8% faster than the previous 3-year CAGR.

Financial services - Monee will be magical to Sea Limited

Without Shopee and Garena, Monee would not have grown to be so successful. Imagine building a digital bank from scratch.

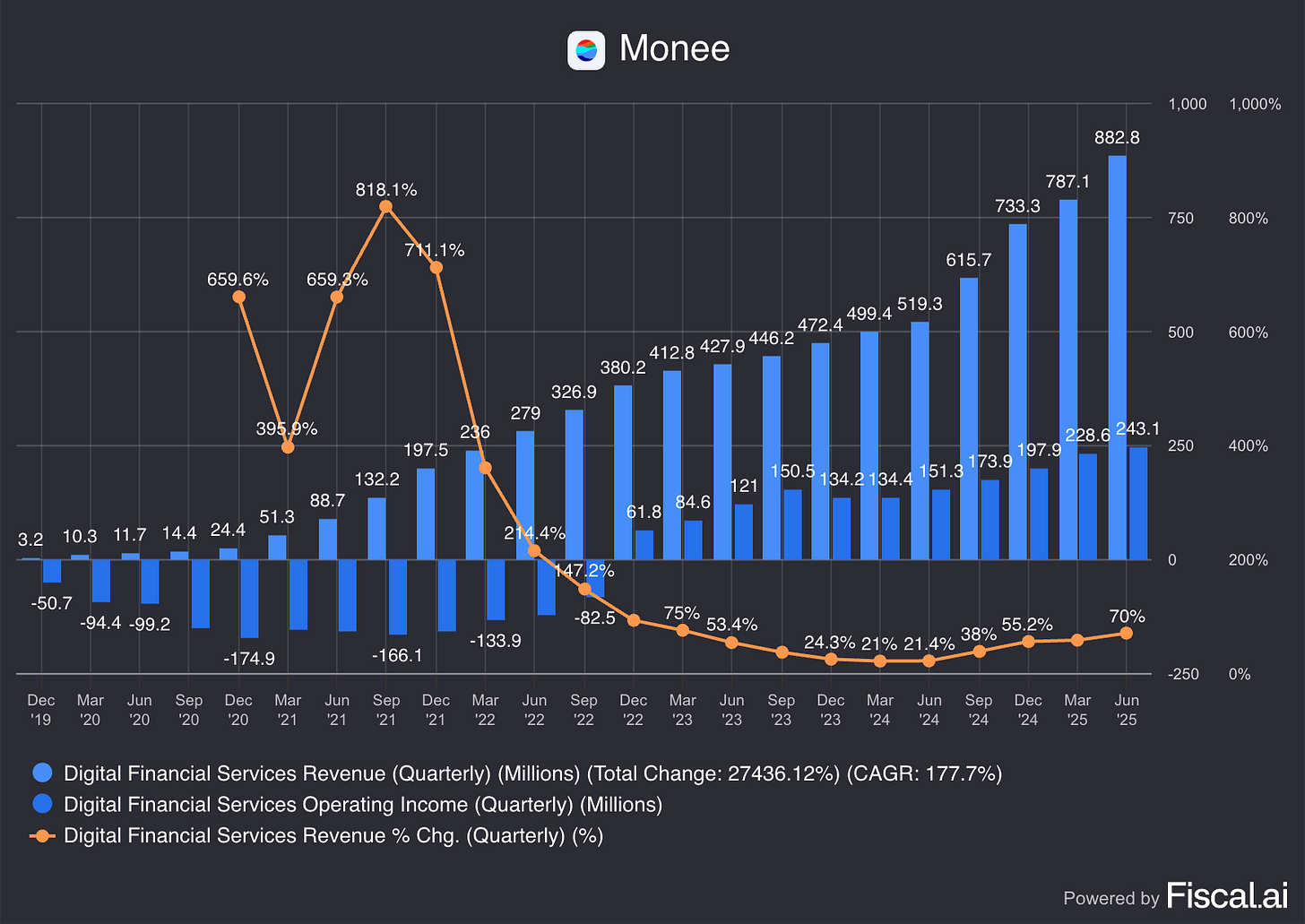

Since generating the first million in revenue in FY2016, quarterly revenue has now reached $882M, or a CAGR of 177%.

Q2’25 also marks the 11th consecutive quarter of positive GAAP operating income. Annualized Adj. EBITDA (~free cash flow) reached ~$1B. Revenue just grew by 70% in Q2’25.

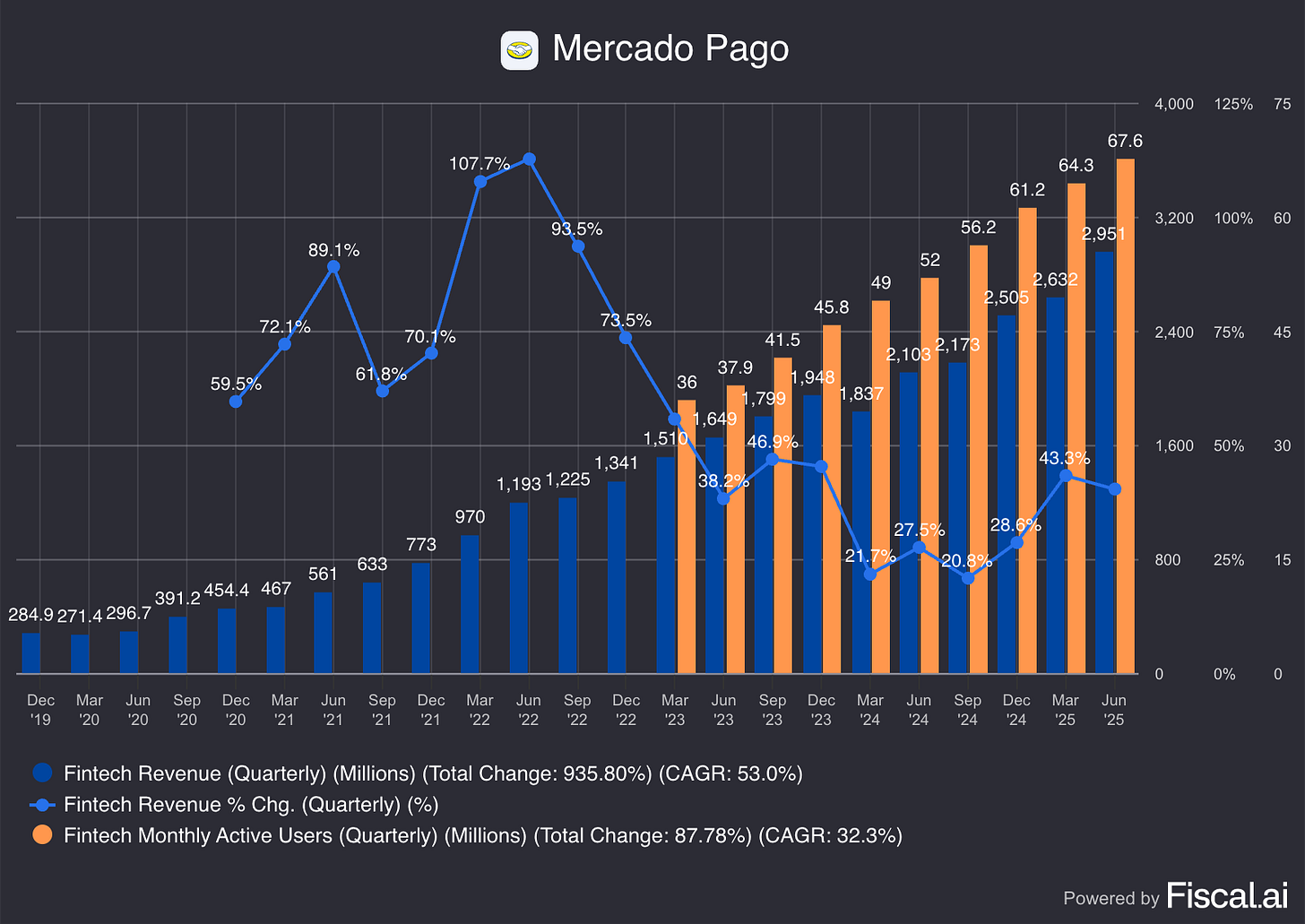

For dreamers out there, Mercado Pago of Mercado Libre was still growing at 32% YoY after more than 20 years of operation. Its quarterly revenue was ~$3B in Q2’25.

We are witnessing a carbon copy of Pago in Southeast Asia!

Selective impressive stats in Q2’25 are:

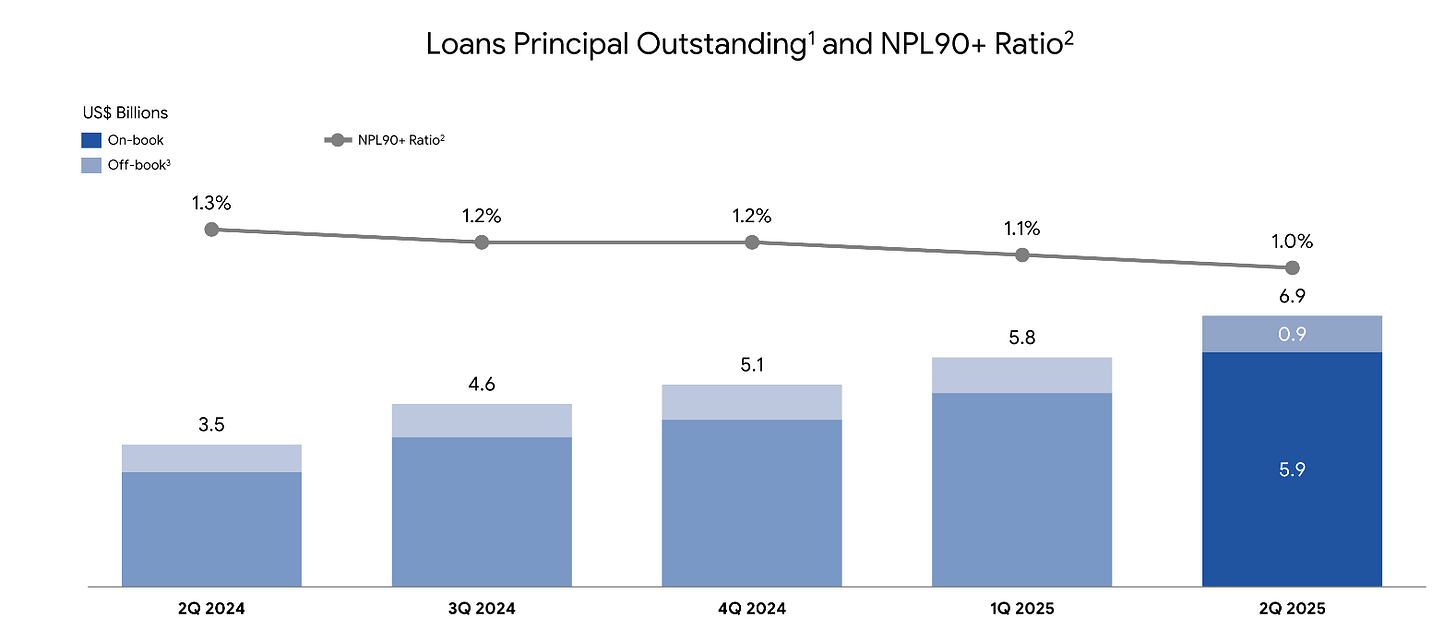

Monee’s loan book was ~$7B, grew 90% with an impressive non-performing loan % of just 1%!

3 countries had surpassed the $1B loan book: Malaysia, Indonesia, and Thailand.

Active loan users reached 30 million and grew 45%.

What that means above is that Monee is serving 30 million borrowers with an incredibly low fail rate (NPL of 1% vs. 2% average in the US in the past 25 years).

Key Q2’25 business discussion

Firstly, altogether, the three segments, annualized, were generating ~$3B free cash flow (Q2’25 Adj.EBITDA ~$830M). The following discussion on Monee, Shopee in Brazil, Logistics, and Advertising suggests that the business should continue to grow free cash flow by at least 20% for 5-10 years. All my other picks will have a tough time taking capital from Sea, even at a 23% SWI and a 55% PA allocation.

Monee vs GrabFin vs Meli’s Pago

It’s worth comparing Monee with the key rivals, GrabFin (Grab) and more distant rival Pago (Meli), for some context of how impressive Monee is executing.

Please note that they are not the same, but they are still worth comparing.

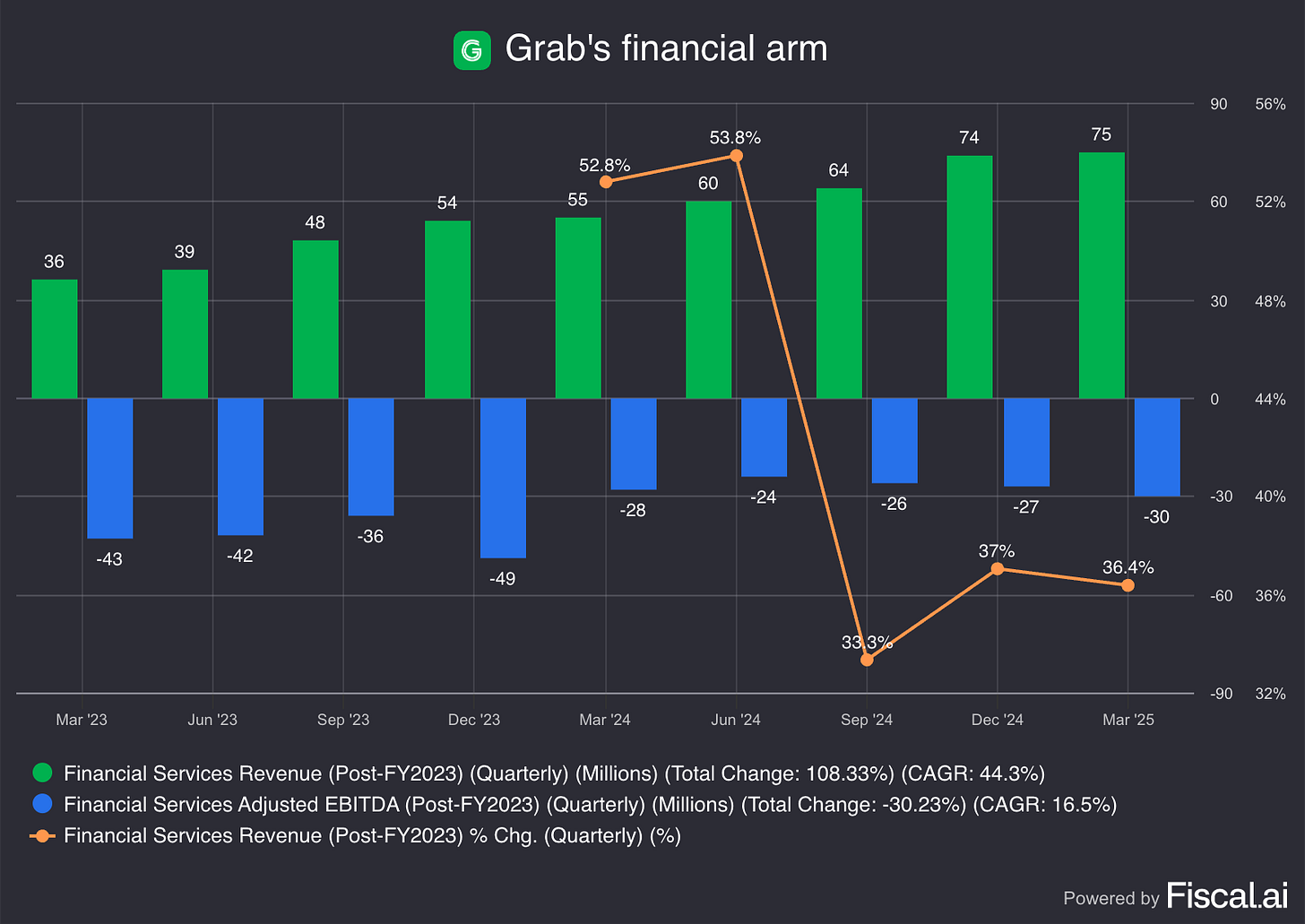

GrabFin’s quarterly revenue was $84M for Q2’25, about 1/10 of Monee’s.

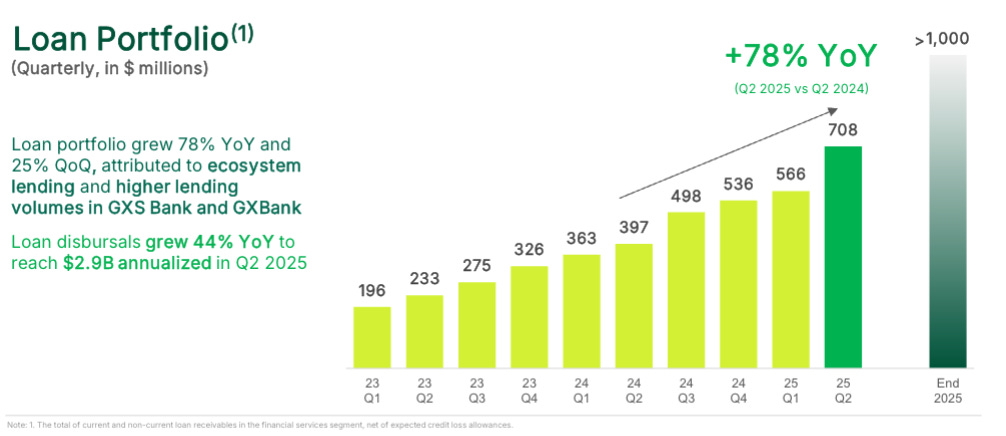

Grab’s loan portfolio was at $700M, or also 1/10 of Monee’s. Growth was at 78%, lower than Monee’s loan book growth of 90%.

It was still making a loss, but expected to break even in the second half of 2026.

Next, Mercado Pago of Meli serves as the blueprint for Monee in Southeast Asia.

In Q2’25, revenue was ~$3B, and grew by 40%, impressive compared to the 43% CAGR growth since 2012.

What’s more intriguing is that 70% of Latin America is still underbanked and unbanked, and 85% of retail is still offline.

With fairly similar banking and e-commerce penetration rates, I see Monee following Pago’s footsteps and perhaps even surpassing its achievements.

Shopee is more dominant in Southeast Asia (50% market share) than Mercado Libre in Latin America (~25-30% market share). Shopee also has unique advantages over all its peers in the region, as Monee can draw user information from both Garena and Shopee. Forest Li shared:

First, deep and seamless integration with our shopping ecosystem.

Second, a very large base of users who are growing their credit track record with us over the years.

Third, our increasing use of AI to improve our credit models.

Together, these advantages uniquely enhance our underwriting capabilities in each market, enabling us to very effectively push for growth across our 3 credit product lines. On-Shopee SPayLater, Off-Shopee SPayLater and cash loan products.

Shopee in Brazil vs Meli

Two months ago, in June, Mercado Libre lowered the free shipping threshold to 19 reais (~$3.4) from 79 reais.

Mercado Libre's action to aggressively reduce the free shipping threshold means only one thing.

Shopee has been causing issues!

Sea Limited founder-CEO, Forest Li, shared that Shopee has become the largest in terms of order volume, all the while maintaining profitability.

This quarter, we celebrated Shopee's 5-year anniversary in Brazil, and I'm very proud of what our team has achieved in this relatively short time. We have become the market leader by order volume, we continue to grow fast, and we are operating profitably. I'm especially happy with the role we have played in promoting digital entrepreneurship to over 8 million Brazilians. 30% of our active sellers said Shopee as their first experience selling online and more than half of our active sellers say they rely on Shopee as their primary source of income.

Shopee has continued to deliver exceptional growth while maintaining its positive adjusted EBITDA. Average monthly active buyers rose by over 30% year-on-year in the second quarter, much faster than the industry average growth rate. Our strong growth in Brazil is built on solid fundamentals, especially logistics improvements and product category expansion.

I find it so impressive given that Shopee is operating in a foreign land, and has a less mature logistics network in Brazil than Meli’s.

We have brought logistics cost per order down by 16%, while also reducing our average delivery time by more than 2 days year-on-year. In the Greater Sao Paulo region, about 1 in 4 Shopee parcels were delivered the next day and 40% within 2 days, up from single-digit percentages in the same period last year.

On Monee in Brazil

Brazil also delivered robust growth in the second quarter, driven by strong adoption of SPayLater and personal cash loan products.

Our active user for loans grew 2x year-to-year. Our outstanding in Brazil also grew more than 2x year-to-year.

We also integrate more external data to our risk assessment system compared to Asia. And this is because in Brazil, there are more external data available compared to Asia in the market.

On logistics in Brazil

We didn't see any observed impact to our growth as far as we can see for now. I think the key thing, if you look at Brazil for us is, number one, to make sure that we operate in a best cost structure, especially on the logistics side, even with the improved speed of delivery, as far as sharing the opening that we are 2 days faster than last year. We still see the costs are coming down.

Even compared with that slow shipping, our cost structure is still very competitive and our speed is a lot faster than the slow shipping. So we believe that we are in a pretty good position on that. I think that's number one.

We are less CapEx heavy. So we don't buy land. We don't buy our own trucks even in Brazil. So the majority of the investment in terms of CapEx is, number one, our sorting machines, our automated sorting machines in our sorting center.

Number two is just setting up the delivery hubs across the countries. So it will not give us a big, I guess, profitability burden in general. And in fact, as we're expanding more and more SPX coverage and improving the efficiency more and more, this will help us on the EBITDA in Brazil. Actually, this trend has been ongoing for a period of time if you track our past.

We have been profitable in Brazil since a few quarters ago, and we are still profitable in Brazil even with growth in such high speed for the market.

On pricing in Brazil

On the price competitiveness. […] our pricing is still very competitive in the market if you -- across all price categories, even with the adjustment from the other side. I think number three is, if you look at our brand seller side, we're expanding our seller base to a better -- to a higher ticket items, especially in the past few quarters. We believe that trend will continue as well and will be not impacted much by the competitor movement. Just all in all, we believe that in Brazil, we are still well positioned. Our growth trend will continue, especially with our core segment group, given the strong focus that we have on the fundamental cost structure, our price competitiveness and also the growth of our seller side.

Logistics

Logistics is the backbone of Amazon's US and European domination. Shopee builds and localizes earlier and better to what we know now as SPX Express. It's the unsung hero for Shopee improving service quality.

On service quality, our logistics capabilities continue to be an important differentiator for us. In the second quarter, we reduced logistics cost per order and improved delivery speed across Asia and Brazil year-on-year in both urban and rural areas. We continue to roll out new initiatives to address specific customer needs such as instant delivery options in dense urban areas. This lets some buyers receive their orders within as little as 4 hours of order placement, our fastest shipping channel yet. We piloted it in Indonesia, and it proved so successful that we have now rolled it out to Vietnam and Thailand as well.

Value-added services revenue, mainly consisting of revenues related to logistic services, was $0.7B ($2.8B annualized), up 3% year-on-year.

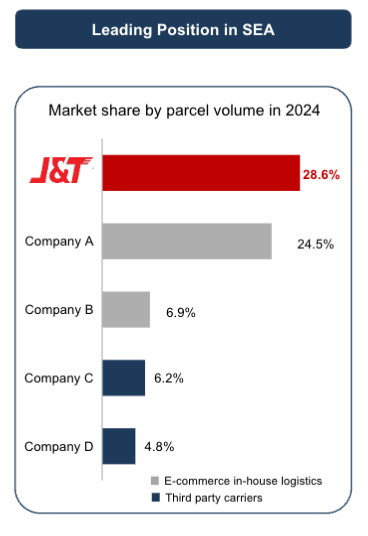

Direct comparison isn’t as simple as SPX Express has all sorts of free shipping discounts and those vary quarterly. However, let’s be content with the information provided by J&T Express below.

SPX Express is now in 2nd place behind the pure logistics provider J&T Express with roughly $3B revenue in the SEA region.

Not bad for a seemingly disjointed company (gaming / e-commerce / fintech).

Advertising - the fourth pillar of growth

Advertising is buried under core market place revenue and correlates with the health of buyers and sellers. Revenue growth was at 46%, so that’s very healthy.

Core marketplace revenue, mainly consisting of transaction-based fees and advertising revenues, was up 46.2% year-on-year to US$2.6 billion.

Currently, it’s around 2% of GMV, and management targets around 4-5% long-term.

How will they get there?

Number of sellers x revenue per seller (Q2 saw 40% increase), driven by

Better traffic algorithms that will improve the conversion rate of the ad placement

On the ad side, there are 2 main drivers for the ad take rate. One is we have a better traffic allocation algorithms between the ad and organic. We had -- we are able to mix the ad slot and the organic slot in a more efficient way, which will improve how much we can essentially improve the conversion rate of the ad placement, which will improve the return on investment from the sellers, so we can essentially cater for more seller demand on the ads.

Self-service allocation for sellers, akin to The Trade Desk (TTD) demand-side platform.

Number two is we have a better seller-facing product. We rolled out GMV Max, which helps the seller to automatic allocate their ad spend more efficiently and maximize their ROI. And we also simplify a lot more ad setup UIs to more and more sellers. I think all this helps to achieve essentially the better take rate. As you can see that we increased both how many sellers are involved in the ad products. We have 20% increase in the active ad sellers.

Conclusion - High bar for other sleep well picks

I will be adding SE opportunistically, even if it’s just a tiny amount each time. Since last year's recommendation, I have added 3 times. Today, SE remains at ~26x EV/FCF for an increasingly more predictable 20%+growth rate. That’s more than reasonable to me.

Importantly, Sea has overcome the post-COVID hangover and is now countering any external pressures that come its way (TikTok Shop, Temu, even Meli in Brazil).

Garena is back to growth (~10%) with stable user engagement and eliminating durability concerns.

Shopee is now on a 3-quarter GAAP profitability streak and growing rapidly (~20% plus long-term penciled), backed by superior cost structure (cost per order) and service quality (product assortment, fast delivery).

Monee has been profitable for the 11th quarter and is promising to be the core cash generator for the group. Growth could emulate Pago’s 40% 20-year CAGR.

If you find my work useful, please do me a favour and help me grow the newsletter.

Let’s win together.

Start here if you are new to Sleep Well Investments.

Ok, that’s it for today—a quick reminder.

Ensure you own resilient businesses with plenty of buffers and redundancies.

Don’t panic sell; all businesses will suffer, but unequally!

Don’t panic add just because a stock is cheaper!

Sleep well,

Trung