Sleep Well Portfolio (Nov 2025) - Underperforming S&P500 for the second month, 3 losers, but I expect a rebound.

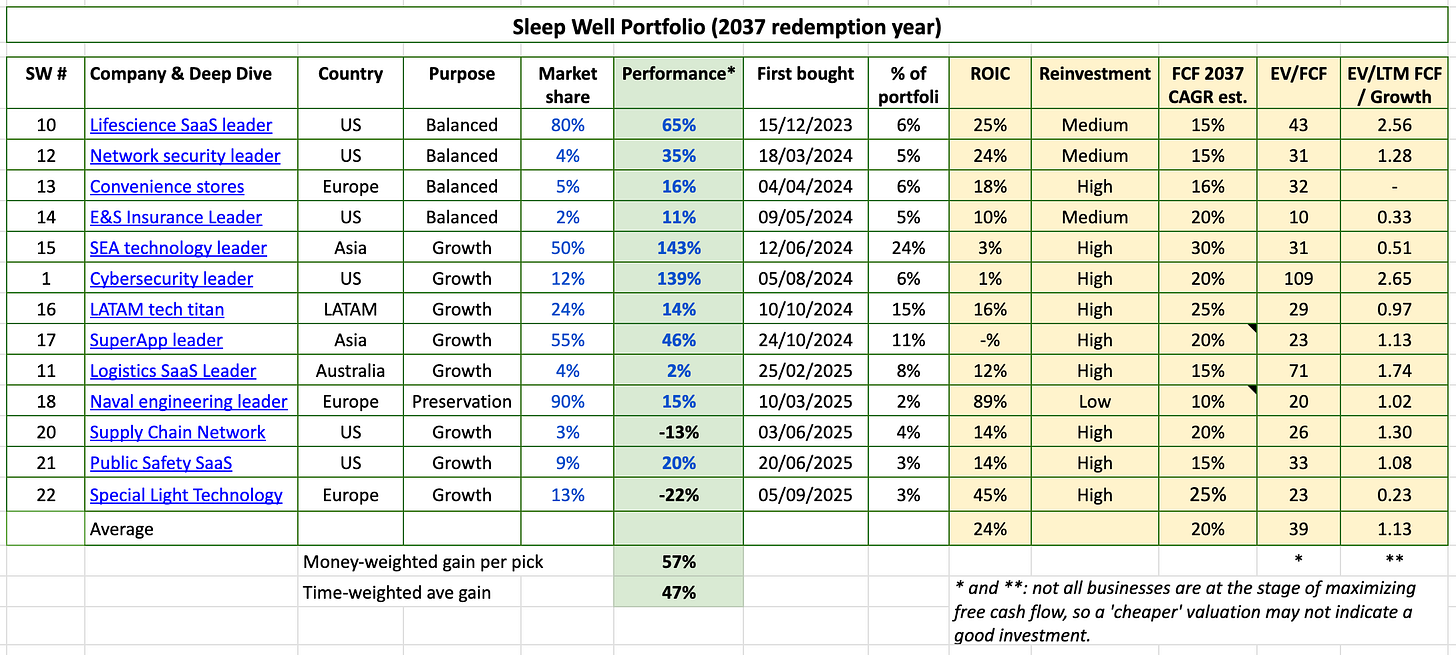

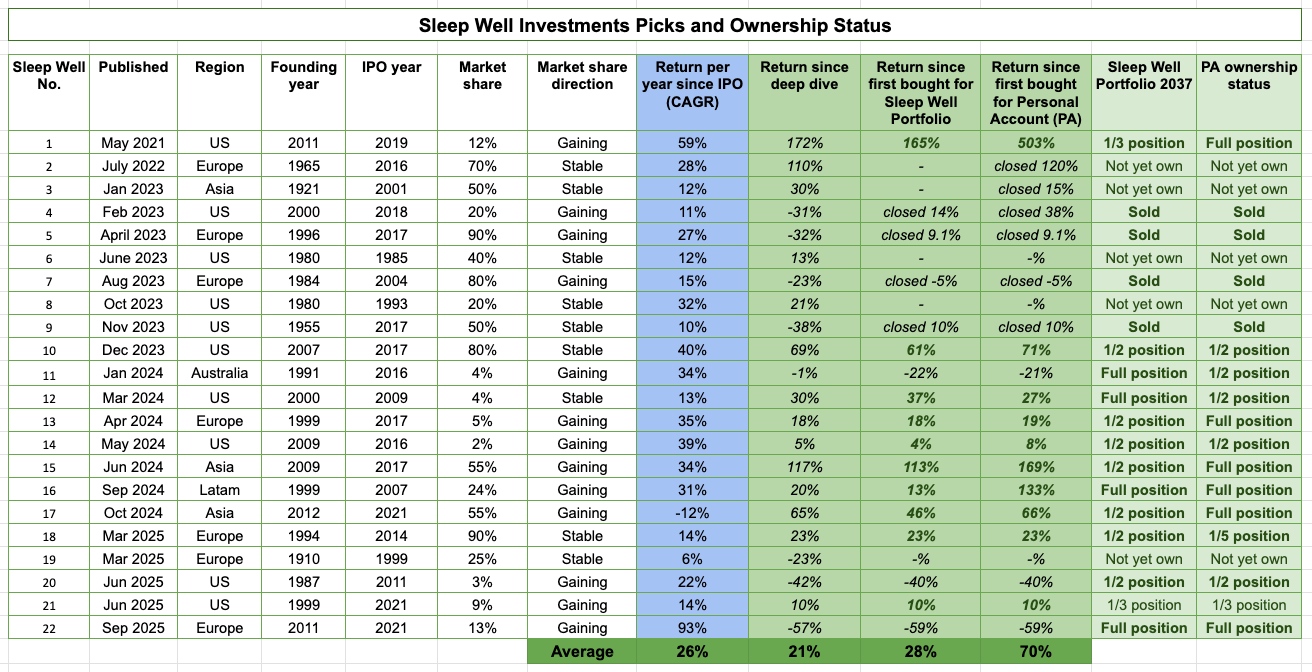

Three losers out of 13 holdings; 30% underperformance vs. S&P500. Two BUYs, 21% annualised return per pick, 23/33 transactions were correct (70% success rate).

Sleep Well Portfolio consists of time-tested leaders. We screen them using a rigorous checklist and track their theses regularly to determine when to buy. So far, we have made one mistake, three losers, and 23 out of 33 transactions have been profitable. All about us here.

Summary of November 2025 - 2nd tough month

The Intellego MISTAKE lingers on for the second month. The founder and CEO has now been detained and is likely to be charged with gross fraud. The business is real, but management is rotten. Deloitte, the Swedish Credit Agency (EKN), Nordea Bank, and investors have all been misled. The stock will likely be delisted, and I won’t know the ending for many years. The SWI portfolio for October and November was impacted significantly. My PA saw a near 7-figure loss, too.

I stuck my neck out and stepped out of my comfort zone with Intellego and got my head chopped. The situation was also compounded by the historic flooding of my new home in Hoi An and the failure of my extended family’s business, which I stepped in to help. Investment decisions during September and October were made under intense pressure. But I am not one to shy away from mistakes; they need to be minced, experienced, and learned.

Onwards, I am excited to grow a new head and turn the portfolio around. The fundamentals of the rest of the portfolio are strong; it requires patience.

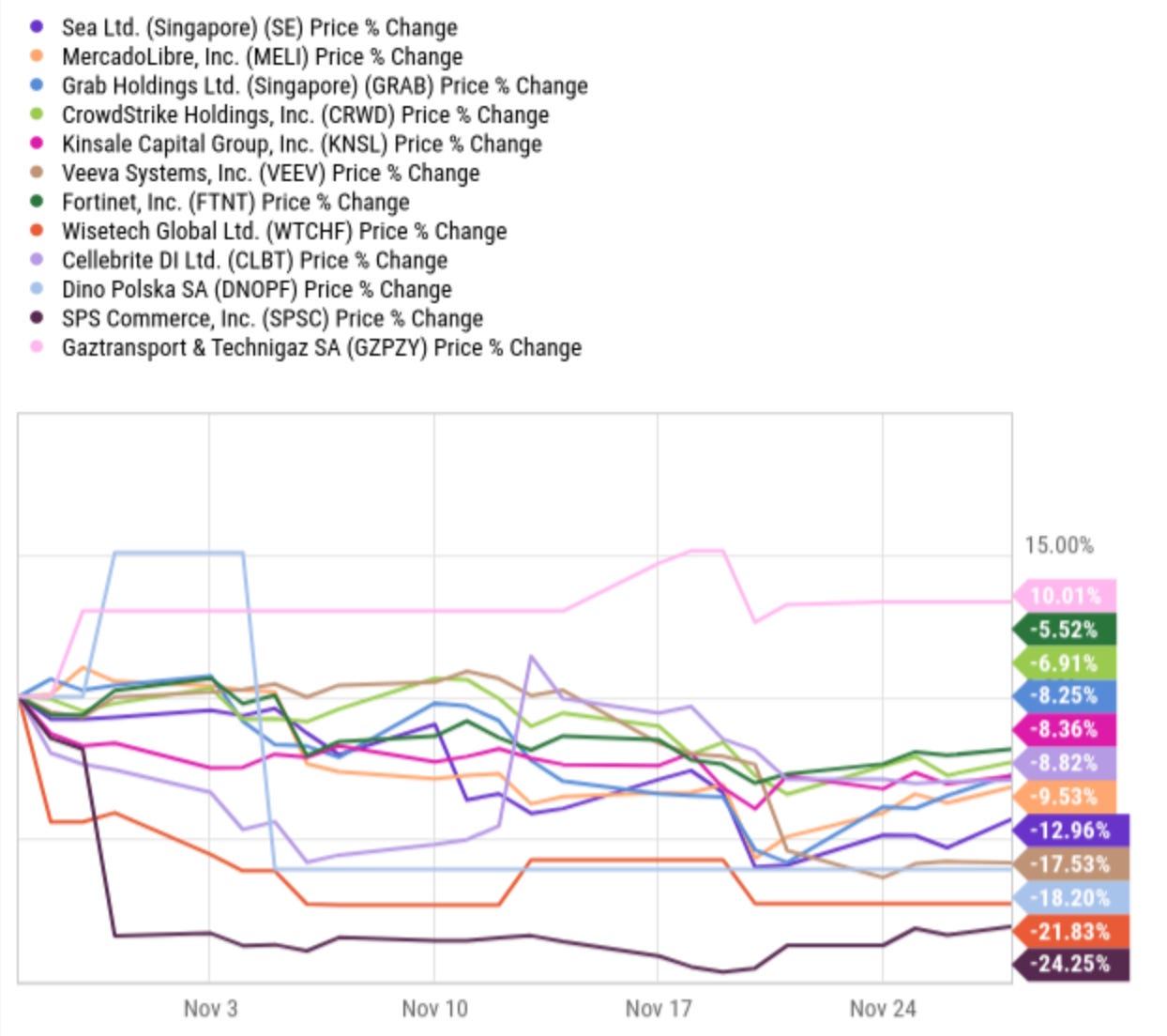

Declines in core positions SE (20%), WTC (9%), MELI (15%), and KSNL (5%) dragged the portfolio down from overperformance to underperformance for the second month. These are temporary.

I expect a rebound. SE and MELI are trading at ~20x FCF for mid-term 20%+ growth and a very low chance of being disrupted from their 50%+ and 30% leadership position. Monetization is just starting from years of building moats around the ‘castle’. I believe those two alone will turn my current underperformance around. A detailed study of SE’s valuation was conducted here on 17th November. Next, I also have strong reasons to think WTC will do well in 2026, but the transition for the new CEO and commercial revenue model will take time. Hence,

The two additions in the month (no sales) were WTC at AUD 66/share and SE at $136/share. Sentiments are low for these two quality businesses and I believe, its’s a good time to add more of its stock.

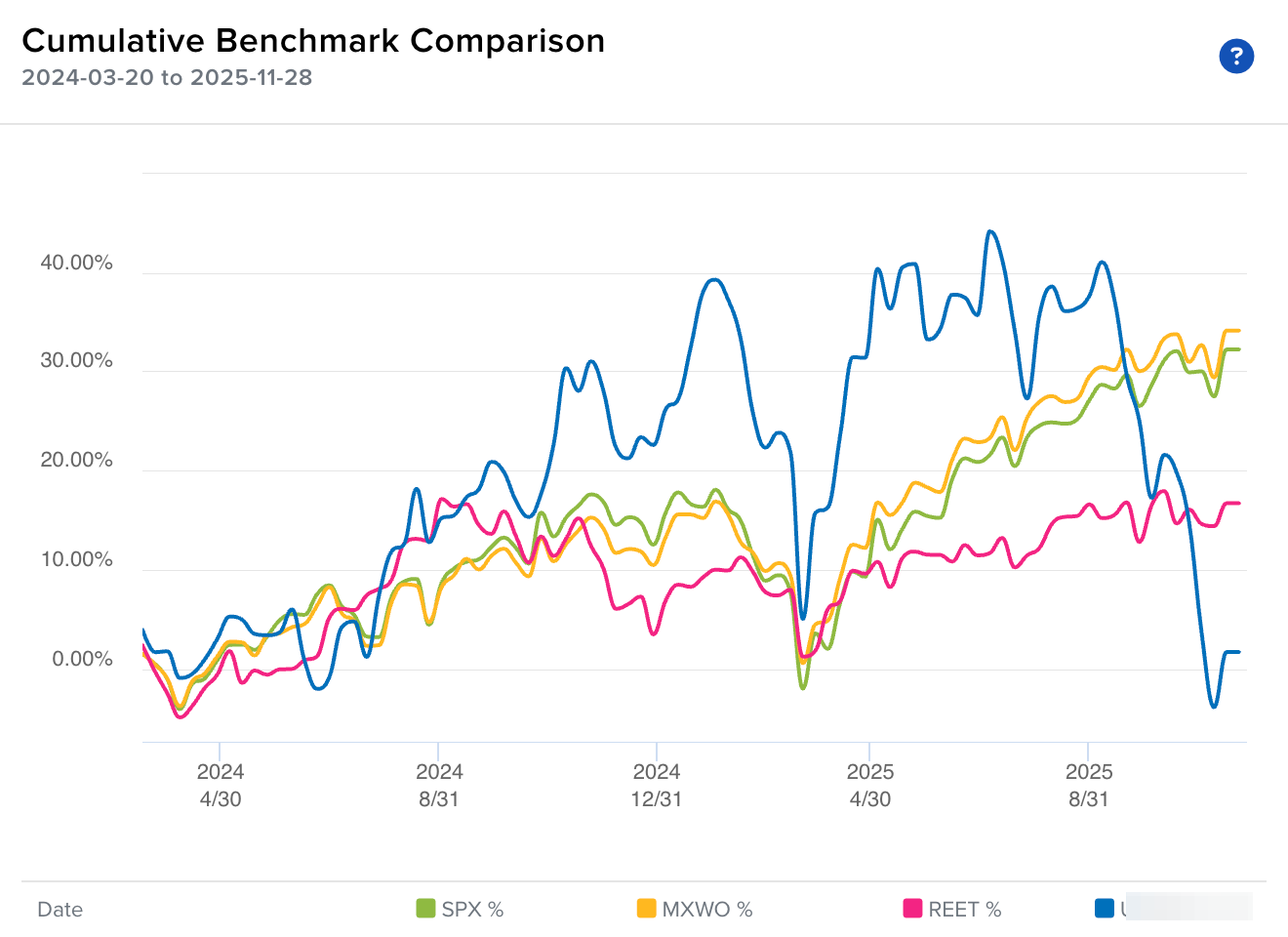

Return from inception was 2% vs. S&P500 32%: ~30% underperformance.

2025 Year-to-date return was -9% vs. S&P500 16%: ~25% underperformance.

Picks’ annualized return is now 21% compared to 27% in October, 47% in Sep, 50% in Aug, 46% in July, 61% in June, 64% in May, 51% in April, and 38% in March.

3 losers, 10/13 making money, and 23/33 transactions were correct decisions.

Best buys and research list - will be posted separately. The latest edition is here.

Sleep Well Portfolio master spreadsheet. If you are new to SWI, check out our FAQ and Owner Manual.

If you are already an annual member, you can access the Sleep Well Portfolio and Thesis Tracker via the link below.

Safety first, returns later.

We saw that avoiding losers is crucial to overperformance. Avoiding future Intellego will help the portfolio perform again.

Next, bet big when the odds of being right are high. We have a high concentration on SE, MELI, GRAB, WTC, VEEV, and CRWD; the success of these four will determine the end of SWI in 10 years.

The downside is that there will be large swings, particularly when you run a concentrated portfolio [current portfolio in the next section].

For now, one WTC is one of the three losers (Intellego, Wisetech, and SPS Commerce). This is the second month we have had three.

As the situation at Wisetech has been self-inflicted [unforced errors] and improved, but the price has remained 50% off peak, I added shares.

I am eying an addition to Cellebrite and SPS Commerce, as both haven’t done much wrong to warrant an 8% and 24% decline in the month.

On SPS Commerce, shares declined by 20% post Q3’25 earnings due to Q4 softness. For me, it’s more about the management’s inability to set a medium-term growth target. While I believe it can continue at ~15% growth, including acquisition, management leaned towards 7-8% organic growth and leaving the inorganic growth for the market’s imagination. The 20% drop is a significant overreaction. I put the business on the last Best Buy list and may add shares down the line. You can follow the thread here.

Since we launched the Sleep Well Portfolio in 2023, we have had:

two losers over 5 months, and

three over 2 months.

one or no losers over 17 months.

With more time to monitor the businesses, we can be more comfortable with betting big on our winners and avoid future Intellego.

Sea Limited and CrowdStrike are examples. Our returns on Sea Limited and CrowdStrike have increased by 100% and 150%, respectively. We added to Sea 5 times in the 17 months, and it now accounts for 21% of our portfolio. Wisetech will do very well, and I am optimistic about closing the gap with the S&P500 by adding more to Wisetech over time. Next, headwinds at Cellebrite and SPSC will be tailwinds in the coming quarters. Time is on my side; my horizon is at least a decade. The course will correct.

To close the commentary section, I am leaving Intellego’s loss on the portfolio as a good reminder, while eyeing additions to my future winners - WTC, CLBT, and SPS Commerce.

SWI Performance since inception 2% vs S&P500 32% - Interactive Brokers:

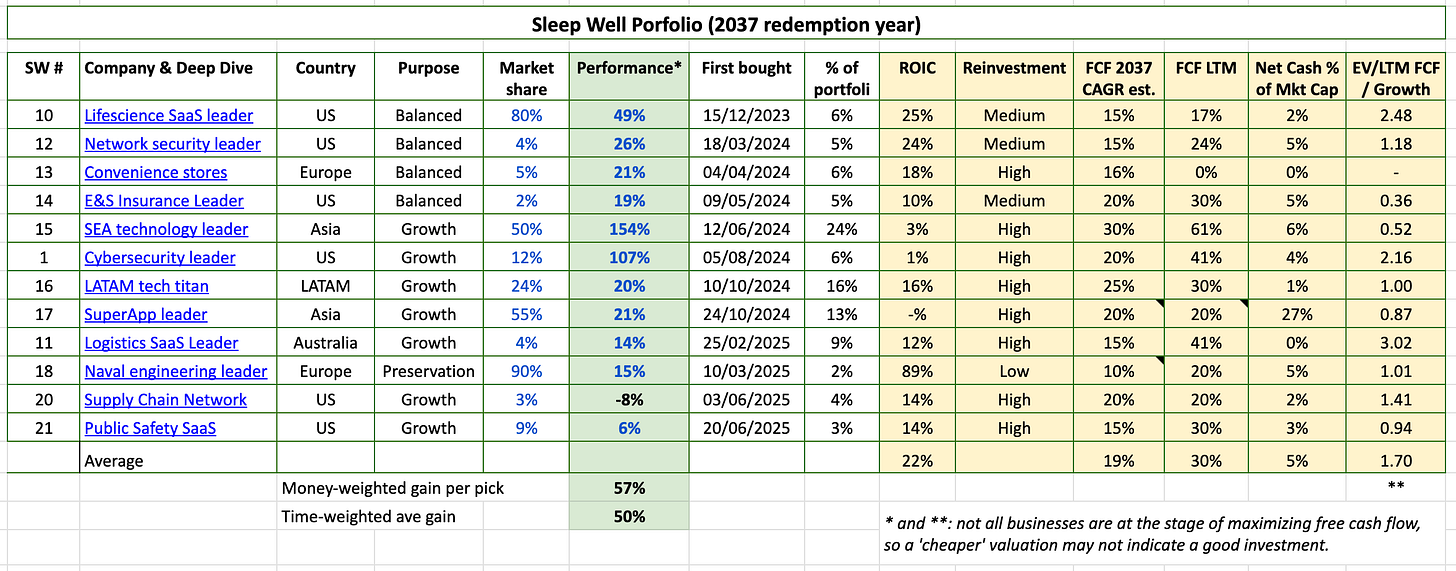

Current portfolio - 3 losers

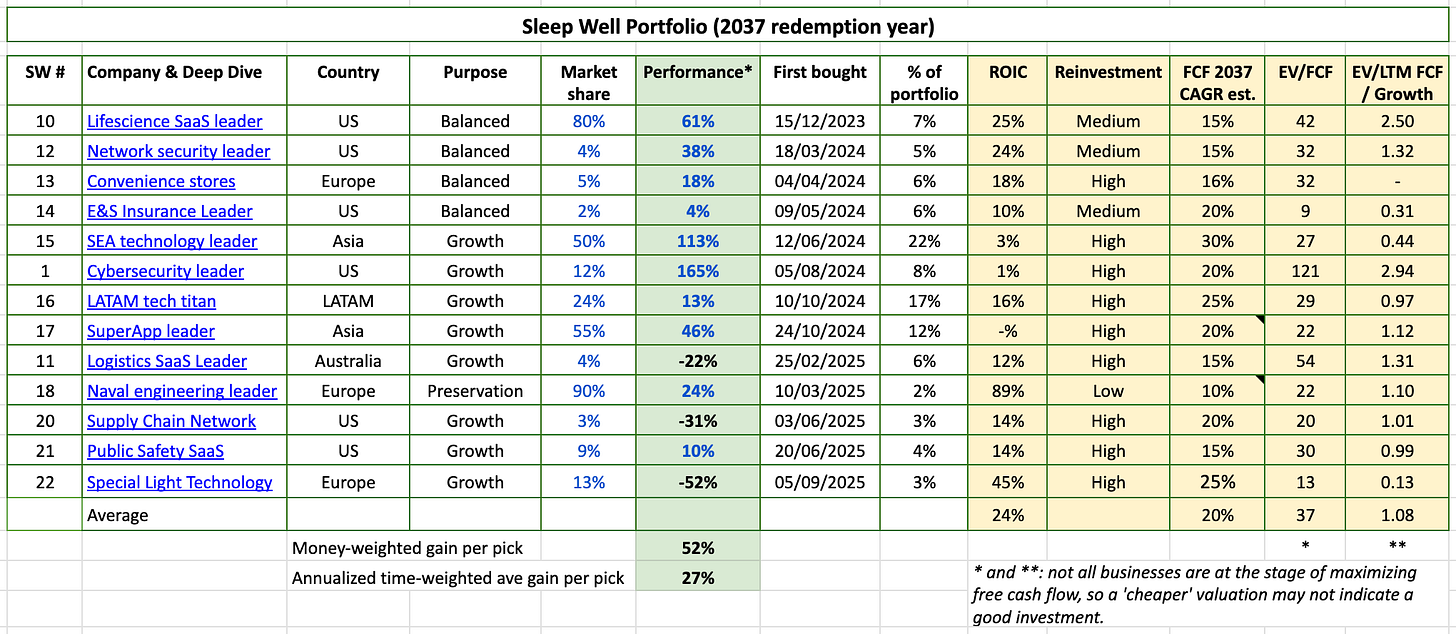

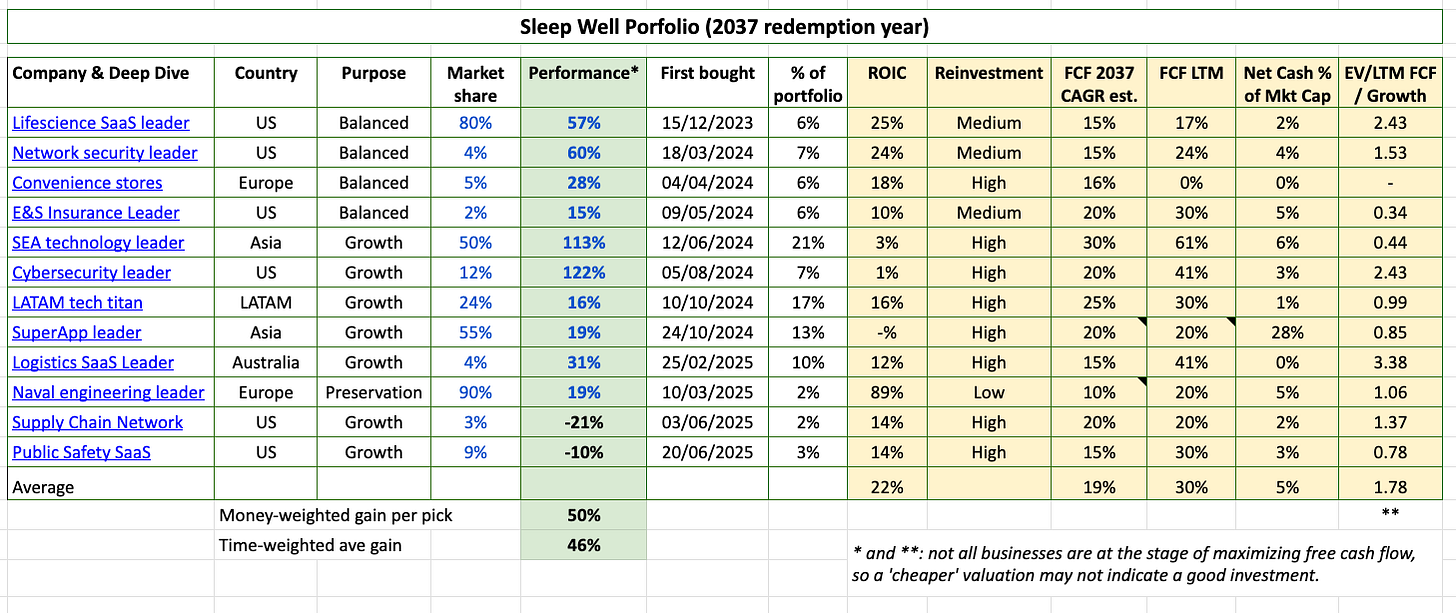

Previously - October 2025

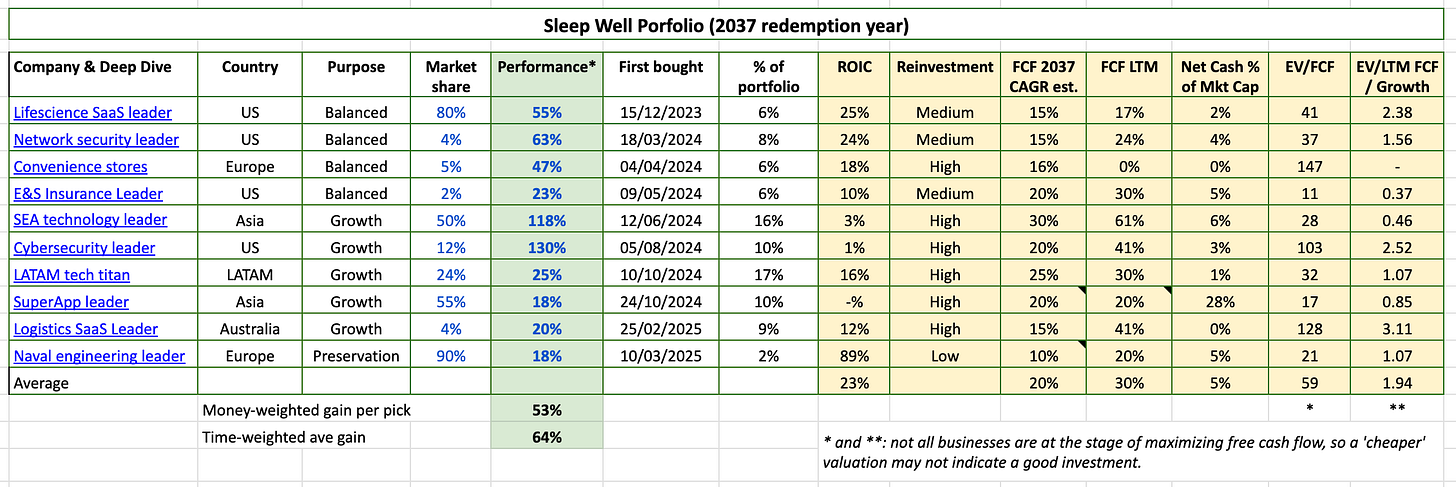

Previously, Sep 2025 - 2 losers

Previously, Aug 2025 - 1 loser

Previously, July 2025 - 2 losers

Previously, June 2025

Previously, May 2025

Previously, April 2025

Previously, Mar 2025

Transactions with notes below:

Expanding investment universe

You will only see me buying businesses that I thoroughly understand (see the deep dives below). I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—27% annualized time-weighted.

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of the investment framework to help find quality companies, and the lessons I have learnt.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.

Love this!