Sleep Well Portfolio (May 2025) - No Losers, 64% annualised return per pick, New Pick Tomorrow.

NO LOSERS; 22% Outperformance vs. S&P500. 64% annualised return per pick, 23/24 transactions were correct. New pick coming tomorrow.

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Good morning, sleep-well owners,

May was relatively calm after two months of volatility. As such, I didn’t feel Mr. Market was offering good deals within my investment universe (19 and counting) for me to deploy cash.

Tomorrow, I’ll release my 20th Sleep Well pick, which is available at a 10-year low valuation despite generating a 40% CAGR for free cash flow per share in the past 10 years.

The portfolio's annualized return per pick is now 64%, compared to 51% in April and 38% in March.

NO Loser status was retained, 10/10 made money, and 23/24 transactions were correct decisions.

The pair bought and sold in April yielded an 81% gain.

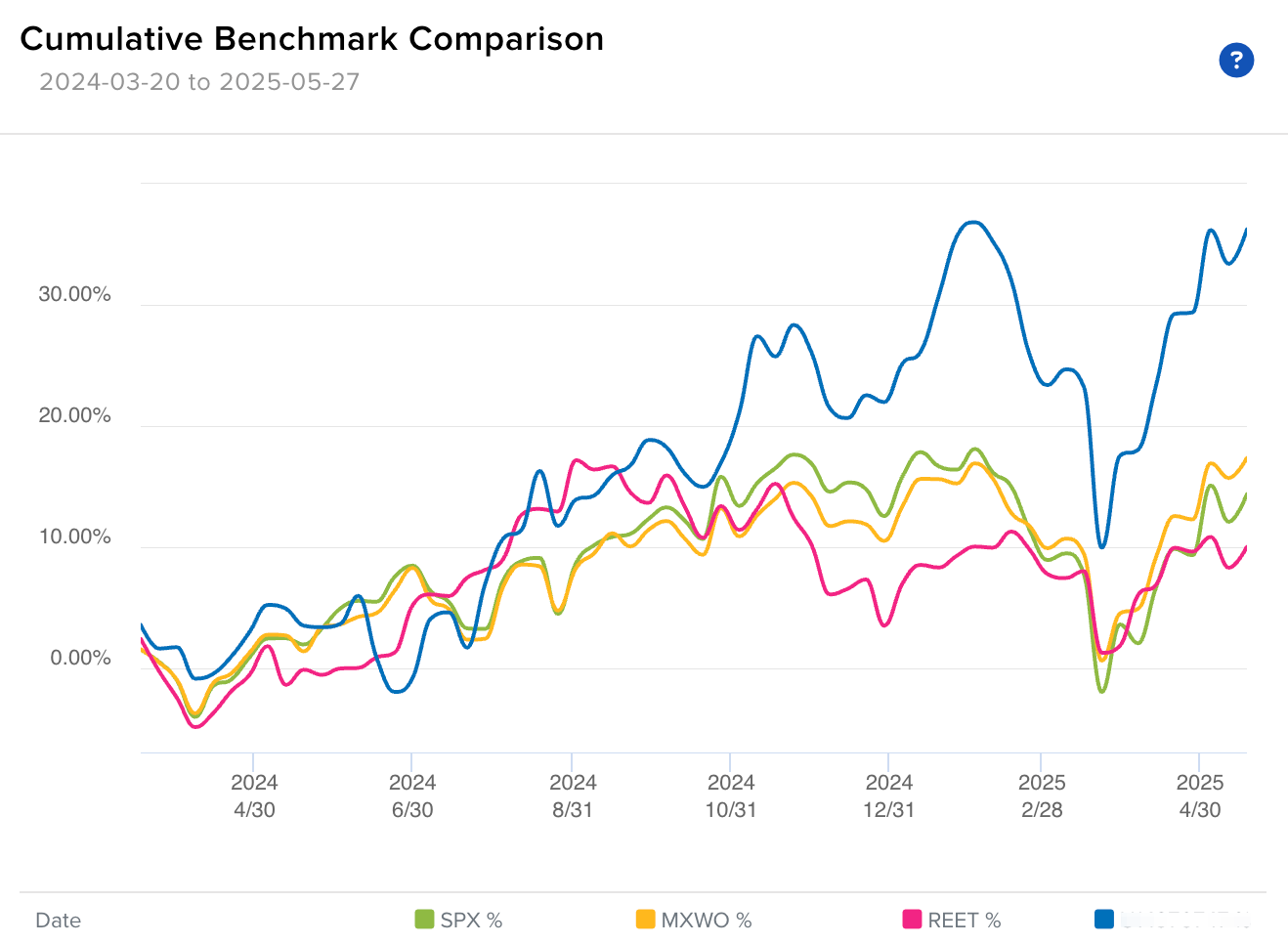

2025 Year-to-date return was 14.5% vs S&P500 0.5%: 14% outperformance.

Return from inception was 36% vs. S&P500 14%: 22% outperformance.

How do we do it?

We are active in fearful periods and quiet in happy times. In March and April, we reviewed every pick for tariff resistance, reviewed Magnificent Seven, bought Sea Limited (up 72%), Wisetech (up 36%), and GTT (up 17%), and sold MIPS (for a 10% gain).

We are focused on buying only the highest-quality businesses, so we don’t panic-sell or buy cheap stocks easily.

In May

We reviewed Q1’25 results of VAT, Kinsale, MIPS, Mercado Libre, Sea Limited, and Grab. We reviewed Wisetech's most significant acquisition in its history and the transition of the Mercado Libre CEO.

June?

I’ll share the 20th sleep well pick tomorrow (Sunday, 1st June).

Then, next week, I will examine Veeva and CrowdStrike Q1.

Remember, Sleep Well is all about not losing. We likely have found a good formula, and I am excited for the future. Time is on our side.

Quality > quantity.

Trung

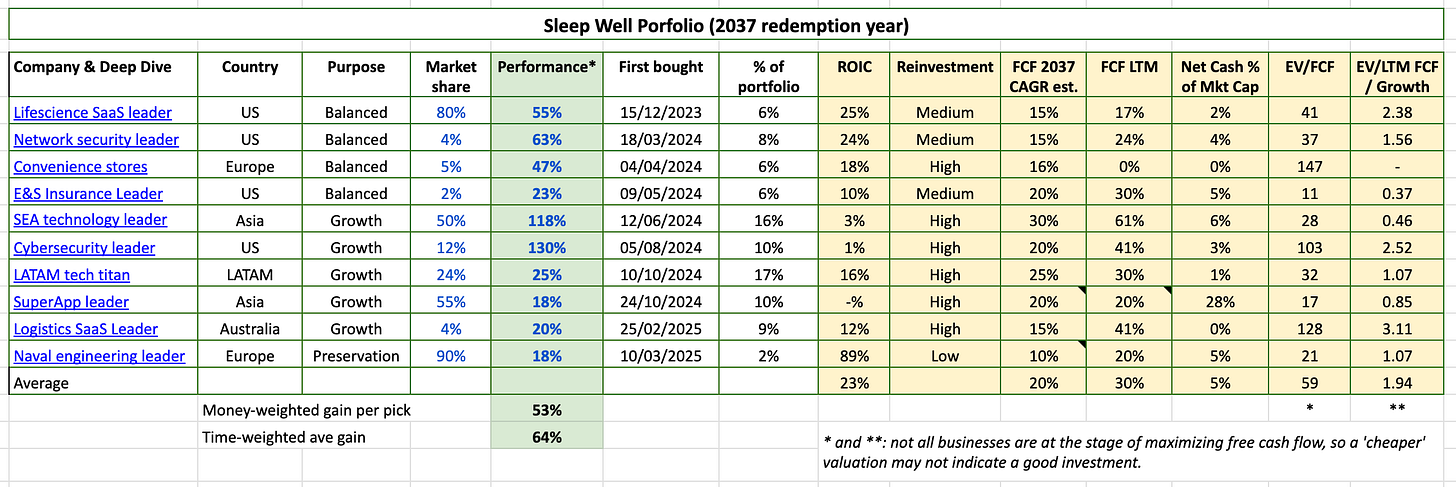

Current portfolio - No losers.

Previously - April 2025

Previously - Mar 2025

Consider becoming an annual premium member to track the Sleep Well Portfolio, transactions, and Sleep Well scores. The link to the Sleep Well Portfolio Spreadsheet is here. For all other write-ups, click here.

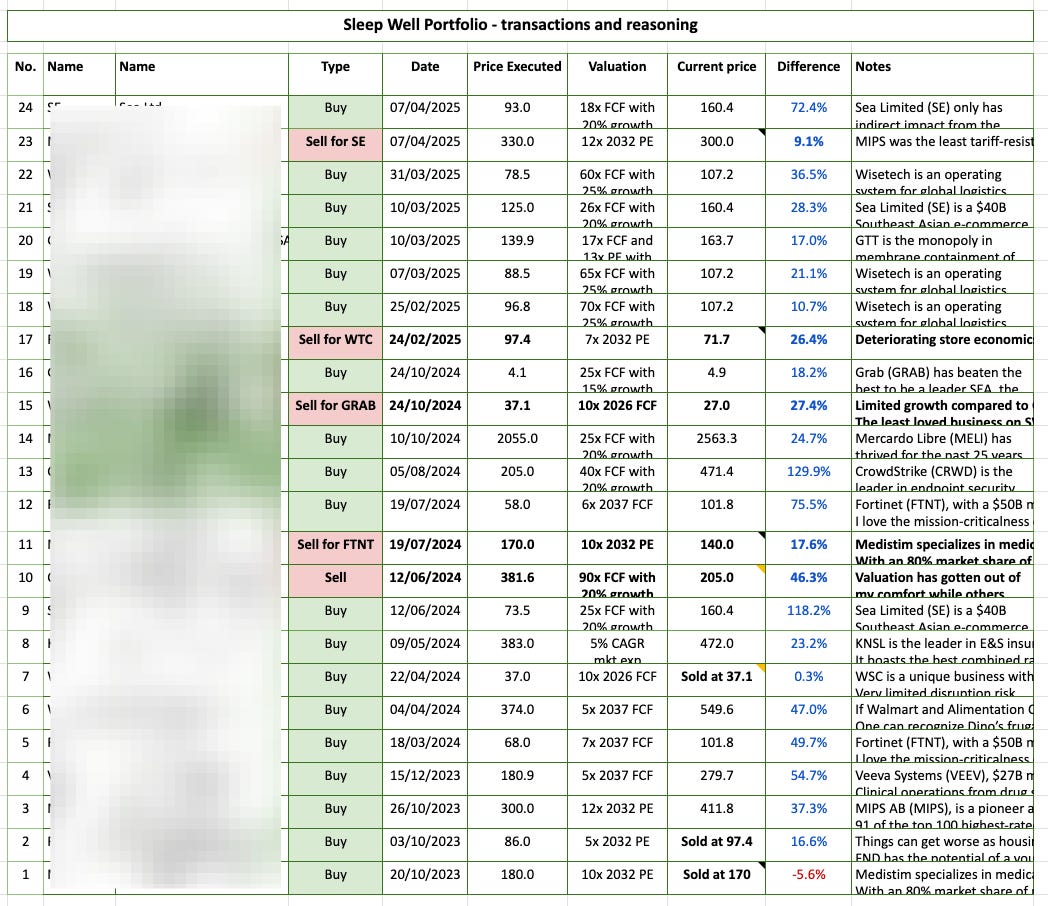

Transactions with notes below:

Performance reporting since inception 36% vs 14% S&P500 - Interactive Brokers:

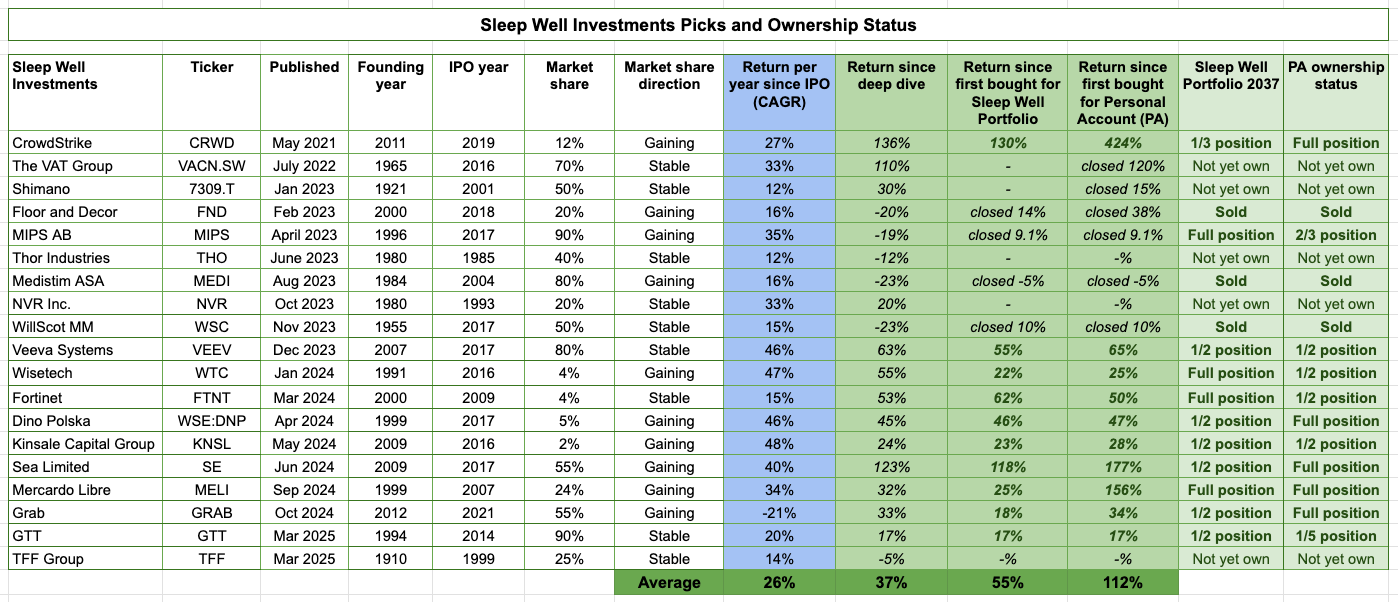

Expanding investment universe

You will only see buy alerts from businesses I deep-dived into below, as I only own what I understand thoroughly. I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

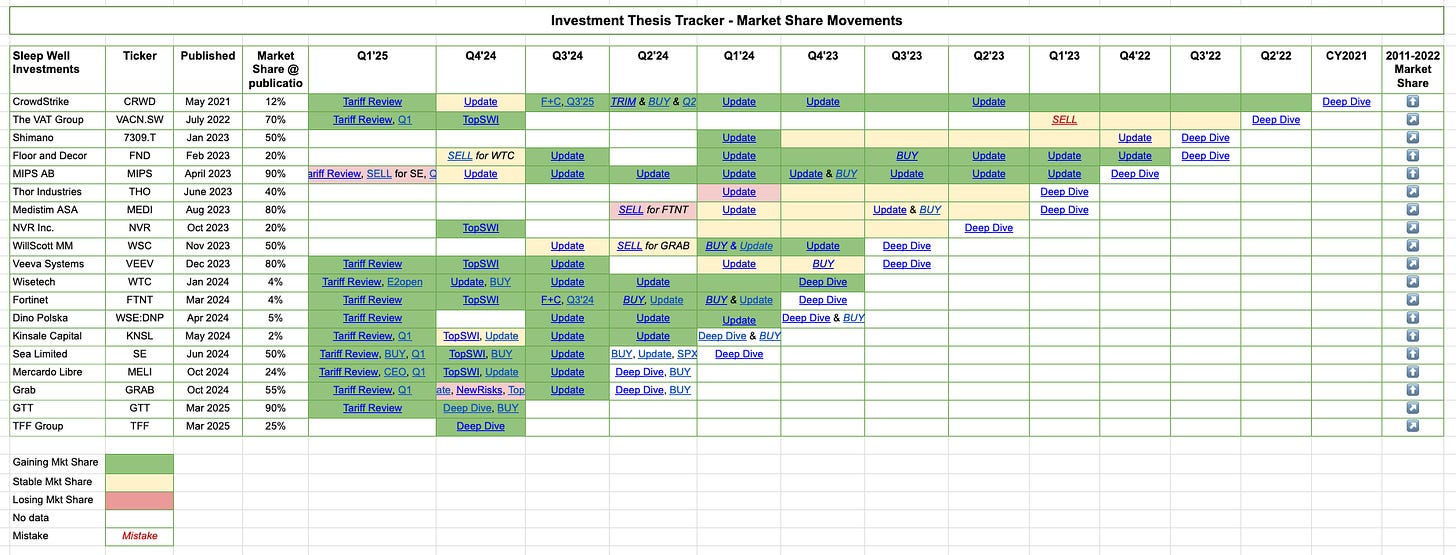

Thesis tracking updates - linked in spreadsheet

One key reason for my incredible investment decision record so far is that I have a tracking system that allows me to observe the progress of my businesses over time. You can track the table and notes in the spreadsheet linked next. However, it’s only for annual premium readers.

**Links to thesis updates, buy-and-sell, and deep dives are all in the Sleep Well Portfolio spreadsheet. (Annual Sub only)

Businesses I am currently considering and Sleep Well Picks to add now.

A basket of luxury (LMVH, Hermes, Kering, Brunello, Ferrari), ASML, Evolution Gaming, Airbnb, Ferguson, TerraVest, IES Holdings, Teqnion AB, Manhattan Associates, Grupo Aeroportuario del Centro Norte, Uber, Veralto, Nekkar, Subaru, Axon, TMO.

Sleep well picks that are good buys right now.

As I write, I believe the following businesses are good buys. But as markets are in a happy mood currently…I’d wait for pullbacks or buy in stages.

Please visit the deep dives and updates before considering buying these businesses. If you don’t know what you own, you won’t know what to do with your shares when the market overreacts.

Mercado Libre - most impressive execution amid political uncertainties.

[The Most Sleep Well Investment Of LATAM, Tariff Review, Top pick for 2025, Q4’24, Q3’24, Buy Alert]

Grab - steady market share gains and profitability amid local competition.

[deep dive, Tariff Review, Q4’24, local competition, buy alert, Q3’24 update]

Veeva Systems - no viable alternative within the life science SaaS, Salesforce + IQVIA partnership is a disjointed solution.

[deep dive part 1, part 2, Tariff Review, Q3’24, CRM+ IQVIA]

Sea Limited - Return of growth in the former core segment (gaming), with the e-commerce arm starting to become profitable, driven by low-cost logistics, the fintech arm generating significant profits, and advertising just getting started.

Kinsale - best low-cost operator in a niche insurance segment.

[deep dive, Q1’25, Q4’24, Q3’24, Q2’24 update, and ownership alert.]

Logistics Leader - less expensive given the leadership instability (a temporary issue, in my opinion).

[deep dive, Tariff Review, BUY, H125 update, CEO update, FY24 update]

Naval Engineering gold standard - indisputable leader and a good candidate to preserve wealth.

VAT - pick and shovels of the semiconductor and AI mega trend. [Q1’25, Tariff review, Top pick beyond 2025, Deep dive]

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—64% annualized time-weighted. No losers.

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of investment framework to help find quality companies and execute with discipline.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.

Looking forward to the new pick

Truly amazing performance, thank you for sharing your knowledge and wisdom.