Business Update - WillScot Mobile Mini (WSC) - Eliminates The Biggest Risk By Acquiring McGrath For $3.8B

Cementing market dominance, financial implications, intangible benefits, good time to buy?

Hi, I am Trung. I write 10K+ words deep-dives on market leaders. I also write Thesis Trackers updates to follow up on their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose the reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Join me in building generational wealth.

Hi, 2000+ sleep well investors,

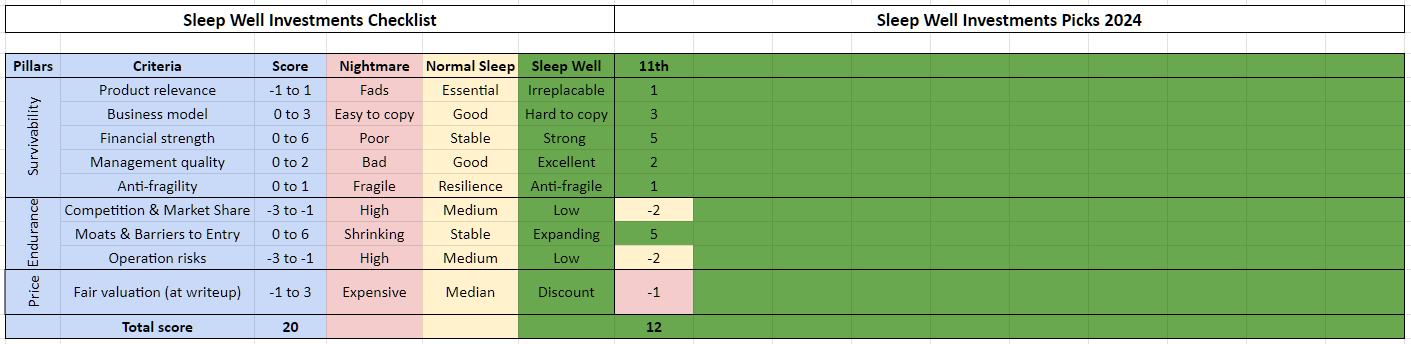

I deep-dived into WillScot Mobile Mini (WSC) in November 2023 (Part 1, Part 2). It was the 9th Sleep Well pick with a 12.5/20 Sleep Well score.

Sleep Well Investments Score (25 Jan 2024)

The thesis for owning WSC was simple:

WSC is five times the size of the next competitor in a $10B+ market,

Has products with 25%+ IRR over a 30-year asset life span,

Has a counter-cyclical capex and working capital profile,

Management is proactive in value creation.

WSC has the best unit economics and has clear organic and inorganic growth opportunities (it acquired 25 businesses in 2017). The stock returned 25% CAGR since its IPO in 2017.

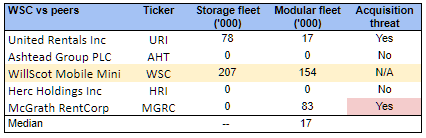

In the deep dive, I highlighted that the biggest near-term risk to WSC was McGrath RentCorp (MGRC), as it competes aggressively in M&A deals and operates the industry's second-largest modular business - behind WSC. I also highlighted the biggest long-term risks: United Rentals (URI), Ashtead (AHT), and Herc Holdings (HRI).

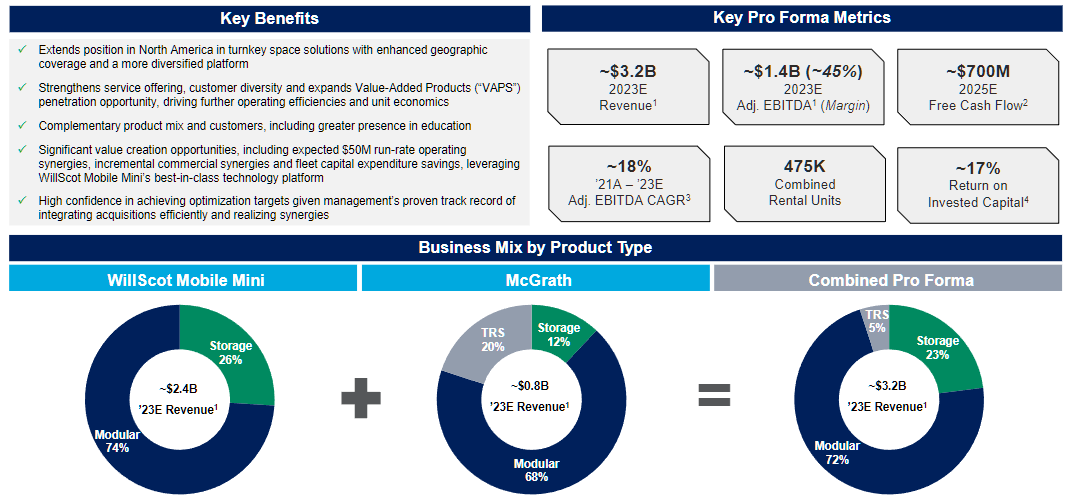

Today, 29th Jan 2024, WillScot has announced it will acquire McGrath for $3.8B, cementing the leadership position and eliminating the biggest near-term risk to its existence.

I will dive into the details of the M&A deal, analyze the business and financial implications, perform a post-acquisition valuation, and set a new plan to own the business.