✅ Buy Alert - 5th sleep-well ownership

Buying the most sleep well business in the cyber security industry

I am Trung. I deep-dive into exceptional businesses. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

I'm adding to my fifth position today, as pre-announced in my 12th Sleep Well Investment deep dive on Mar 17th.

The business and industry have been dissected and thoroughly observed for investment risks; I will keep track of crucial KPIs and report to you in the next few quarters. The groundwork has been done, and the decision to buy is not rushed or half-baked. Notably, the price is reasonable as we take a 10-year view, ideally longer.

Note: BUYING is the easiest part of investing. What’s challenging is to keep learning about the business, separating the noise from fundamental changes, and being humble when the thesis goes wrong. Thus, my deep dives and live trade alerts are just the beginning.

Before we discuss why I want to own this business until 2037, the Sleep Well Portfolio, below is a quick reminder of what it is about:

✔ The portfolio will eventually consist of 20 names.

✔The portfolio redemption year is 2037. When my daughters will take over.

✔ It mirrors my family's portfolios, following the same rigor and philosophy.

✔ No market timing. We buy at a price that offers a healthy margin of safety.

✔ No quick take, hot picks, the portfolio only invests in deep-dived stocks, which must possess these sleep-well qualities:

Stable / strengthening market position with reinvestment opportunities

Enduring and hard-to-replicate competitive advantages

Management with aligned interests and a strong capital allocation track record

Anti-fragility attributes (healthy balance sheet, adaptable business model, endured competitors and past crises)

Trading at a fair/reasonable valuation (least important)

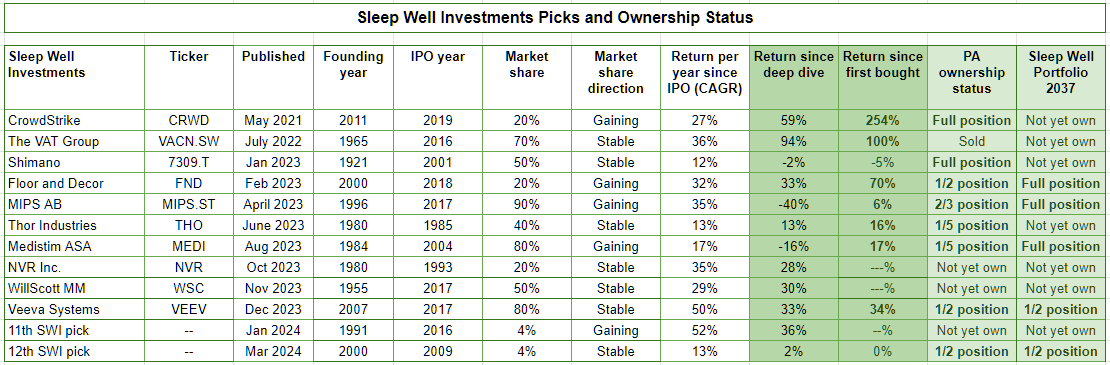

Below is Sleep Well Portfolio's current investable universe (all content here). I aim to build up the list to 40-60 exceptional businesses and own 20.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett.

It’s important to highlight that the greatest threat to investing is yourself.

Investing is a lifelong journey, not a sprint. That’s why the portfolio redemption year is 2037. I intend to own businesses, refine my investment process constantly, and eliminate luck. I will not trade a good night of sleep for a shot at a few extra percentage points of return.

For this reason, access to the portfolio is only available for annual paid subs who are in it for the long run. I apologize to monthly subscribers; I don’t want to mislead or tag you along for the marathon when you are looking for a sprint. You still have full access to my deep dives and thesis-tracking updates.

For annual subs, you have additional access to the following:

Research list

Sleep Well Portfolio

Thesis tracking summary

Ownership status of SWIs in my family portfolio

Important note: I do not provide ownership details in absolute $ value as it doesn’t matter if you manage a $50K or a $50M portfolio; if you can’t manage the small amount responsibly, then managing $50M will magnify your mistakes.

The purpose of showing how I manage my daughter’s and my family's portfolio is to encourage long-term ownership, showing I eat my own cooking and, for your reference, that it is possible to have a lasting investment process over multiple cycles. Please don’t copy it blindly; your saving is finite; treat it responsibly. We also likely have very different financial goals and circumstances.

Finally, I will only reveal new Sleep Well Portfolio positions after publishing my deep dive. I believe an investor should only consider an investment after thoroughly researching it.

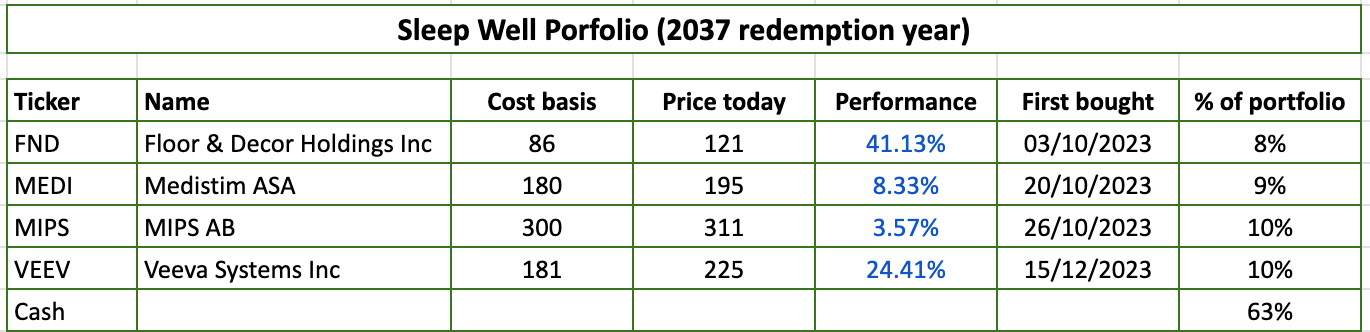

Let’s look at the fifth BUY for the Sleep Well Portfolio. The first four BUYS performances are:

*past performance is not an indication of future performance

![A Sleep Well Investment In Network Security [Part 1]](https://substackcdn.com/image/fetch/$s_!DAZN!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4035d862-137e-40ef-afa1-17abab5f6651_717x403.jpeg)

![A Sleep Well Investment In Network Security [Part 2]](https://substackcdn.com/image/fetch/$s_!I8y8!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fb34a6cbc-c401-4c38-8b45-723d0cea02c1_717x403.jpeg)