Intellego Q3'25 - Huge Improvement in Reporting, Except One!

EKN is critical to Intellego, future guidance is a 10x in sales and profit! But the treatment of Moveomed's 22M euro deal is odd.

**Update 19 Nov 2025** - A mistake was admitted on 10 Oct 2025, and will be written off the portfolio as a loss.

Intellego, a position acquired in September, just before the storm of bearish reports, is down 50%. Am I wrong? Yes, it’s not a sleep well pick (I admitted my mistake on 10th October here), but am I wrong about the business? I am not sure!

I need at least another quarter to know.

Before you read my Intellego’s Q3’25 review, please read the 29-page report first.

I am biased. But in my opinion, the disclosure has improved significantly.

Content:

Q3’25: Expectations

What was delivered?

Q3’25: results, including EKN and Moveomed

Future expectations

SWI’ writeups on INT: [mistake, deep dive, 1st buy, 2nd buy, 3rd buy, risk management, 1st live event, mispriced]

If you are new, read more about us here, our latest portfolio review here, and best buys here.

Q3’25: Expectations pre result.

I wanted better disclosure. Details:

i) sales composition, including from subsidiaries, and payment terms

ii) more information on the business model

iii) cash flow conversion from operating income (EBIT),

iv) working capital needs, and capex.

v) progress of the partnership with Henkel and Likang.

vi) capital allocation from recent cash build-up.

What was delivered?

i) sales composition, including from subsidiaries (Yuvio & Daro) - YES - page 10 and more, the top 10 customers composition was provided

ii) more information on the business model - YES - page 5, prior quarters focused more on the ‘What are the technologies’, this one explained the ‘Why it matters to customers’. It also clearly shows that the strategy is to sell/lease disinfection devices at minimal profit to up-sell the dosimeters, which are high-margin and recurring.

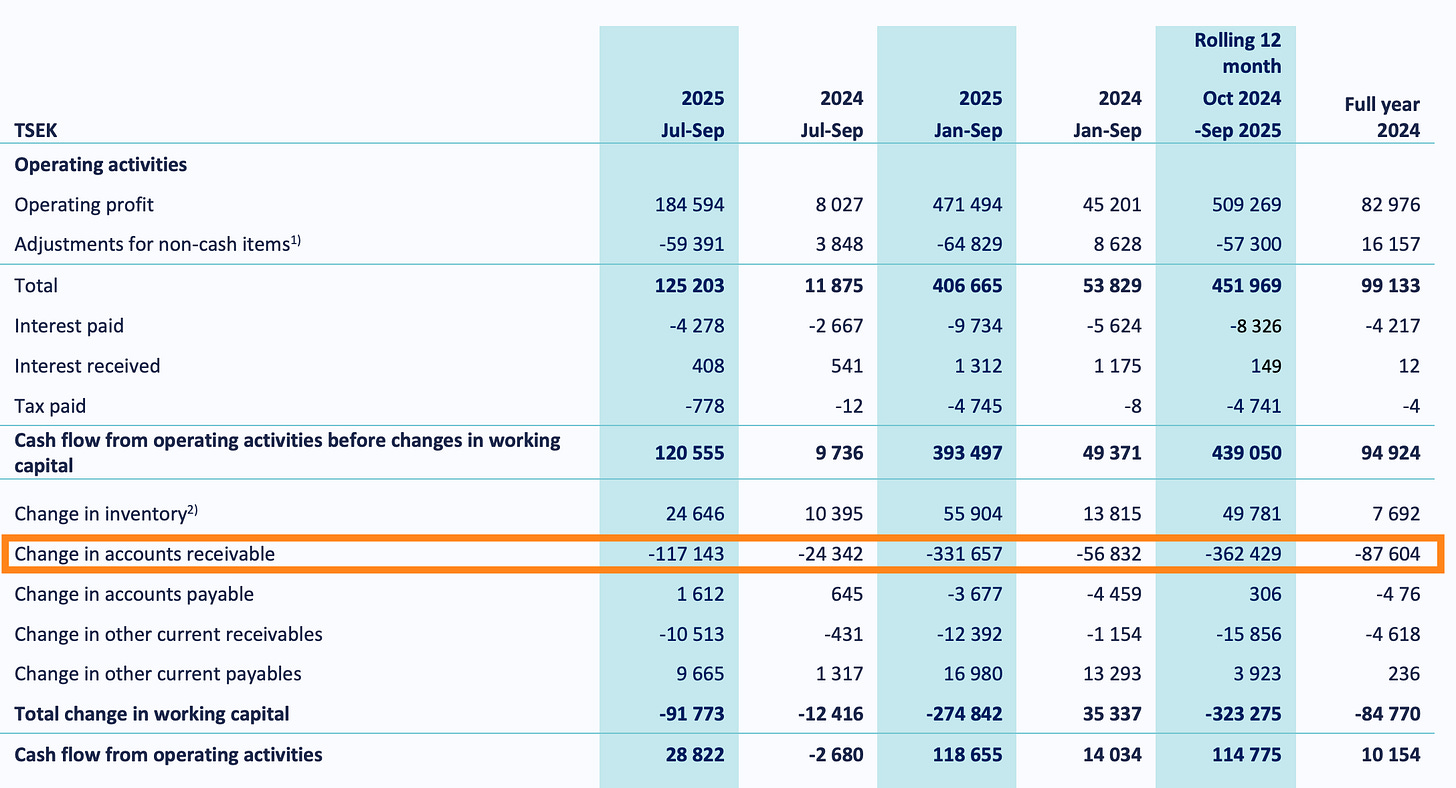

iii) cash flow conversion from operating income - YES - page 22-24, page 8 (EKN)

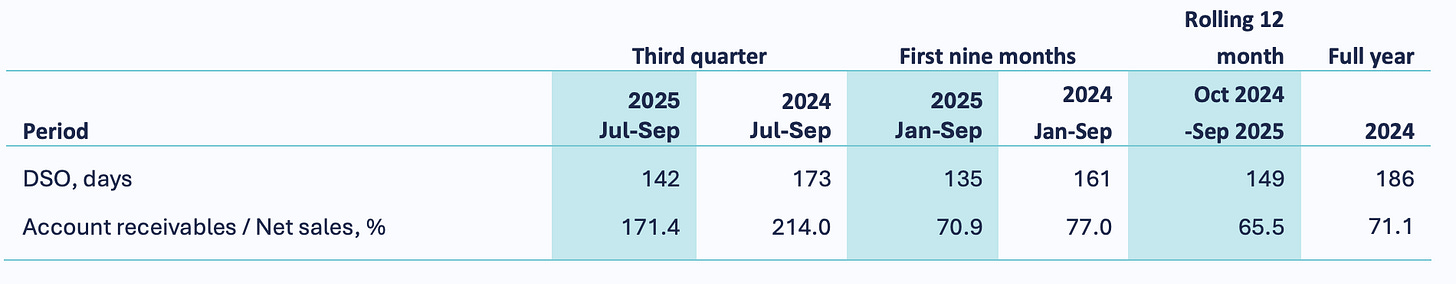

iv) working capital, including a breakdown of day sales outstanding (DSO) - YES - page 10

v) partnership with Henkel and Likang. YES, but limited—pages 3 and 6 show how and why the dosimeter is essential in the curing process. Page 3 also discloses what to expect in 2026 when all hospitals in China must use products like Intellego to validate their disinfection runs.

vi) capital allocation from recent cash build-up. YES

Q3’25 Results

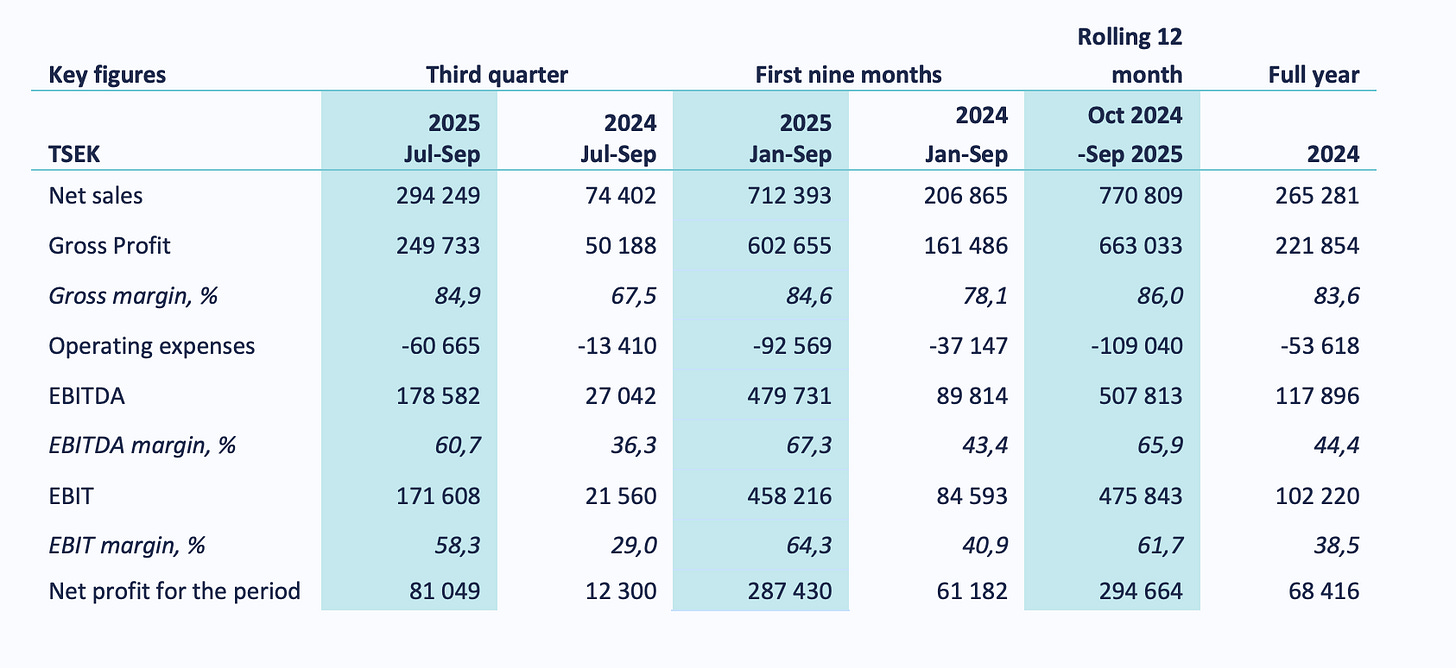

Let’s skim through the income statements and cash flow statements.

Sales was ~300M SEK increased ~300%, 87% from existing customers (recurring). To date, the Group has sold hundreds of devices globally. It has 331 active customers (who bought once in the last 12 months). Millions of dosimeters were sold and could double in 2026. Dosimeters are becoming an integral part of daily routines across the healthcare sector. It helps to improve workflow efficiency and disinfection results for users.

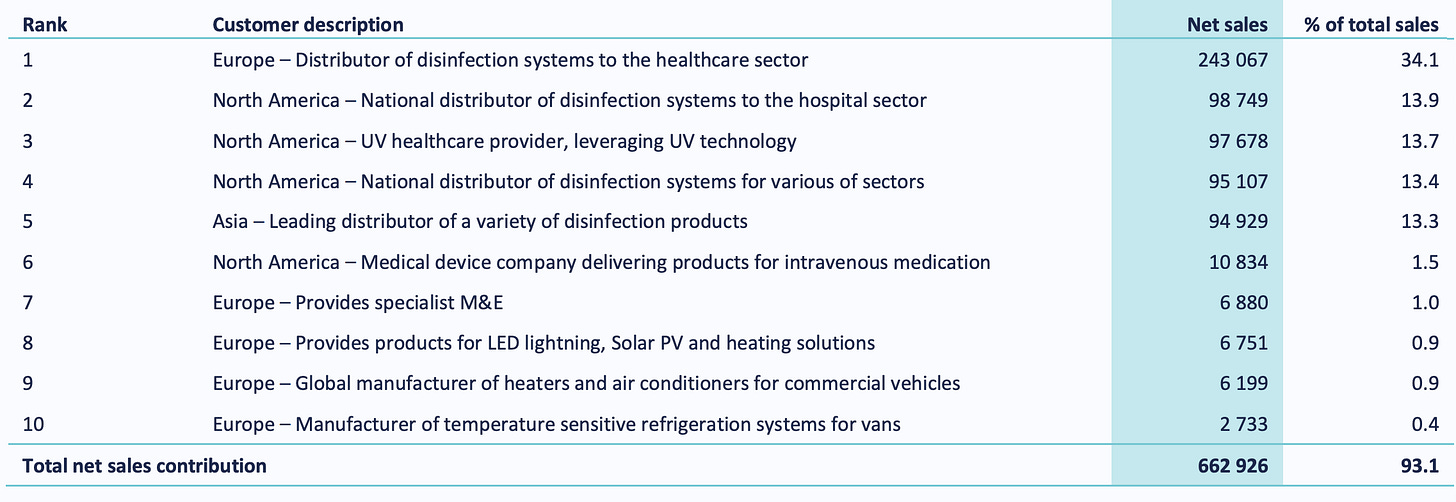

Below are the top 10 customers. There is a high concentration, but it’s common in hyper-growth companies. Likely the 13% from China was from Likang? The 1.5% from a medical device is likely HAI Solutions, which is very interesting. Do check it out.

Importantly, the top customer is likely to be Moveomed’s €22M deal announced on 4th October. I find this one a little strange, as the deal was announced just after the Q3 cut-off dates. Smarter investors can shed light here, but as long as the orders were delivered and ‘in the customer’s control’, Intellego is allowed to recognize the sales in full under IFRS 15. I would argue that would be for Q4. Why was it recognized in Q3? I don’t know.

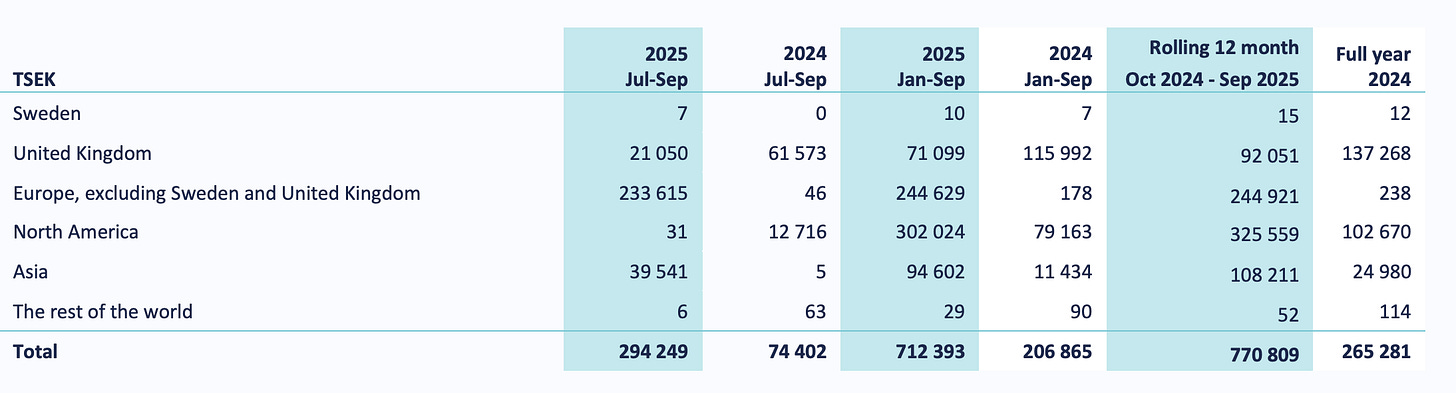

Below is the sales broken down by country, with the US and Europe accounting for the majority.

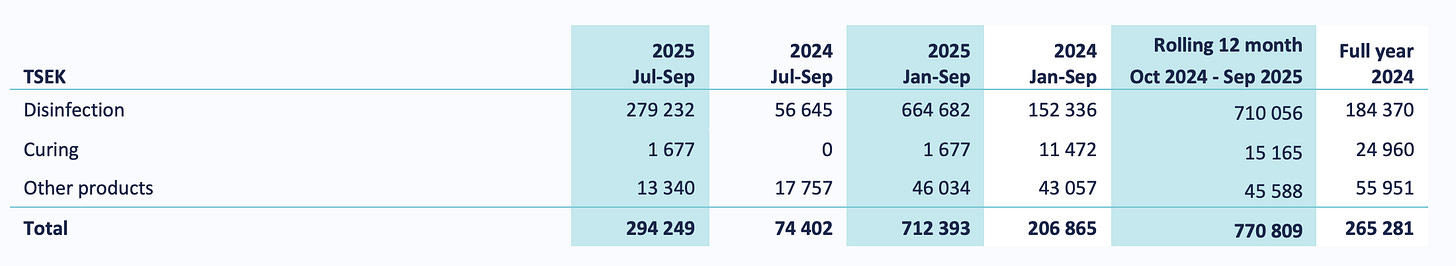

Disinfection is still 98% of sales in Q3 and 93% YTD.

In disinfection, the company expects a significant tailwind in 2026 when the national regulations take effect. Likang’s connections to 30,000+ hospitals MUST use products like Intellego. Given the development, it’s now likely that it’s just a matter of time before the EU, the US, and other markets implement the same regulations.

EBIT was 171 SEK, increased by ~700%.

Cash flow from operations was SEK 37M, increased from a cash burning position of SEK -5 M. So, the conversion from EBIT to cash is just 22%, low but not out of the ordinary for a hyper-growth company.

The key thing to see here is the reduction in accounts receivable, indicating customers have paid more of their invoices.

However, it will still be a slow grind, as day sales outstanding were 142 days, so the company still has to wait over 6 months to receive cash from customers. The good news is that the DSO has improved from 173 last year.

Below is the company's context.

Since 2023, Intellego has offered extended payment terms as part of a deliberate strategy to increase market share. Over the past year, we have gradually begun shortening these terms to improve cash flow and strengthen the company’s financial position. The transition is taking longer than expected, as customers have become accustomed to longer payment periods and the associated liquidity benefits.

The other core thing to understand is also the following disclosure:

The extended collaboration with The Swedish Export Credit Agency (Exportkreditnämnden, EKN) has enabled the Group to receive SEK 52 313 thousand in financing, after deductions for transaction costs, during the third quarter. Leading to totally received funds during January to September 2025 of SEK 128 645 thousand, after deductions for EKN and financing partner transaction costs. The financed invoices are not considered in the accounts receivable per 30 September 2025 as they are financed without recourse. The total EKN guaranteed invoices per 30 September 2025 conclude to SEK 132 996 thousand (0) when EURO is converted to SEK currency.