Intellego Was A Mistake.

I was wrong to label it 'sleep well'. Here's how I am going to improve on this experience.

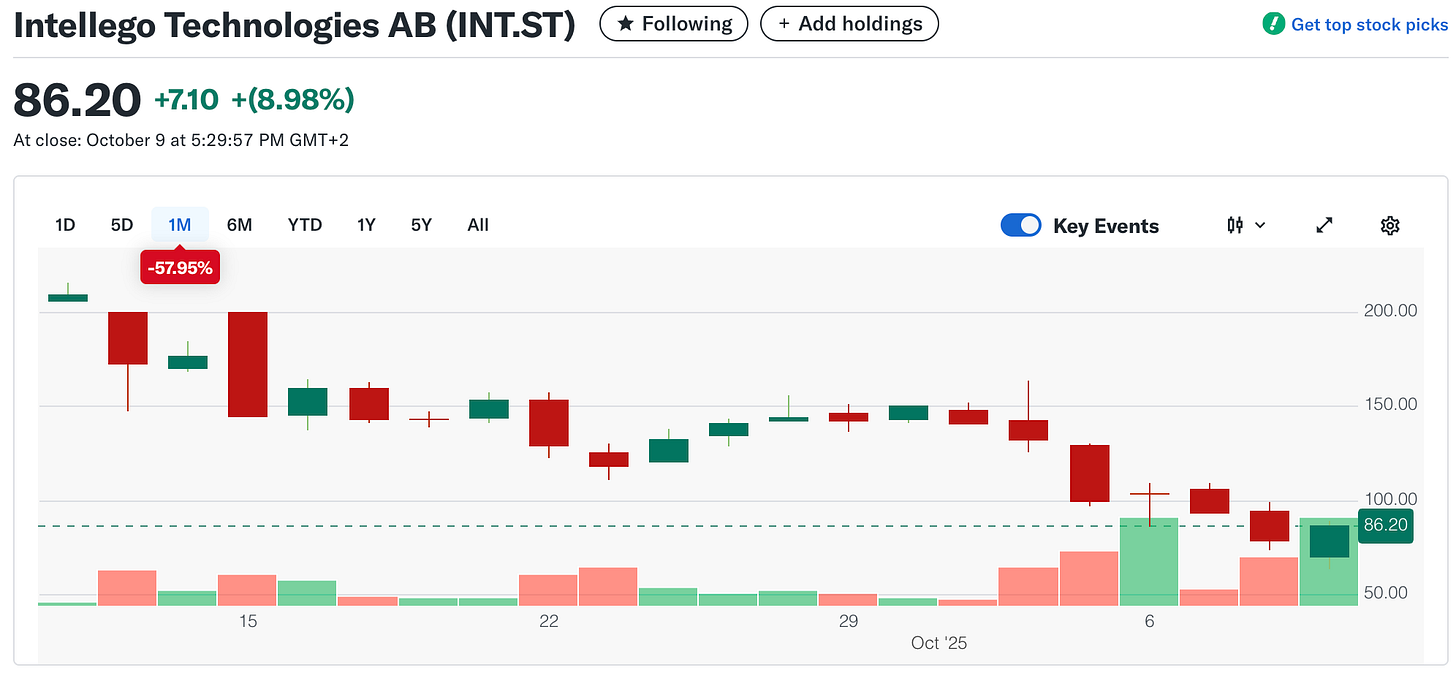

Price drives narrative.

When Intellego’s stock was on its way to SEK 220, it was the best Swedish export!

However, when the stock fell to SEK 66, it was labelled a fraud. Even Montega, the only analyst, bailed coverage from 8th Oct due to the concern we had all along - lack of disclosure.

While ‘the house’ was on fire, nothing has changed within the company. Insiders haven’t cashed out, large customers haven’t terminated contracts, and EKN (the Swedish government) or Nordea, the most significant financing backer, haven’t said a bad word.

On the contrary, the FY2025 guidance was raised, and a new €22 million order has been announced. EKN/Nordea has increased its credit line by approximately SEK 500 million.

However, given the 50% decline within just a month (1st September to 9th October), and the continued ‘start-up-like’ communications from the founder-CEO, I can no longer classify it as ‘sleep-well’.

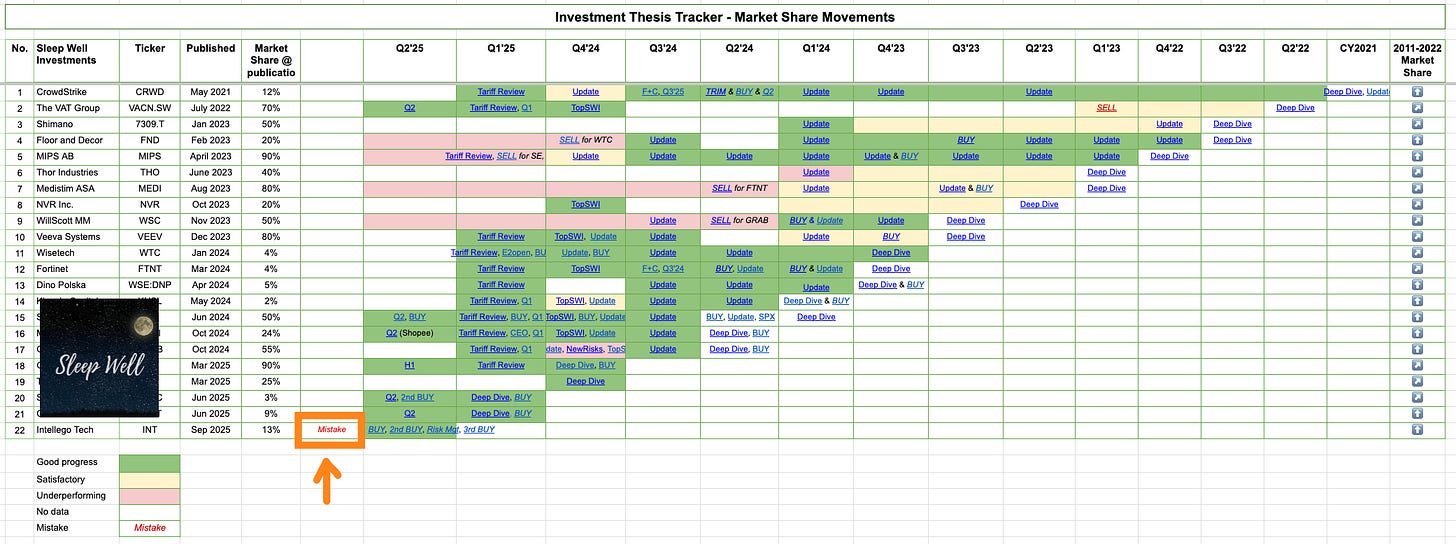

I have made a MISTAKE.

The biggest mistake since going paid. I apologise.

To improve, I’d like to outline a plan, but more importantly, I will reassess my position in Intellego.

Should I sell Intellego’s stock at a 50% loss, or should I hold to find out the truth?

So, this is what I will cover today.

Timeline of negative news

What I did wrong and the lessons learnt

What I did right

What do I do with the 50% loss

Improvements

SWI' writeups on INT: [deep dive, 1st buy, 2nd buy, 3rd buy, risk management, 1st live event, mispriced]

1. Timeline of bad headlines

September 11, 2025: Negative news from Sweden titled ‘Two top executives have left the stock market crash - CEO puts the lid on it’

September 12, 2025: Short report (Kobayashi) built up from SS’s Short in June’s [here], both anonymous.

October 2, 2025: Intellego provides additional information on cash position following preliminary Q3 2025 results announcement

October 2, 2025: Another short report

October 8, 2025: Clarification regarding press release “Intellego’s subsidiary Yuvio receives order worth EUR 22 million”

October 9, 2025: Montega suspends ratings

October 9, 2025: New COO Henrik Resmark starting Jan 1, 2026.

The first and second short reports had a powerful impact on the share price — see the chart above. The second one really exploited the ‘vague’ communications from the CEO, ultimately questioning the usefulness and existence of the product. All of this culminated in Montega suspending coverage until better disclosure and a new executive hire, specifically a COO, following the hiring of a new CFO in June.

At this point, Intellego is trading at 5x EBIT (~80 SEK), a 55% decline from my average cost of 11x EBIT (~170 SEK), and 60% from my initial purchase price (~200 SEK).

2. What I did wrong and the lessons learnt

Placed too much trust in management. Trust comes from doing what you say. The CEO does deliver in terms of headline numbers, but the issue lies in the ‘saying’ part. Claes’s communication has been vague and lacked transparency, which planted doubts about the cash flow. I appreciate that the rapid growth was challenging and that Claes will improve with time. And, even though he is seeking help from the new hires, I think he needs to step down and appoint someone else as the CEO.

Lesson: Don’t underestimate the importance of communication/disclosure of a company. And don’t assume the stock price is an indication of excellent execution.

Forgot that cash is king. Intellego’s sales and profits trend was one of the best I have come across, increasing tenfold since 2022, following its vertical integration (through the creation of Yuvio and the acquisition of Daro). However, the conversion to hard cash was contracted by long-dated payment terms (reportedly up to 12 months initially). In other words, booked profit in Q1 2024 would only be converted to cash in Q4 or Q1 2025. There was some evidence of that in Q2 and Q3 (preliminary). However, I jumped in too early. It would be better to wait for at least a full year of cash conversion in motion to get the certainty and understand the seasonality.

Lesson: Revenue is vanity, profit is sanity, but cash is king. Wait for at least a full year of cash conversion in motion.

Stepping out of my lane, rushing to buy, overconfidence. I specialize in time-tested and anti-fragile businesses. I should never forget that. I also got overconfident, given my past success/luck. Intellego, while indicating qualities to be one, was premature in labeling it as a ‘sleep-well’ given the fragility in the disclosure and the time it was taking to collect money from customers. I was also ‘charmed’ by the upside potential (low coverage and low institutional ownership) and the validation from EKN (the Swedish government). Although it was a small position (now 3%, previously 5%), the mental space it occupied was more significant than the 24% allocation in my top position, Sea Limited.

Lesson: Stick to my lane, and only step out with lower exposure and slower buy-in. Be extra critical of companies with a non-institutional shareholder base, where share movements could be more driven by emotion.

3. What I did right

While I bought in quickly and called it a sleep-well pick, what I did right was:

I mentally prepared myself to expect and stomach volatility. I experienced worse drawdowns in Sea Limited (70%) and CrowdStrike (50%) in the past, and so coming into Intellego, I was ‘prepared’ for a bumpy ride.

I allocated accordingly to the risk I was taking (5%). If I were to lose that amount, it would not impact my life. The 5% limit saved me from adding more when the stock appeared ‘attractive’, as noted in the write-up below (September 16th).

I remain focused on the long-term driver of value: cash flow conversion. I believe the business outcome remains unchanged in the long term. Customers haven’t canceled contracts, Claes hasn’t sold shares, EKN or authorities haven’t investigated and indicated any wrongdoing. We will know more in Q3 and Q4.

4. What do I do with Intellego’s 50% loss?

Given the magnitude of the mistake and the short period of time I have owned the company. I will hold onto my shares to let my thesis unfold.

The glaring -50% loss will serve as a reminder for me to work on my mistakes and that I am not committing one of the most common mistakes in investing: panic selling when the stock is down and the thesis isn’t broken. I have a diversified portfolio, and I don’t need the cash today; there is time for the thesis to unfold.

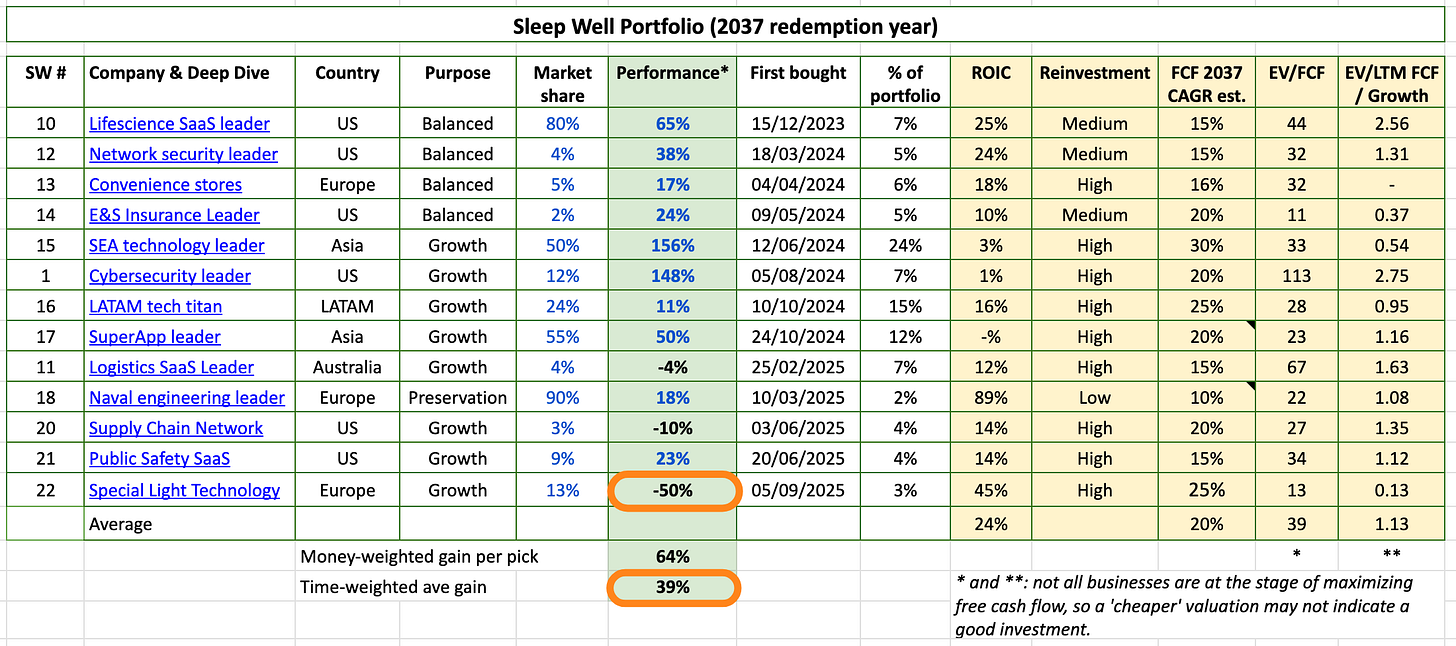

The impact of a 50% loss in a month (~500% loss annualized) means it has reduced my average holding gain to just 39% (from a 45-60% range since inception).

Bad for my ‘marketing’, but as loyal readers know, I am not doing Sleep Well Investments for attention. I am doing it, partly for the money (thank you for your support), and mainly for the joy I get from learning to explain why and how a company creates value. And in that process, improve as an investor, learn from my mistakes with you, and, as a byproduct, accumulate a meaningful sum of ‘startup capital’ for my daughters when they grow up. The substance I receive from that every day is a privilege, and I want to ensure it’s lasting and impactful to you, too. Hence, as we advance, I’ll continue to make improvements.

5. Improvements for SWI

I will introduce a threshold for ‘sleep-well’ picks to minimize getting into ‘story’ stocks (typically small/micro cap). I’ll update on this in my next deep dive; perhaps parameters such as market cap, corporate governance standards, years of existence, or time on the public market should be considered.

Be more patient - buy in slower, wait for more evidence of cash generation, particularly on less time-tested companies. All has trade-offs. So, I must accept the possibility of lower returns for lower-risk investments.

I hope you will learn from my mistakes today!

Please send me your feedback, and I apologize again for labeling Intellego as a ‘sleep-well’. Since I’m not selling, you will see this mistake permanently in my Sleep Well Investments Portfolio and any future ‘branding’ of the newsletter. Even if it becomes green in the future, I will still highlight it as a mistake!

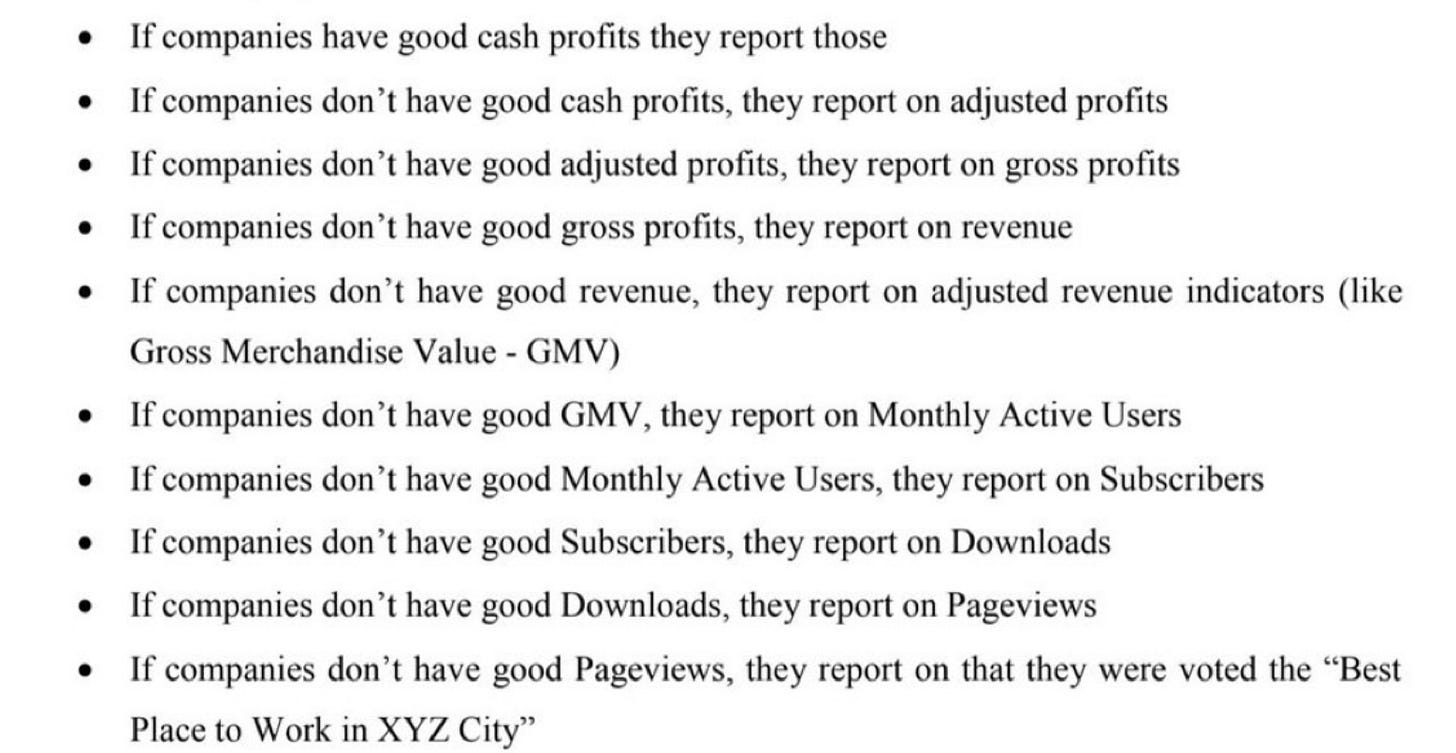

In closing, I’ll leave you with an interesting hierarchy of information funnel. Guess where Intellego stands?

If you are new, read more about us here, our latest portfolio review here, and best buys here.

We’ve all made bad calls. What matters is owning them and learning from them. You’ve always been upfront, and that’s why people trust your work.

Thanks. Always great to read this. Some valuable lessons in there! Intellego still looks interesting