Business Update - MIPS AB: Q4-23 Thesis Intact - Clearer Recovery Signs

MIPS sales decline decelerated, margins stabilized. Long-term thesis intact and I may add more shares.

I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th).

Hi, sleep well investors (SWI),

I thoroughly enjoyed a ‘get to know’ call yesterday with Thomas a managing partner at 4D Ventures and a founding member of Sleep Well Investments. He spends 90% of his time finding potential winners and investing over EUR 250K in late rounds. As you know, Thomas is on the opposite spectrum to me, as I focus on finding proven winners. But that proved a perfect matchup to learn from each other.

As Sleep Well Investments grows (we have over 2.2K sub and 350+ professional investors today), I can facilitate expert exchange so we all benefit. Feel free to email me at trung.nguyen@sleepwellinvestments.com to connect with Thomas. Alternatively, paid members can join me in Chat; I’ll make an intro there.

Thank you for being a subscriber and, even better, a paying member🙏🙏. Sharing my work helps me improve the quality of my research and allows you to fortify your portfolio.

MIPS Q4’23 results overview

This post reviews MIPS AB Q4’23 results (08 February 2024) - a monopoly in bike helmet safety systems.

Three quarters ago, in Q1’23, I wrote this:

MIPS reported a challenging Q1’23 results. The market didn’t like it but I see signs of market recovery in within a few quarters, in-line with my expectation, and sooner than the industry bellwether, Shimano, also a sleep-well business that I deep dived into and own.

Here we are in Q4’23. We can see the lights at the end of the tunnel after three consecutive tough quarters (Q3’23, Q2’23, and Q1’23). Patience is critical in investing.

MIPS is finally transitioning from 50%+ sales and profit margin decline rate to 15%. Free cash flow is improving sequentially, and the order book is busy again. We are closer to the trough than the peak. Notably, the data points from the last four quarters show MIPS has the right product/market fit, business model, and strong buffer to weather adversity.

Keeping a close watch on the improvement (and deterioration) of MIPS’s universal appeal and moats in recent quarters has shown me that MIPS is highly likely a future compounder.

As 2024 will likely remain challenging, investors must remain open-minded in the next few quarters. More importantly, investors need to understand why they own MIPS.

For me, I own the business because

MIPS enjoys multiple enduring competitive advantages that are hard to replicate — agnostic safety technology and a clever distribution strategy that won 90%+ of manufacturers.

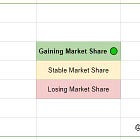

MIPS controls most of the market share as viable peers struggle to replace it. MIPS remains the leading brand for 18 teams at the Tour de France out of 22, and 91/100 top helmets.

Long growth runway in the Motor, Safety, and Asian markets.

Excellent track record — revenue compounded by 49% CAGR, earnings by 62% CAGR, and free cash flow per share by 39% CAGR since 2014.

I hope you will enjoy this Q4’23 update.

My next sleep-well pick will be a leader in a complex and fragmented industry; it serves the most critical segment of the industry and is on the cusp of growing an extra revenue stream. I don’t think the market appreciates this change yet. I am excited to dig deep into it and prepare to own some shares opportunistically.

My previous deep dive was a leader in logistics - 11th Sleep Well Investments. I am still developing a buying plan for this phenomenal business; stay tuned.

Are you curious about the research quality of Sleep Well Investments? Check out this FREE deep dive in NVR and Thesis Tracking of CrowdStrike.