Sleep Well Portfolio (Jan 2026) - Software Under Threat?

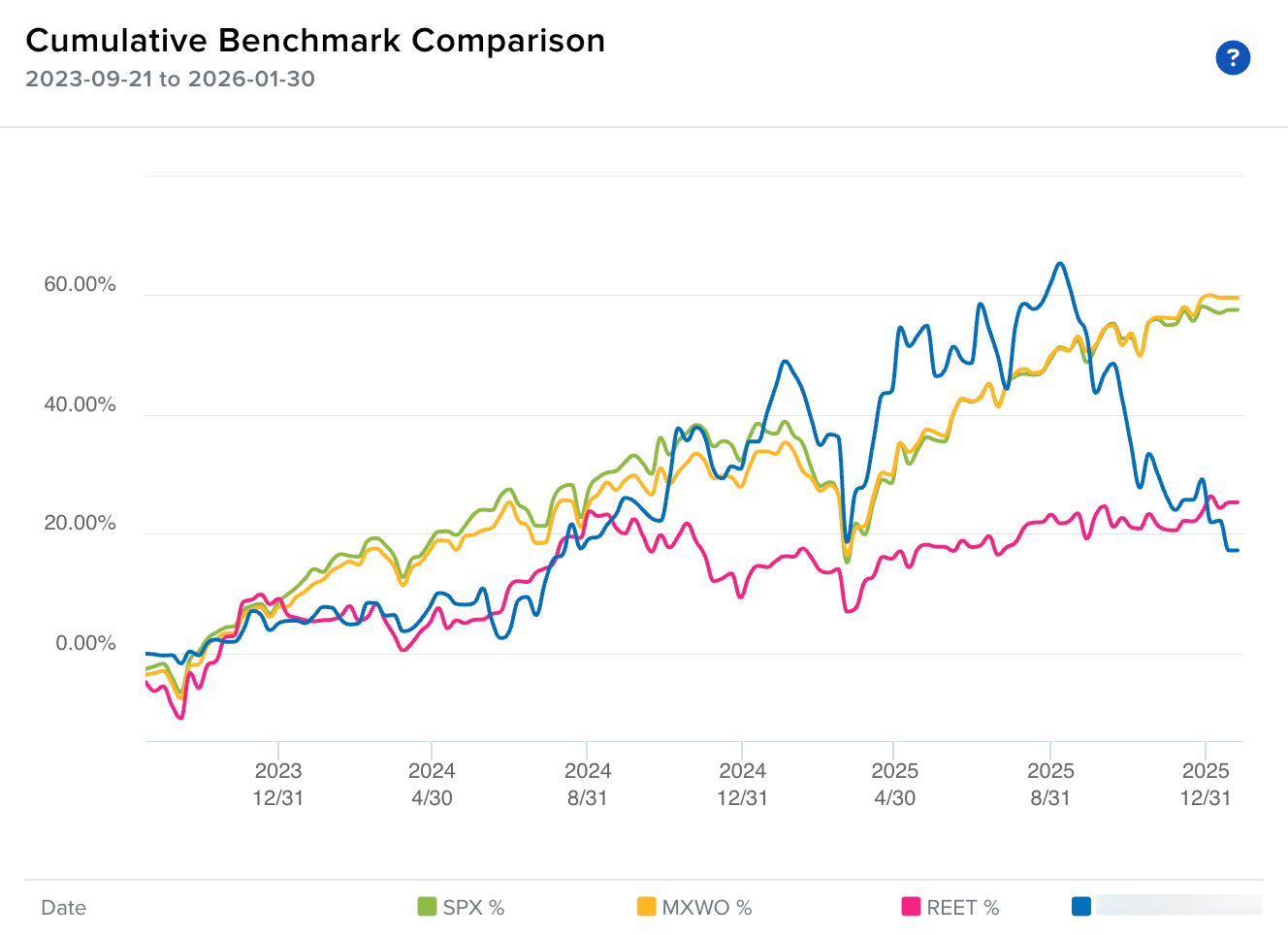

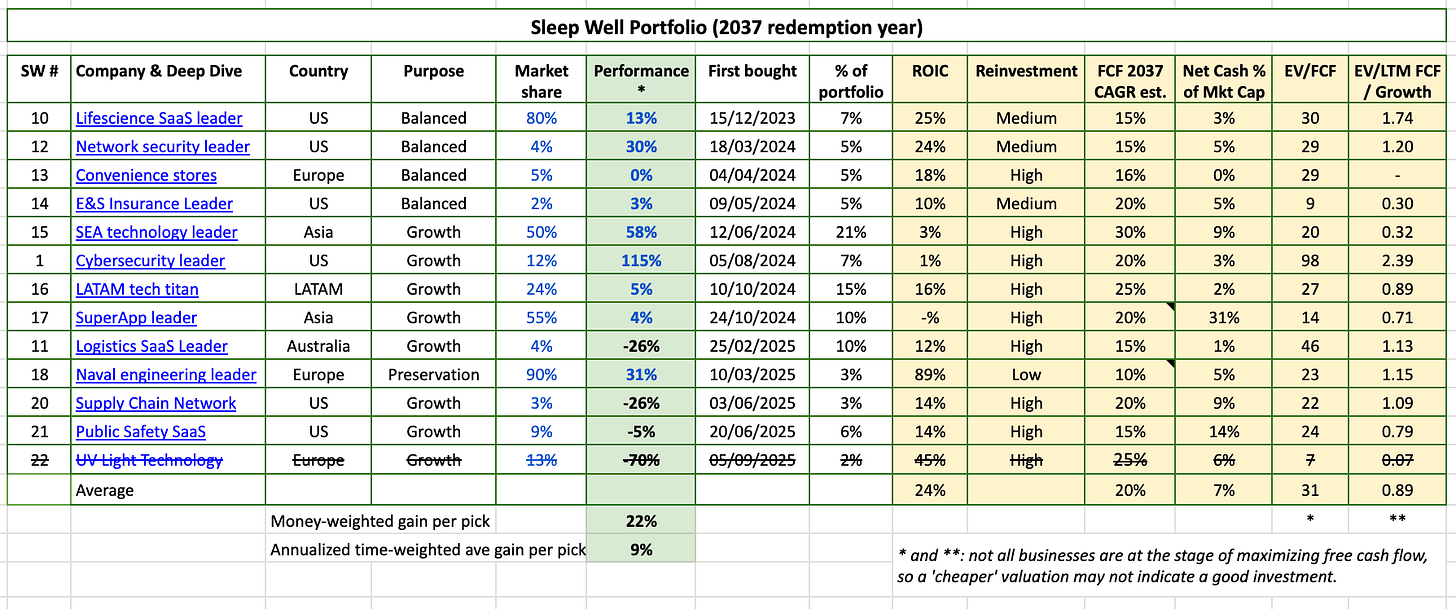

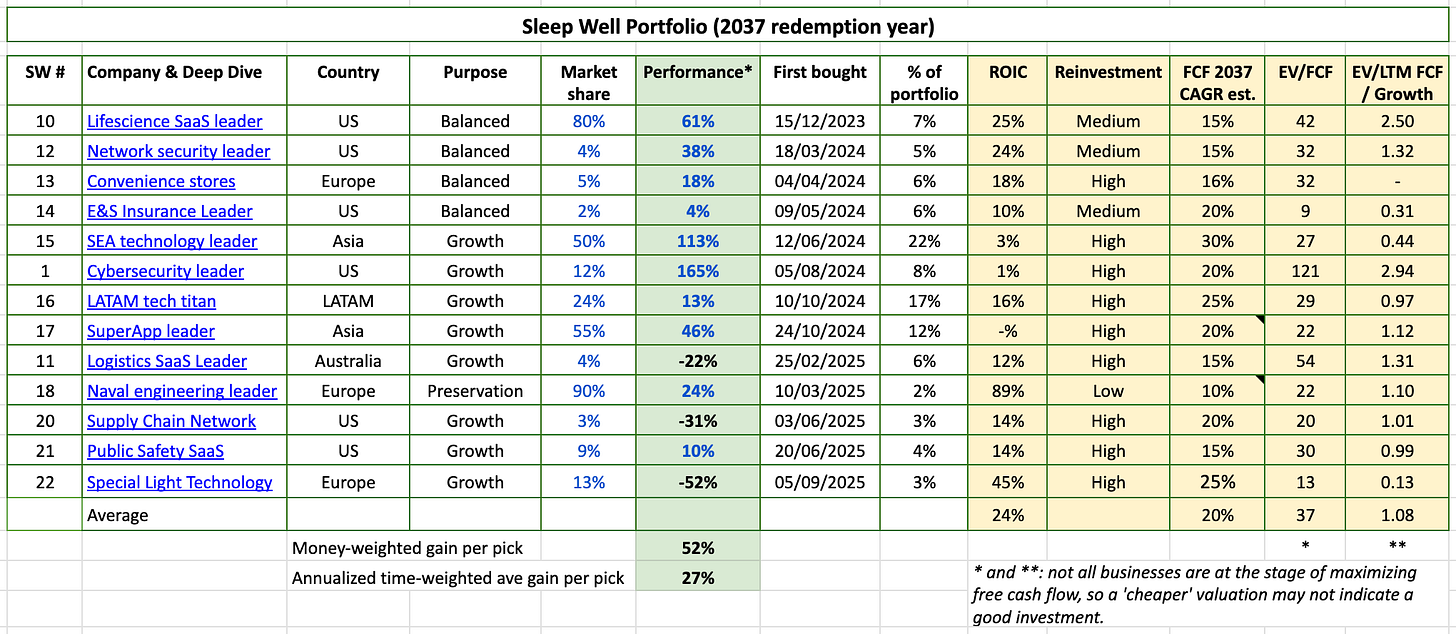

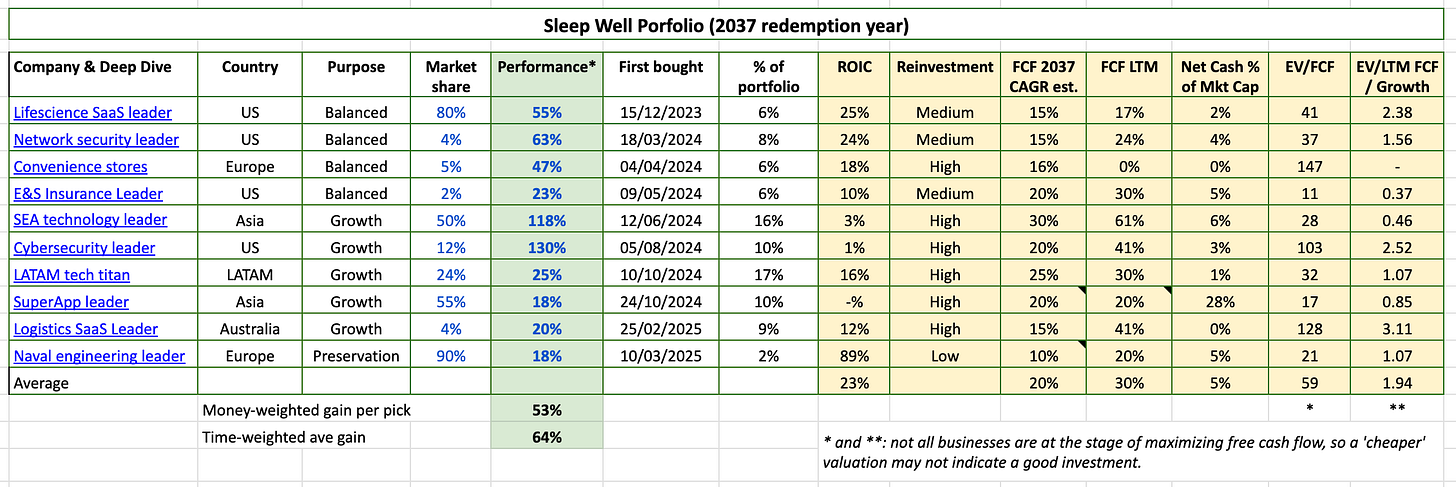

Four losers out of 13 holdings; one BUY, one new pick (ISRG). SWI: 17% vs S&P500: 58% since inception. 4 months of underperformance. Excited for 2026.

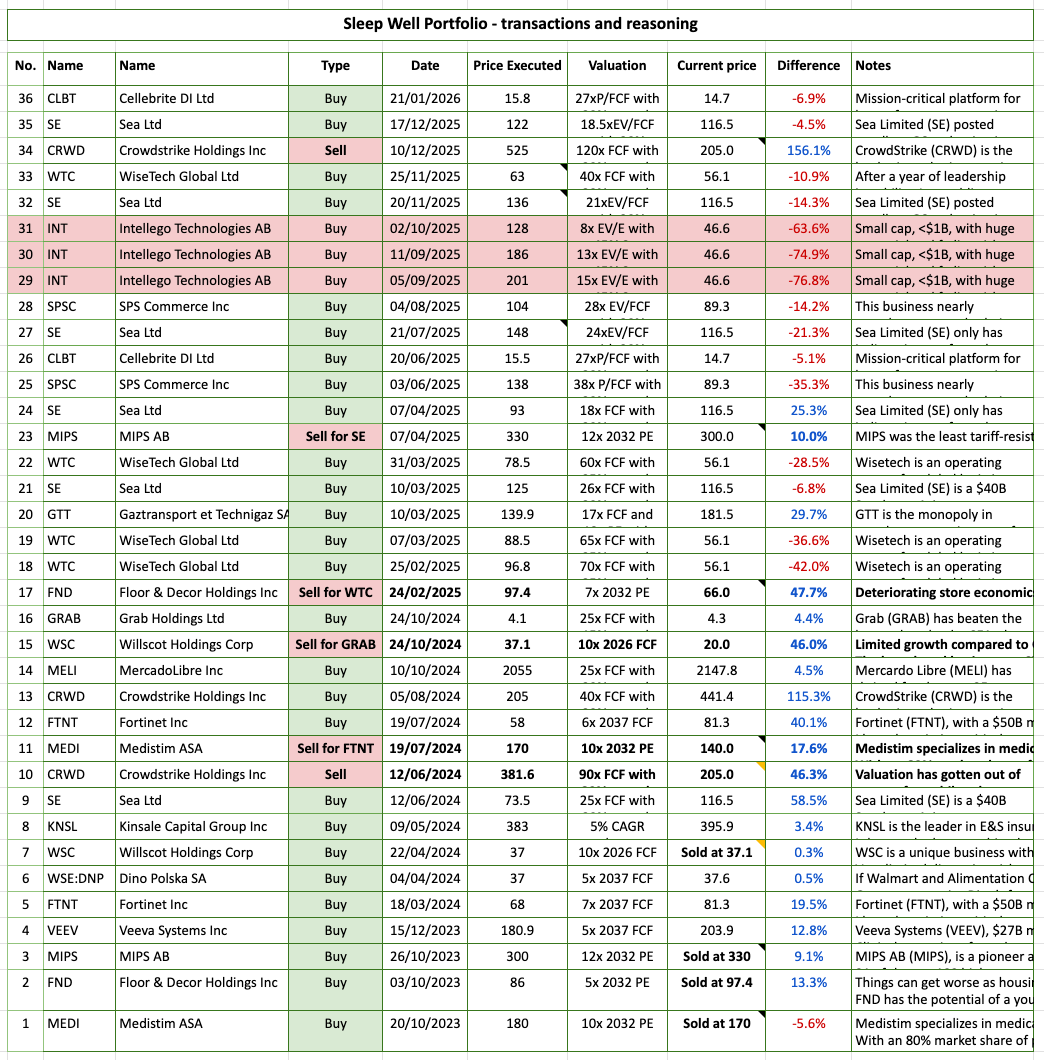

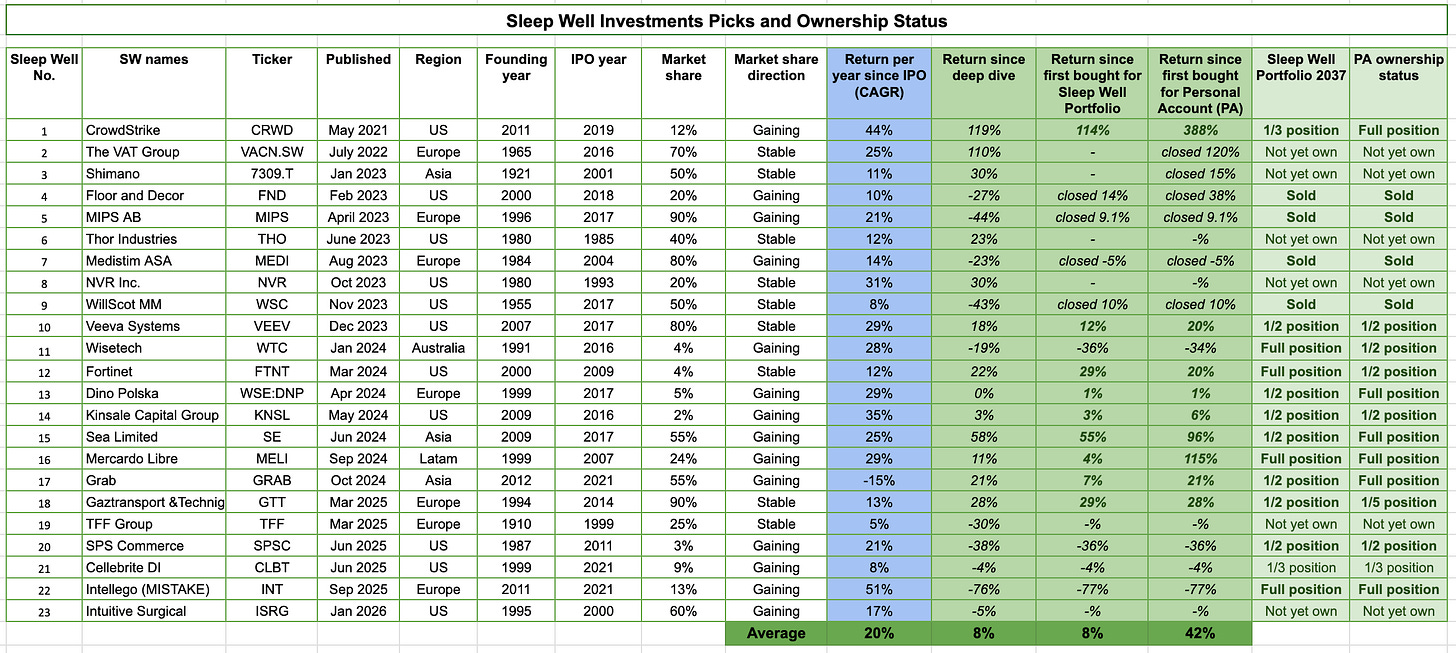

Sleep Well Portfolio consists of time-tested leaders. We screen them using a rigorous checklist and track their theses regularly to determine when to buy. So far, we have made one mistake, three losers, and 21 out of 36 transactions have been profitable. All about us here.

Summary of Jan 2026

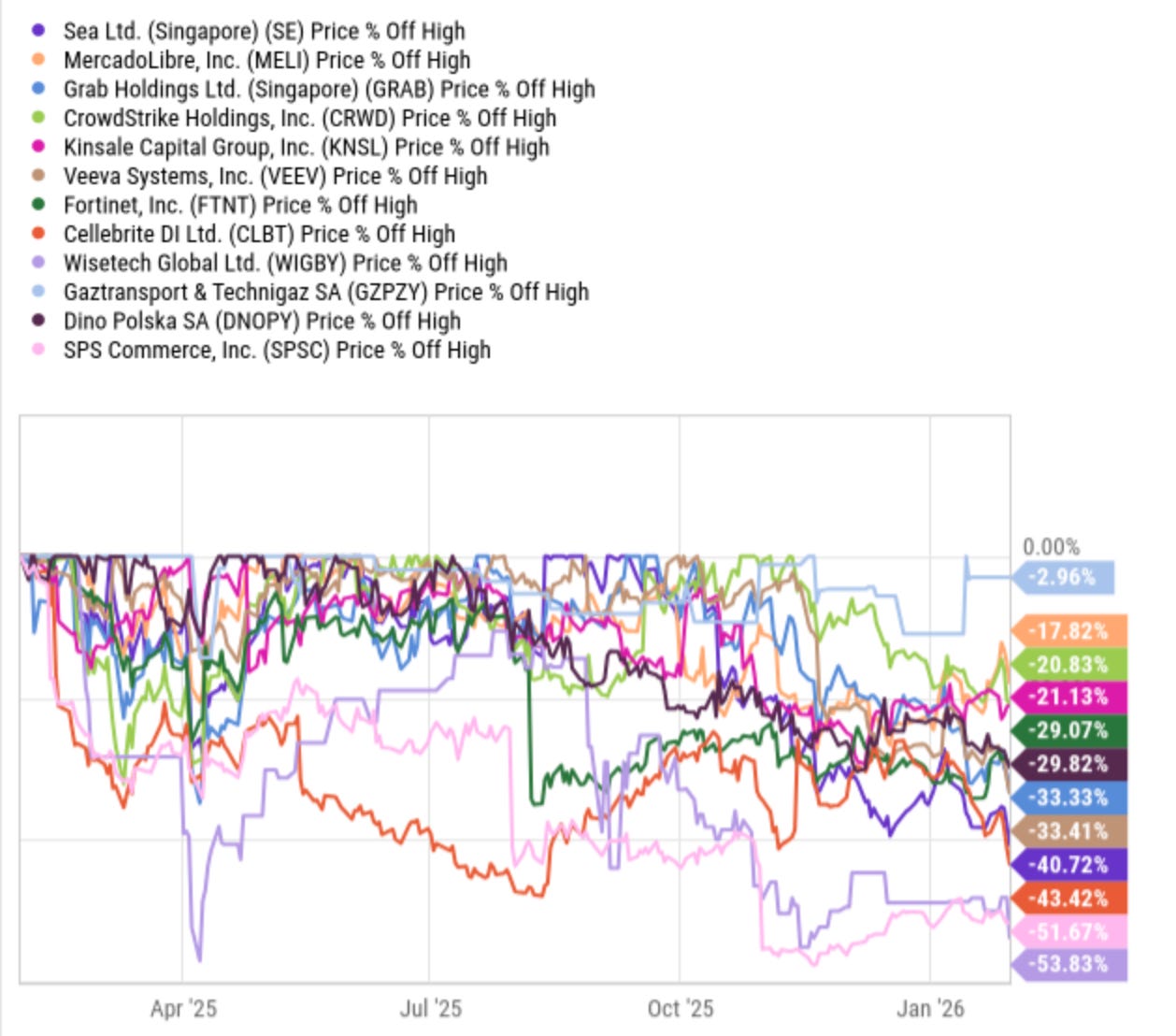

January continued the decline from the end of 2025. Software continued to be sold off amid rising concerns about AI’s disruption. Constellation Software (CSU.TO), the poster child for high-quality software names, fell 52% since June 2025.

Sleep Well Portfolio owns 13 names, of which 2 have suffered a similar 50% decline from peak last year, like CSU. But I argue the share price decline is an opportunity for long-term owners. I’ll explain.

The lens I am viewing through is, first and foremost, fundamental. Then I give the time that the business needs to prove itself. Even when dissecting the steepest-declining stocks in the portfolio (Wisetech or Cellebrite), I get more excited than worried. Why?

Both provide solutions with no comparable alternatives that require thousands of customer iterations to reach where they are today. Employees and stakeholders require extensive training and adjustments to company-wide workflows to adopt the solution. Add to that the customers are slow-moving governments/large entities; they will not be willing to spend years migrating away from what they have been using for years, if not decades. Their business trajectory is on track to compound at a 15-20% CAGR in free cash flow per share, while the stock price has declined by 50%.

No doubt, AI is a risk - an existential risk to simple, UI only, point-based software, but not to Wisetech / Cellebrite / Veeva; they own the data, the workflow, the platform. Hence, during January, I have added to Cellebrite (and Wisetech in November) and have published my intention to buy the 23rd Sleep Well Pick - Intuitive Surgical (ISRG), the least likely software/hardware business to be replaced by AI.

The next few sleep well picks will be of a similar quality to ISRG, and 2026 may prove to be the best year to accumulate more shares of the best businesses. Performance may not turn right away, but I am excited for 2037.

Now, let’s skim through the January 2026 performance.

Return from inception was 17% vs. S&P500 58%: ~40% underperformance. Sharp decline from September 2025, when SWI was >60%, due to the high concentration in SE/WTC.

Picks’ annualized return is now 9% compared to 16% in December 2025, 21% in November, 27% in October, 47% in Sep, 50% in Aug, 46% in July, 61% in June, 64% in May, 51% in April, and 38% in March.

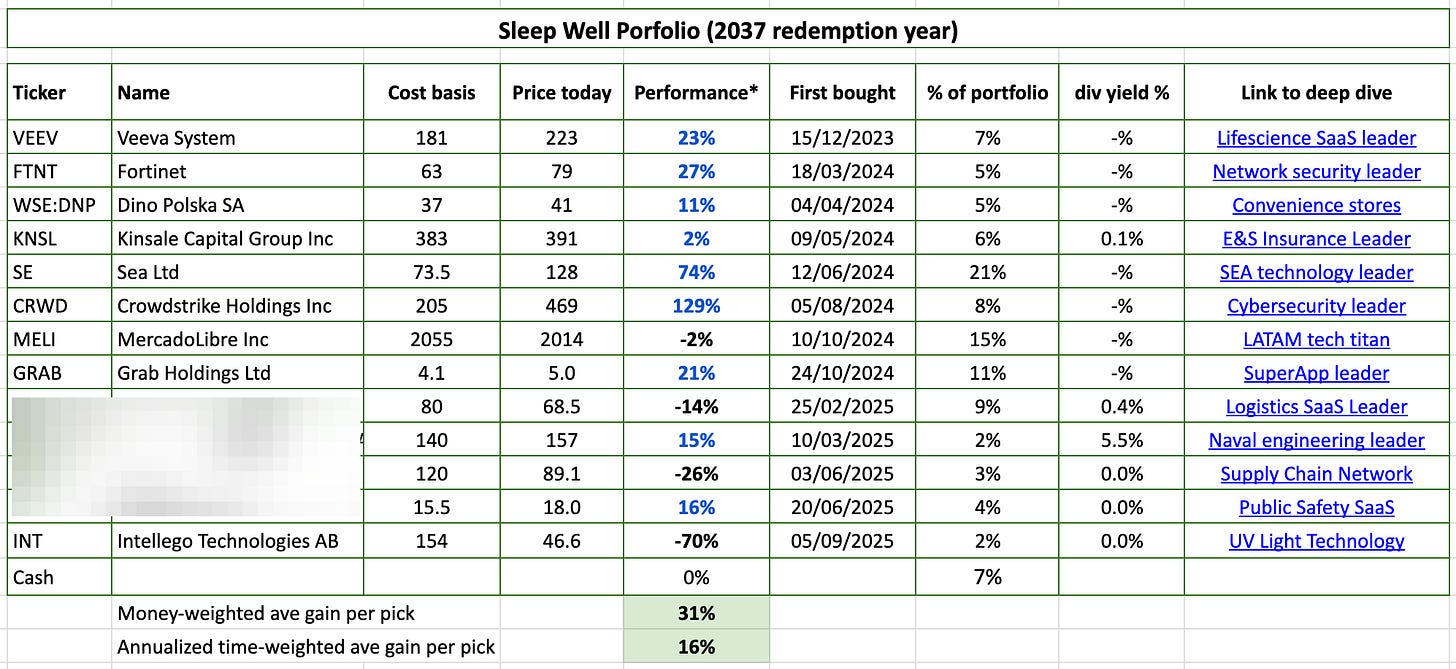

4 losers, 9/13 making money, and 21/36 transactions were correct decisions.

Monthly Best Buys and research list - will be posted separately. The latest edition is here.

Sleep Well Portfolio master spreadsheet. If you are new to SWI, check out our FAQ and Owner Manual.

If you are already an annual member, you can access the Sleep Well Portfolio and Thesis Tracker via the link below.

What’s in store for 2026?

We will continue to own leaders in niches and allocate capital concentrated on a few names. SE, MELI, GRAB, WTC, FTNT, and VEEV are over 70% of the portfolio. When they rebound, it will be spectacular, but in the interim, I will have to stomach the large swings and focus on the fundamentals.

In 2026, you can expect more deep dives like Intuitive Surgical and shorter profiles of watchlist companies in my Best Buys series.

SWI Performance since inception 17% vs S&P500 58% - Interactive Brokers:

Current portfolio - 4 losers

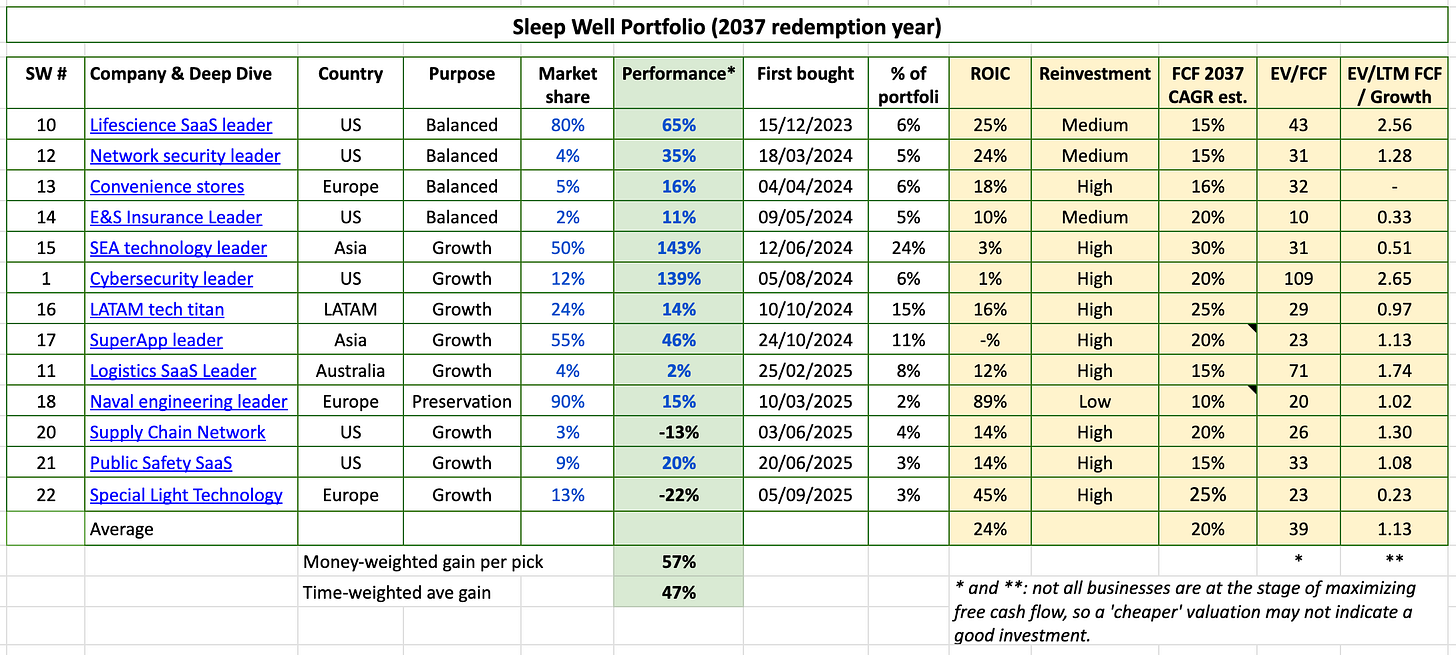

Previously - December 2025

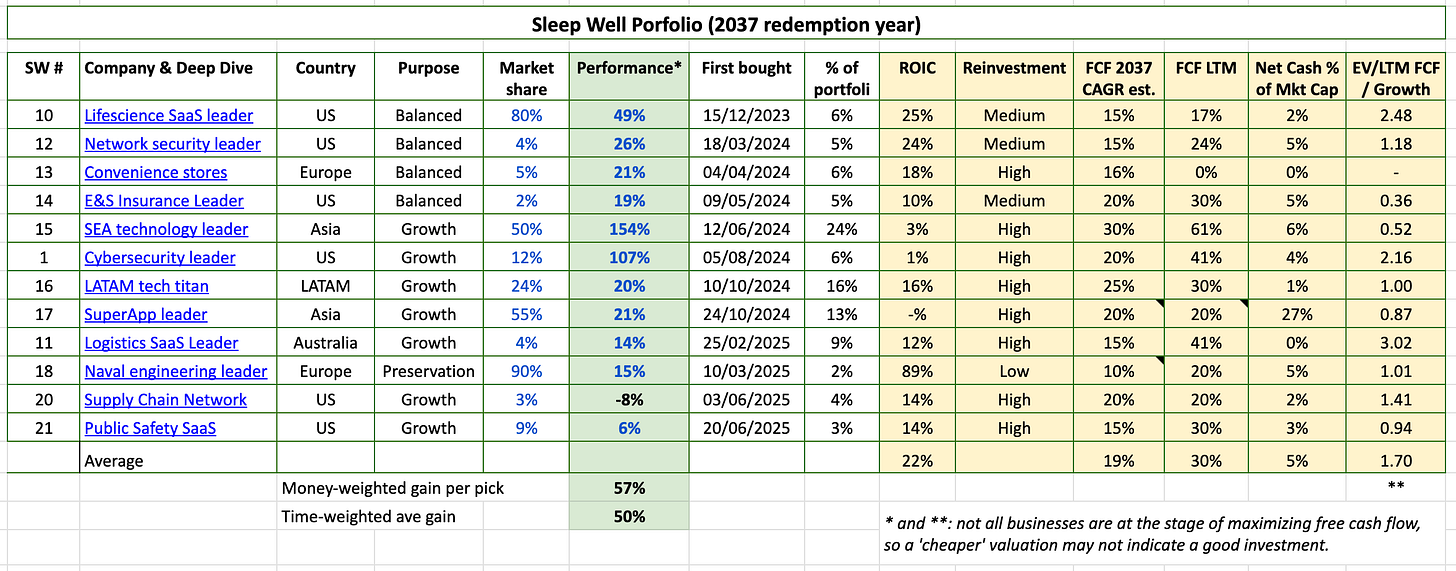

Previously - November 2025

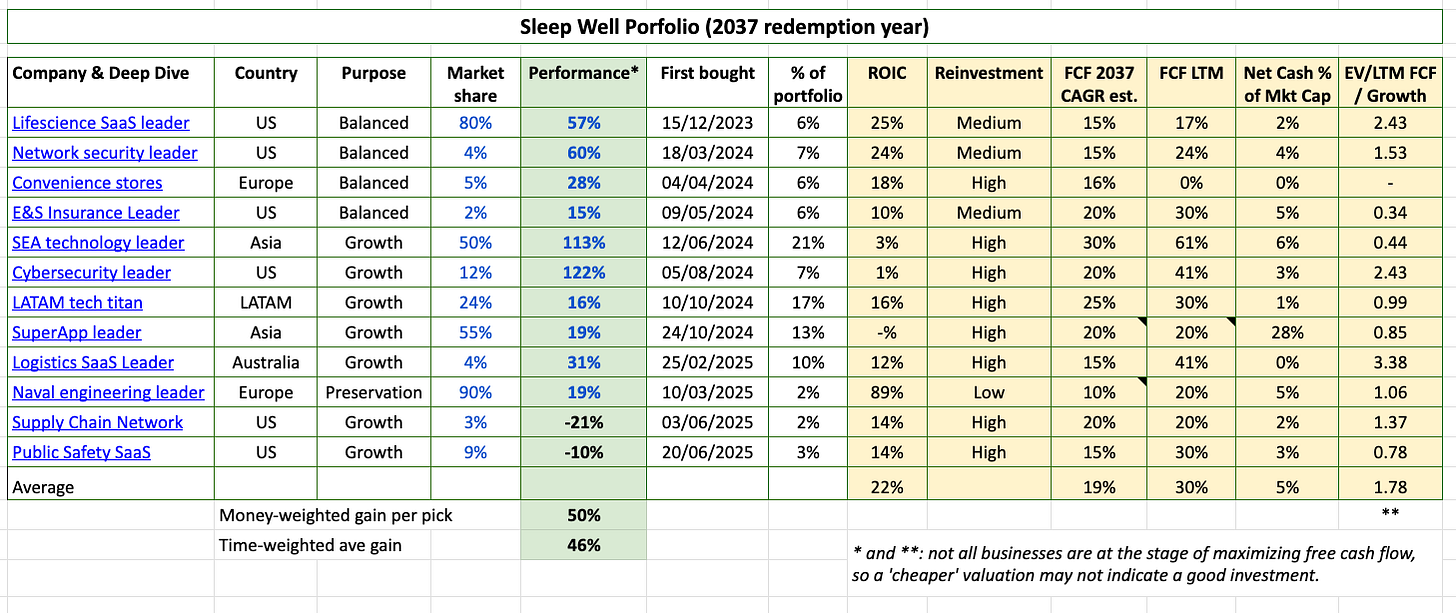

Previously - October 2025

Previously, Sep 2025 - 2 losers

Previously, Aug 2025 - 1 loser

Previously, July 2025 - 2 losers

Previously, June 2025

Previously, May 2025

Previously, April 2025

Previously, Mar 2025

Transactions with notes below:

Expanding investment universe

You will only see me buying businesses that I thoroughly understand (see the deep dives below). I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—9% annualized time-weighted.

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of the investment framework to help find quality companies, and the lessons I have learnt.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.

Brilliant framing on treating price declines as opportunity when fundamentals remain solid. The point about switching costs for enterprise software like Wisetech and Cellebrite is often underestimated by the market. I've seen similar dynamics in legacy B2B SaaS where migration risk to newer AI tools gets overhyped vs the actual stickiness of embedded workflows. 2026 could def be a buyers market for quality names if sentiment doesnt improve.