Business Update - Q1'24 - Shimano, MIPS, Thor Industries, Dino Polska

Updates on these exceptional businesses, 3 progressing great, 1 downgraded. SMNNY, MIPS, THO, DNP.WA

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

This is a thesis update for 4 of the 14 sleep well picks:

Shimano (SMMNY), Q1’24 results

MIPS AB (MIPS.ST), Q1’24 results

Thor Industry (THO), Q2’24 results

Dino Polska (DNP.WA), Q1’24 results

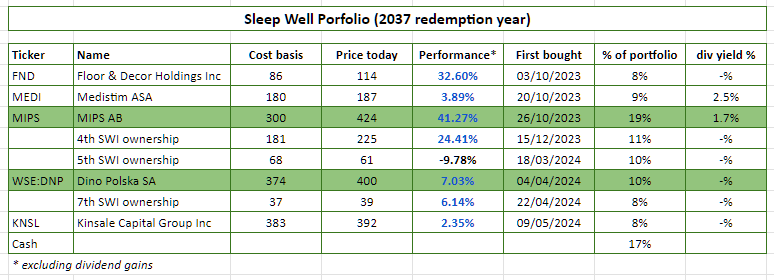

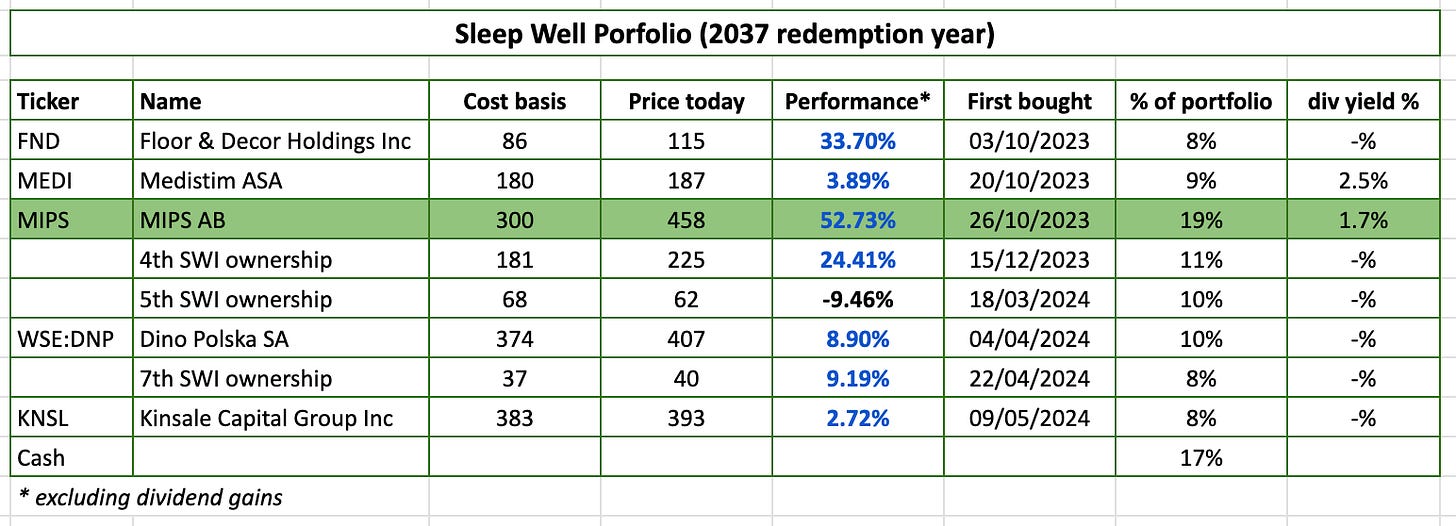

Performance since deep dive and first bought are below:

Performance of the Sleep Well Portfolio, with MIPS and DNP, discussed in this post:

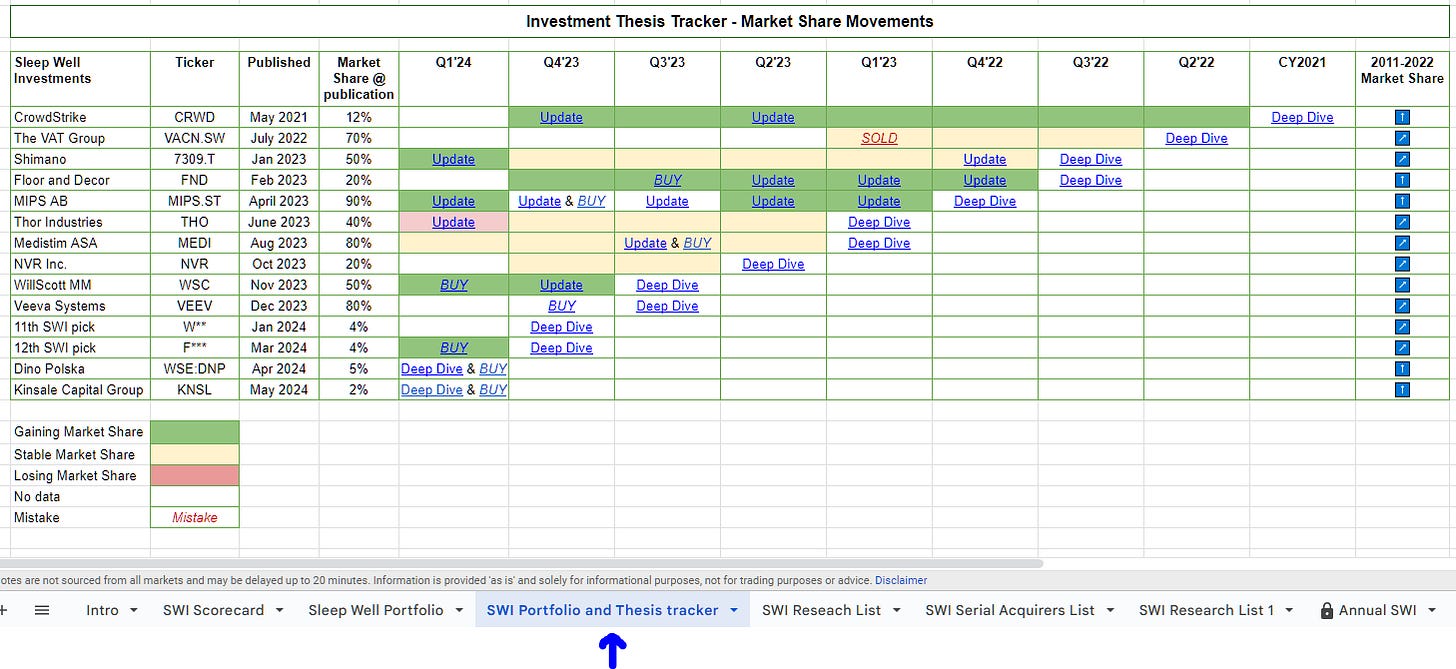

You can revisit previous updates and deep dives on the Sleep Well Portfolio spreadsheet tracking tab:

Or find the relevant links in the directory:

Shimano (SMNNY) - Q1’24

Shimano (7309.T, SMNNY) is the world's largest bicycle parts and second-largest fish tackle manufacturer, commanding about 70% of the bike market and 20% of the fishing tackle market. It’s a rare company that benefits from scale and differentiation advantages over competitors by operating the most advanced manufacturing capability, the broadest product range, and the largest distribution network.

Free cash flow per share (FCF/share) has expanded at a 12% CAGR since 2008, and shares returned 13% CAGR (excluding dividends).

Today, the company is still headed by the same family and driven by the same mission: ‘focusing on customer happiness and bringing them closer to nature.’ The future looks bright as eco-friendly transportation and outdoor leisure activities become central to our lives.

It benefitted from COVID-19's pulled-forward demand for bicycle parts and fishing tackle and subsequently suffered from overstocking during FY2023.

However, Q1’24 has finally hinted at a return of growth.

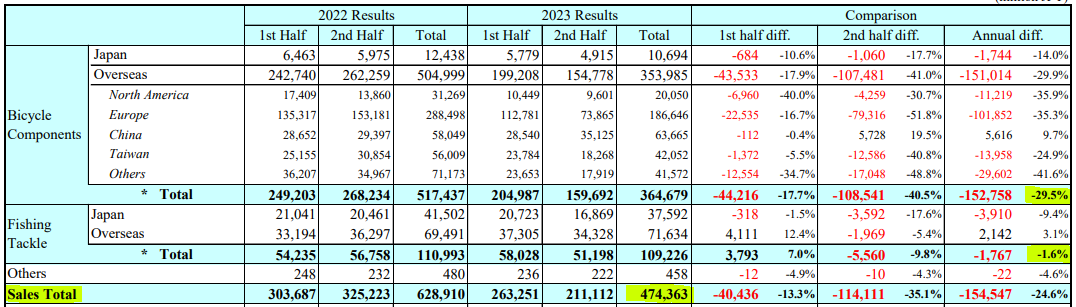

Shimano’s Q1’24 results

Taking out peak COVID performance (FY2021 and FY2022), compared with pre-COVID numbers, sales and operating income have returned to growth from Q4’23 (blue check above).

This is a stark contrast to FY2023's decline (expected), with sales falling nearly 25%, worse than the previous large decline in the 2008/9 recession at a 20% decline.

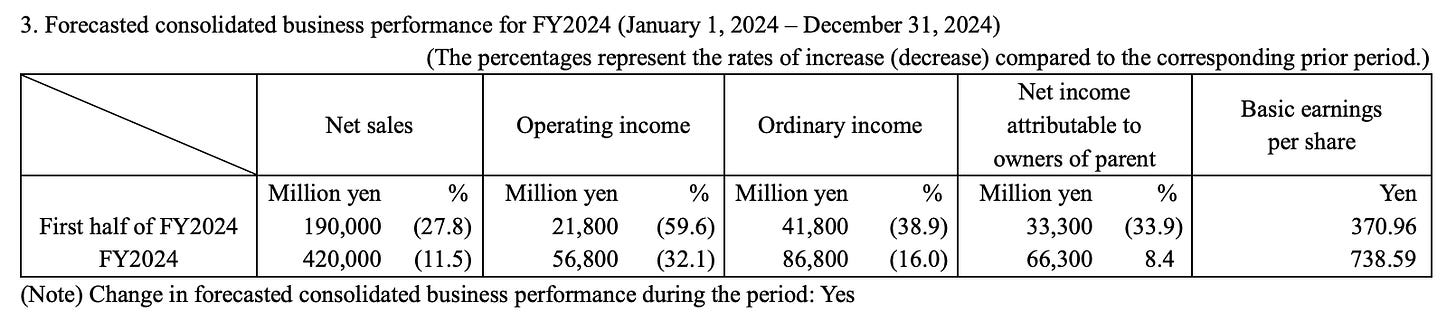

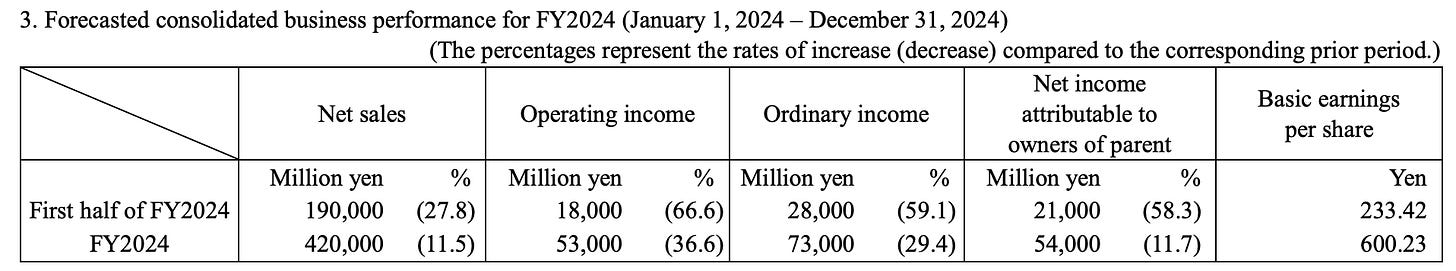

Still, Shimano is not out of the woods yet. FY2024 sales are forecasted to be at Yen 420,000M, a decline of another 11% compared to FY2023.

However, this is an 11% growth compared to FY2020 sales of Yen 378,000M.

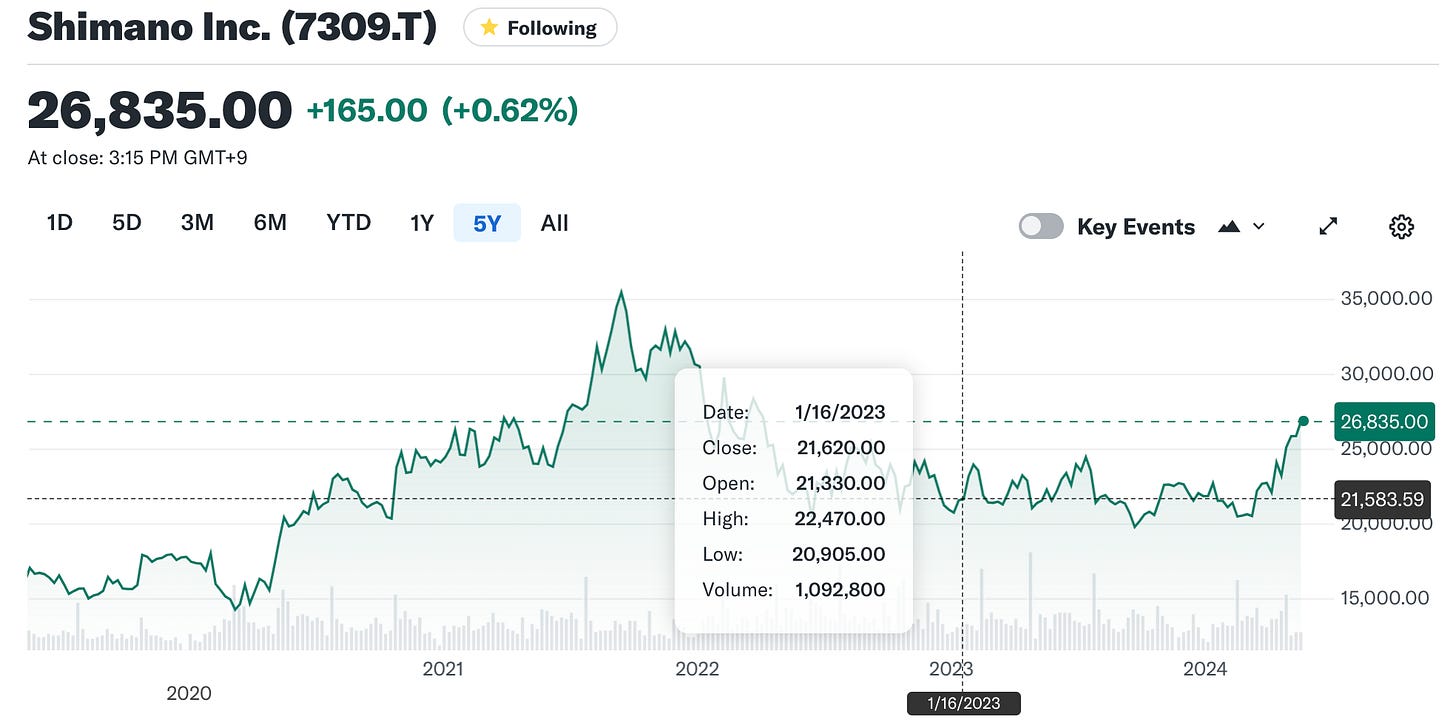

This shows that you should ignore the daily movement of the stock price. The stock price will follow if the business has a reason to exist and the competitive advantage to endure adversities (read here for Shimano’s sleep-well qualities).

Shimano’s corporate governance and capital return

When picking Shimano, I knew Japanese firms have a reputation for hoarding cash. I am pleased to see Shimano's continued improvement in its corporate governance and increased share repurchases and dividends.

More independent directors

For FY2023, the board had increased the number of outside directors to four from three, and it's the first year they had a female director. The change is positive in the long term, showing the company is continuously adapting to the modern operating environment.

Share Buyback

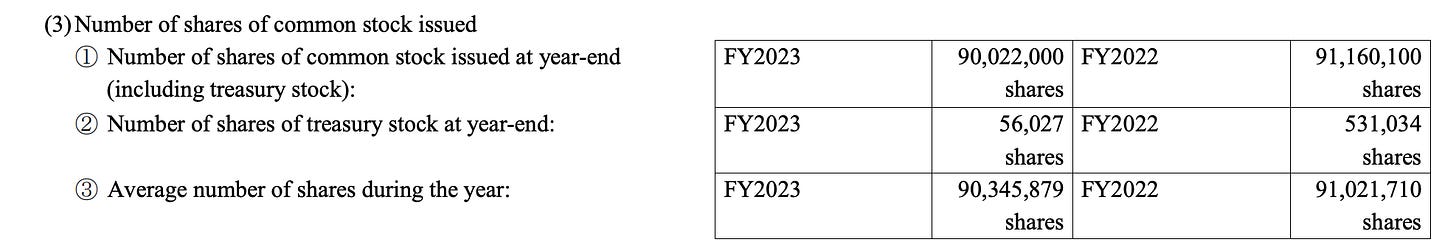

In FY2023, the company reduced the share count to 90M from 91.1M in FY2022 (92.5M in FY2021).

At JPY 27,000 today, that’s just a 1% buyback yield, half the 2.2% buyback yield at JPY 21,000 (or $16/ ADR share) when the company bought more shares in FY2022.

Nevertheless, it’s a continued improvement, as the company barely bought back a meaningful amount of shares before 2019. The table below shows the company buyback activity in USD.

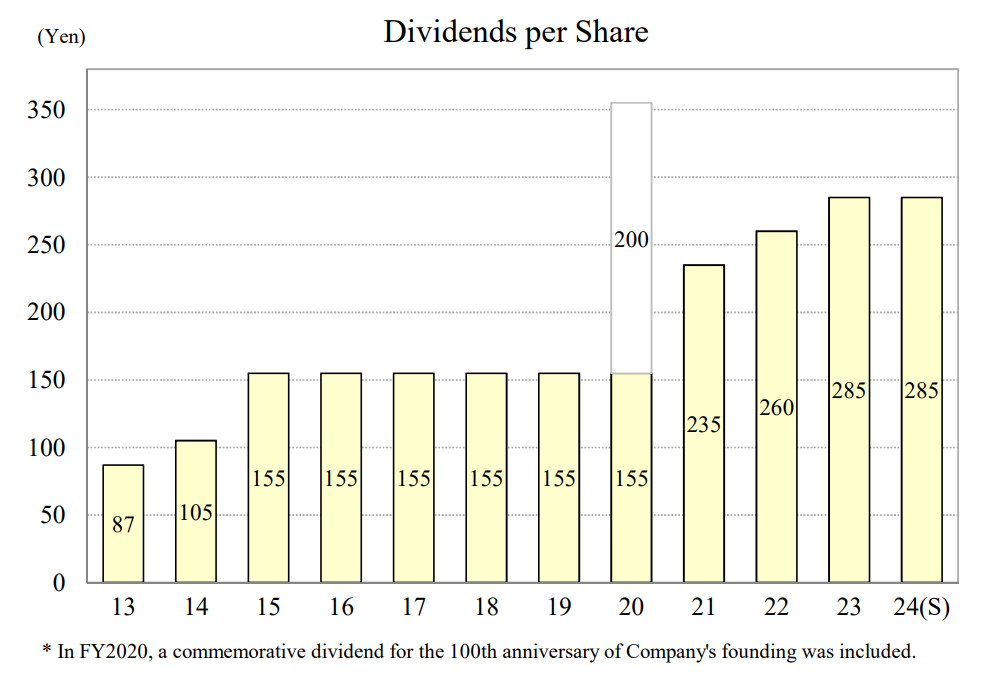

Increased Dividends

The company also pays semi-annual dividends, which have been increasing since 2009. The FY2023 and FY2024 dividend continue the uptrend. The company proposed to pay a JPY 285 dividend per share in FY2024 or a 1.1% yield at the current price of JPY 27,000.

If Shimano continues buying back shares (1% yield) and paying dividends (1.1% yield), shareholders could get roughly 2.1% in total in FY2024.

Shimano’s FY24 guidance

Shimano’s management is known to be conservative but has been wrong before. Their FY2023 revenue forecast was a 20% decrease vs. a 25% actual result. So, take their 11.5% decline for FY2024 lightly; no one knows what lies ahead in the short term.

Seeing MIPS and Thule for the last five quarters, I am comfortable ‘predicting’ that the bloated inventory for completed bicycles is mostly over. Shimano will be back to growth soon.

Summary

This is what I wrote after the FY2022 results a year ago.

The market was not excited by Shimano's FY2022 results. But I am. Fundamentally, everything has stayed the same. Shimano's FY2022 results showed improved sales of 15% vs. 8% expected and higher than bike-related peers, MIPS, THULE, and LEATT, who saw their sales cratered during the year. Shimano's operating margin also performed much better than I expected, generating a 22% operating margin vs. 15%. Additionally, while inventory backlog remains a problem in the near term, the picture for Shimano's mid-to-high-end segment is already better.

Finally, investors are getting a slightly lower price today at JPY 21,000/share or $16/ADR share. I maintain my BUY rating and increase Shimano's fair price to $24/ADR share, representing a 50% upside.

FY2023 is over, and the share price has rallied back to JPY 27,000, pushing the implied growth from 3% a year to 5% (reversed DCF), parity to the long-term bicycle market growth.

As a result, it’s a fair expectation for Shimano, depending on what it does with the large cash reserves. I am not banking on Shimano to buy back shares aggressively (ever), so I am reluctant to buy more since I hold a full position in my PA. Still, I will watch Shimano’s continued improvements and add to my daughter’s portfolio if the share price drops again.

MIPS AB (MIPS.ST), Q1’24 results

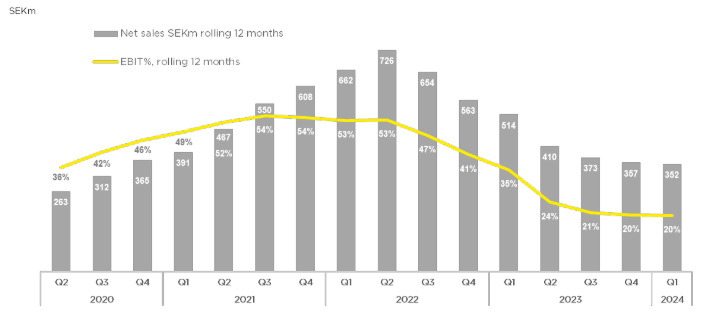

The recovery is here after four consecutive tough quarters (links to reviews - Q4’23, Q3’23, Q2’23, and Q1’23).

Q4’23 showed the clearest signs. I wrote

Yesterday, 08 February 2024, the Q4’23 results showed signs of recovery:

sales decline slowed to -15% from -50%, helped by the bike segment regaining growth

positive momentum in customer activity in the bike offset by motor and snow

continued strong margins with gross margin at 70% and EBIT margin at 19%

free cash flow grows sequentially and positively from Q2-Q4

growth opportunities remain strong in the safety and Asian markets.

Thule’s earnings confirm that the bike market is improving.

Those are good signs! The management has been more or less correct in the past three quarters. They guided a recovery in H2 in Q1 and Q2. Then, they zoomed in on a Q4 recovery in Q3.

I added shares after the Q4’23 review (initial buy at Q1’23) and may add more to my PA if the market allows me.

**It takes me a year to follow MIPS and the industry to know when to buy the business; it takes 10 seconds to share with your friends. Do me a favor; help me spread the winning calls. Multiple members put in over $50K on MIPS; at 50% gain in 6 months, that’s a lifetime of Sleep Well Investments subscriptions.

The biggest reason to know when to buy is knowing why you want to own the business.

For me, I own MIPS because

MIPS is an asset-light business offering an essential product - protection for the brain. The business enjoys multiple enduring competitive advantages that are hard to replicate — agnostic safety technology and a clever distribution strategy that won 90%+ of manufacturers.

MIPS controls most of the market share as viable peers struggle to replace it. MIPS remains the leading brand for 18 Tour de France teams out of 22 and 91/100 top helmets.

Long growth runway in the Motor, Safety (largely untapped), and Asian markets.

Excellent track record — revenue compounded by 49% CAGR, earnings by 62% CAGR, and free cash flow per share by 39% CAGR since 2014.

Q1’24 results show a recovery is within reach. Sales and margin decline have bottomed out and surpassed pre-COVID levels.

Four quarters ago, in Q1’23, I commented:

MIPS reported a challenging Q1’23 results. The market didn’t like it but I see signs of market recovery in within a few quarters, in-line with my expectation, and sooner than the industry bellwether, Shimano, also a sleep-well business that I deep dived into and own.

Here we are in Q1’24. Let’s examine why MIPS is poised to rally as the market cycle improves.