Business Update - Thesis Tracking Q3'24 - MIPS, Kinsale, Wisetech, Fortinet + CrowdStrike

MIPS recovered, KNSL negligible impact from storms, CEO's shake up for WTC, and a marriage of leaders FTNT + CRWD

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Hi, sleep well friends,

This post is the first Q3-24 thesis tracking for 5 of the 16 sleep-well picks:

MIPS - leader in helmet protection, up 85% since bought (May 2023)

KNSL - leader in E&S insurance, up 15% (May 2024)

WTC - leader in logistics SaaS, up 74% (Jan 2024)

FTNT + CRWD partnership of endpoint and network security leaders, up 26% and 48% (Mar & Jun 2024)

I compile all thesis tracking here and linked in the in the Sleep Well Portfolio spreadsheet (annual sub only). You can also access all buy-and-sell, and deep dives.

As a reminder, I focus on the long-term story/execution of the business, not the quarterly Wall Street beat/miss quarterly records. So, my thesis tracker primarily checks how my picks build their value propositions, cope with adversity, and maintain/grow moats and market share.

For all sleep-well writeups, please visit this link.

Finchat.io, my personal Bloomberg terminal, sponsors this post; join Finchart.io using this link to get 20% off and support sleep-well investments.

MIPS - Q3’24 results - Business recovered, operating leverage is back, but 2027 target looks tough

MIPS reported its best quarter since Q2 2022.

MIPS stock has risen 87% since my buy alert last Oct 27th, 2023 (SEK 550 from SEK 300).

But MIPS’s stock rally isn’t a huge surprise if you have been reading my last six earnings reviews Q2’24, Q1’24, Q4’23, Q3’23, Q2’23, Q1’23).

I also tracked Thule (the largest outdoor retailer in the Nordic) and Shimano (the largest bike part manufacturer) for the last six quarters, so I was comfortable pitching that MIPS’s bloated inventory was ending.

I must also credit the management, who have been adamant that MIPS will return to growth, albeit slightly longer than expected but more impressive than peers, as we will see in the market share section.

Resilience and Scalability

Sales grew +61% to SEK 123M (77M), a rapid turnaround after a seven-consecutive quarter of decline to as low as -51% between Q3'22 and Q1'24 (highlighted above).

This is mainly because sales from all regions and helmet types have started to come from new MIPS tools and products and not from the digestion of old inventory — that has finished.

I am particularly pleased with the gross margin of 73.4%, which is even higher than peak Covid’s, showing pricing power. It also has been stable throughout the inventory glut (see table above).

Now that growth has returned, we also see operating leverage ramp back up as marketing and R&D account for only 7% and 5% of total sales, and capex is tiny.

MIPS is highly scalable:

Operating profit increased by 320% to SEK 48m (15).

Operating margin increased by almost 20 percentage points to 38.5% (19.5%), levels not seen in Q2 ’22, when things were still very rosy before the inventory drawdown.

Earnings per share, diluted, increased by 263% and amounted to SEK 1.37 (0.52).

Finally, cash flow from operating activities (below) increased by 300% to SEK 36m (12).

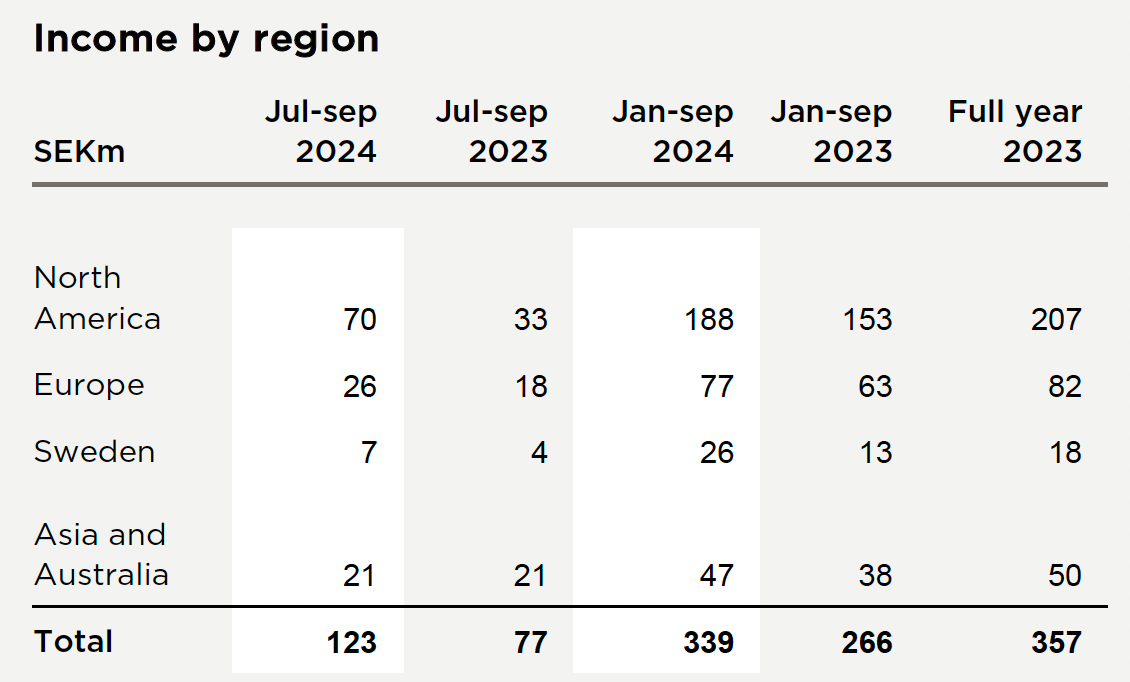

Below, you see that all regions and helmet types have recovered.

Safety is still tiny, but the CEO shared that MIPS is winning 3-4 out of 10 deals, and their sales price per helmet is $5-6. This is slightly higher than the price of bike/sport helmets, but it often goes through a distributor, so the final helmet retail price is less than 4-5x the markup.

Safety category is a little bit different because, of course, when you sell in, what we call, consumer products, then, of course, normally, you will have a multiple of $4 to $5. So if you add $1, that can be $4 to $5 in the retail industry. And of course, when you look at the Safety category, it's normally less than that because normally, you don't have the retail in between. Normally, we sell to helmet brand that sells to a distributor that sells directly to construction companies. And therefore, the retail margin is not in between. And that, of course, generates lower markup. We don't see any inability to markup in terms of what the safety brands expect, and we see that price doesn't seem to be the issue. - Q3’24

Safety is a massive opportunity in the long term, so it’s nice to see it back to growth after a slight decline in Q2 ’24.

Overall, the return to growth while the market is still challenging shows that MIPS’s technology has brand relevance and stickiness—MIPS's top helmet ranking, embedded helmet design and assembly processes, store designs, etc. Brands continued to adopt MIPS in many new helmet models, which management said were winning new contracts reported from the last three quarters.

The interest in implementing Mips' safety system in new helmets remains high and market share and penetration of Mips continue to increase throughout the world, and we are confident in our long-term strategy and our financial targets.

we also see that we are gaining a lot of market share on the North American market,

Max Strandwitz's comment is consistent with what he said in Q2’24 and Q1’24.

It's the customers buying from us, we are stealing market share, and we are increasing the penetration. — Max Strandwitz, Q2’24

We also see when inventory is being replenished, especially on the European market, that a lot of the new orders from customers is with Mips, because Mips is stealing a lot of market share. And when you now buy new inventory, of course, we see that there is an over-representation of Mips versus before. — Max Strandwitz, Q2’24

This is a sign of a resilient and scalable business.

Market share and high relevance

I can update MIPS market share information every Q2 by using the number of teams using MIPS in the Tour de France and the top-ranking helmets done by Virginia Tech as a proxy.

In 2024, Mips was used by 18/22 teams, the same as in 2023. Notably, the winner (Pogacar Tadej—the first man to win the Giro D’Italia and Tour de France in the same season) and the winning team (UAE Team Emirates) used MIPS.

The number of top-ranking helmets in the Virginia Tech industry report for 2024 shows that 97 top helmets were MIPS, up from 91 in 2023. Kash had one helmet in the 80th position, and Rudy had two in the 59th and 94th positions. HJC had none, but it makes sense as they specialize in motorcycles and mainly sell in Europe—not a direct competition to MIPS, more to Leatt.

Virginia Tech report is a good proxy as it collaborates with the Insurance Institute for Highway Safety to test popular helmets in the market (238 bike helmets in 2024, using the STAR evaluation system). Its crash impact tests evaluate helmets' ability to reduce linear acceleration and rotational velocity of the head resulting from a range of head impacts a cyclist might experience.

My findings above validate the CEO's message in the past few earnings:

MIPS continues to steal market share - Q3’24

MIPS is over-represented in new inventory - Q2’24

MIPS sees increased market penetration of helmet models with Mips’ safety system - Q2’23 review

Importantly, MIPS remains an essential brain protection technology, and brands continue to equip it in their new and best-selling models.

2027 target far-fetched

MIPS 2027's target of SEK 2B sales and 50% operating margin looks far-fetched in the past eight quarters, as sales declined rapidly. However, Q3’34 and Q2’24’s quick 61% and 31% YoY growth inflection gives the management hope that the target could be met.

Off-the-napkin math shows that MIPS will need to record 50% growth every year to achieve the level that MIPS achieved between 2014 and 2022.

That seems very tough, as MIPS is no longer a small company! In addition, the Safety segment must deliver (it is still tiny and underperformed last quarter), and non-US sales must also impress (Europe and Asia are still challenging).

The good news is that MIPS has limited competition, and the white space is big (in China, it's MIPS vs. helmets without lateral protection!).

In addition, I don’t think MIPS needs to achieve SEK 2B sales to do well. The market expectation has been rock bottom in the past two years. If MIPS continues to maintain the top helmet ranking (97/100) and is adopted by 18/22 Tour de France teams, I think MIPS will do very well in the upcycle, which has just started again.

I am still excited for the next few years.

Our customers are still showing plenty of interest in developing new helmets equipped with Mips’ safety system in all three categories, and the number of completed helmets developed with our technology will be the highest ever this year.

We remain convinced that we have the right longterm strategy, with a major focus on innovation and on steadily building a well-recognized ingredient brand that makes us an essential partner within the helmet sector.

— Max Strandwitz, CEO, Q3’24