Sea Limited Q3'25: Accelerated Profitable Growth, More Investments in Key Moats.

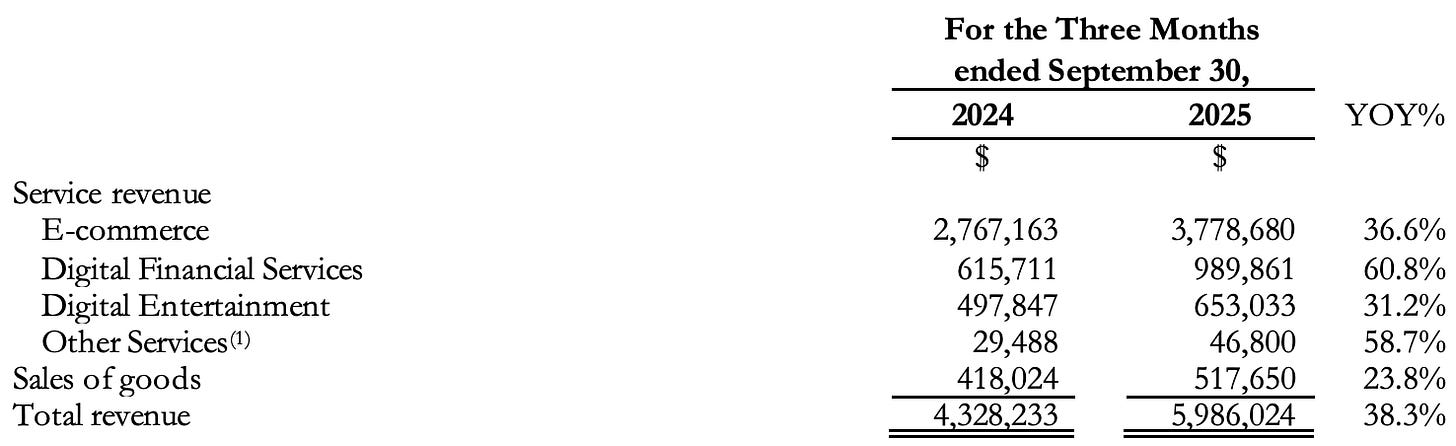

Excellent business to add over time. Garena's bookings up 51%, Shopee's GMV up 28%, Monee's Loans up 70%. Group Adj.EBITDA up 68% to ~$900M, nearly $4B annualised.

Sea Limited, a 55% position of my PA and 22% of Sleep Well Portfolio, reported excellent Q3’25. Shares dipped 5% after the results for reasons not aligned with my time horizon and thesis. So, I’ll be adding to my PA if it stays weak. (I can no longer add to my SW Portfolio, due to my broker’s restrictions on ADR shares.)

Hedgeye analyst Felix Wang’s short call at $190/share in September is correct in this time frame, and I am thankful to him, as I can add more shares at a 25% discount today.

Why am I bullish on the business long-term? I’ll go through:

KPIs (operations, financials, peers, market share)

Other highlights (Brazil, Argentina)

Why is it the largest position of SWI

Valuation - $145/share, market expectations vs. SWI’s expectations

SE coverage: [deep dive, 4th buy, 3rd buy, 2nd buy, 1st buy, tariff review, Q2’25, Q1’25, Q4’24, Q3’24, Q2’24 update]

I use all my financial data and charts on Fiscal.ai. Get a 15% discount while supporting SWI, the following affiliate link should work.

Don’t miss out on the November Best Buy List.

For everything else, start here. Please use the FAQ alongside the SWI Manual to get the most out of your subscription.

KPIs (operations, financials, market share)

As a group, this was a blowout reacceleration of growth.

Management’s focus remains the same:

“continuing to deliver high and profitable growth across all three of our businesses. With e-commerce and digital finance penetration in our markets still low but increasing, strong growth lays the best foundation to maximize our long-term profitability,” - Forrest Li, Sea’s Chairman and Chief Executive Officer.

Q3 saw 38% growth as a group, with Monee growing the fastest again at 60% YoY.

All still profitable with Monee investing heavily in increasing the loan size (marketing up 140% to $157M and provision for credit loss up 76% to $373M)

Let’s dive into all the segments. I’ll focus on the long-term trajectory.

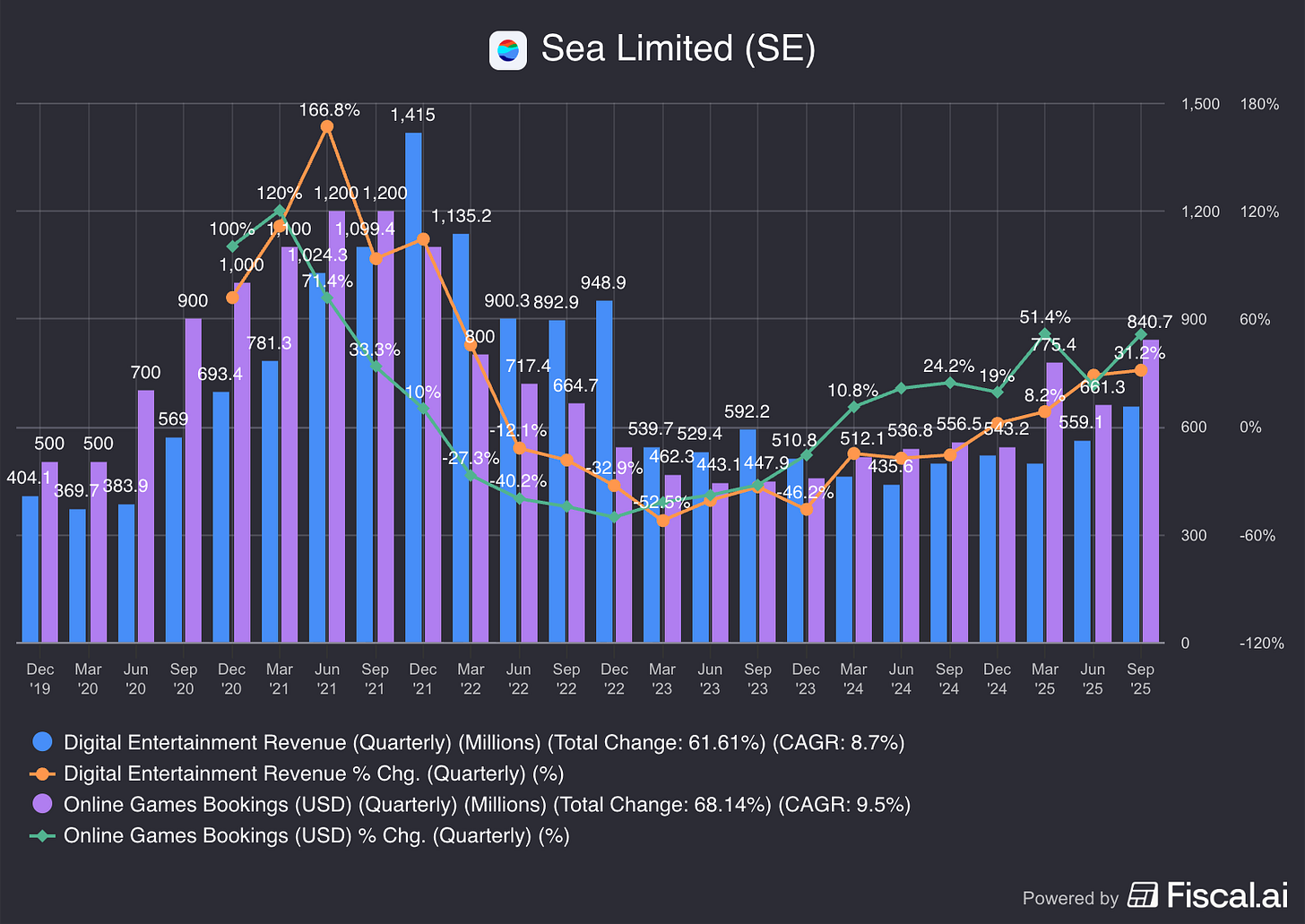

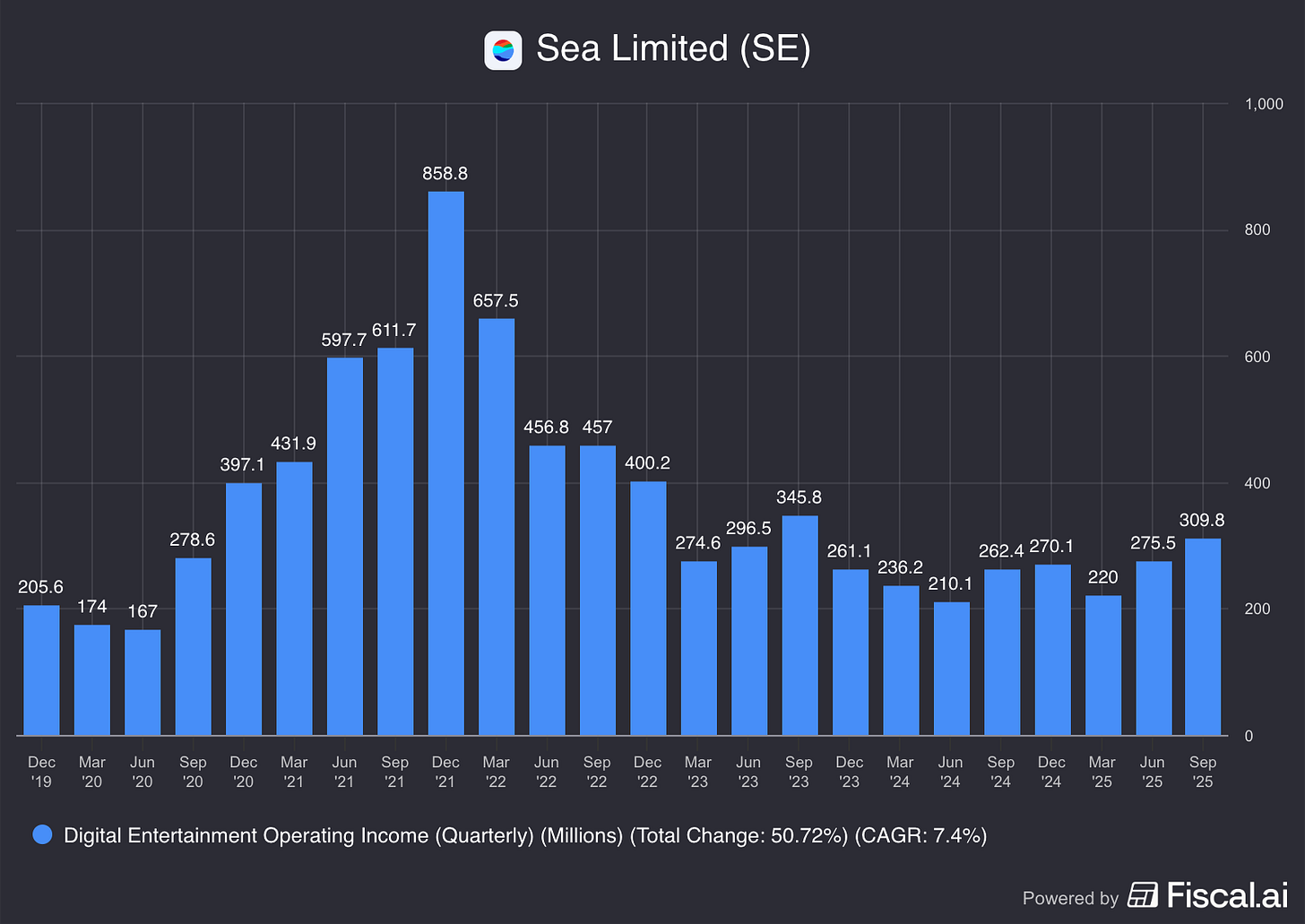

Garena - back to hyper growth, best Q since 2021

Garena, once a hyper-growth cash cow pre-COVID, then a struggling division post-COVID, is back in hyper-growth mode, posting 31% revenue growth and 51% bookings growth.

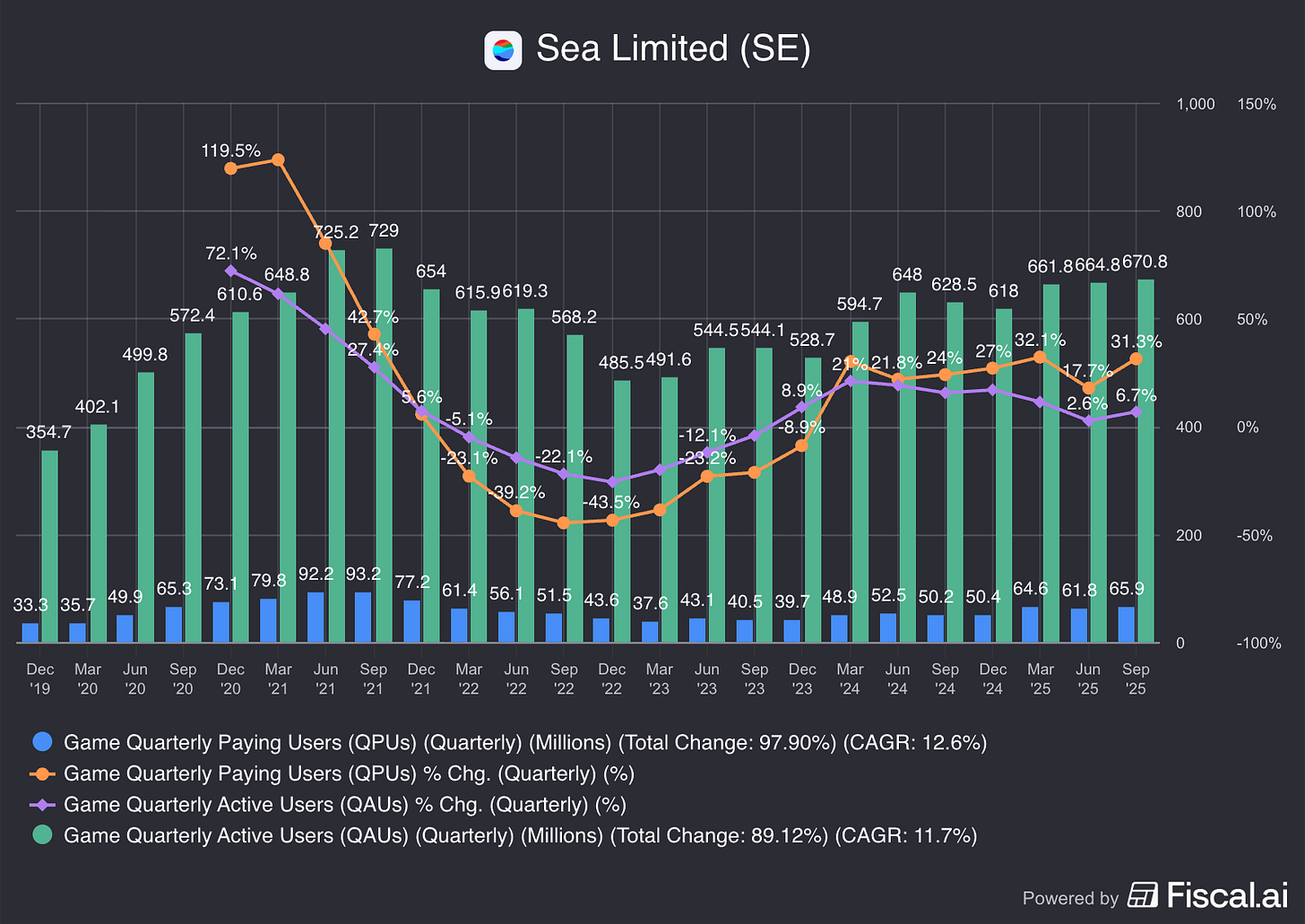

The trend is well supported by the 670M Quarterly Active Users and 66M Quarterly Paying Users. Numbers are yet to hit peak Covid, but it doesn’t have to. I view this segment as a cash cow and expect little growth onwards.

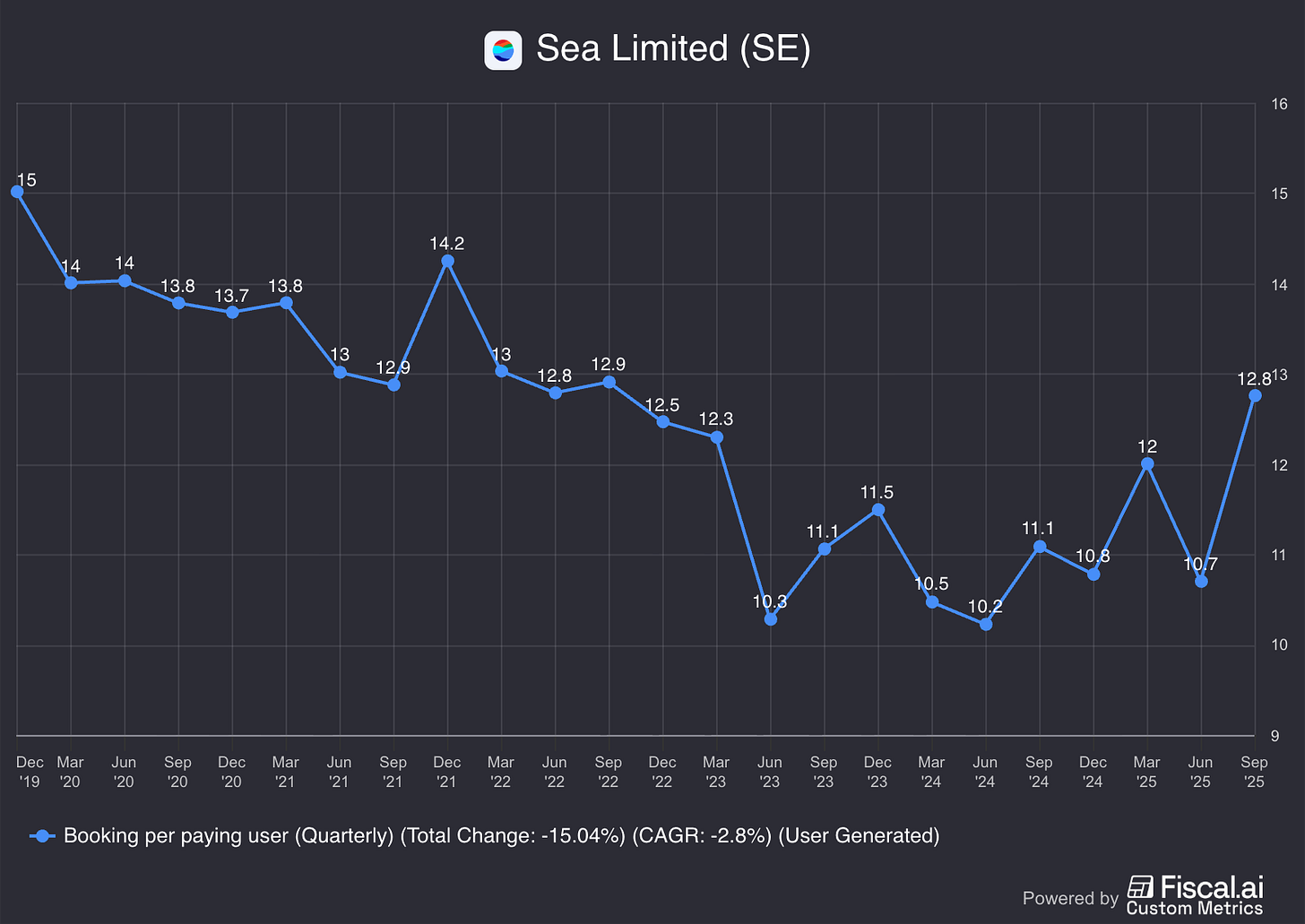

Booking per paying user was at ~$13/user, an increase of ~20% from the bottom two years ago.

As such, EBIT has remained strong at ~$300M and Adj.EBITDA at $456M (operating cash flow). Annualized, this is almost a $2B operating cash flow segment!

Why the strong performance may continue.