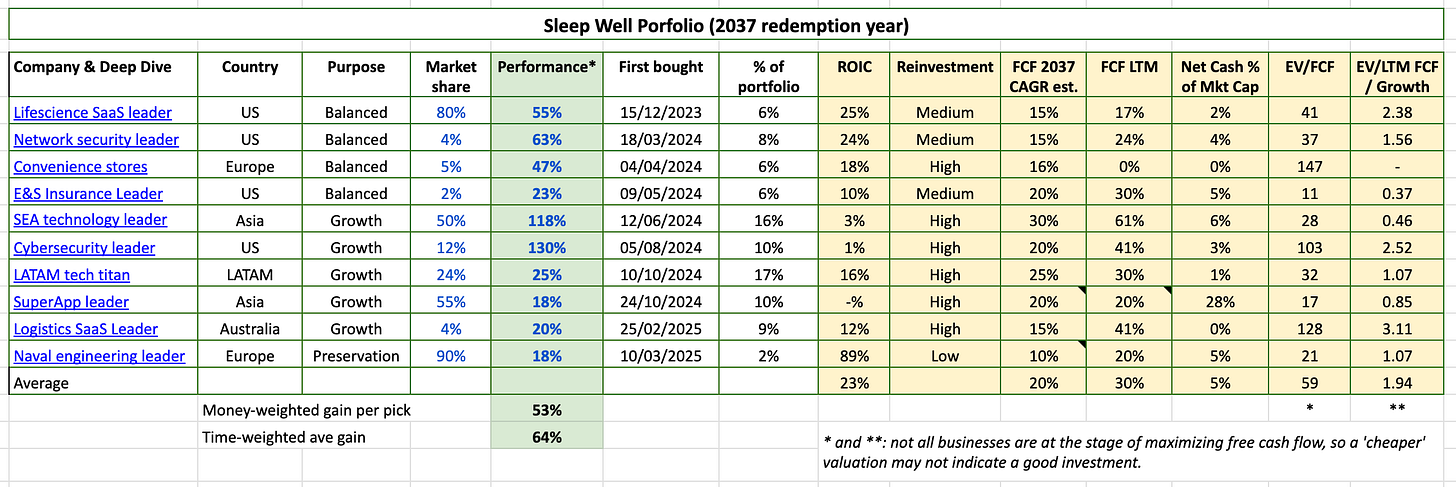

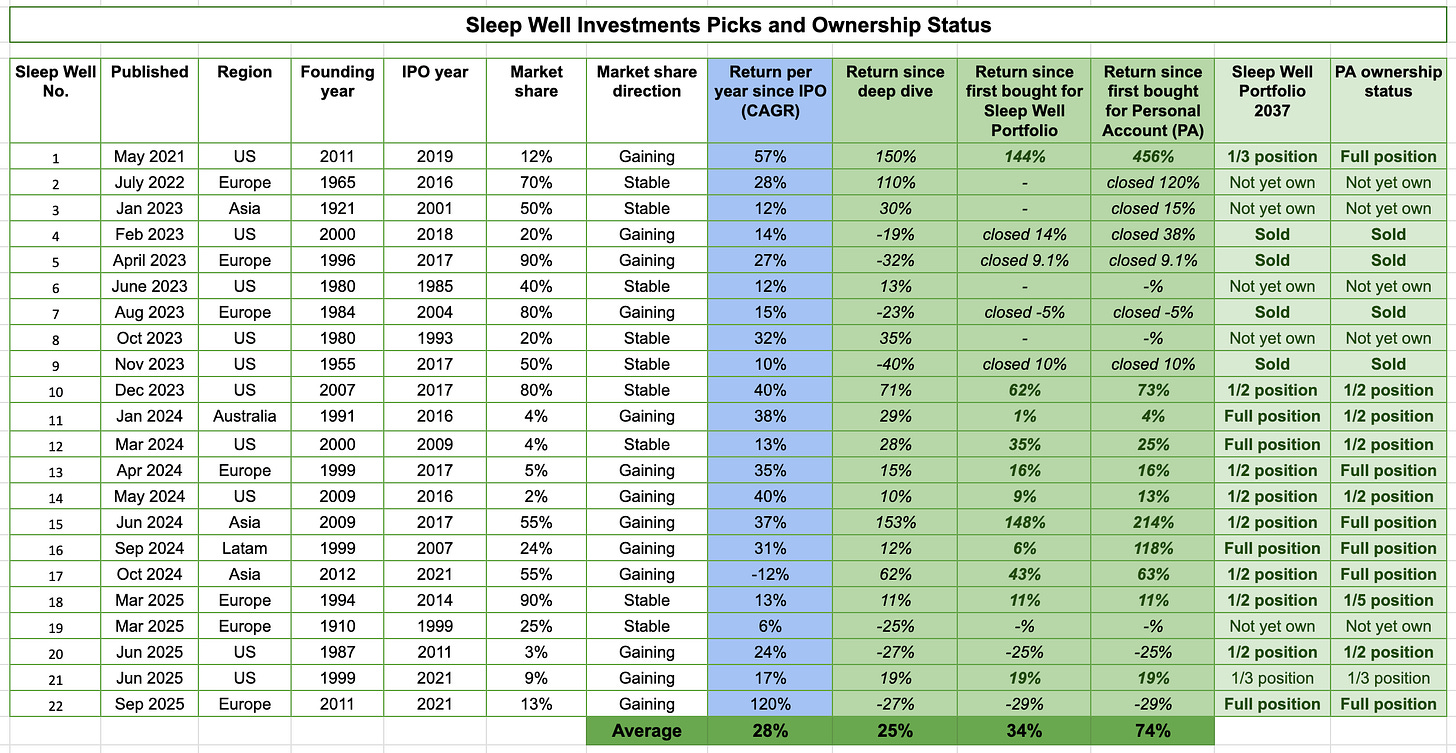

Sleep Well Portfolio (Sep 2025) - 47% annualised return per pick, 2 losers.

Two losers out of 13 holdings; 6% Outperformance vs. S&P500. 47% annualised return per pick, 25/30 transactions were correct (83% success rate).

Sleep Well Portfolio consists of only time-tested leaders. We screen them through a rigorous checklist and track their thesis regularly to know when to buy. So far, we have only had two losers, and 25 out of 30 transactions have been profitable. All about us here.

Good morning, sleep-well owners,

Summary of September

We bought Intellego [deep dive, 1st buy, 2nd buy, risk management, 1st live event, mispriced].

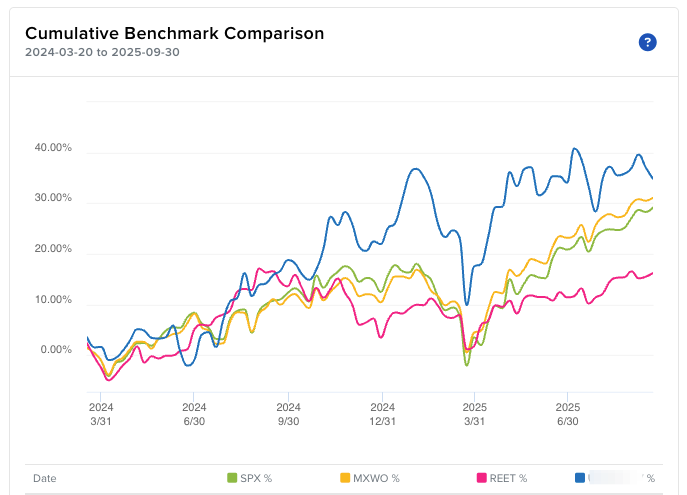

Return from inception was 35% vs. S&P500 29%: ~6% outperformance.

2025 Year-to-date return was 13% vs. S&P50013%: ~0% outperformance.

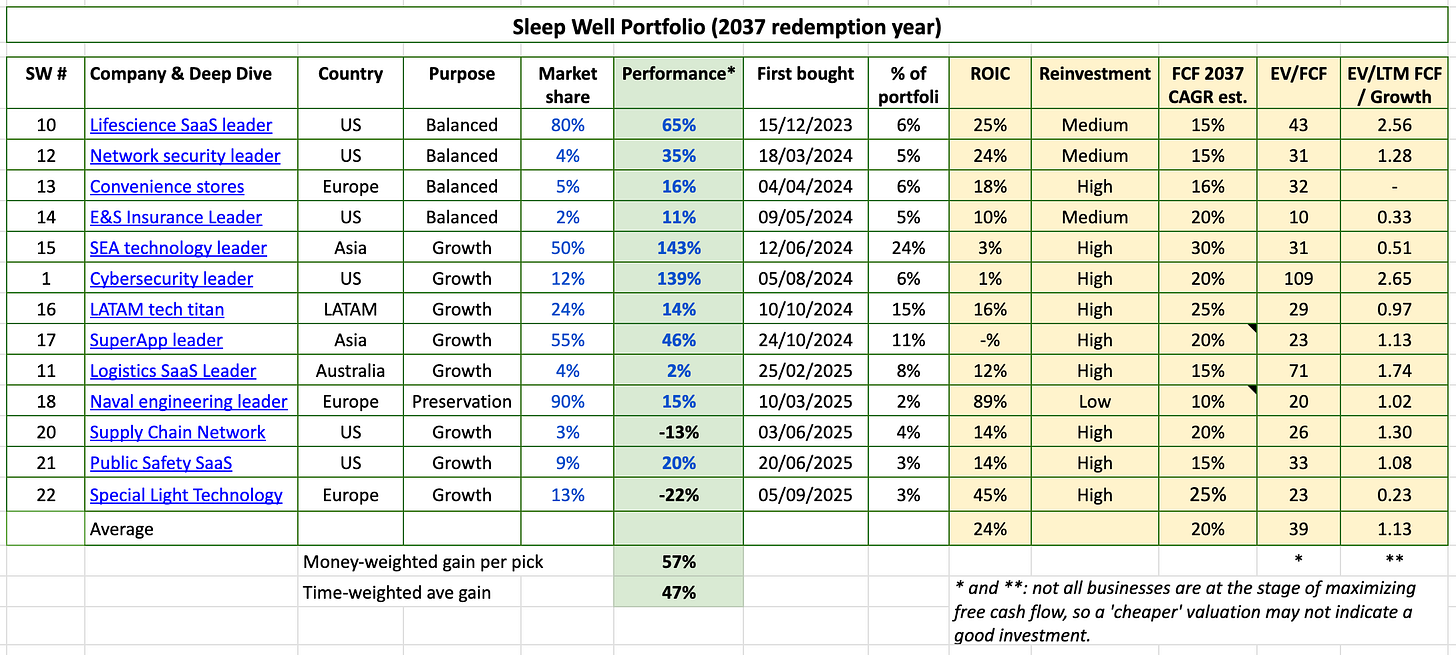

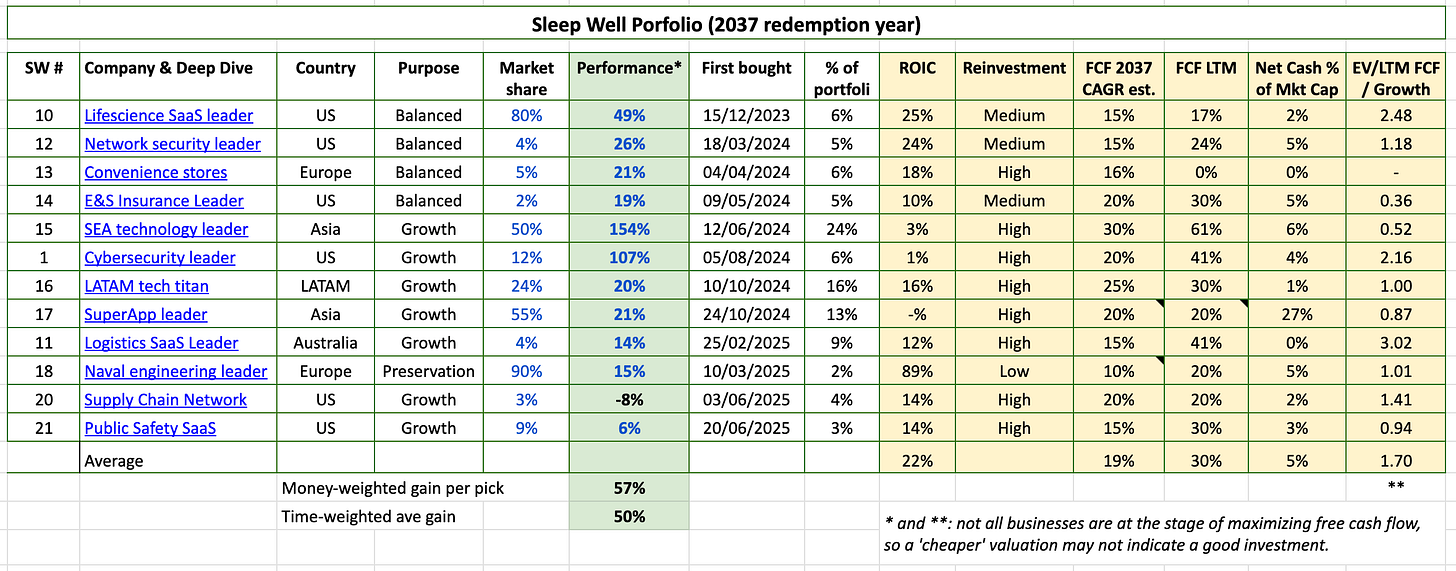

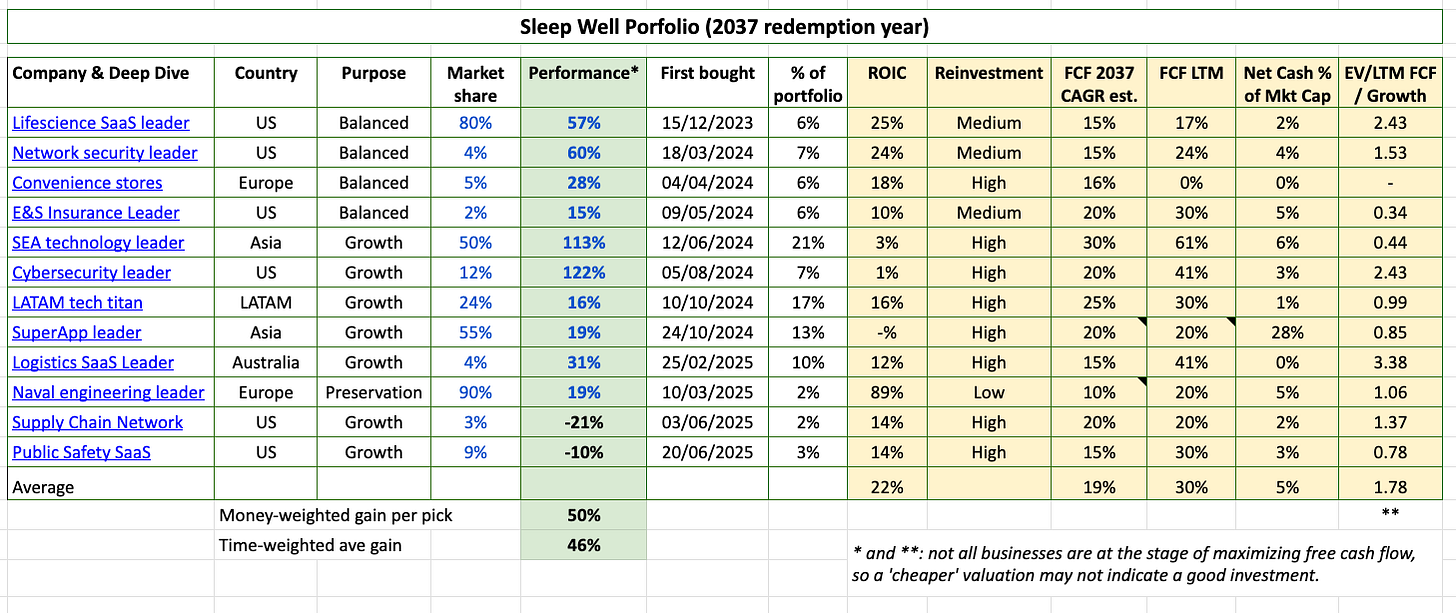

Picks’ annualized return is now 47%, compared to 50% in Aug, 46% in July, 61% in June, 64% in May, 51% in April, and 38% in March.

2 losers, 11/13 making money, and 25/30 transactions were correct decisions.

Best buys and research list - will be posted separately. Annual members can already see the reasons why FILA and Rubrik were added to the Research List (in the SWP spreadsheet), as well as companies worth adding at current prices (Monthly Update tab).

Sleep Well Portfolio master spreadsheet If you are new to SWI, check out our FAQ and Owner Manual.

Bitesize learning topic of September: Understanding Risk, an underappreciated topic when things are going well. Please check them out to learn more about how we build our Sleep Well Portfolio.

If you are already an annual member, you can access the Sleep Well Portfolio and Thesis Tracker via the link below.

Safety first, returns later.

Our future performance will come from avoiding ‘losers’ and betting big when the odds of being right are high.

In other words, we only want to own high-quality companies that can overcome challenging periods. Currently, we have two losers. We expect to return to green as time goes by. An interesting stat, all of our losers turned green after a year of ownership. Since we launched the Sleep Well Portfolio in 2023, we have had only two losers for a total of 5 months. For the rest of the time, the portfolio has had either one or no losers.

With limited losers and enough time for observations, we can be more comfortable with betting big on our winners (much like watering flowers and cutting the weeds, as they say). Sea Limited is an example. Our return on Sea Limited has increased by 150%. We added it 4 times in the 16 months, and it now accounts for 24% of our portfolio.

We believe we have found a sustainable formula, and I am excited about the future. Since our investment horizon is long, time is on our side.

Quality > quantity.

Intellego in focus

In September, our attention was on Intellego, our 22nd sleep-well pick:

A ~$500M Swedish company selling UV validation technology, expanding beyond disinfection to industrial curing applications.

Operating margin above 40%, patent-backed, and growing by more than 100%.

The valuation was 8x EBIT for FY2025 figures, significantly lower than that of peers.

The pick strikes a balance between innovation, market relevance, pricing power, and a reasonable valuation. While the stock is volatile, I believe that by holding the company for longer than an average investor, whose holding period is than 1 year (down from 30 months in the 1990s), we will have a higher chance of owning a much larger company (triple-digit revenue growth at 50%+ operating margin). We will also be able to capitalize on more volatility.

More information on the 22nd pick here: [deep dive, 1st buy, 2nd buy, risk management, 1st live event, mispriced]

**2nd October, I also bought Intellego for the third time. Article here.

SWI since inception 35% vs S&P500 29% - Interactive Brokers:

The slight dip in our outperformance was attributed to a corresponding decline in larger positions, including Sea Limited, Mercado Libre, Wisetech, and Intellego’s 28% drop in the first three weeks. I view this as a temporary drop, and I am open to adding more to these businesses. Meanwhile, the Mag7 did great with a resurgence of AI-related developments.

Current portfolio - 2 losers

To achieve a ‘no loser’ status, I am committed to ensuring I don’t own bad businesses in the long term. In the short term, I don’t know what will happen to the stock, nor the market’s perception of the stock; I am more interested in studying the business underneath - core business drivers and evolving threats - which are the main factors that influence my buy/sell decision.

Please keep in mind that these monthly updates are only snapshots of stocks’ performance. So, if you examine SWI’s performance history, you will see that all of our ‘losers’ are a result of temporary dips in stock price shortly after acquisition. All of our purchases have eventually turned green after one year. I believe that by next June, SWI's 20th pick (-13%) will turn green, and I certainly have high hopes for SWI’s 22nd pick (-22%) to do the same by then, if not earlier.

Previously, Aug 2025 - 1 loser

Previously, July 2025 - 2 losers

Previously, June 2025

Previously, May 2025

Previously, April 2025

Previously, Mar 2025

Transactions with notes below:

Expanding investment universe

You will only see me buying businesses that I thoroughly understand (see the deep dives below). I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—47% annualized time-weighted.

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of the investment framework to help find quality companies and execute with discipline.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.

Great results and a wonderful idea generator, really appreciate the quality of work you’re putting out.