Business Update - Fortinet (FTNT) Q3'24 - Core Segment Returned To Growth, Record Profitability

Position up 70%, $2.5B free cash flow run rate for FY2024, at 30x FCF and 12% est. 3yr forward growth, is it still reasonable to buy more?

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Hi, sleep well friends,

This post is the Q3-24 thesis tracking for Fortinet—next, Veeva, and CrowdStrike.

Previously:

Floor & Decor (FND) - Coping well with slow existing housing sales.

WilScott MM (WSC) - Is the McGrath deal closing? Trimmed for Grab.

Dino Polska (DNP.WA) - Reaccelerating store opening

Sea Limited (SE) - SEA e-commerce leader, up 58% since bought (Jun 2024)

Mercado Libre (MELI) - LATAM e-commerce and banking leader, down 5% since bought (Oct 2024)

GRAB (GRAB) - SEA Super App leader, up 25% since bought (Oct 2024)

MIPS - helmet protection leader, up 61% since bought (May 2023)

Kinsale (KNSL) - E&S insurance leader, up 15% (May 2024)

WiseTech (WTC) - CEO shakes up, logistics SaaS leader, up 88% (Jan 2024)

FTNT + CRWD partnership of endpoint and network security leaders, up 26% and 48% (Mar & Jun 2024)

I compiled all thesis tracking here and linked it to the Sleep Well Portfolio spreadsheet (annual sub only). You can also access all buy-and-sell and deep dives.

As a reminder, I focus on the long-term story/execution of the business, not the quarterly Wall Street beat/miss quarterly records. So, my thesis tracker primarily checks how my picks build their value propositions, cope with adversity, and maintain/grow moats and market share.

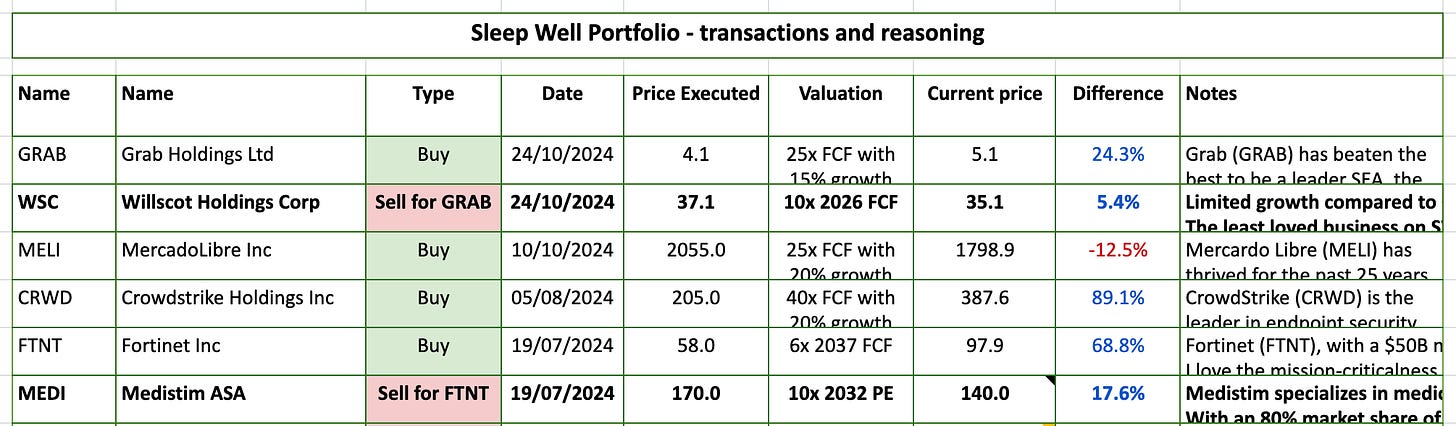

Current Sleep Well Portfolio holdings:

For all sleep-well writeups, please visit this link.

Finchat.io, my personal Bloomberg terminal, sponsors this post; join Finchart.io using this link to get 20% off and support sleep-well investments.

FTNT Q3’24 - Core segment returned to growth, record profitability

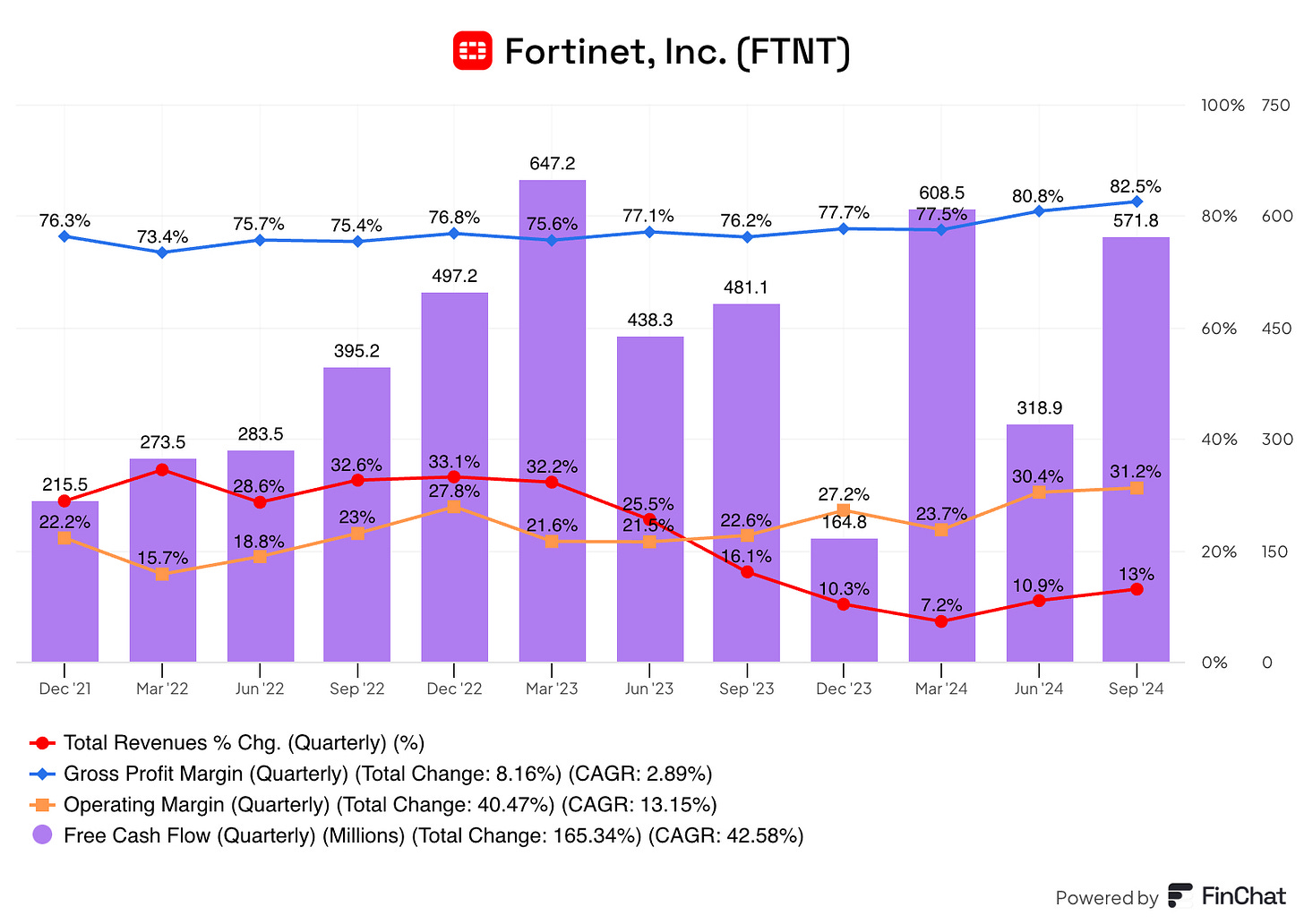

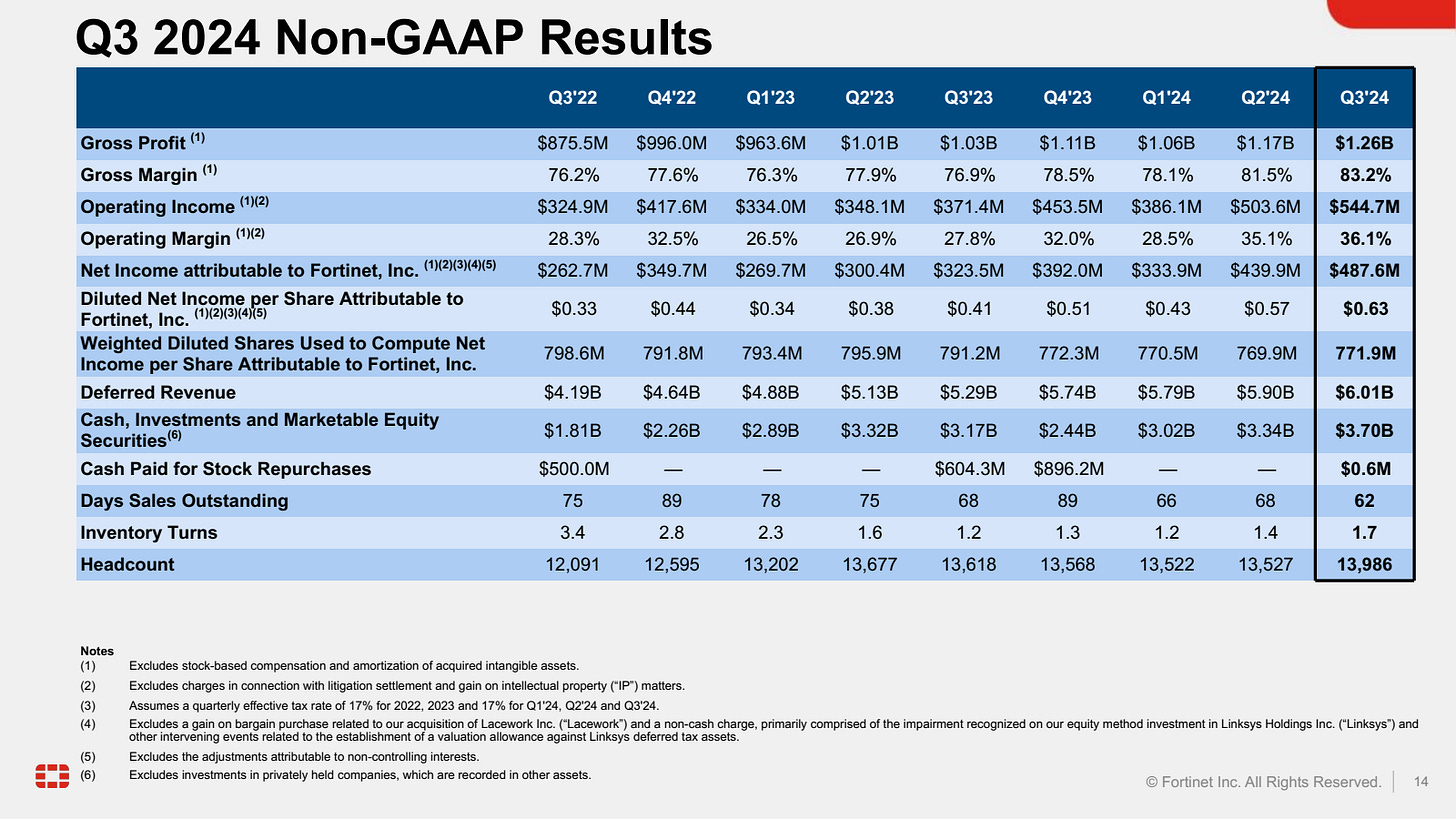

In Q3’24, I saw a return of growth in product revenue and billings, record operating margins, and generating a $2.5B free cash flow run rate for FY2024, making it at 30x FCF, still reasonable if growth can accelerate above 15%!

Please read my Fortinet deep dive [Part 1, Part 2] to familiarize yourself with the industry and the critical role this company plays in enterprise networking and cybersecurity.

Read more about Fortinet here: deep dive [Part 1, Part 2], FTNT+CRWD partnership, Q2’24, Q1’24

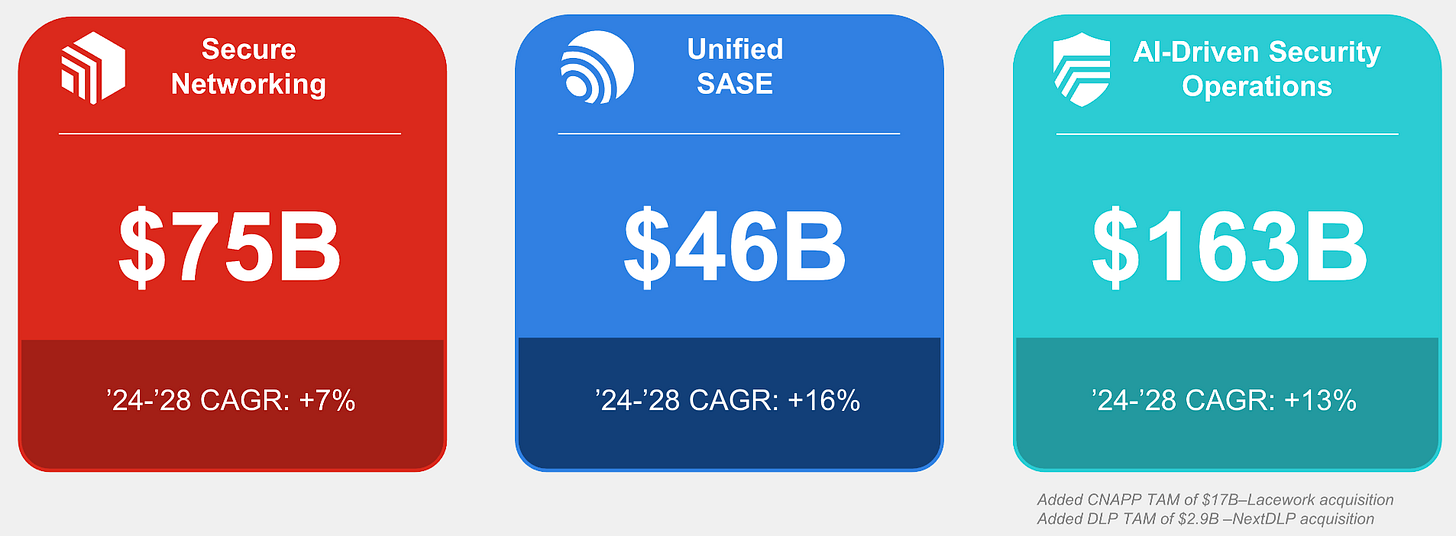

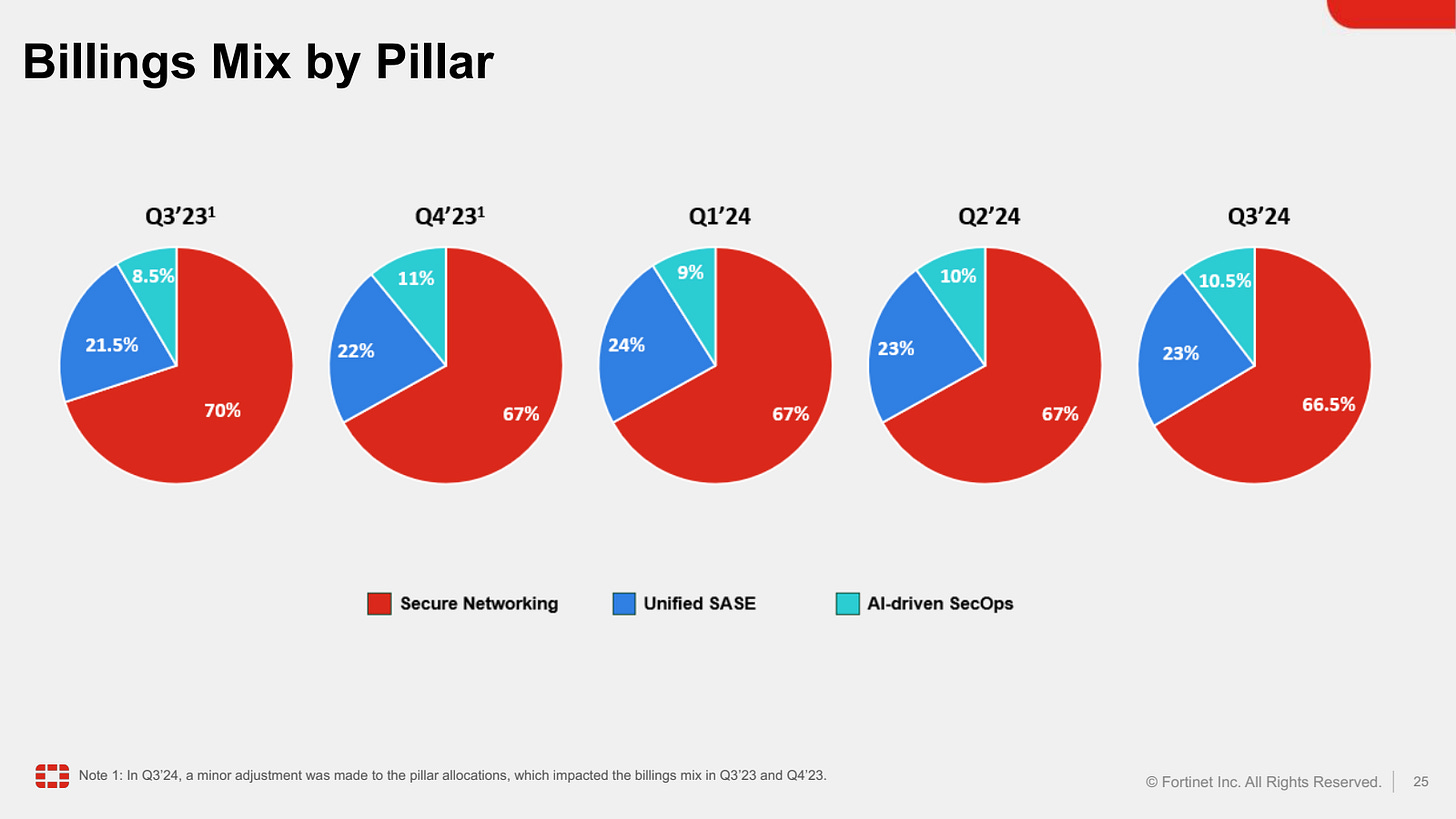

At a 30,000-foot view, an enterprise is secured by creating defenses in five areas: the network infrastructure, software, the cloud, endpoints, and data. Fortinet is the market share leader (55%+ in number of firewall units sold) in securing network infrastructure, a $75B market. Fortinet’s approach provides the broadest vision of the enterprise; all data goes through it; hence, in my view, it is the most effective strategy. It is also used by 77% of Fortune 100 (up from 76% in 2023). Secure networking makes up 66% of Fortinet’s business and is practically future-proof. Despite this core segment growing steadily at 10%+, leveraging the scale, Fortinet has been building new capabilities to protect the cloud, a $200B+ market ($46B Unified SASE + $163B AI-driven SecOps), growing at over 13%+ with higher margins.

Before we move to the Q3 ’24 review, please read the following extract from the March 2024 deep dive - The Most Sleep Well Business in Cyber Security.

Key sleep-well ingredients

FTNT’s core offerings combine essential networking hardware (switches, routers, firewalls) and sticky software-as-a-service ‘SaaS’ (network security) to help enterprises build, manage, and secure their IT infrastructure. The superior performance and cost benefits vs peers drove the company to the leader position in network security from a challenger position a decade ago (Gartner 2011 vs. 2023).

In my opinion, Fortinet’s core offerings face the least disruptions and are more future-proof than other cybersecurity areas. First, no matter how enterprises organize their IT infrastructure, they always need networking hardware, especially the best-of-class ones. In 2022, IDC reported that 50% of global shipments of networking firewall appliances were Fortinet’s. Next, organizations will always prefer to keep key assets, applications, and workloads on-premise. This is especially true for regulated, data-sensitive, and latency-sensitive industries, supporting a respectable 10-year growth rate between 5% and 15%. Moreover, when employees work in the office, accessing data and applications in a local network system is safer and faster.

Fortinet’s core offering is also future-proof because there is no ‘one’ way to protect an enterprise’s infrastructure. All solutions have security gaps, and adversaries evolve in real time. What’s more, Gartner reports little desire for an organization to be protected by just one vendor. Thus, it’s unlikely Fortinet’s offerings will be obsolete.

FTNT also has room to grow. Its expansion to SASE Cloud Security and Security Operations has been successful for five years and is positioned to maintain 15-20% growth for the next 5-10 years. It’s a hyper-competitive market, but Fortinet has a good pathway to maintain/gain market share.

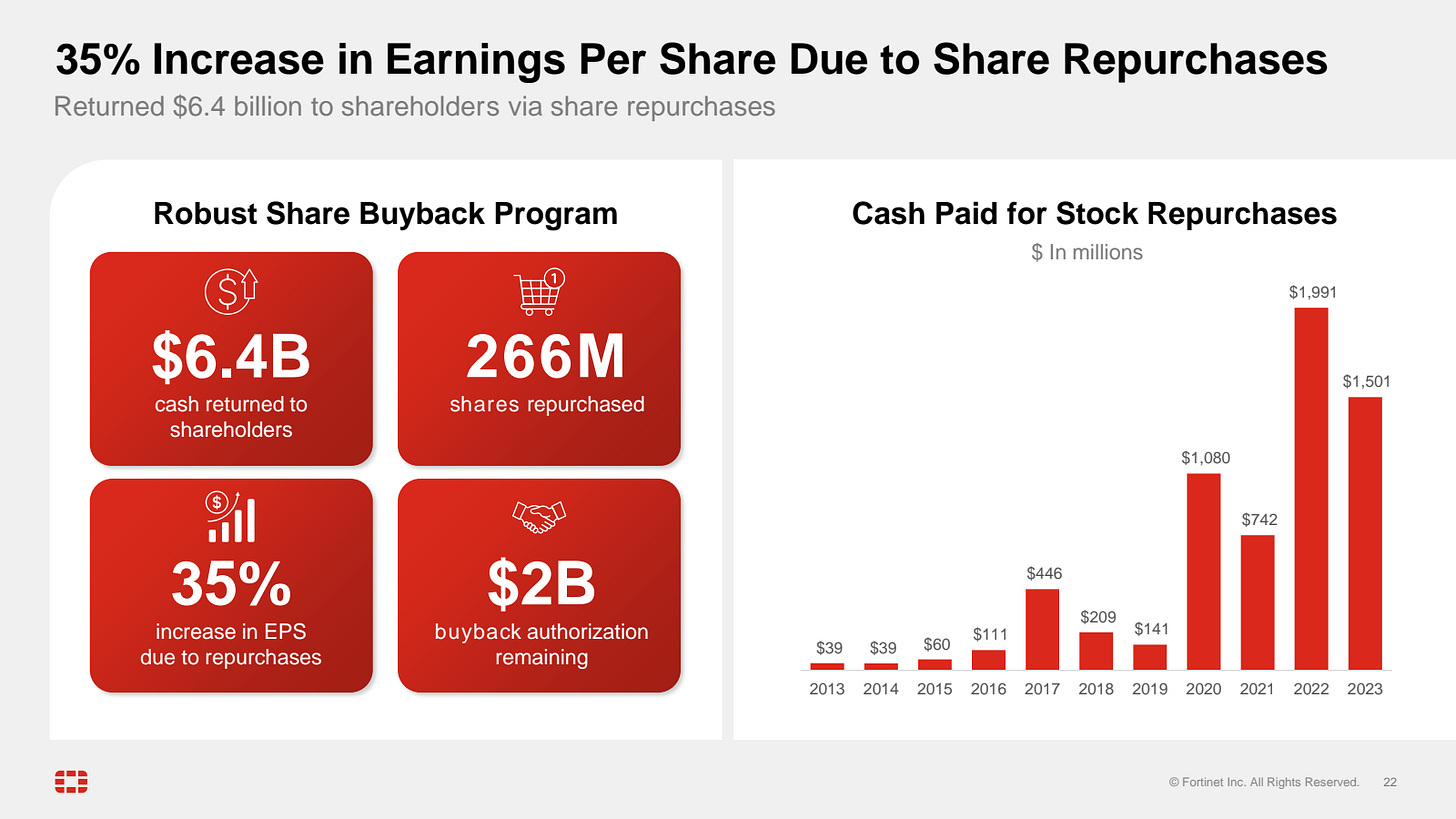

Management is founder-led and measured in capital allocation - focusing on organic growth in high-probability avenues, preferring to acquire lands and buildings to house its data centers (vs. renting), and returning capital to shareholders with an 11.4% buyback yield ($5.3B) since FY2020, 3%+ a year.

FTNT boasts the best business model with the highest margin profile in the industry, at 77% gross and 28% operating margin. It has been free cash flow positive since its IPO in 2009. As we advance, its moats and market share are well protected by integrated hardware and software offerings, which are centrally managed and have a consistent leadership ranking on Gartner for network security.

The current market expectation implies a 9% growth over the next decade, which I believe is low given the broad industry growth rate is already 15% in the next five years. FTNT stock will not rocket one’s portfolio but will help one sleep well.

Q3’24 steady reaccelerating growth and record margin

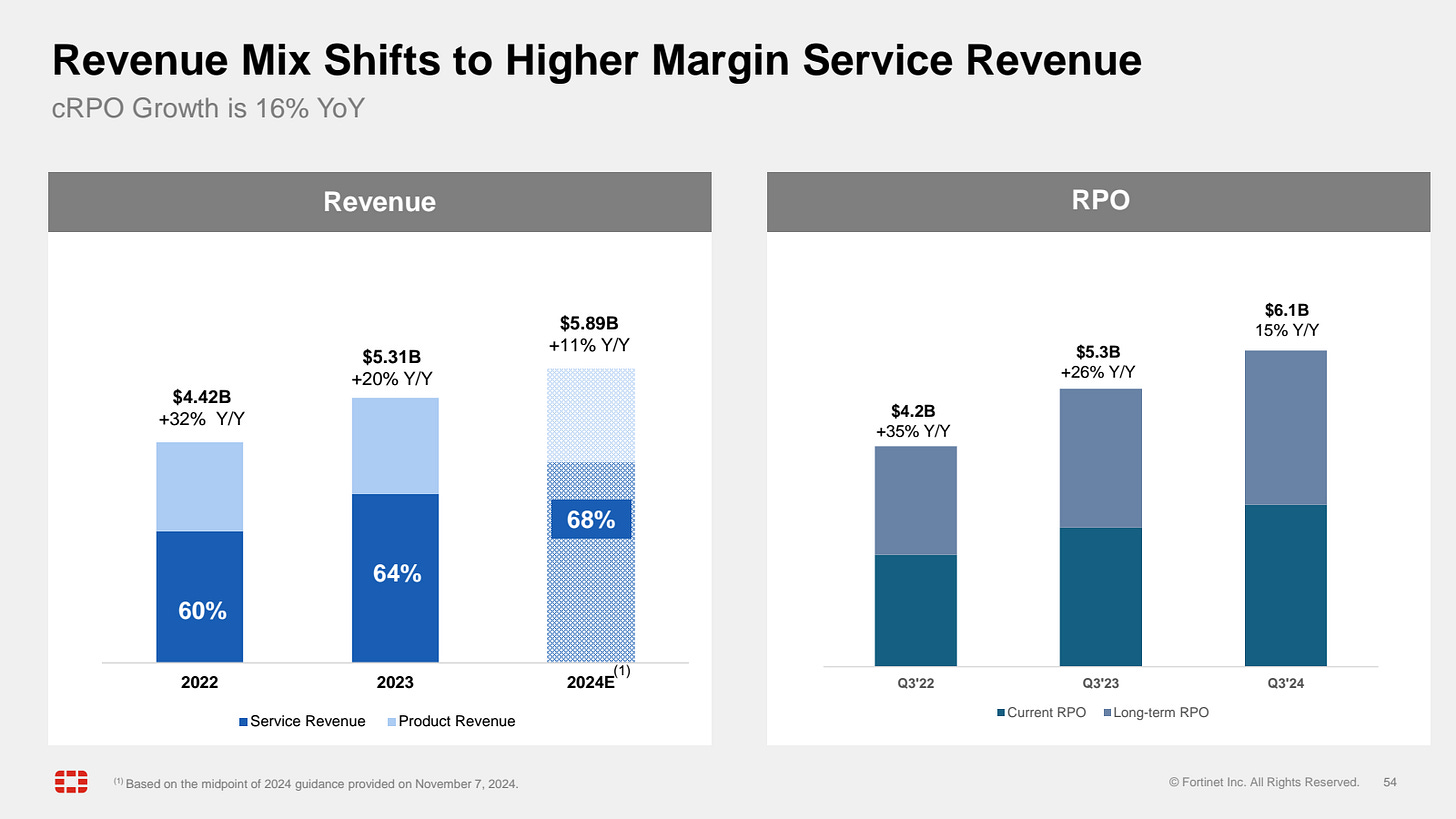

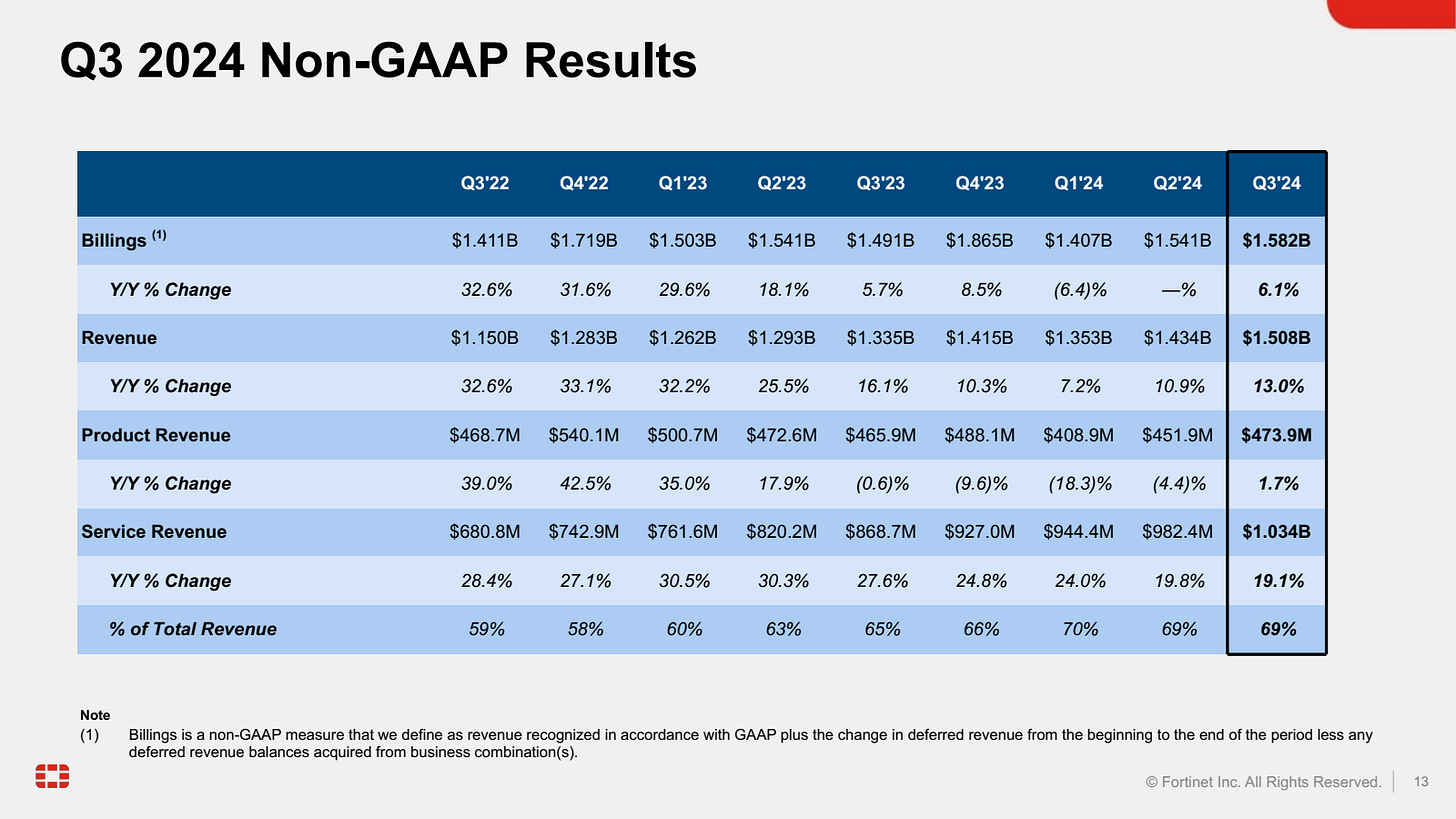

Fortinet reported a strong Q3 2024 with a 13% increase in total revenue, an acceleration from the last 3 quarters (7-10%), driven by a nice recovery of the product segment - network appliances to $473.9 million, a 1% growth vs. 4-18% decline in the last 3 quarters, and a steady 19% growth in service segment - SASE and SecOps to $1.03 billion, a slight deceleration from 20-25% in the last 5 quarters.

Meanwhile, Fortinet posted a record non-GAAP operating margin of 36.1%, reaffirming the right direction to leverage scale to grow SASE and SecOps. This makes them 68% of revenue, up from 64% last year and 60% in 2022.

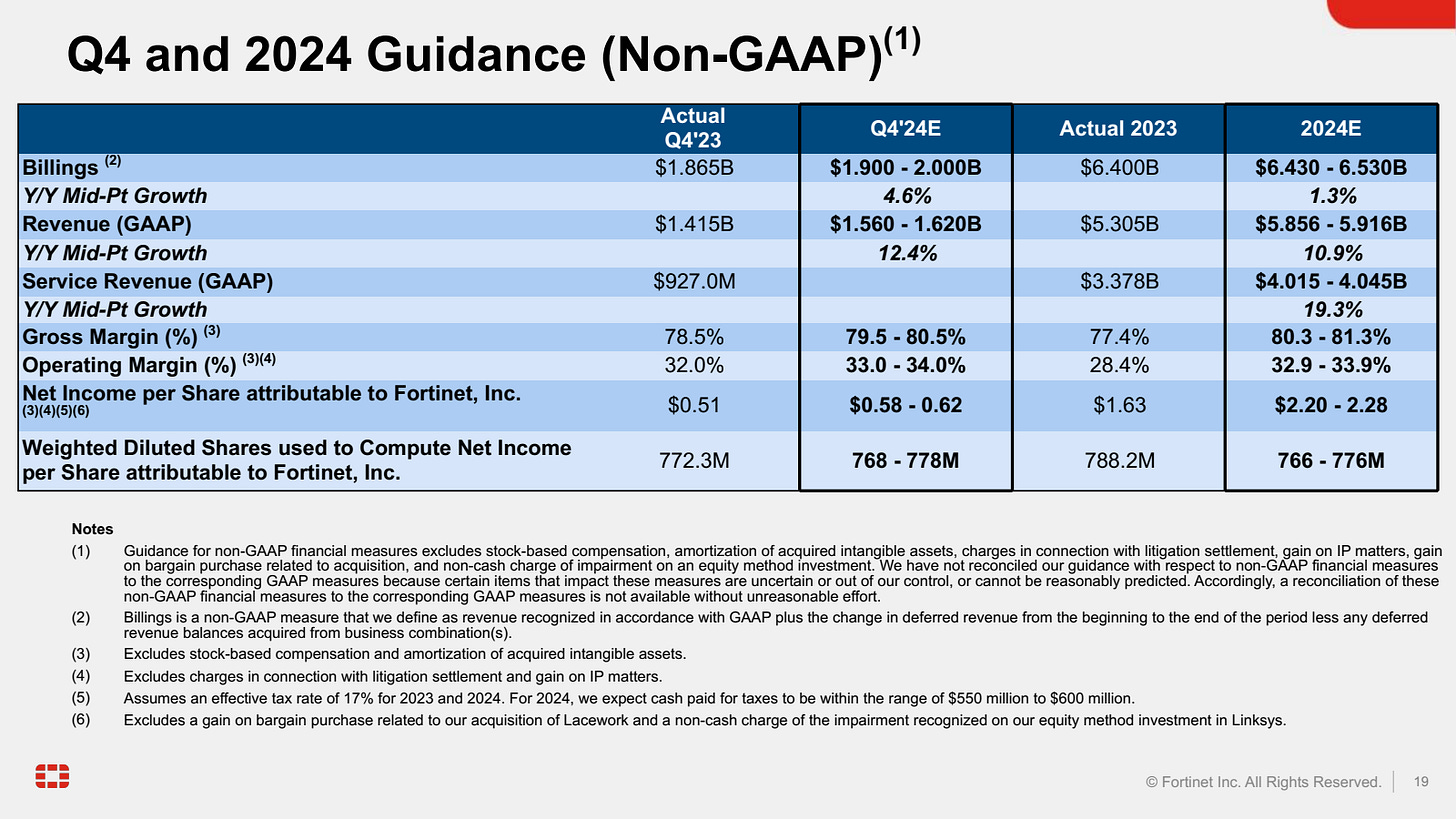

As a result, the company raised its 2024 guidance, reflecting confidence in the return of secure networking and the shift to SASE and Security Operations.

This is a decisive vote of confidence in the management, who were firm in Q1’24 that the decline in billings, slow down in networking appliances, and the impact of Palo Alto throwing products for free was temporary—our bet on adding to the initial position shortly after has paid off, up 70%.

Exceptionally, billings have returned to growth (+6%) after two-quarters of decline (-6%). This is a good proxy for forward development in the coming quarters, given most of Fortinet’s subscription revenue (SASE and SecOps) has a 1-5-year contract.

Below, you can see the raised FY2024 guidance to $5.87B in Q3’24 from $5.7B in Q1’24.

Importantly, it is good to see the willingness to return capital to shareholders through timely buybacks in 2023, when shares were between $50 and $75 vs. the current share price of $90 to $100. The remaining buyback program was also increased to $2 billion from $1 billion.