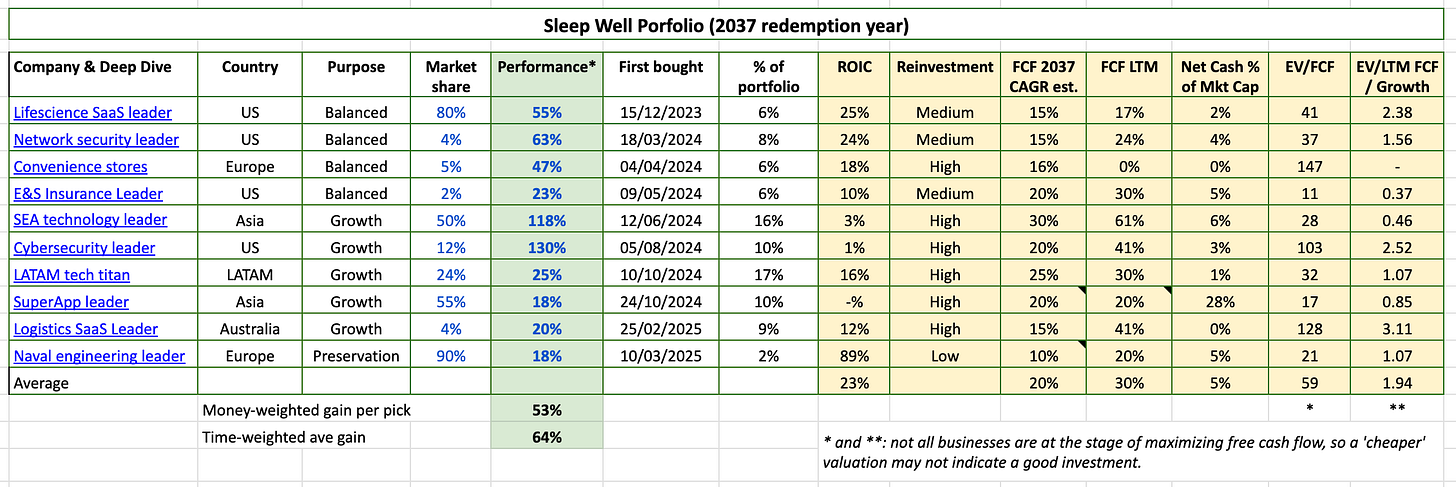

Sleep Well Portfolio (Oct 2025) - Declines from SE, WTC, SPSC, KNSL & INT, Underperforming S&P500, 3 losers.

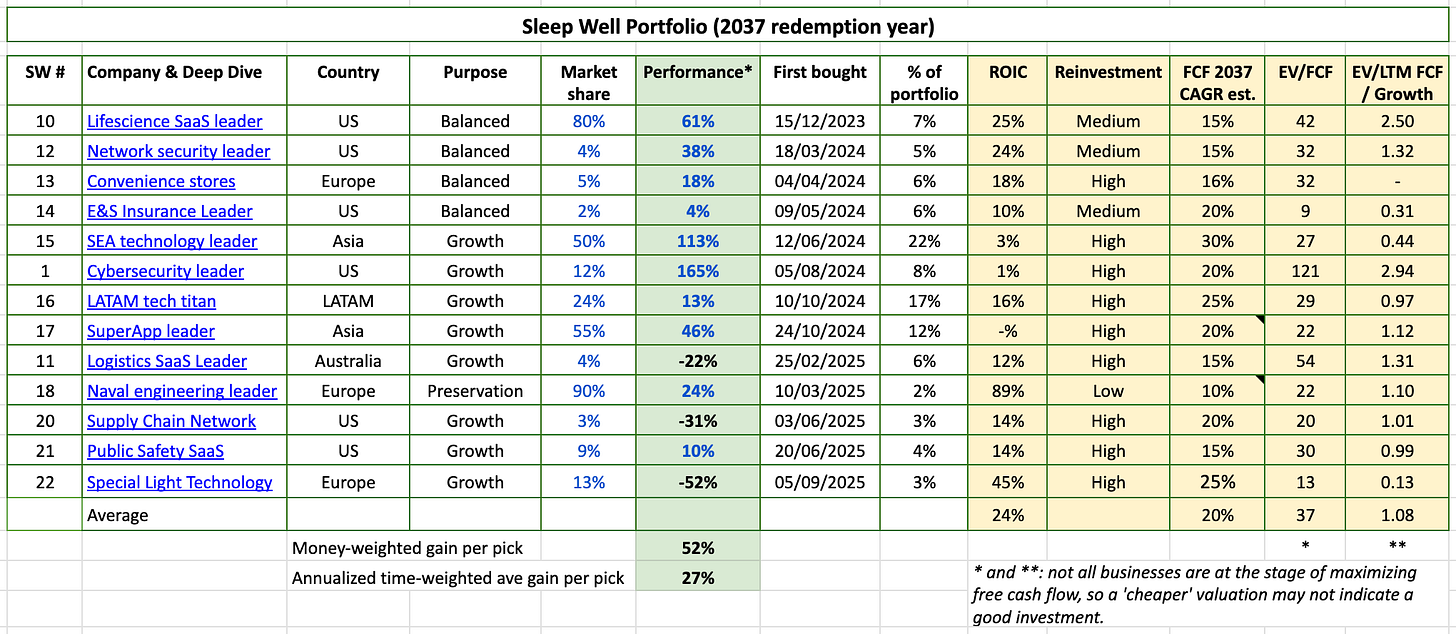

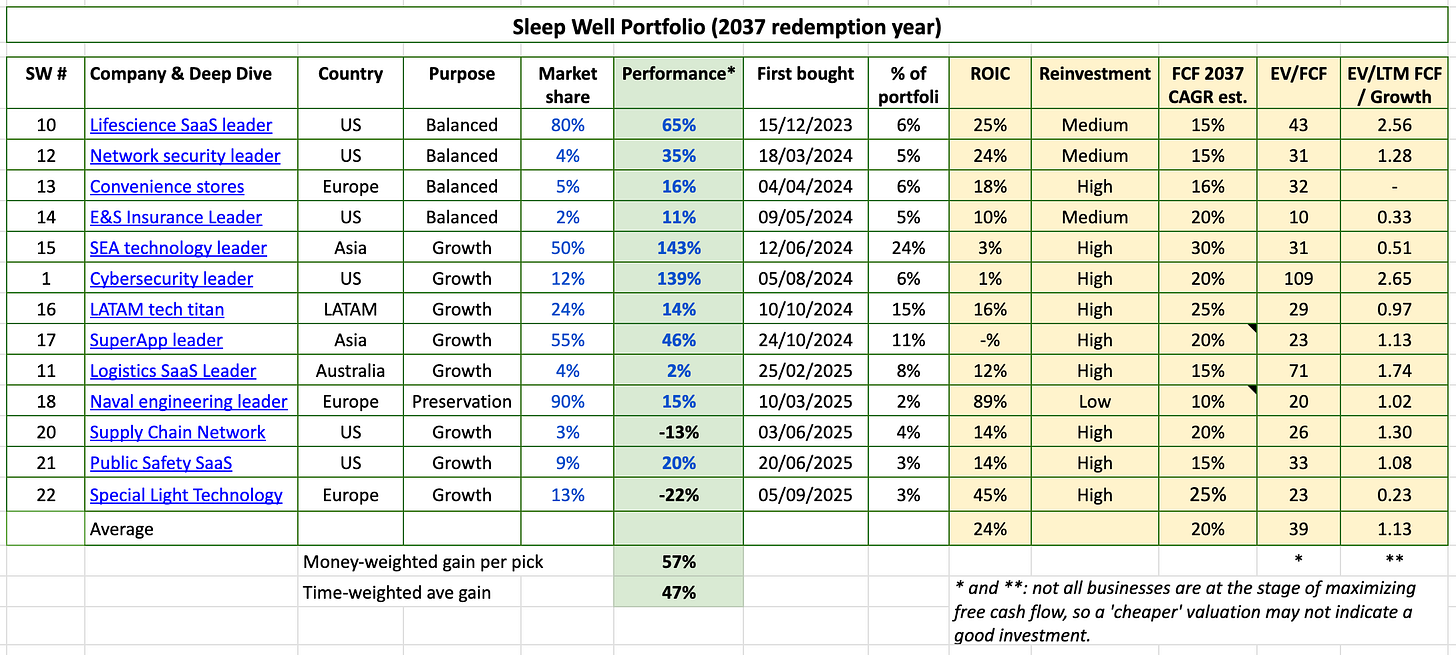

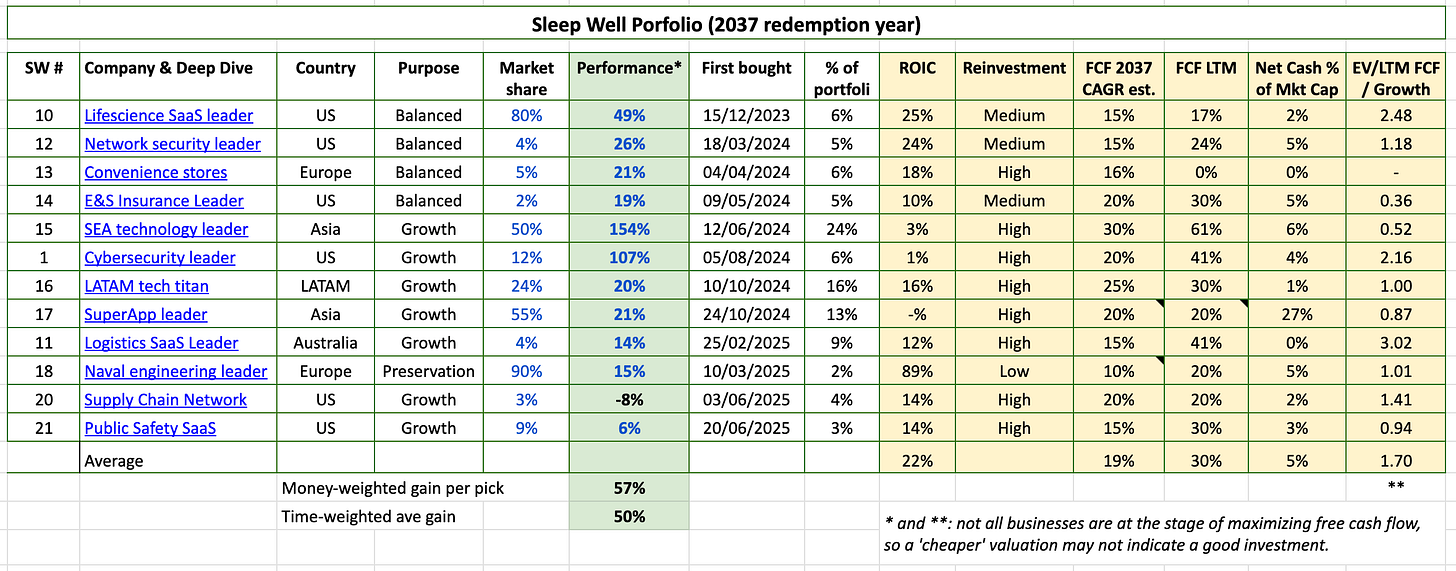

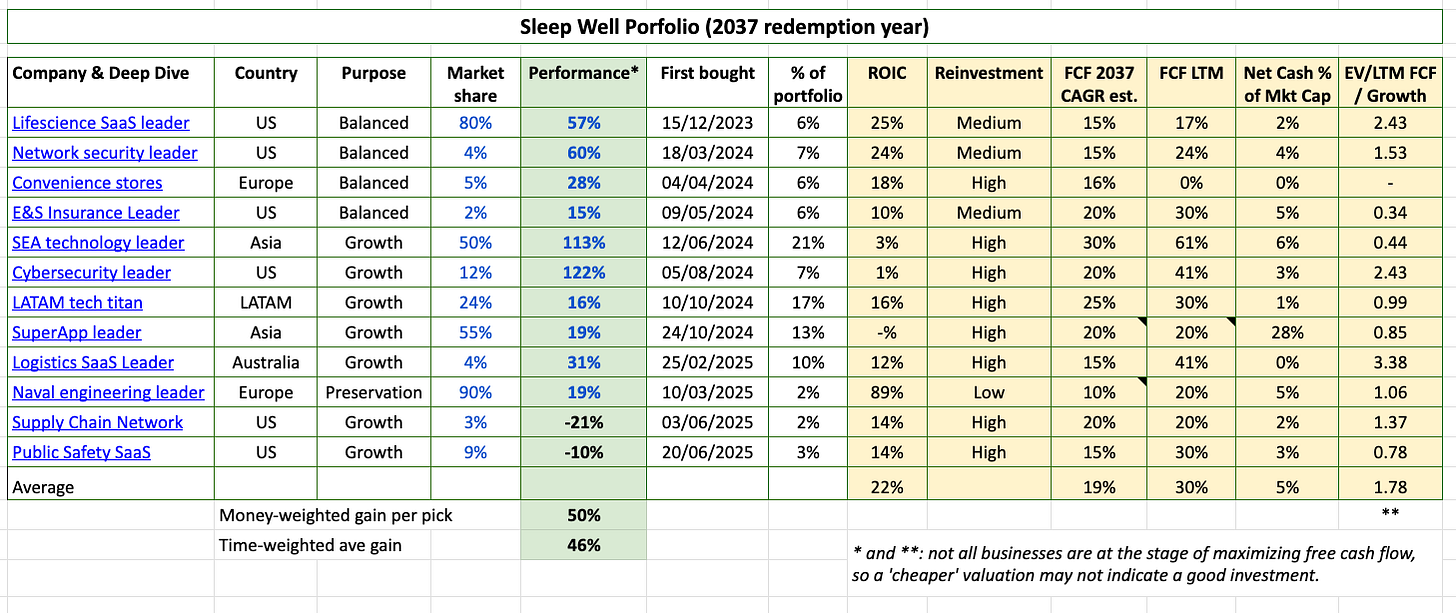

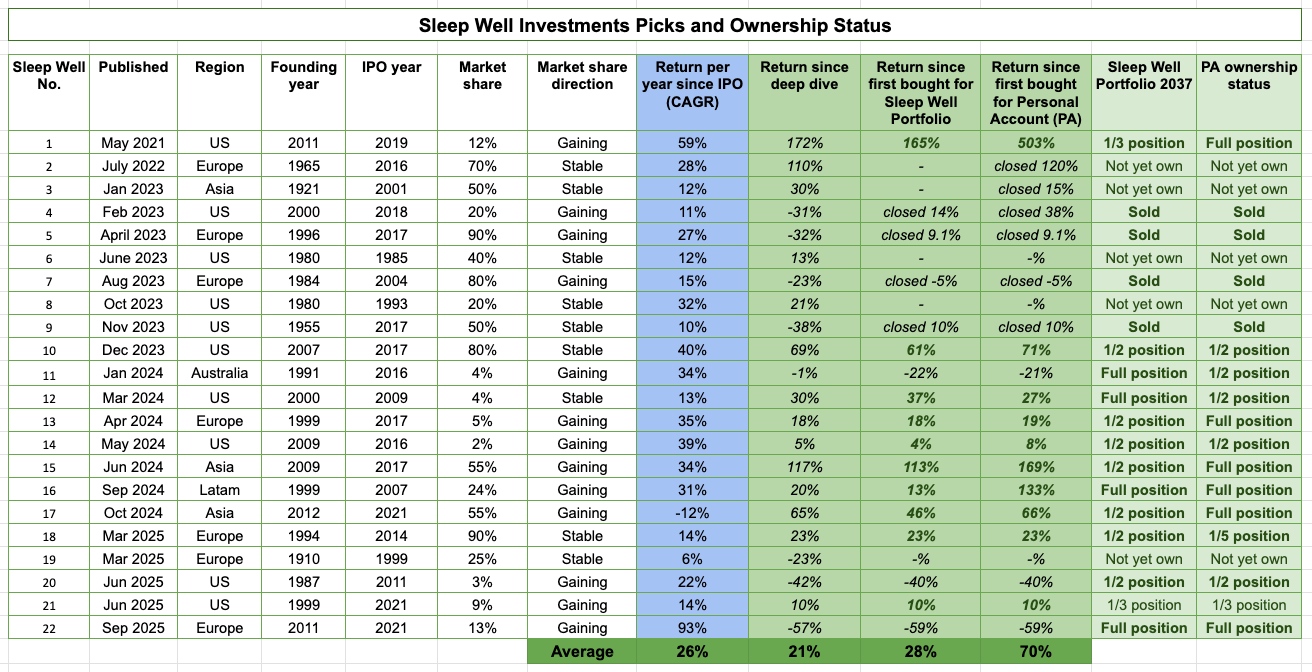

Three losers out of 13 holdings; 12% underperformance vs. S&P500. 27% annualised return per pick, 22/31 transactions were correct (71% success rate).

Sleep Well Portfolio consists of only time-tested leaders. We screen them through a rigorous checklist and track their theses regularly to determine when to buy. So far, we have had three losers, and 22 out of 31 transactions have been profitable. All about us here.

Good morning, sleep-well owners,

Summary of October 2025 - Tough Month

We made a MISTAKE in naming Intellego as our 22nd sleep well pick. [deep dive, 1st buy, 2nd buy, 3rd buy, risk management, 1st live event, mispriced, mistake].

Moderate declines in big positions SE, WTC, KNSL, and huge drop in smaller positions SPSC and INT dragged the portfolio down from overperformance to underperformance.

Return from inception was 20% vs. S&P500 32%: ~12% underperformance.

2025 Year-to-date return was 3.6% vs. S&P500 16%: ~12% underperformance.

Picks’ annualized return is now 27%, compared to 47% in Sep, 50% in Aug, 46% in July, 61% in June, 64% in May, 51% in April, and 38% in March.

3 losers, 10/13 making money, and 22/31 transactions were correct decisions.

Best buys and research list - will be posted separately. The first edition is here.

Sleep Well Portfolio master spreadsheet. If you are new to SWI, check out our FAQ and Owner Manual.

Bitesize learning topic of October: Learning from mistakes. I have introduced thresholds for market cap, corporate governance standards, years of existence, and time on the public market to ensure I don’t select another Intellego again. I will also be more strict on my additions, waiting at least a quarter or two to let the initial buy play out first.

If you are already an annual member, you can access the Sleep Well Portfolio and Thesis Tracker via the link below.

Safety first, returns later.

Our future performance will come from avoiding losers and betting big when the odds of being right are high.

We only want to own high-quality companies that can overcome challenging periods. Currently, we have three losers: Intellego, Wisetech, and SPS Commerce. This is the first month we have three.

An interesting stat, all of our losers turned green after a year of ownership. Even after making a mistake in Intellego, I still believe it can come back (more on this later), while a drop in Wisetech and SPS Commerce are both candidates for me to add soon. I would also add Sea Limited, but my broker no longer allows ADRs in non-taxable accounts.

Since we launched the Sleep Well Portfolio in 2023, we have had only

two losers over 5 months, and

three over 1 month.

one or no losers over 17 months.

With limited losers and enough time for observations, we can be more comfortable with betting big on our winners (much like watering flowers and cutting the weeds, as they say). Sea Limited and CrowdStrike are examples. Our returns on Sea Limited and CrowdStrike have increased by 115% and 165%, respectively. We added to Sea 4 times in the 16 months, and it now accounts for 23% of our portfolio.

We believe we have found a sustainable formula, but we will hit bumps on the road from time to time. October saw a large pothole on the road. It marks the first month of underperformance after over a year. AI taking over the S&P500 makes things even harder. However, I believe the dip in Sea Limited, WiseTech, SPSC, and Intellego will turn into a tailwind in the coming months /quarters. Since our investment horizon is long, time is on our side. The course will correct.

Intellego was a mistake.

Intellego’s fundamentals are impressive on paper. Great IP, world-class customers for Intellego’s size (Henkel, IKEA, hospitals, etc), unbounded potential if expanded beyond healthcare disinfection markets (industrial curing and water disinfection). However, high accounting receivables and subsequent slow cash conversion brought in an army of shorts in September and October. The short ratio was nearly 10% at one point. There were as many as seven bearish articles. Three short reports were anonymous, with just one article on their Substack and zero followers, yet as soon as they were published, they were shared across Sweden. I won’t go into detail here, as I don’t want to make any allegations. It just seemed excessive that a company could be under so much attack.

The news flow was unfortunate, but not the frequency I would like to receive going forward. I also want companies with better CEOs or ones that can admit their weaknesses and be candid with investors. I will give Claes Lindahl Q3 (10th November) and Q4 as the last chance to prove worthy of staying in the portfolio.

I have documented it in depth here if you want to give me further feedback.

But, make no mistake, this is an exciting company.

A ~$400M Swedish company selling UV validation technology, expanding beyond disinfection to industrial curing applications.

Operating margin above 40%, patent-backed, and growing by more than 100%.

The valuation was 5x EBIT for FY2025 figures, significantly lower than that of peers.

Wisetech and SPS Commerce are the two remaining losers.

I am much less worried about these two, I believe Wisetech's recent drop has been purely self-inflicted thanks to the scandalous CEO, who in the past 12 months has been exposed to be involved in sex scandals with an employee, got ‘kicked out’ of the company, and subsequently sold 1% of his 36.5% ownership in the black out period (as a sign of rebellion). Fundamentally, the business is sound, and I may add further to Wisetech. You can follow the chat thread about this here.

SPS Commerce, on the other hand, declined by 20% post Q3’25 earnings due to Q4 softness. For me, it’s more about the management's inability to set a medium-term growth target. While I believe it can continue at ~15% growth, including acquisition, management leaned towards 7-8% organic growth and leaving the inorganic growth for the market’s imagination. The 20% drop is a significant overreaction. I will likely put the business on my next Best Buy list. You can follow the thread here.

SWI since inception 20% vs S&P500 32% - Interactive Brokers:

The significant dip in our outperformance was attributed to a corresponding decline in larger positions, including Sea Limited (to $155 from $175), Wisetech (to $70 from $90), Kinsale ($400 from $460) and Intellego’s 60% drop since first bought. I still view this as a temporary drop, and I am open to adding more to these businesses (but I can’t add SE anymore due to Interactive Broker’s restrictions on ADRs shares). Meanwhile, the Mag7 and AI related companies did brilliantly during the past two months.

Current portfolio - 3 losers

To aim for a ‘no loser’ status, I am committed to ensuring I don’t own bad businesses in the long term. In the short term, I don’t know what will happen to the stock, nor the market’s perception of the stock; I am more interested in studying the business underneath - core business drivers and evolving threats - which are the main factors that influence my buy/sell decision.

These monthly updates are only snapshots of stocks’ performance. So, if you examine SWI’s performance history, you will see that all of our ‘losers’ are a result of temporary dips in stock price shortly after acquisition. All of our purchases have eventually turned green after one year. I believe there is good chances some of these will next year, SWI’s 11th pick (-22%), 20th pick (-31%), and SWI’s 22nd pick (-52%).

Previously, Sep 2025 - 2 losers

Previously, Aug 2025 - 1 loser

Previously, July 2025 - 2 losers

Previously, June 2025

Previously, May 2025

Previously, April 2025

Previously, Mar 2025

Transactions with notes below:

Expanding investment universe

You will only see me buying businesses that I thoroughly understand (see the deep dives below). I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—27% annualized time-weighted.

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of the investment framework to help find quality companies and execute with discipline.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.

Couldn't agree more. Learning from mistakes is absolutely crucial. Even the most robust algoritms need retraining sometimes to adapt. Markets are tricky, but your systematic approach is solid.

Cheers Rainbow Roxy! My aim is to own great businesses, and I have let them concentrate themselves....but when they underperform, it does hit the portfolio a bit harder...but I'm generally happy (barring Intellego) with my diversified positions. Some of them will be added pretty soon :) the journey to invest better continues :) thank you for your kind words gain. Bw, Trung