Business Update - Q1'24 - WillScot, Floor and Decor, Medistim

Key updates for WSC, FND, and MEDI

Hi, I am Trung. I deep-dive into market leaders. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, 4th). Access all content here.

In case you missed it, we recently bought Sea Limited (SE) and trimmed my largest position, Crowd Strike (CRWD). They have similar fundamental prospects but polar differences in market expectations: 7% 10-year compounded annual growth vs. 25% growth at 25x FCF vs. 90x, respectively.

This post is an update for the following sleep-well picks:

Willscot Mobile Mini (WSC) - Q1’24 results - McGrath merger steals the headline, a reply to DF Research short report

Floor and Decor (FND) - Q1’24 results - Gaining shares in tough conditions

Medistim (MEDI) - FY23, Q1’24 results - Demand is steady, but slowing system sales and margin decline can be concerning, joining Thor as the least favorite sleep well pick.

The last thesis update was about Shimano (SMNNY), MIPS (MIPS.AB), Thor (THO), and Dino Polska (DNP.WA). All previous updates can be found here.

Next will be Fortinet, Crowd Strike, and Veeva

Fortinet (FTNT) - Q1’24 results - A slight negative offset by a positive

CrowdStrike (CRWD) - Q1’25 results, Slight FY2025 guidance raise, Full Amazon partnership, Expanding Google and launching Falcon for Microsoft’s Defender

Veeva (VEEV) - CRM partnership with IQVIA

Sea Limited (SE) - Analysts’ downgrade, competition and regulation

For all sleep-well writeups, please click this link.

WillScott MM - Q1’24 results

The business has done well since my coverage (Q323, Q423, and Q124). Importantly, my focus is the management guidance that free cash flow per share will reach $4/share between 2025 and 26. However, as I read the conference call and looked at the share price movements, the market is anchored on the short-term quarterly changes of different metrics and the closing of the $3.8B acquisition of McGrath (MGRC).

I want to focus on the business's quality (free cash generation, growth prospects), defensibility (competitive advantages, adaptability), and long-term industry setup.

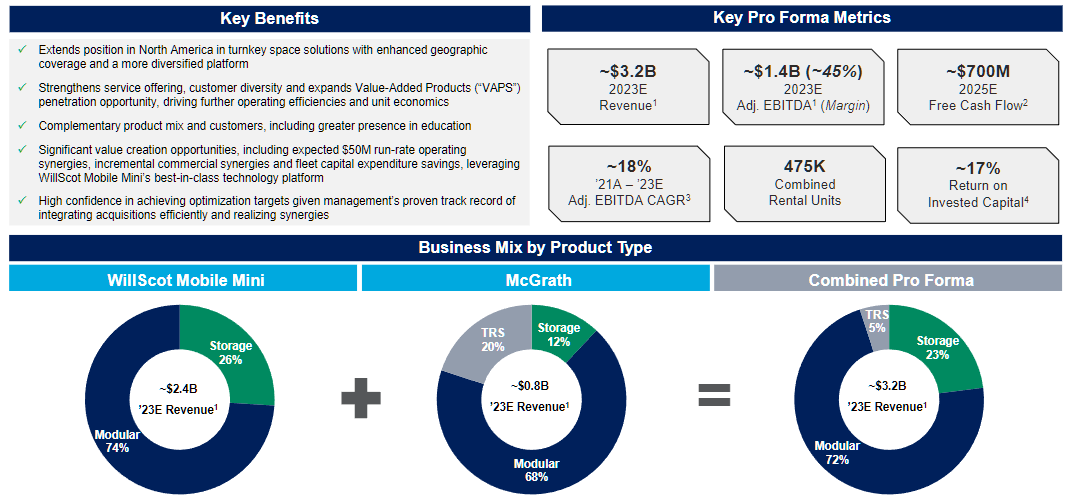

I have analyzed the potential impact of the McGrath deal here, concluding that the most important takeaway is eliminating the biggest competition risk, as WillScot would have gobbled up the second largest player (10% share, 5x smaller than WSC). Financially, there are logical cross-sale and scale advantages to gain.

The market was excited upon the announcement, bidding the stock up to over $52/share. However, as management pushed the completion timeline from Q2’24 to H2’24, the share price gave up the initial rise and returned to $36/share mark. Last month, the CEO bought 5000 shares, bringing back some excitement. You can tell the market is pretty fickled and easily swayed.

I bought WillScott at $37/share without considering any particular catalyst, only that WillScott remains a niche market leader and that the orange line above—free cash flow per share—keeps growing.

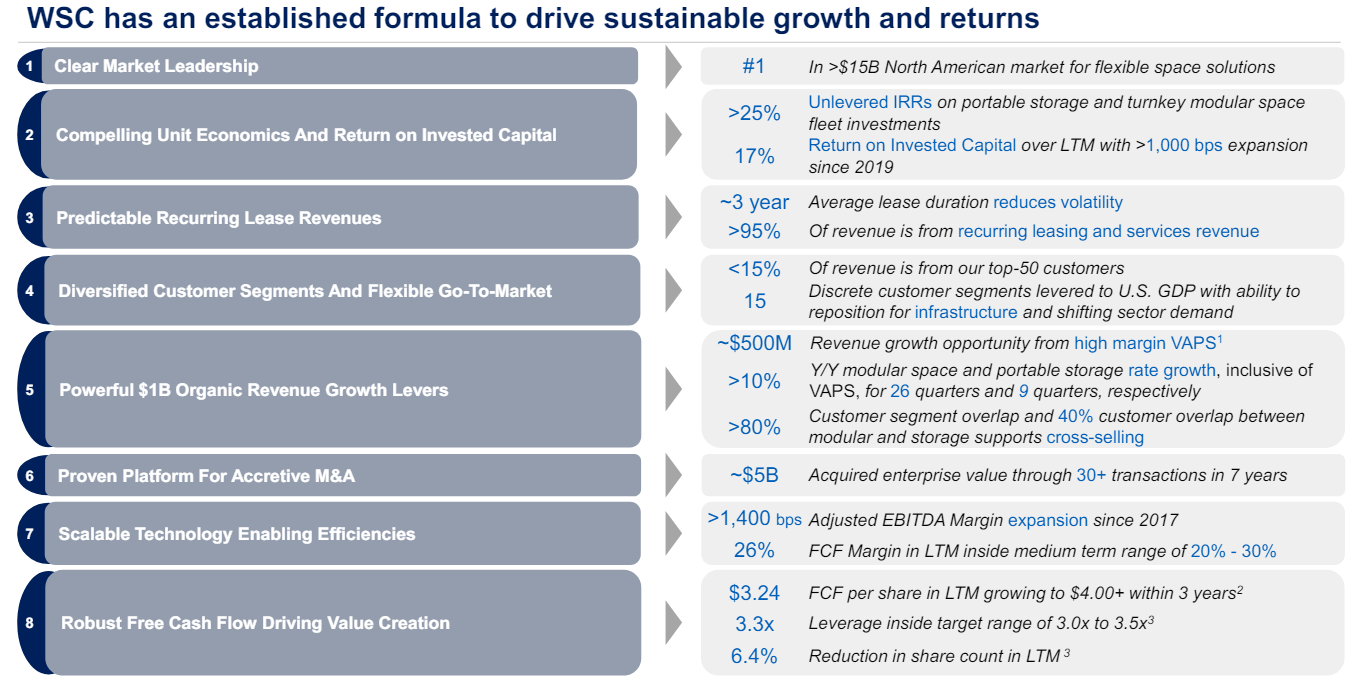

Q1’24 results give me no reason to change my opinion since the deep dive [Part 1, Part 2] and merger analysis. WillScott is well-positioned to gain market share and deliver its 2026 targets with or without McGrath. It offers superior customer relationships, price, service, delivery speed, breadth and quality of equipment, and additional services [VAPS]. —>business quality

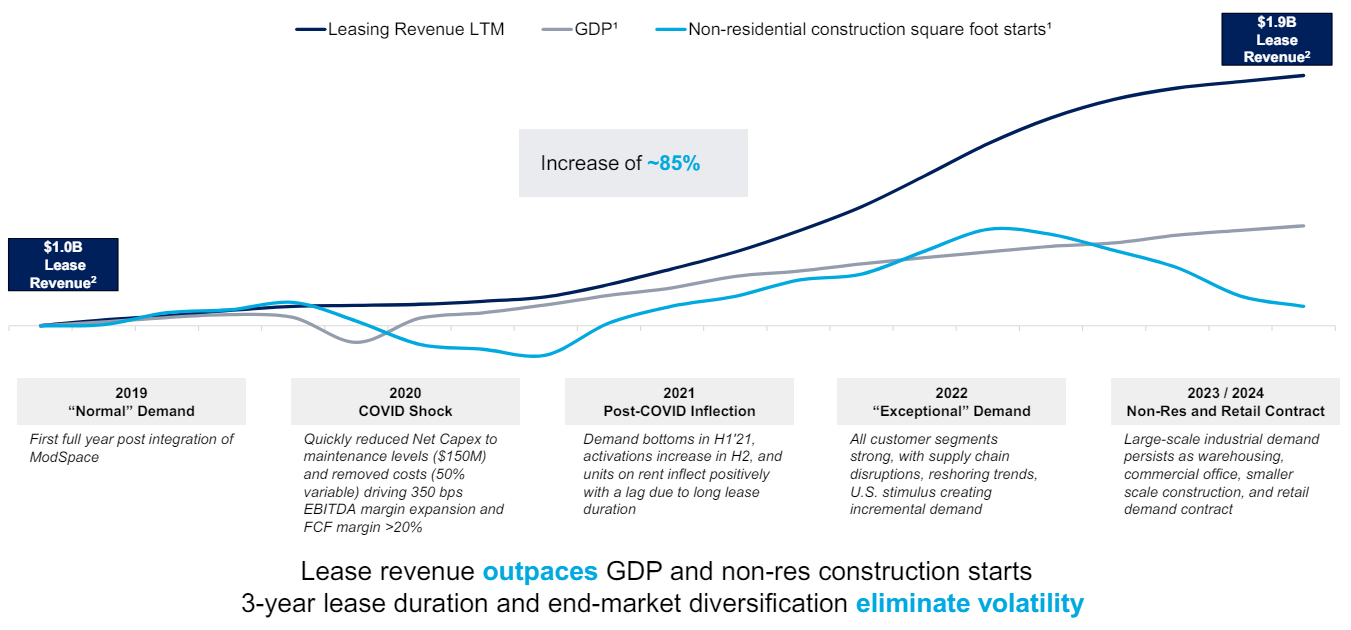

Looking back over the years, I am also comfortable knowing that the business does well even in choppy market conditions thanks to the counter-cyclical CAPEX profile, 3-year leasing terms, and 30-year+ asset life with 25% IRR. —>defensibility and adaptability

In the short term, the market will focus on WSC’s correlation with the ups and downs of US construction.

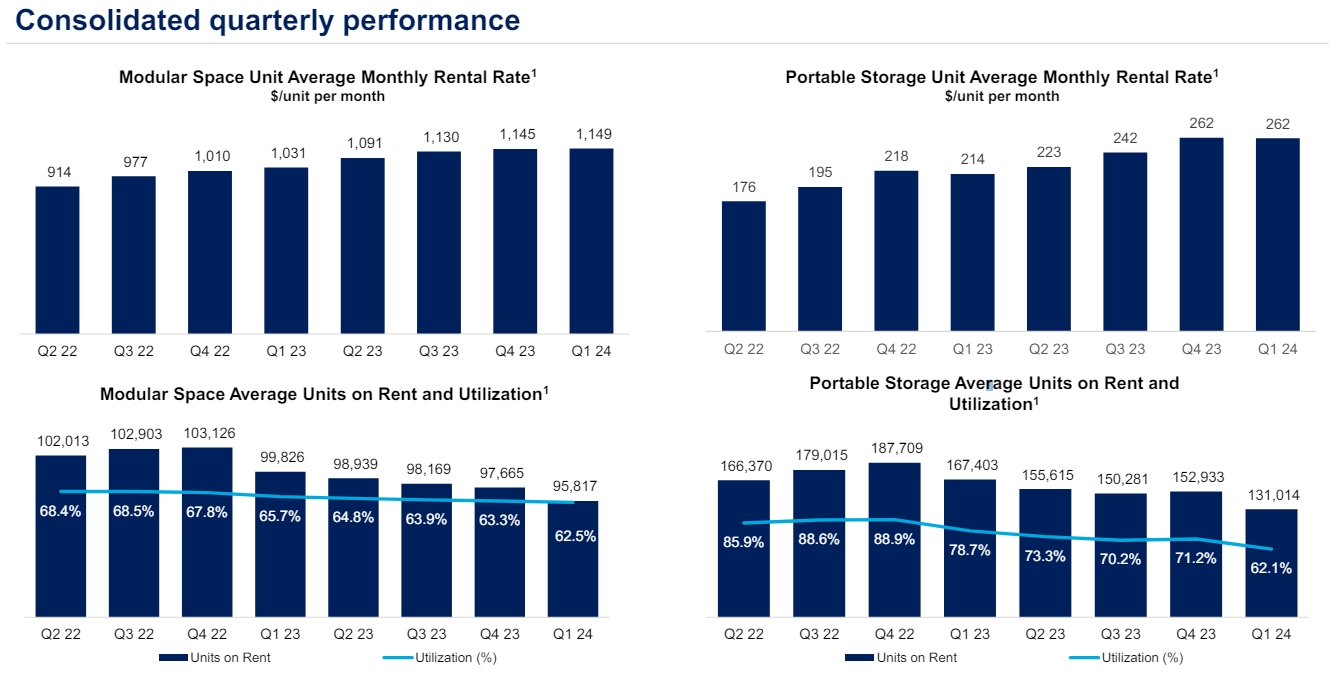

One can expect continued reduced leasing activities in the coming quarters, driving down rental volume and negatively impacting revenue growth.

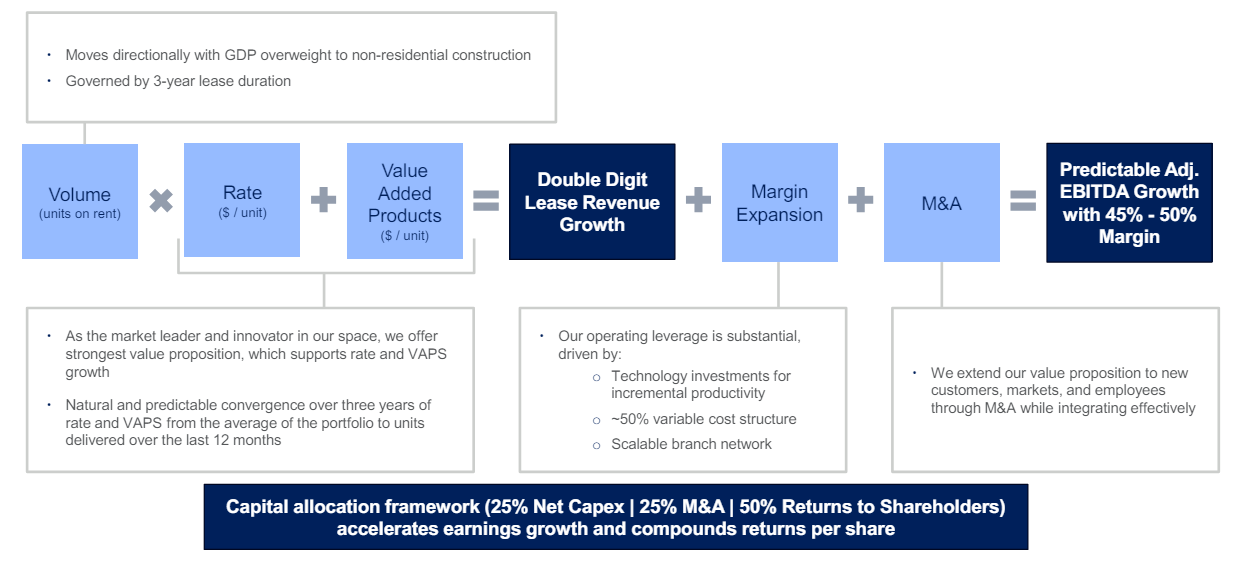

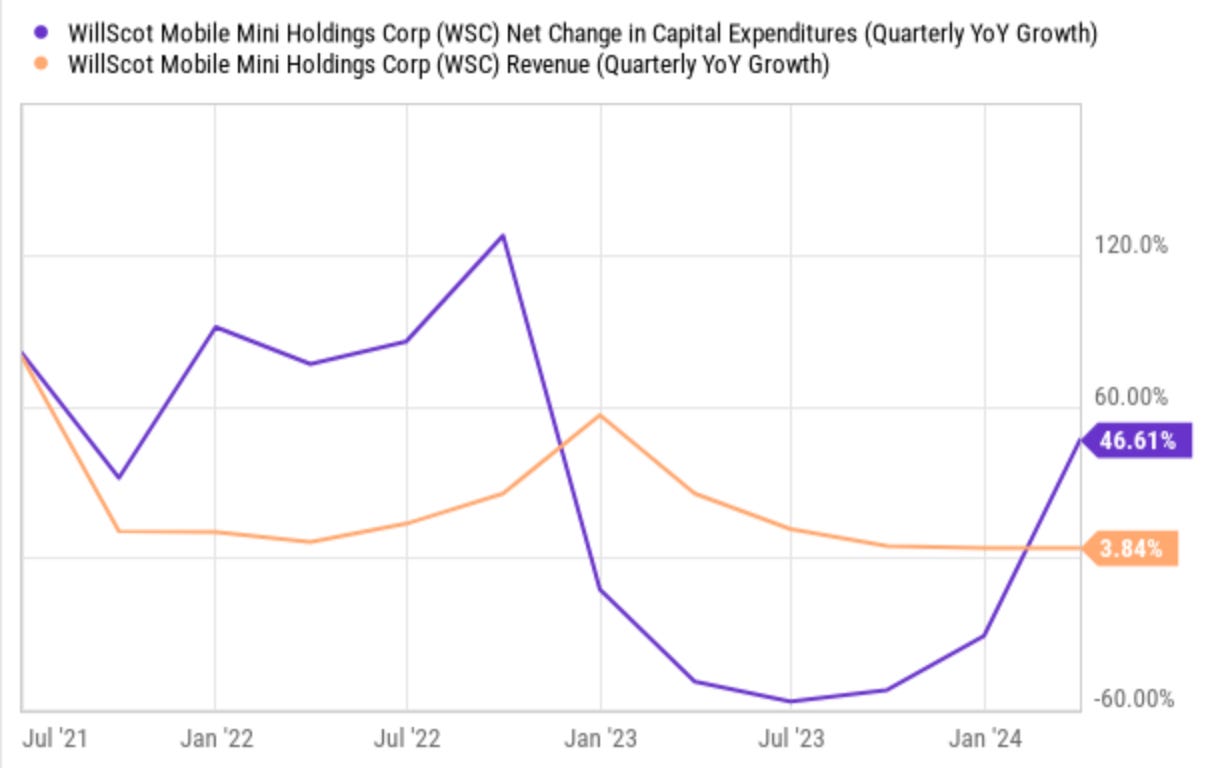

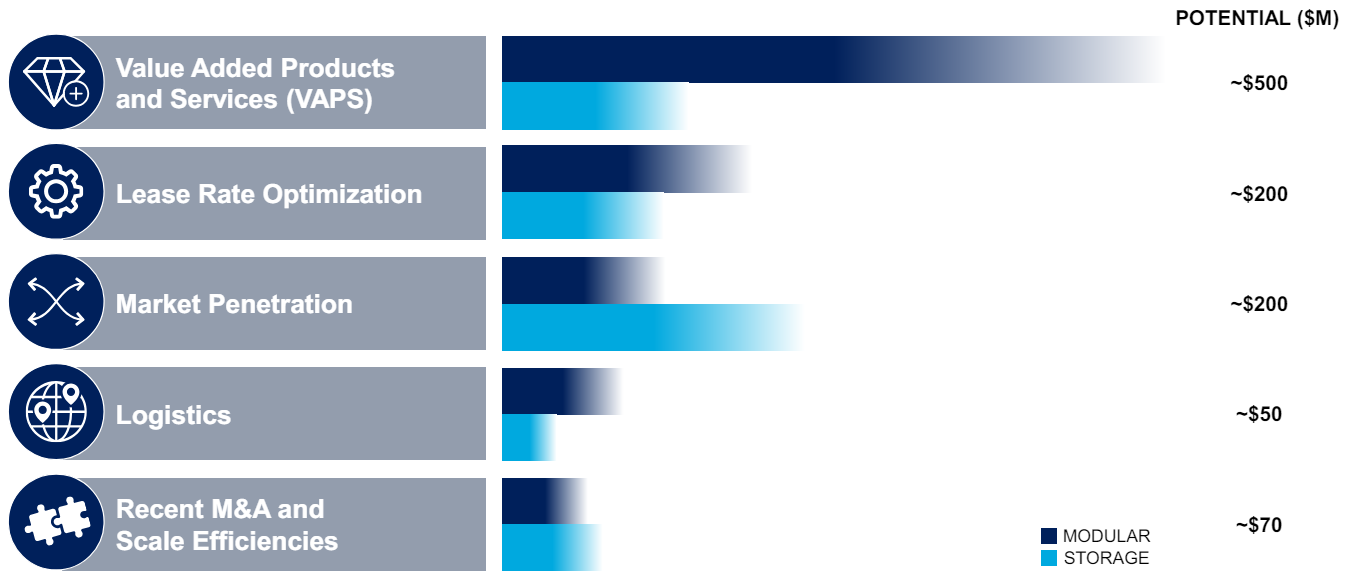

However, the negative impact is met with steady rental prices, indicating pricing power and supported by a favorable industry setup whereby renting space solutions costs only 0.5% of total project costs. Continuous VAP expansion and the lower CAPEX growth than revenue also help counter the current market downturn (see Q2, Q3, and Q4 of 2023).

Q1’24 net CAPEX increased 41% YoY to $65M, faster than revenue growth. This was explained by investments in new work orders to support modular activations and new climate-controlled storage units. Without this new investment in anticipation of demand later in the year, CAPEX would often be used to refurbish old units (maintenance CAPEX).

Importantly, management strives for accretive capital allocation. They repurchased 6% of shares last year and paused buying back shares during Q1 when prices shot up, but they have been back buying in April as prices have fallen back to the $40s. They intend to focus on closing McGrath before reducing debts next. I think that’s responsible stewardship of my capital.

As we advance, I feel comfortable with their capital allocation framework: 50% share buyback, 25% M&A, and 25% Net Capex. Ideally, I would want higher capital for M&As, but with over 50% market shares, buying back shares is the next best thing.

As a result, the management has multiple levers to maintain free cash flow per share growth (resilient rates, VAPs, cost optimizations, accretive M&As, repurchasing shares). As a leader, when construction activities return, WillScot is poised to capture the volume increase, completing a powerful and adaptive compounding algorithm.

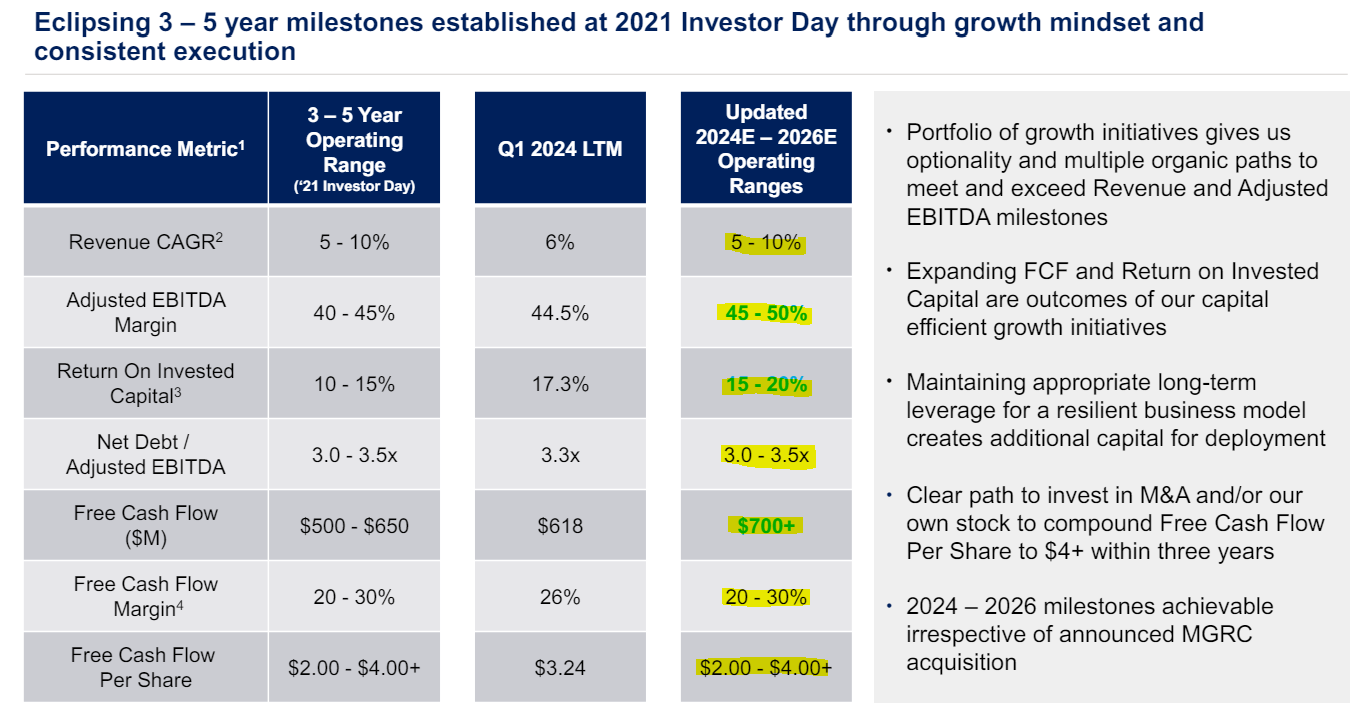

Recall management FY2026 targets are tracking well, and operation guidance was raised slightly from FY2021 investor day:

So, paying 10x FCF in FY2026 is not expensive for a leader with little disruption risk, in my view. Top-line growth is more limited with the dominant 50% market share. However, there is clear and satisfactory organic $1B revenue potential from VAP, lease price increases, and market penetration.

In the case that the combination with McGrath goes through in H2’24. There is a lot to gain.

In the short-term:

modestly accretive to earnings and free cash flow per share in the first full year post closing.

In the long term:

there are cross-selling opportunities across both companies', complementary product offerings [VAPs, Kitchens-To-Go, Enviroplex and custom modular sales capability], their diversification opportunities as we go bigger into the education segment [McGrath’s leadership position], there are a host of operational efficiencies as we think about scale advantages, using inventory centers, sharing fleet across the combined branch network and sales force. So the list literally goes on and on.

And the beauty in a transaction like this is you don't have to execute and being successful across all 30 of these nodes, if you can want to think about it that way. You can win some, you can lose some, but we're highly confident that this is going to be a home run over time.

Regardless, I want to own WillScot because:

WSC is five times the size of the next competitor in a $10B+ market,

Has products with 25%+ IRR over a 30-year asset life span,

Has a counter-cyclical capex and working capital profile,

Management is proactive in value creation.

WSC has the best unit economics and clear organic and inorganic growth opportunities (it acquired 25 businesses in 2017). The stock has returned a 25% CAGR since its IPO in 2017.

The company slide below summarises the thesis in a few bullet points.

Updated: 15th July to include my reply to DF Research short report.

A quick note on WillScott's (WSC) short report. The report posted evidence of WSC's unrentable inventories in 15 venues and pointed out WSC's low utilization rate compared to peers. I acknowledge their research but think they are not a cause for concern for my position in WSC.