2025 Sleep Well Portfolio Review - 70% win-rate, Underperformance from September 2025

78 institutional-grade research, 5 new picks, 37 follow-up reports, 13 stocks BUY/SELL alerts, 70% win rate, It's still Day 1.

Happy holidays to 5900+ sleep-well investors,

I am honored to be building a Sleep Well Portfolio with all of you. Sharing every ownership decision, along with my thoughts and the lessons behind them, has been very humbling. 2023 and 2024 were near-perfect, and in 2025, we hit a minor roadblock, but I am certain we are on the right path - owning irreplaceable monopolies and focusing on the right aspects - enduring growth.

2025 was not perfect, with a 70% win rate, after 92% in 2024 and 100% in 2023.

🕵️ 22 sleep-well picks yielded 14% return on average.

☑ 37 thesis tracking reports that deepen knowledge of our 22 picks.

🎯 37% vs. 60% of the S&P500 since inception, underperformance from Sep 2025.

📚 learned from Pulak Prasad, Mistake in Intellego, Navigating Tarriff Headlines.

A striking and recurring theme I experienced this year was that investors tend to overreact to short-term stock movements and underestimate the long-term drivers of the underlying businesses. Simply put, an investor’s average holding period is 6 months (and shortens each year), while mine is at least until 2037, when my daughters will take control of this portfolio. I am not under stress about this year’s underperformance. My patience and my focus on the long-term drivers of value are my edge and the reason why I sleep well. Any mistakes I make this year or next will be crucial to the performance of the next 10-20 years.

An example I want to key in is my ~20% position in Sea Limited (55% in my PA). Its share price dropped ~40% from its peak at $200/share over just two months, starting in September, as margins in its core ecommerce business division - Shopee, contracted.

Yes, that alone displaced the portfolio from outperformance over the past few years to underperformance (more on that later).

However, every day, I wear the business owner’s hat. I focus on the product, the supplier, the competitor, and what investment the business makes to create value. Vastly different from someone with a 6-month view.

Therefore, I am not concerned about Sea’s stock decline.

The following chart means little.

I dived deep into why margin dropped from 5% in Q1 to 2.6% in Q3 here, among competitive dynamics, if you are interested, and the rest are [deep dive, 4th buy, 3rd buy, 2nd buy, 1st buy, tariff review, sum-of-parts, Q3’25, Q2’25, Q1’25, Q4’24, Q3’24, Q2’24 update]

As a business owner, I examined and understood why the margin dropped.

Sea Limited’s mission is to create greater value for customers, a prerequisite to being in a position to capture that value over the next 10-20 years.

That requires building the best experience at the lowest cost for merchants and customers to exchange goods and payments, and then positioning it to capture most of the value created:

create value to the ecosystem (better than competition) —>

capture value / cash flow

reinvest to create and capture more value

= longevity.

The ending is still unfolding for Sea Limited, as the market's competitiveness has yet to reach equilibrium. Therefore, it’s essential to step back, look beyond immediate news flows, and consider how industry/customer trends affect the business over the long term, as well as the rationale for the company's and competitors’ actions.

Sea Limited is creating real customer value, beginning to extract value from customers, and appears to defend well against competitive market conditions. I say ‘appears’ because at 50%+ market share, you need to start overstating the competitiveness to avoid anti-monopolistic regulations. The reality is that when the whole industry is raising the take rate, that means excess value is being created and extracted.

So, when Sea’s value should drop by 40% because its margin drops by a few basis points, I examine why and zoom out.

Case in point: Amazon and Mercado Libre, the first and second proven iterations of e-commerce, one created in 1994 and the other in 1999, have shown time and time again that their path to market leadership was broad SKU at low prices. Meli’s road is the most similar to Sea’s, and Amazon’s path is the most different. But their journeys all required consistent and substantial investment in infrastructure. Amazon still spent nearly ~$100B in logistics last year, 30 years later, and plans to invest $40B in the UK alone in the coming years. Meli also spent ~$13B last year, the workforce increased by 30% in 2025, and it plans to continue investing in rural regions and markets outside Brazil.

So for Sea, it’s still early days. To capture and retain more customers, Sea will not stop at investing in logistics. It must continue to hyper-localise its services and increase customer touchpoints to differentiate itself. Every move reduces the investment risk. Hence, I am happy with temporary margin compression due to higher expenses and investments in VIP programs, Shopee Live, and credit/loans to customers through its fintech services (Monee). In a region where e-commerce and digital banking are still left to be desired, I see these continued investments as future value creation, and the recent drop in the stock price is highly welcome for cheaper buybacks ($1B program authorized) and for my further buys.

Finally, at ~$120/share and under 20x free cash flow, my estimates indicate the market expects only 7% free cash flow per-share growth through 2037. The market is underestimating Sea's ability to evolve and create value for the increasingly demanding 700M population in Southeast Asia, of which 300M (mostly in SEA) are active Shopee buyers, 45M are already active Fintech users, and 66M are paying gamers.

The above sums up my view as a part-owner of the businesses. A 40% price dip does not reflect the value Sea can capture and extract in the future; hence, my additions in November and December at $122 and $136/share.

Key lessons and improvements in 2025.

With a focus on deep fundamental research and long-term ownership, I am reasonably comfortable with the advice: ‘bet big when the odds are in your favour’. However, selling and cutting winners remains my weakness.

Last year, I learned that when selling, I should ‘sell my least loved business’. This year, I realized that no matter how good the business is, I need to be more ‘critical of my most loved stocks’, dissect them, and be ready to part ways (not clinging to stocks that I have spent considerable time on) for better opportunities. It’s a balancing act, given I don’t want to mistakenly ‘cut my flowers’.

During the year, I started the Best Buys series to force me to consider every position in the portfolio as if I were starting from scratch each month. As a result, I was able to trim CrowdStrike by half, a position I have held for over 5 years, from <$90/share (vs $525/share - sell alert).

So, no stock is ‘not for sale!’.

Together with CrowdStrike, Sea Limited, Mercado Libre, and Veeva were held for over 5 years. All have suffered 30% drops multiple times, 50% once, and 80%+ once (Sea).

I am glad I didn’t sell then, but this year CrowdStrike’s stock has ventured into unimaginable valuations. The sale also pushed me into uncharted territory and set a precedent for all my future sales decisions.

From now on, all stocks are candidates for trimming; to capture better opportunities or for cash until valuations come down to warrant further additions. Even Warren Buffett is sitting on nearly $360B cash (36% of the $1T market cap).

During the year, Wisetech also traded at close to 100x FCF (Q1 2025). CrowdStrike traded at 120x recently. In hindsight, Sea Limited trading over 30x FCF would have warranted a slight trim or a discussion of selling, given the 20% holding.

Avoid highly debated stocks - Intellego.

My next lesson is about my mistakes with Intellego. I have already written multiple articles on this (mistake; cautioned others about the risk), but I add here that greater attention should be paid to working capital management. Quality of the revenue isn’t just about recurring revenue (89% of sales are from existing customers for Intellego), but I should also demand stable inventory days and receivable days. In other words, I demand that my business has inventory that sells and customers that pay. I relaxed these parameters for Intellego, given its early stage in the business/technology, where it needed to offer incentives (extended payment terms) to attract early, large international customers. Additionally, investing in smaller-cap companies will require more stringent parameters, as outlined in this article.

Now, my Intellego’s shares are treated as if I own a private unlisted business. Regardless of whether it is relisted on the Nordic Nasdaq, I hope that only a few actors are bad apples and that the company can continue to serve real hospitals and save lives. Even if all else fails, Intellego’s 10.5% ownership stake in one of its partners, HAI Solutions, may be worth something. HAI Solutions has the first and only FDA-approved UVC Technology for Microbial Reduction on Needleless IV Connectors, a $1.5B global market, and has the exclusive right to distribute the product in China and to receive royalties on global sales. This thriller continues….but will be the last I watch before bed.

Even better businesses and engagement.

In the past, I have shared my sleep well picks only after conducting research and writing up everything. But with the lessons above, I have started sharing research in the Best Buys series to get early feedback from you, many of whom are experienced fund managers. This will help us avoid more pitfalls like Intellego. So far, we talked about Rubrik, Fila, and ReposiTrak, and crossed out Airbnb, Evolution AB, Teqnion, and LVMH, all of which have yet to prove to be high-quality businesses (yet).

In 2026, I’ll continue to profile my early research monthly.

Next are three incredible businesses that I intend to dig deeper into and buy when their valuations take a break (every stock dips at some point). You will see that they will significantly improve the quality of the Sleep Well Portfolio companies.

Company A:

Oligopoly with ~35% market share, over a century of history of operation, a company with the longest revenue visibility I have come across, which is up to 25 years, and 70% of it is recurring. Demand has never been an issue, and growth is well supported by high barriers to entry, driven by the business's near-natural moat (regulations) and high switching costs. Management is incentivised based on their performance in ROIC (return on invested capital) and growth in free cash flow. They want what investors want. The business has simplified significantly in recent years, and opportunities to acquire shares at a lower valuation could be on the horizon.

Company B:

A monopoly of general surgery with a 90% high-margin recurring revenue. The company aims to increase the installed base by 5x by 2035, with no competition and a strong contender to counter AI risks. High regulatory hurdles, a long sales cycle, and high switching costs protect the company’s market share. The company is highly resilient to health crises, has a substantial cash buffer, and is AI-embedded.

Company C:

A leader in 2D, 3D, and 4D medical imaging. An aging population, ongoing cloud adoption, and a massive skill shortage are driving extremely long-term growth. Additionally, most of the US market still relies on legacy systems, and other geographies remain largely untapped. High-margin revenue is extremely defensible, as customers are guaranteed contracted revenue for five to eight years.

FY2025 Performance 😴

Caveat emptor: Our finish line is in 2037, not 2025. Judge my performance in a few years, not today. That said, let’s celebrate crossing our third year together!

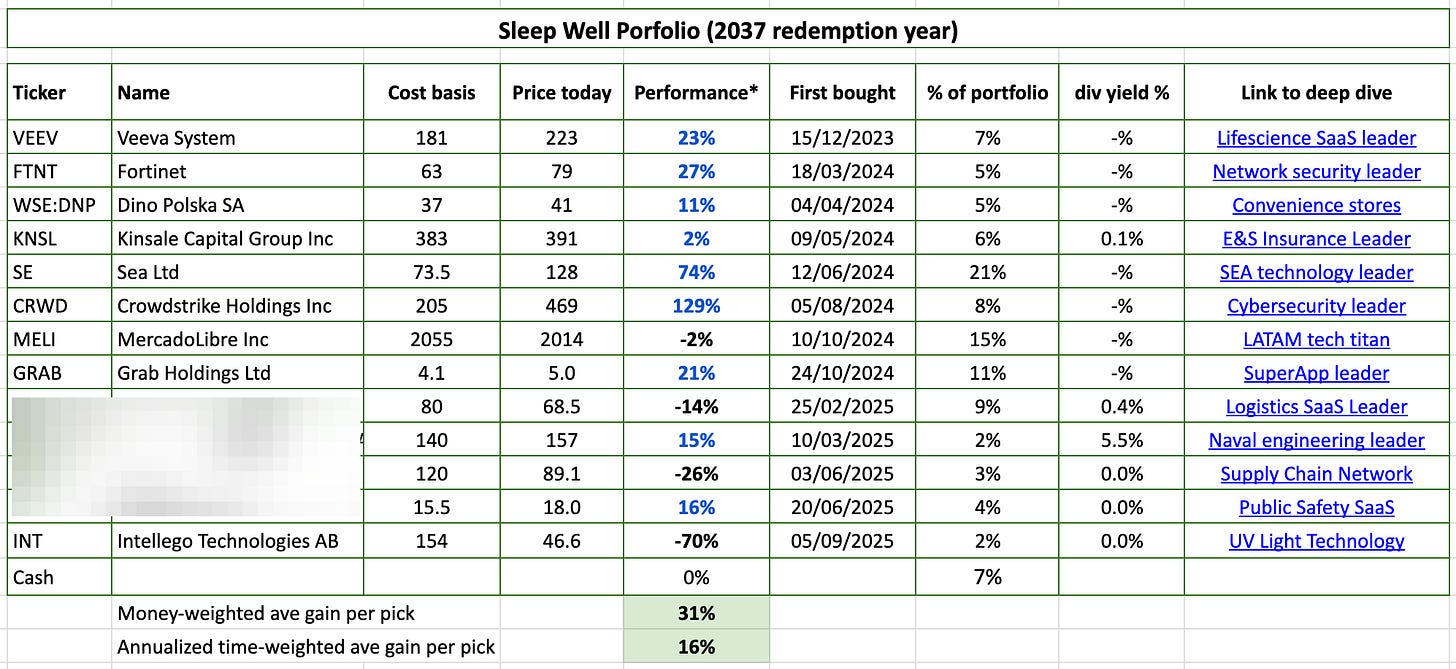

Since the inception of Sleep Well Portfolio (October 2023), my self-reported result is 16% money-weighted per pick (32% in 2024).

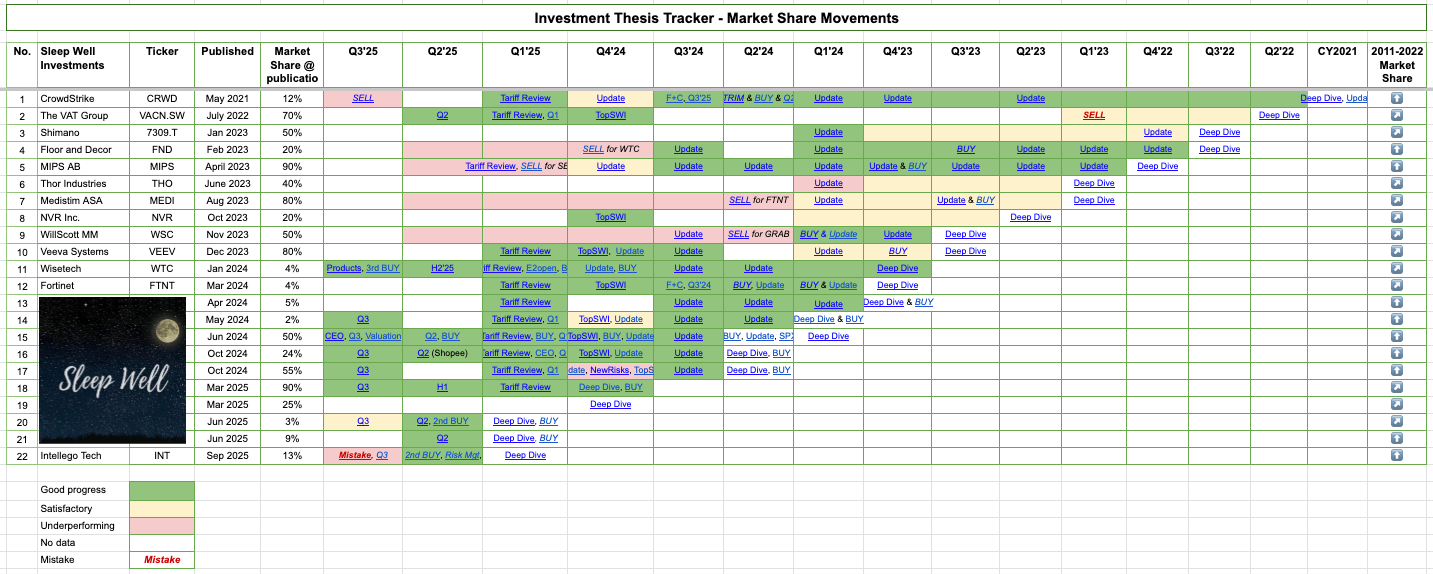

For more details and all transactions since inception, please refer to the Sleep Well Portfolio spreadsheet (available only for the annual subscription). One of the sheets you can see is the thesis tracker below, which includes links to all write-ups, sorted by quarter and name.

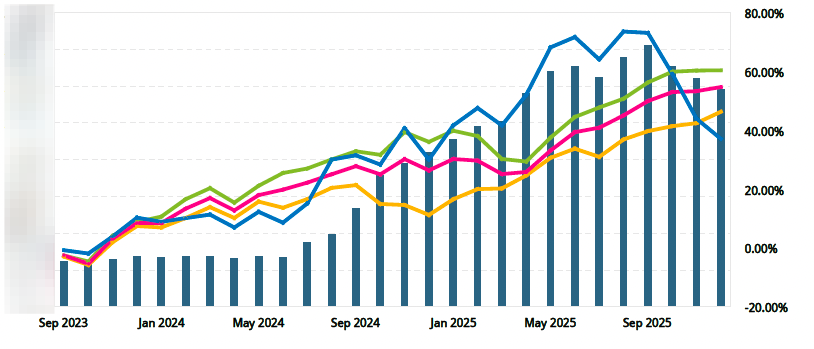

As per Interactive Broker’s automated report, the Sleep Well Portfolio (blue) returned 37% since inception, compared to ~60% for the S&P 500 (Sep 2023 - 24 December 2025). You can see the underperformance began after the September decline, which coincided with the declines in Sea Limited and Intellego. As per the commentary on both businesses above, I am optimistic Sea will come back and drive positive contribution to the portfolio in 2026, and Intellego might come out less than the current 70% loss as a private company.

Year to date, SWI returned 5% vs. SP500 at 16%.

Meanwhile, my Personal Portfolio (PA) returned 0% this year, compared to 16% for the S&P500 (01 January 2025 - 24 December 2025).

My PA’s underperformance is attributable to holding much larger positions in Sea Limited, Mercado Libre, and Grab, all of which I have held for over five years and underperformed this year.

But 2025 has already passed. What is most important is the health of the portfolios beyond 2026. I am very excited to learn from the mistakes of 2025 and share our success as the year progresses!

Don’t hesitate to comment, help me improve, and contact me through trung.nguyen@sleepwellinvestments.com, LinkedIn, or twitter/X@SleepWellTrung

Happy holidays with your loved ones!

Trung 🙏

If you are new to SWI, check out our FAQ and Owner Manual.

What do you get?

thanks for the candor of your posts.

my 2 cents:

Howard Marks said "Everything is triple-A at the right price".

paraphrasing on it, i think you should be be more mindful of the valuations in your periodical reviews.

if investment A has tripled in price, and it is now at 100 P/E - you can sell 2/3 (== still hold long position) but reduce the risk to 0. I don't think it shows less conviction or a character flaw - but rather recognition that markets are volatile.

it's the flip side of buying more when the business you believe drops by 40%.