Sleep Well Investments Framework

Finding time-tested businesses trading at a reasonable price - helping investors sleep well.

Hi 5700+ sleep-well investors,

Here, you will find a detailed explanation of our framework and the thought process behind it.

If you are new, I recommend you read the Owner’s Manual first, which has a guide on how to use the tools that we’ll cover in this article.

Table of Contents

SWI Checklist explained

At the core, the checklist is adapted from

Anti-fragility concept borrowed from Nassim Taleb,

Irreplaceability from Anthony Deden,

Mundane businesses from Matthew McLennan,

And various studies from other reputable investors (Terry Smith, Ralph Wanger, Scott Fraser, Peter Lynch, and more). They provided me with the knowledge and wisdom to judge if a business can endure the test of time.

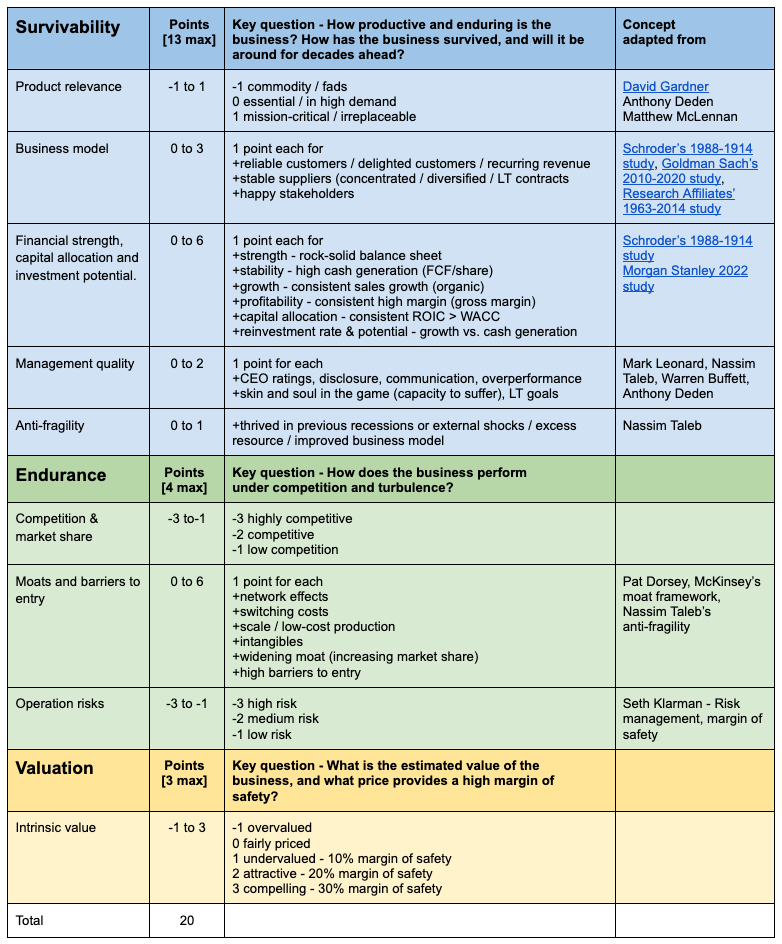

At a high level, I have grouped the criteria into three categories in order of importance:

Survivability - Business quality [13 points]

Endurance - Competitive position and risks [4 points]

Valuation - Intrinsic Value [3 points]

The first group examines how a business has withstood the test of time and the likelihood that it will remain viable for decades; the key lies in product relevance and the evolution of the business model. The second category assesses whether the business can endure the pressure of competition and external shocks by measuring its moat development. Finally, I employ multiple valuation methods to estimate a business's intrinsic value and establish a price range for acquiring a stake in companies that offer a high margin of safety.

Notice that business quality (17/20 total points) is more important than valuation (3/20 total points). For me, a business’s margin of safety comes mainly from its resilience rather than its cheapness. I’m not discrediting value investing; as you can see, overvaluations are penalized under the SWI framework (i.e., they receive a negative score). However, I am more comfortable choosing a high-quality business at a fair price over a low-quality company at a cheap price.

Sleep Well Investments aims to analyze only top-quality businesses (monopolies, oligopolies, market leaders) and avoid bad ones. Henceforth, points will also be deducted for unconvincing missions, commoditized/fad products, high competition, low barriers to entry, and business risks.

The following table breaks down what I analyze under the three categories:

A business is rated resilient and investable if it achieves 13 points. Above that, I rate it sleep-well and would be willing to allocate more capital.

Why did I create the SWI Checklist?

"Ultimately, nothing should be more important to investors than the ability to sleep soundly at night," Seth Klarman.

Unfortunately, I wasn’t sleeping well between 2018 and 2022.

I fell into the trap of buying companies that were growing at all costs and broken businesses at cheap valuations! While it looked great when the market was optimistic, it proved disastrous in uncertain times. With the benefit of hindsight, these baskets of stocks dropped the hardest.

This numbing experience led me to radically change my investment process.

From this day on (2022) -

I will only consider time-tested businesses that can defend their moats and reinvest at a high return on invested capital over time — high-quality companies.

I will only buy these businesses when they perform on the SWI Thesis Tracker and when the price is right. — disciplined ownership

To earn a position in my Sleep Well Portfolio, they must score at least 13/20 points on the Sleep Well Investment Scorecard (below).

SWI Scorecard explained

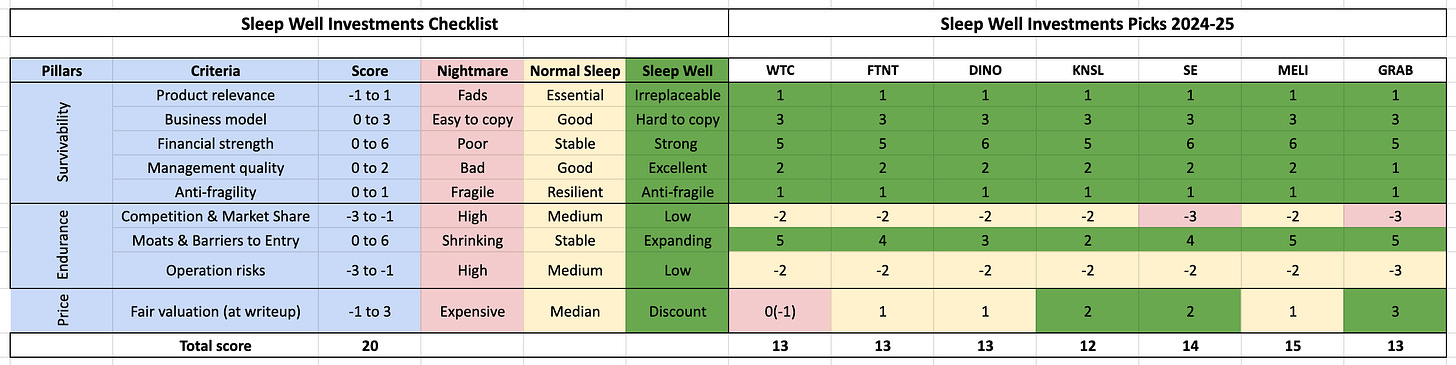

Below, you will find the criteria in the SWI Checklist and their corresponding scores for some of the companies that SWI has analyzed in 2024-2025.

These companies are niche market leaders and have a very long runway for reinvestment.

The catch is that they are rarely offered at a reasonable price, which means you will need to own them for decades so that the value they will create outweighs the initial multiple you paid. Alternatively, you can try to find relatively unknown and under-appreciated (mostly boring) businesses. BCG research shows that sales, profit, and free cash flow drive 95% of stock performance, while valuation drives just 5% over 10 years.

SWI Deep Dives explained

A deep dive is a report (~10,000 words) where you can expect a breakdown of

how the business has built its success,

how it will overcome competition and future adversities, and

a simple valuation framework to ensure we buy at a reasonable price.

Every industry and business model is different, but I always dig deep into understanding why the chosen company has a better product/platform, how it can adapt to changes, and what barriers it has built for new entrants. That, to me, is most important and will contribute the most to our sleep-wellness.

SWI Thesis Tracker

Sleep Well Investments stay ‘sleep well’ if they continue overcoming the competition and unknowns over time. They must perform and adapt to remain on the watchlist/portfolio, which I track under my Thesis Tracking updates.

It often boils down to one KPI - market share movements against key rivals - my proxy for the quality of the moats and barriers to entry.

Check out the thesis tracker section for follow-up updates if anything interests you.

Behind the KPI is a comparative report of (i) revenue growth, (ii) major client wins/losses, (iii) industry rankings, and sometimes (iv) product reviews, if relevant. You will know the market share movements and the why and how they gain/lose.

FREE tracking reports: MIPS, CRWD, and FND.

As shown in the table above, green indicates gaining market share, red indicates losing, and yellow indicates stability. Gaining or losing market share speaks volumes about the quality of the moats and barriers to entry.

Consider this:

A business expanding its market share relative to key rivals is likely a result of widened competitive moats and stronger pricing power. In theory, this should enable the company to sell products at a higher price, purchase supplies at a lower price, and enter new markets and products more effectively. Operationally, that likely leads to better cash conversion and higher free cash flow per share growth. From an investment perspective, the return on invested capital (ROIC) is likely higher than its peers.

Market share movements encapsulate all the underlying aspects above. Simple and elegantly effective.

Tracking market share also encourages investors to think long-term and provides an excellent opportunity to verify the business quality (Sleep Well Investment Scorecard).

What makes the Sleep Well Portfolio sleep-well?

The Sleep Well Portfolio is my daughter’s Junior ISA portfolio, which I use to demonstrate how I construct a long-term portfolio from scratch. The portfolio’s redemption date is when she turns 18 in 2037, so 12 years from today.

✔ The portfolio will consist of between 10-20 market leaders

✔ The portfolio consists of businesses that we want to own long-term, hence the 2037 redemption date.

✔ No market timing. We buy at a price that offers a healthy margin of safety

✔ The portfolio only invests in deep-dived stocks that are monitored closely

✔ They are market leaders who:

have a stable / strengthening market position

have enduring competitive advantages

have management with aligned interests and a strong capital allocation track record

have anti-fragility attributes (i.e., a healthy balance sheet, excess capability, an adaptable business model, and have previously endured competitors and crises)

have plenty of reinvestment opportunities

is trading at a fair valuation

Investing is a life-long journey, not a sprint. That’s why the portfolio redemption year is 2037. I buy stocks that I intend to keep for the long-term, so no short-term trades. A few extra percentage points of return aren’t as important as sleeping well, achieved through knowing why I own a business and trusting my investment process.

For this reason, access to the portfolio is only available for annual paid subs who are in it for the long run. I apologize to monthly subscribers; I don’t want to mislead or tag you along for a marathon when you are looking for a sprint. You will still have full access to my deep dives and thesis-tracking updates.

Important note: It doesn’t matter if you manage a $50K or a $50M portfolio; if you can’t manage a small amount responsibly, then managing $50M will magnify your mistakes. Hence, I do not provide ownership details in absolute $ value.

The purpose of showing how I manage my daughter’s and my family's portfolio is to encourage long-term ownership, showing I eat my own cooking, and that it is possible to have a lasting investment process over multiple cycles. Please don’t copy it blindly; your saving is finite; treat it responsibly. It’s likely we have very different financial goals and circumstances.

Finally, I will only reveal new Sleep Well Portfolio positions after publishing my deep dive. I believe an investor should only consider an investment after thoroughly researching it.

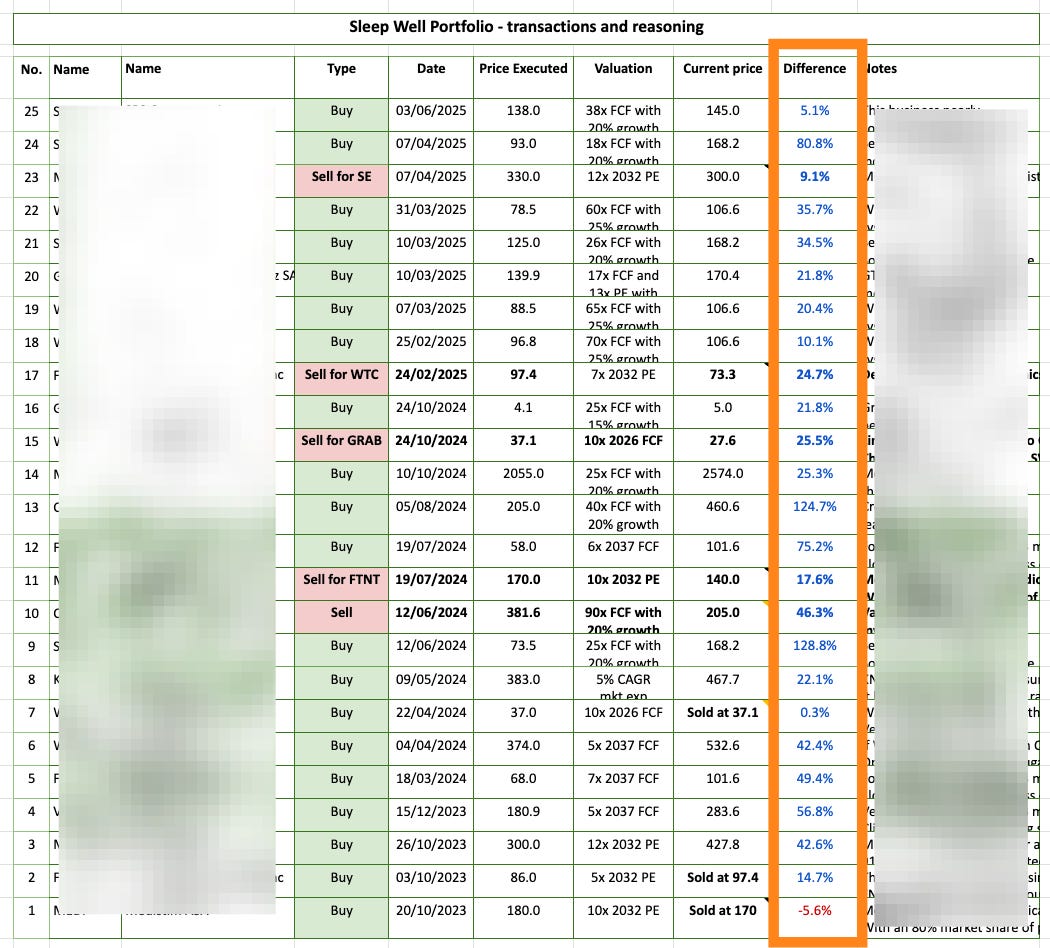

Sleep Well Portfolio *Buy/Sell Alert*

For transparency and disclosure, I share my detailed thought process behind every BUY and SELL. I also review the portfolio monthly.

I aim to own these businesses as long as they perform well in my Thesis Tracker, which I update new data becomes available.

Please click this LINK to see the Sleep Well Portfolio in full.

[FREE Sample report - 1st, 2nd, 3rd, 4th, 9th]

Below, you can find the links to the first 15 sleep well deep dives:

CrowdStrike - Cloud security leader +27% CAGR since IPO

The VAT Group - Vacuum valve leader +32% CAGR

Shimano - Bike component leader +12% CAGR

Floor and Decor - Future leader in hard-surface flooring +30% CAGR

MIPS - Helmet safety leader +45% CAGR

Thor Industries - RV leader +14% CAGR

NVR - Top US East Coast Hombuilder +30% CAGR

Circle Business Leader [Part 1, Part 2] +24% CAGR

Veeva Systems - Leader in Life Science [Part 1, Part 2] +43% CAGR

Leader in global logistics software [Part 1, Part 2] +31% CAGR

Network security leader [Part 1, Part 2] +13% CAGR

ok

Hi Trung!

Your framework looks really cool! How do you do initial screening to find these niche businesses?