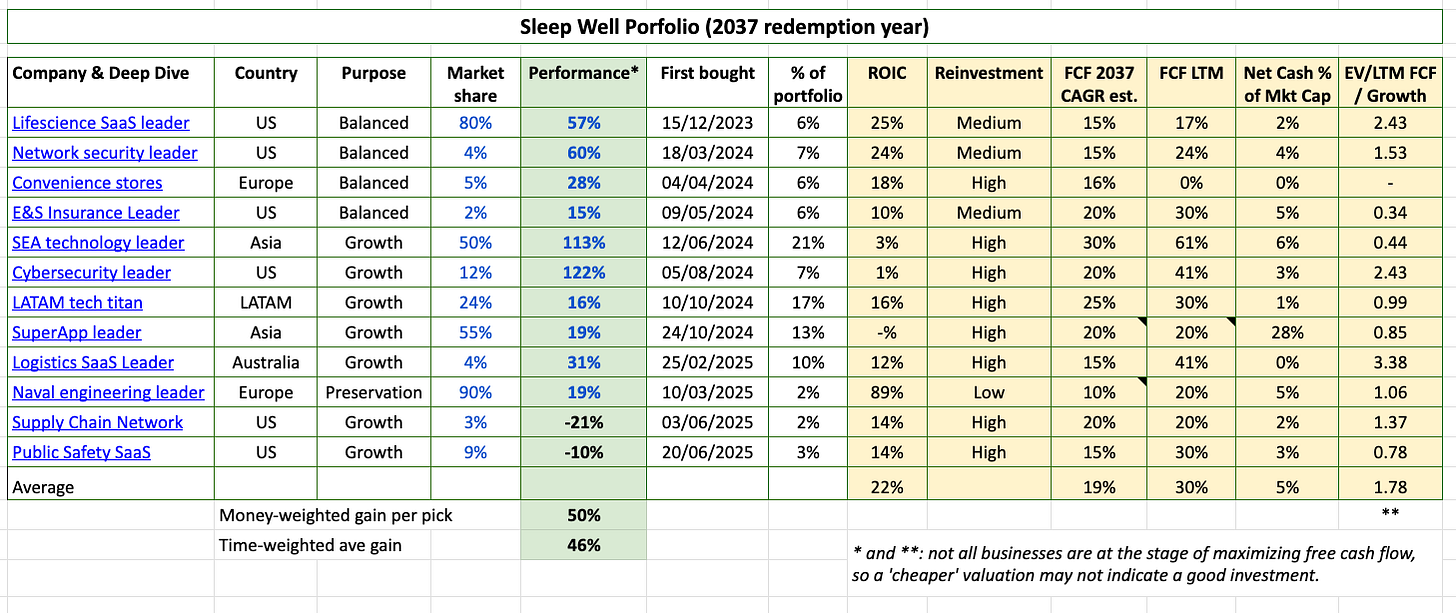

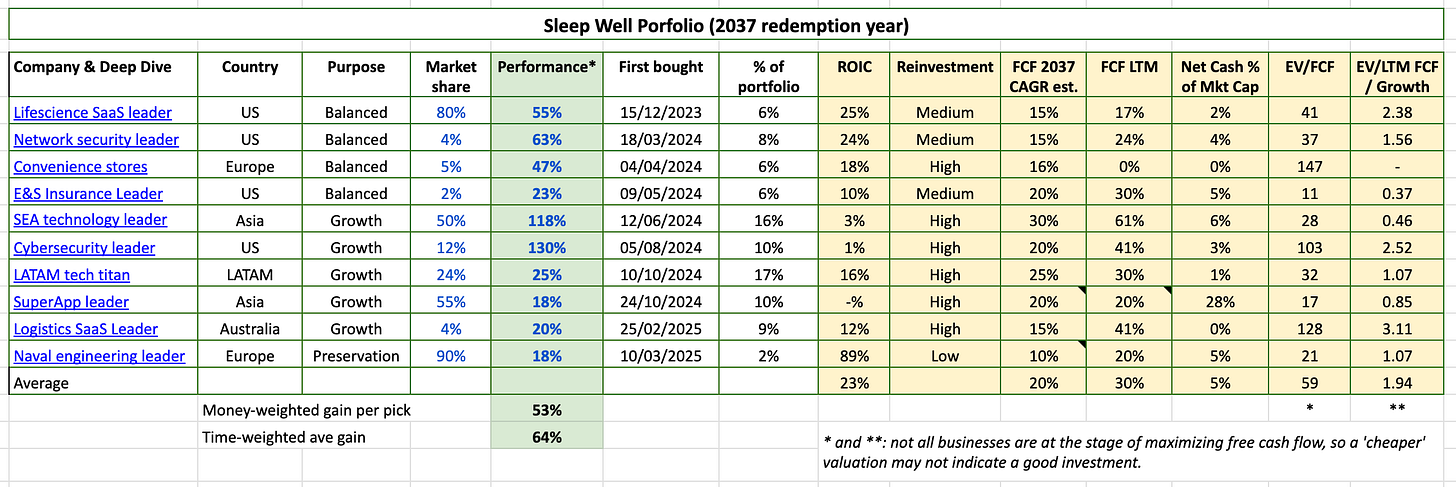

Sleep Well Portfolio (Jul 2025) - First drop (Anticipated), 46% annualised return per pick

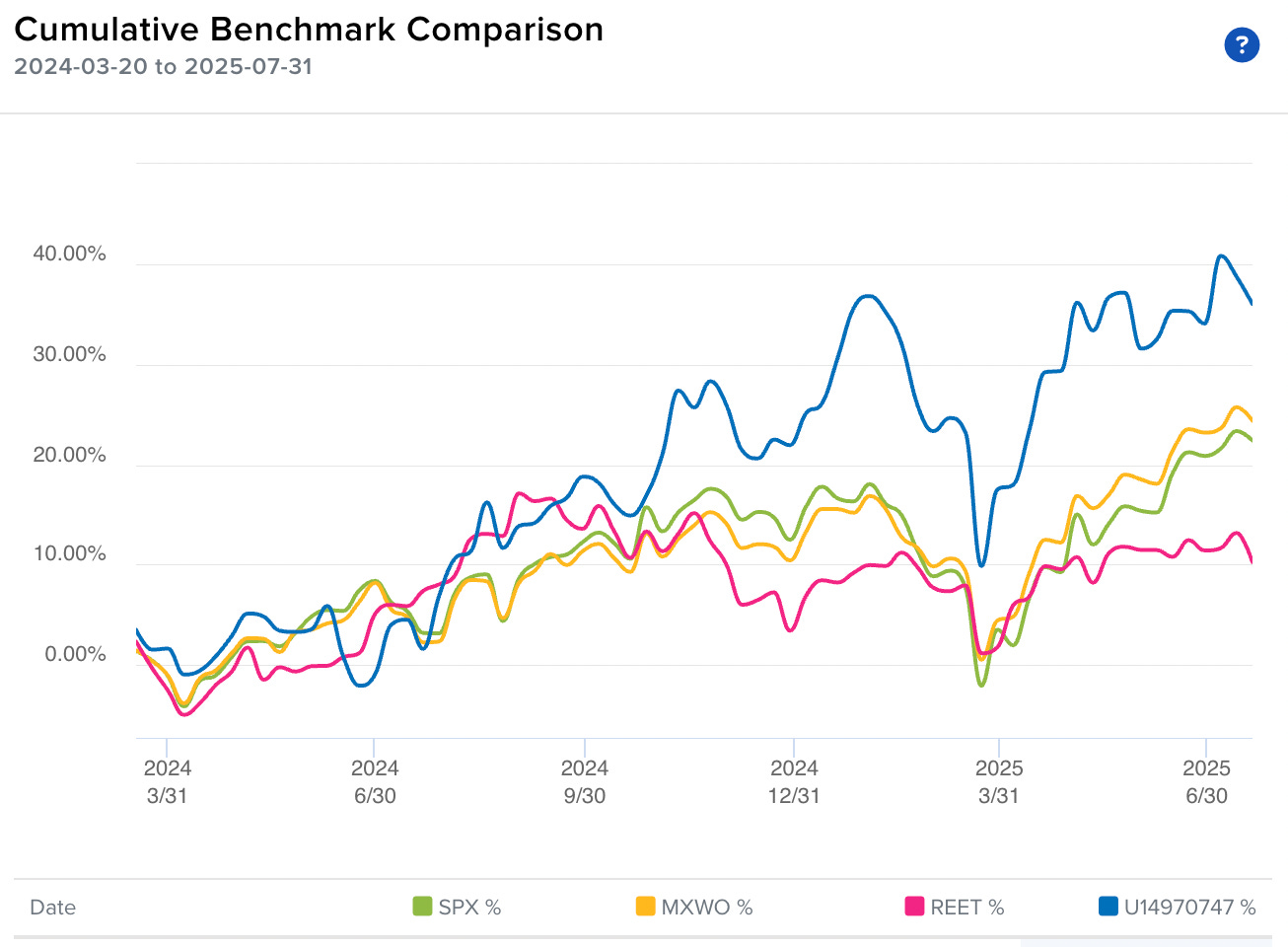

No LOSER status lost; 14% Outperformance vs. S&P500. 46% annualised return per pick, 24/27 transactions were correct (89% success rate).

Hi, I am Trung. I own only niche market leaders. They must pass my initial Sleep-well checklist and perform well in my Thesis Tracker to enter the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

Good morning, sleep-well owners,

The market is back with uncertainties in July after a cheery June. After adding the first position for the 20th and 21st picks. July was about focusing on these two Q2’25 results to ensure the second add would be for the right reasons.

Considering one of the buys dropped by 20% while the business quality remains intact, the Buying plan drawn out in June is working out correctly. The lower price is very welcome, as it allows us to own a little more of the business now.

Both are available at reasonable valuations, between 28-35x free cash flow, offering midterm 15-30% free cash flow growth, pristine balance sheets, and limited competition.

Don’t miss out:

20th sleep well - Supply Chain Network leader [deep dive, 1st buy alert, Q2’25 update]

21st sleep well - Public Safety SaaS leader [deep dive, buy alert]

Buying plan for the 20th and 21st pick

Q2’25 results reviewed so far:

VAT Group - Shares nearing attractive point

18th Sleep Well H1’25 - Hidden growth

20th Sleep Well Q2’25 - Likely Adding More

Coincidentally, both 20th and 21st picks are seeing their founder-CEO, who has held the role for 20 years, step down, so the added leadership uncertainty presents an excellent opportunity to accumulate shares.

Quick overview of July:

The portfolio's annualized return per pick is now 46%, compared to 61% in June, 64% in May, 51% in April, and 38% in March.

NO Loser status is now lost (the two losers are two new buys in June that we had laid out a clear buying plan), with 10/12 making money, and 24/27 transactions were correct decisions.

2025 Year-to-date return was 14% vs S&P500 7.5%: ~6.5% outperformance.

Return from inception was 36% vs. S&P500 22%: 14% outperformance.

How do we do it?

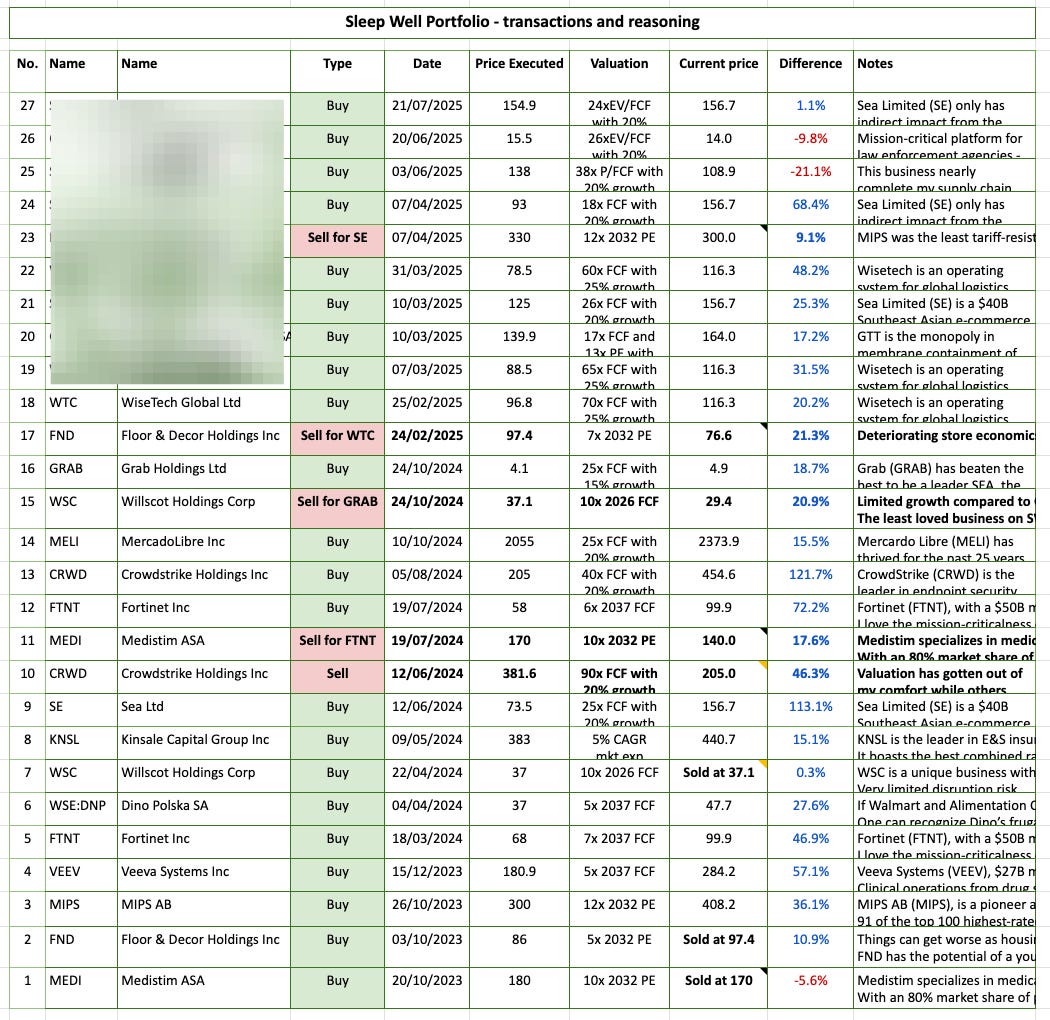

We are active in fearful periods and quiet in happy times. July saw a return of tariff uncertainties, and I am hoping for lower prices in the coming months. It’s a good time to review the tariff resistance health checks I wrote in March. I also reviewed Magnificent Seven, and used the volatility to buy more Sea Limited (up 72%), Wisetech (up 36%), and GTT (up 17%), and sold MIPS (for a 10% gain).

We are focused on owning only the highest-quality businesses. The 20th and 21st picks are the focus for now.

Daily prices and news seldom catch our attention. Stock price fluctuations don’t alter the underlying value of our businesses, so we observe them, buy at fair prices, and keep learning. It’s repeatable.

Remember, Sleep Well is all about not losing. We have likely found a good formula, and I am excited about the future. Time is on our side.

Quality > quantity.

If you are new to Sleep Well Investments, start here.

I am currently relocating to Asia and will review more earning results after mid-August, including those from our largest positions: Sea Limited, Mecardo Libre, and Grab. Schedules below:

**Links to thesis updates, buy-and-sell, and deep dives are all in the Sleep Well Portfolio spreadsheet.

Current portfolio - 2 losers (intended).

Previously June 2025

Previously - May 2025

Previously - April 2025

Previously - Mar 2025

Consider becoming an annual premium member to track the Sleep Well Portfolio, transactions, and Sleep Well scores. The link to the Sleep Well Portfolio Spreadsheet is here. For all other write-ups, click here.

Transactions with notes below:

Performance reporting since inception 36% vs 22% S&P500 - Interactive Brokers:

Expanding investment universe

You will only see me buying businesses that I thoroughly know (see the deep dives below). I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

Thesis tracking updates - linked in spreadsheet

One key reason for my incredible investment decision record so far is that I have a tracking system that allows me to observe the progress of my businesses over time. You can track the table and notes in the spreadsheet linked next. However, it’s only for annual premium readers.

**Links to thesis updates, buy-and-sell, and deep dives are all in the Sleep Well Portfolio spreadsheet. (Annual Sub only)

Businesses I am currently considering and Sleep Well Picks to add now.

A basket of luxury (LMVH, Hermes, Kering, Brunello, Ferrari), ASML, Evolution Gaming, Airbnb, Ferguson, TerraVest, IES Holdings, Teqnion AB, Manhattan Associates, Grupo Aeroportuario del Centro Norte, Uber, Veralto, Nekkar, Subaru, Axon, TMO.

See the Sleep Well Portfolio spreadsheet (Annual Sub only) for a complete list and reasoning of what and why (and why not) I am studying them.

Sleep well picks that are good buys right now.

As I write, I believe the following businesses are still good buys.

Please review the deep dives and updates before considering a purchase of these businesses. If you don’t know what you own, you won’t know what to do with your shares when the market overreacts.

20th sleep well - Supply Chain Network leader [deep dive, 1st buy alert, Q2’25 update]

21st sleep well - Public Safety SaaS leader [deep dive, buy alert]

Mercado Libre - most impressive execution amid political uncertainties.

[The Most Sleep Well Investment Of LATAM, Tariff Review, Top pick for 2025, Q4’24, Q3’24, Buy Alert]

Grab - steady market share gains and profitability amid local competition.

[deep dive, Tariff Review, Q4’24, local competition, buy alert, Q3’24 update]

Veeva Systems - no viable alternative within the life science SaaS, Salesforce + IQVIA partnership is a disjointed solution. [deep dive part 1, part 2, Tariff Review, Q3’24, CRM+ IQVIA]

Sea Limited - Return of growth in the former core segment (gaming), with the e-commerce arm starting to become profitable, driven by low-cost logistics, the fintech arm generating significant profits, and advertising just getting started. [deep dive, buy alert 3, buy alert 2, buy alert 1, Tariff Review, Q3’24, Q2’24 update]

Logistics Leader - less expensive given the leadership instability (a temporary issue, in my opinion). [deep dive, Tariff Review, Buy alert 1, Buy alert 2, H125 update, CEO update, FY24 update]

Naval Engineering gold standard - indisputable leader and a good candidate to preserve wealth. [deep dive, BUY, Tariff Review]

VAT - pick and shovels of the semiconductor and AI mega trend. [Q2’25, Q1’25, Tariff Review, Top pick beyond 2025, Deep dive]

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—46% annualized time-weighted. Only 2/12 are losers (intended).

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of investment framework to help find quality companies and execute with discipline.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.