SWI's Framework - Averaging Up Stocks That Had Soared

Also, comments on the recent dip in share price

Hi, I am Trung. I deep-dive into market leaders that passed my sleep-well checklist. I follow up on their performance with my Thesis Tracker updates, and when the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my daughters to redeem in 2037. I disclose my reasoning for all BUY and SELL (ideally never). Access all content here.

How I average up, and note on recent dip.

I am building the egg nest for 2037, when my first daughter turns 18. So, until then, as long as the portfolio businesses create more value per share than the % gain in the share price, I will continue to take advantage of dips.

It’s simple but not easy to execute (if you can’t control your dopamine level).

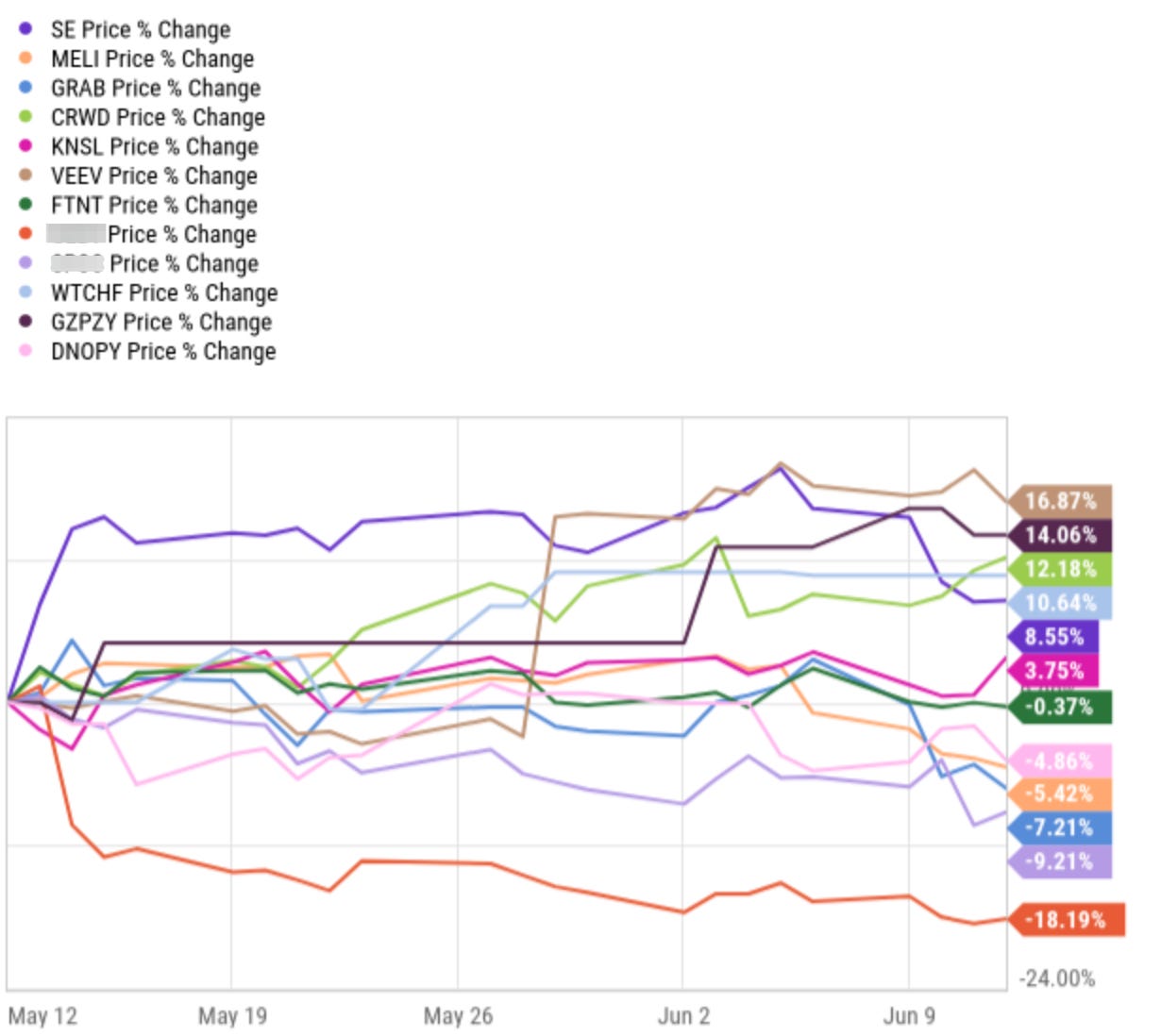

The following chart shows the price changes from last month. Bright orange is the 21st pick, which has dropped the most, by -18%. The setup is similar to Wisetech’s 25% drop in January (which it mostly recovered from) and the 20th pick’s CEO uncertainties in recent months, which partly caused the share price to drop by ~10%.

The remaining picks have only dropped a little, namely Grab, Meli, and Dino Polska. Sea Limited dropped in the last week after news of Meli’s increasing investments in logistics (more free shipping for lower ASP items) in Brazil to counter Sea Limited’s formidable growth in the region (10% of Sea’s total GMV and 40% of Meli’s Brazil GMV).

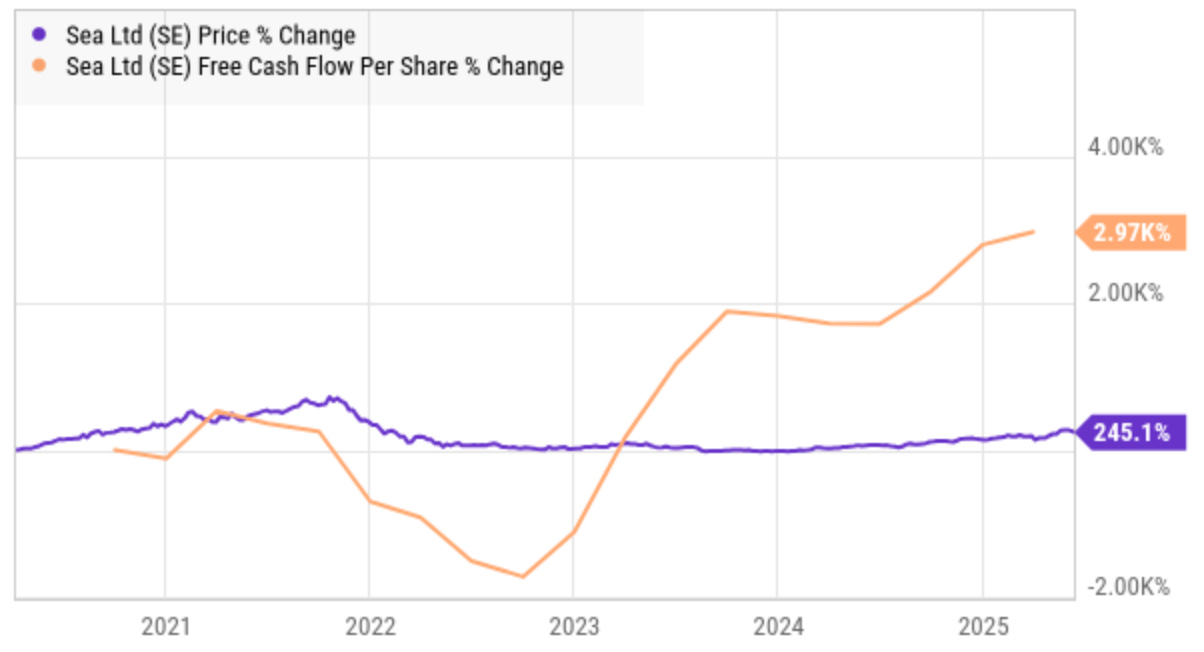

So, the dip isn’t tempting me yet. I am not after a few % gains, and I want to continue adding to companies that can create value (free cash flow per share) faster than their share price rises.

This indicates that they have created more value than the market is giving them credit for, and this should be reflected in a higher multiple. Some have duly received this, but I argue that as fcfps grows faster, the multiple can still rise. Let's look at a few charts.

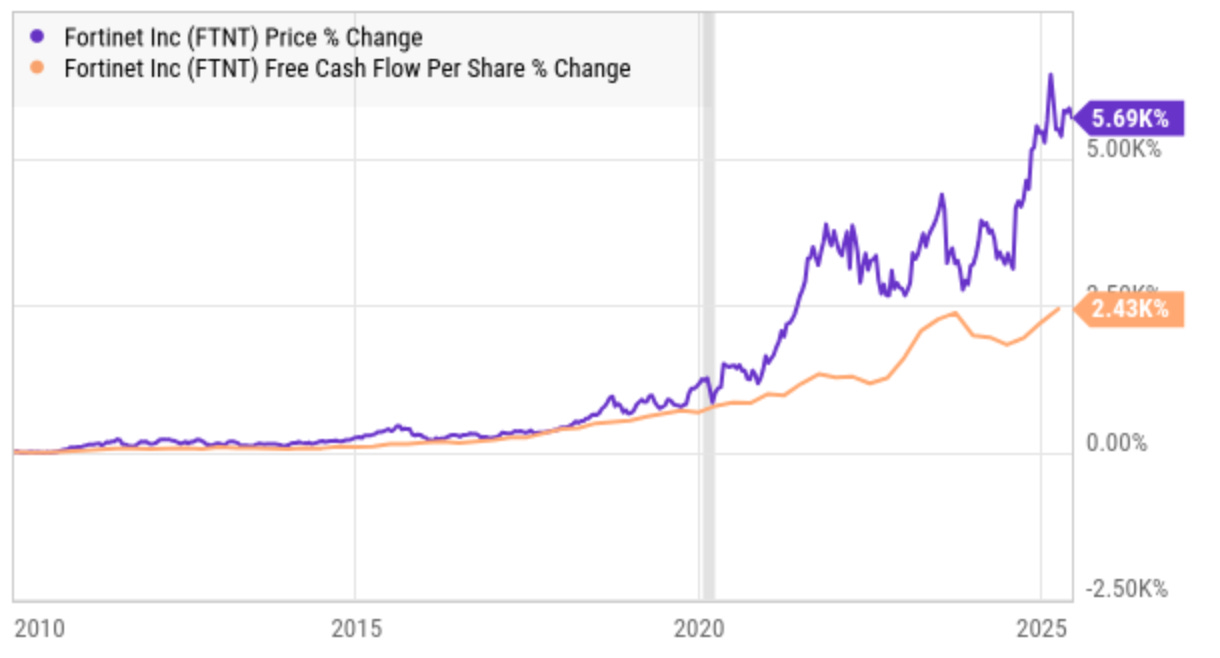

Since its IPO, Fortinet’s value creation has been more than 2x the share price gain.

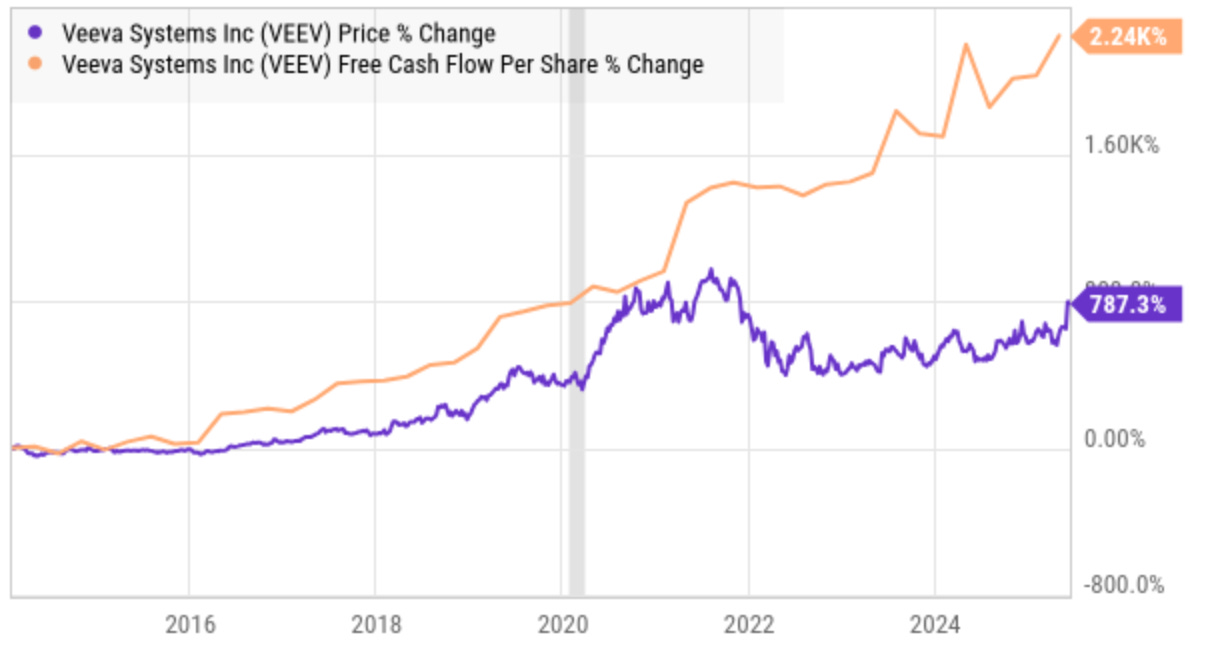

Veeva’s 3x

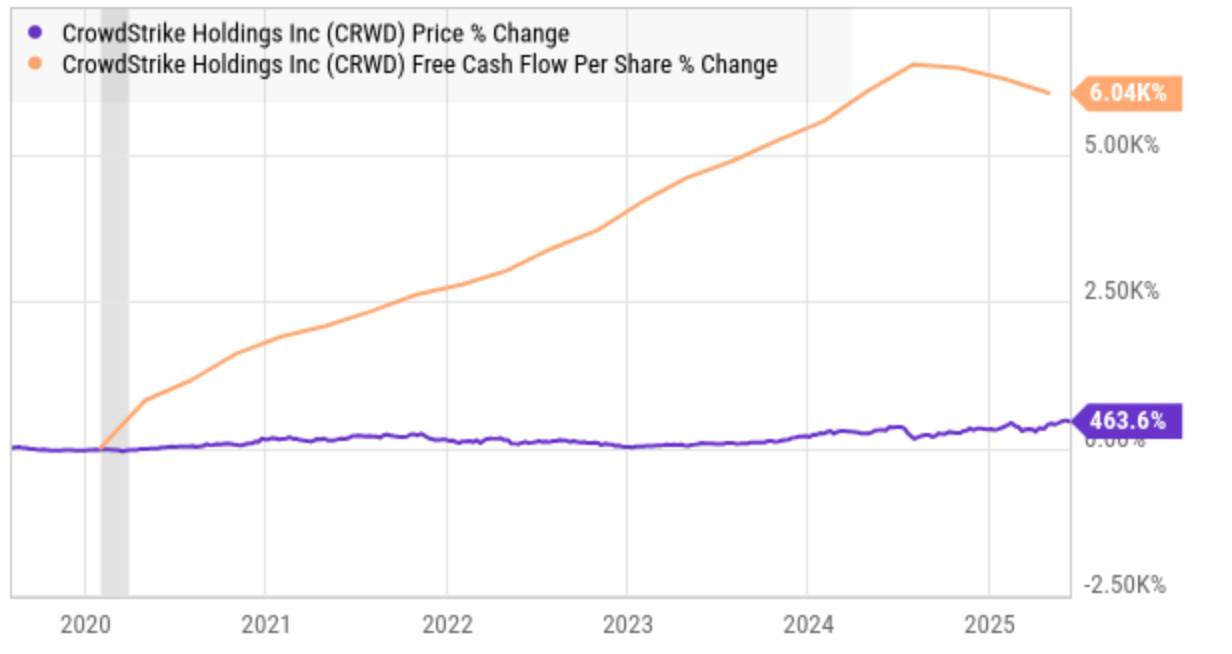

Since turning positive, Crowdstrike’s free cash flow per share has grown more than ten times the share price gain.

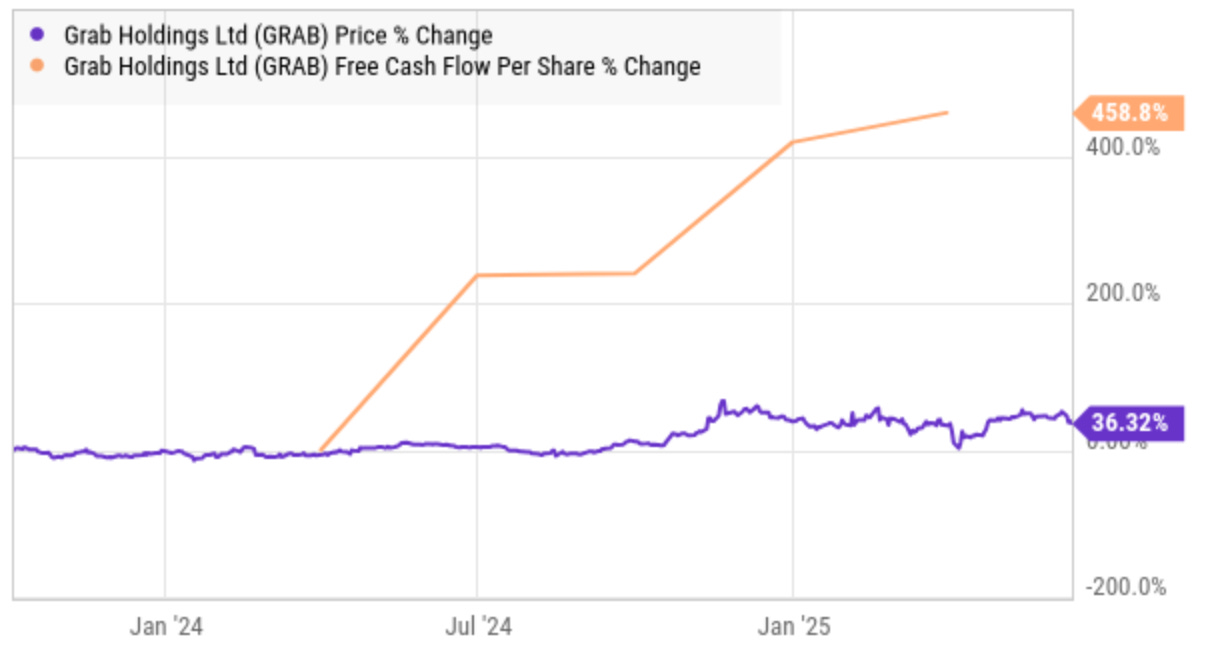

Grab has also performed similarly, growing free cash flow per share 10 times more than the growth of its stock.

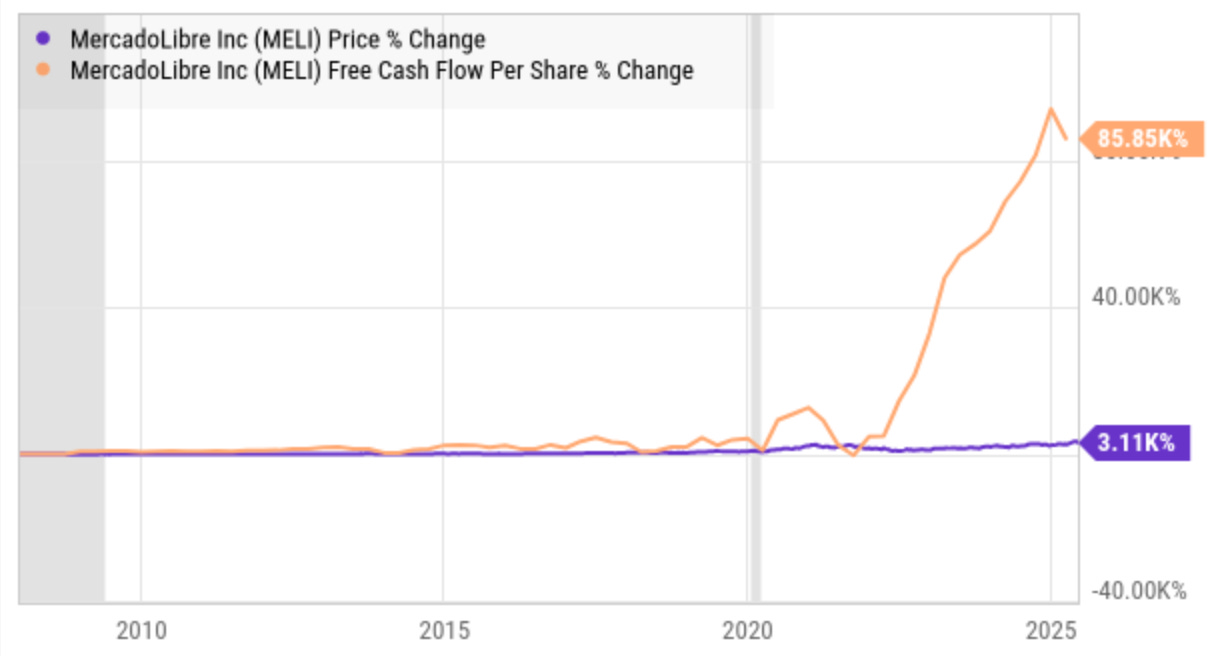

Meli, 28 times, is the most impressive!

Sea Limited, created value 12 times the stock gains, is only getting started as Shopee, the largest division, has only turned profitable in the last few quarters.

I purposely left out a few to reserve the best for paid members.

So, despite the dip not being as ‘attractive’ as it looked in the past month, zooming out to years and decades, you can see which company has consistently created value to shareholders.

I consider investing like a long hike over the mountains. I visualize the destination as a motivation while enjoying my current view (i.e., keeping things simple).

Caveats: I have a high degree of confidence that the destination is worthwhile (owning niche leaders) and that my path (selection process) to get there is directionally correct, so I worry very little over small market dips.

Averaging up - aka ‘watering flowers’

Before you leave, I’d like to share a question from a member regarding my framework for averaging up positions that have run up significantly (10/11 positions have done this).

Averaging up is like taking extra care of your flowers. You want to ensure they continue adding the most value to your portfolio.

Additionally, I don’t wait until everyone thinks it’s cheap, and I try to strike a balance between making money and avoiding decision fatigue.

I hope you find the question and answer useful. I am a student of the market (not a slave to money) and welcome your feedback.

See you next week!

Sleep well,

Trung