Sleep Well Portfolio (Aug 2025) - 50% annualised return per pick, New Pick Preview

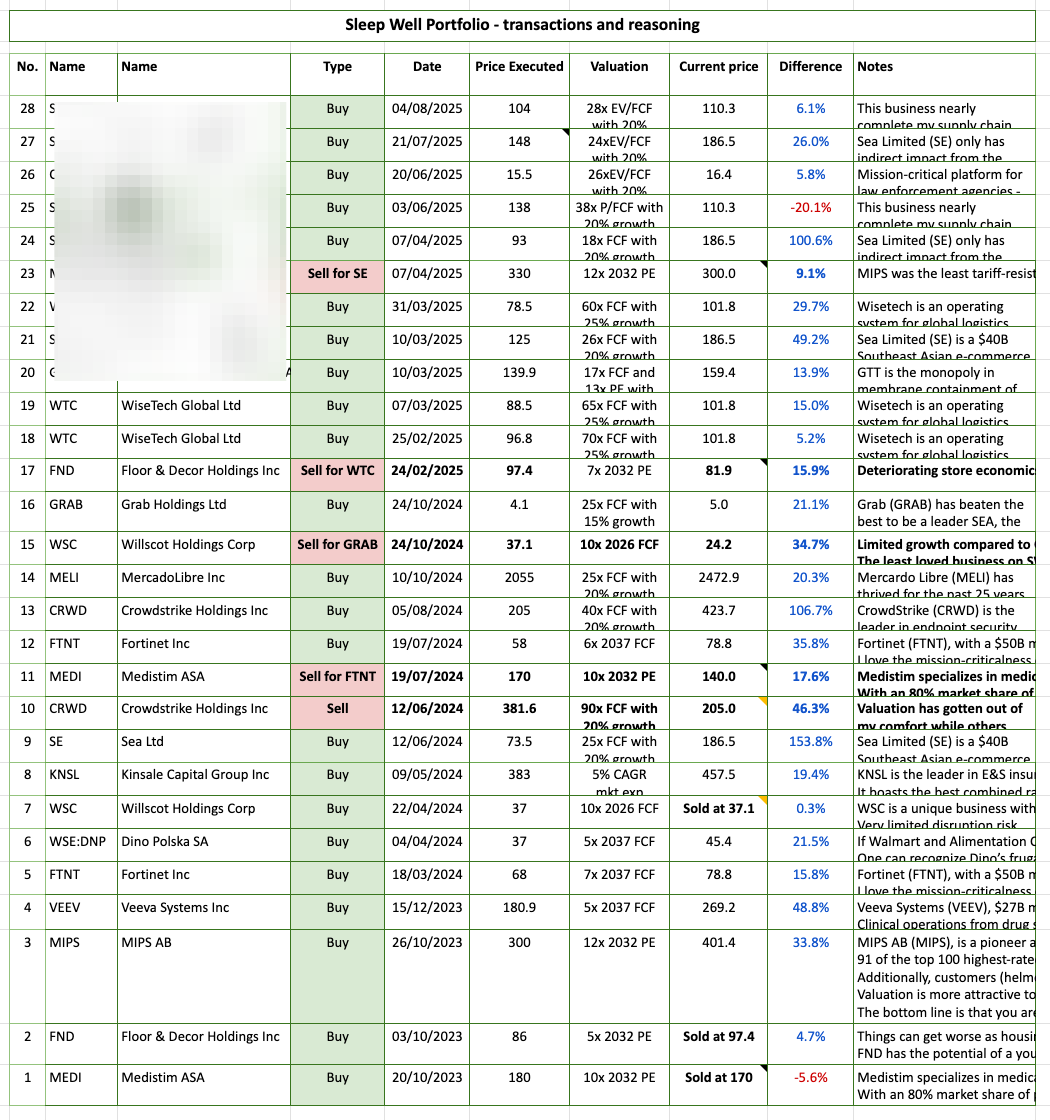

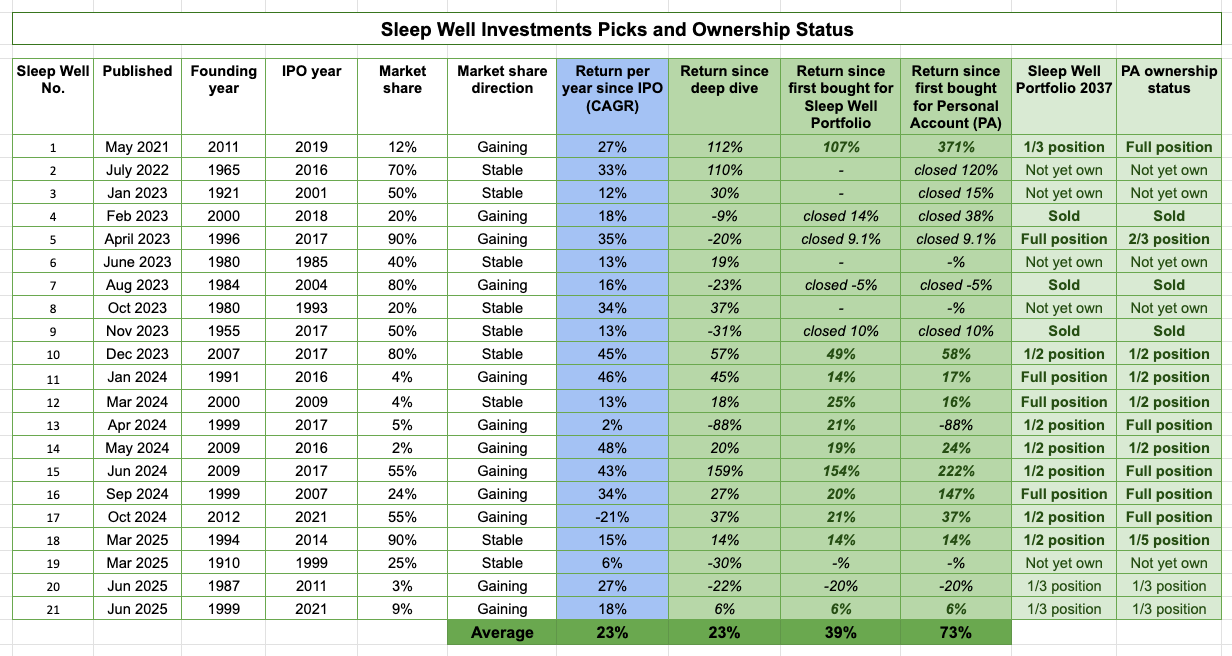

One loser out of 12 holdings; 11% Outperformance vs. S&P500. 50% annualised return per pick, 26/28 transactions were correct (93% success rate).

Sleep Well Portfolio consists of only time-tested leaders. We screen them through a rigorous checklist and track their thesis regularly to know when to buy. So far, we have only had one loser, and 26 out of 28 transactions have been profitable. All about us here.

Good morning, sleep-well owners,

We are working on the 22nd sleep-well pick.

<$1B market cap expanding outside of the medical devices sector,

Operating margin above 35%, patent-backed, and growing by more than 100%,

Valuation lower than peers

The pick strikes a balance between innovation, market relevance, pricing power, and a reasonable valuation. I hope to get the work out in a week.

In August, we also focused on the 20th and 21st picks and successfully capitalized on the price falls following their Q2 Results.

Facts didn’t change, and we added more shares.

We also capitalized on the falling prices of our top position, Sea Limited, now sitting on a 150% gain. The company remains misunderstood and is still a candidate for further additions.

Our future performance will come from having a ‘no loser’ policy and also from betting big when the odds of being right are high. Sea Limited accounts for 24% of the portfolio and is the top performer (150% gain). We have performed well on the first (11 out of 12 holdings are green), and we strive to improve on the second.

We have likely found a good formula, and I am excited about the future. Time is on our side.

Quality > quantity.

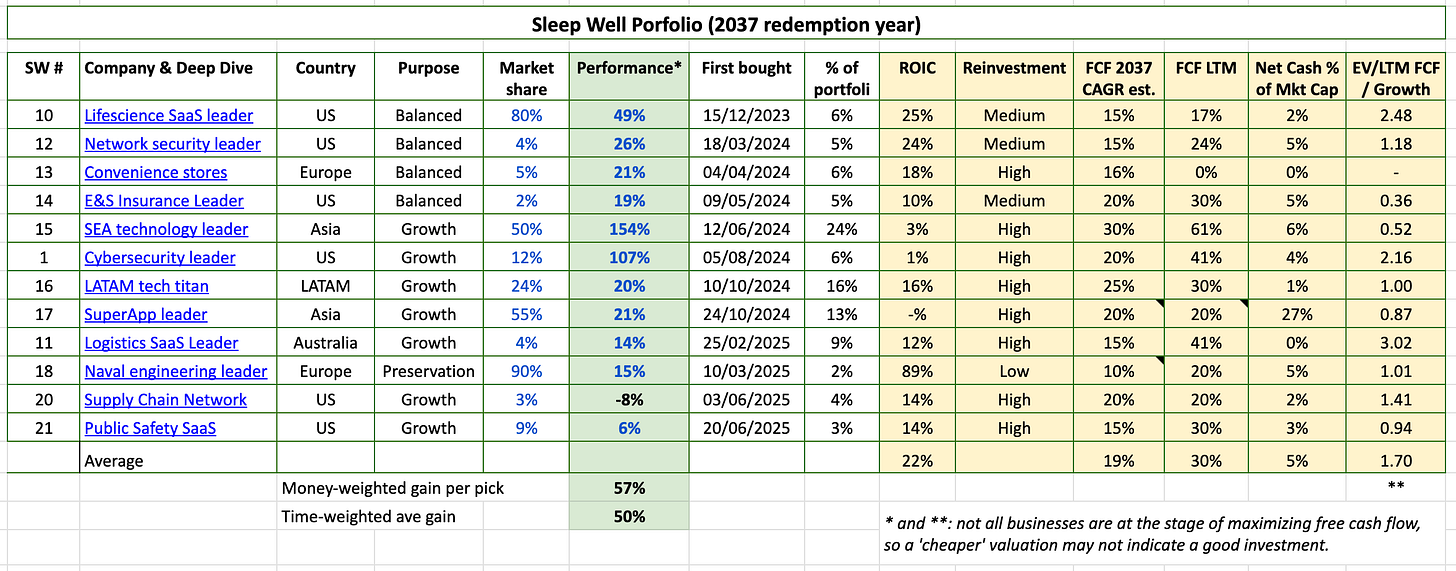

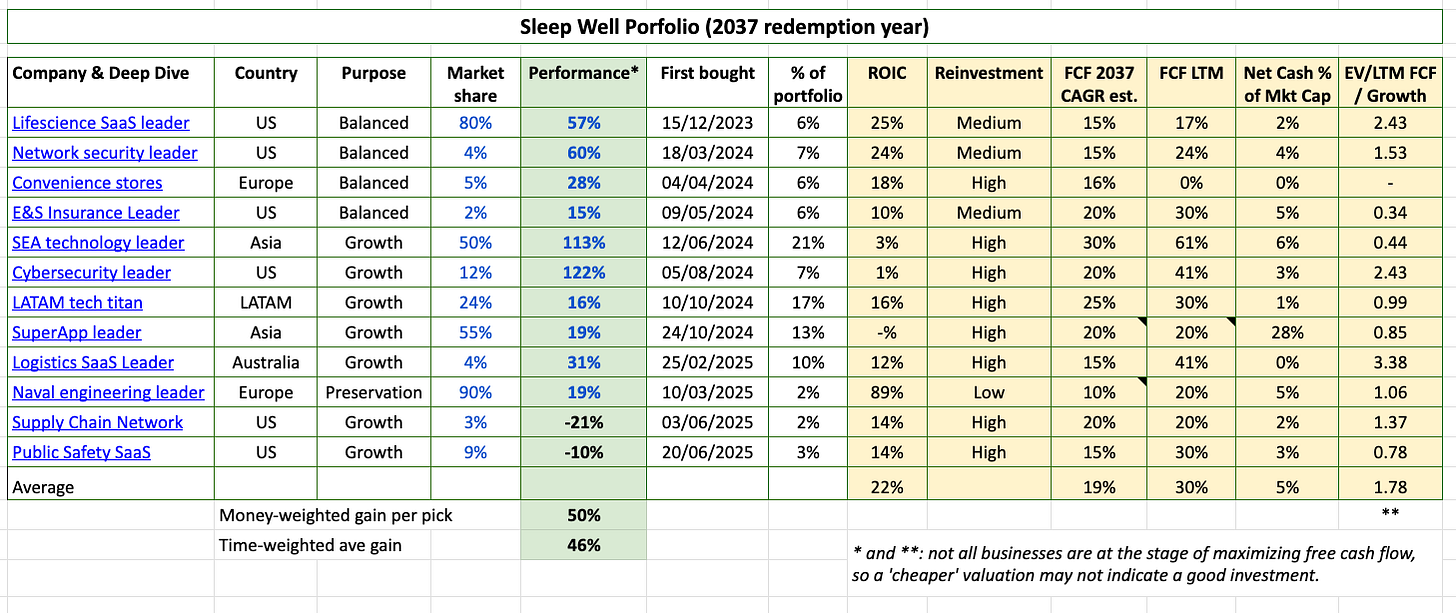

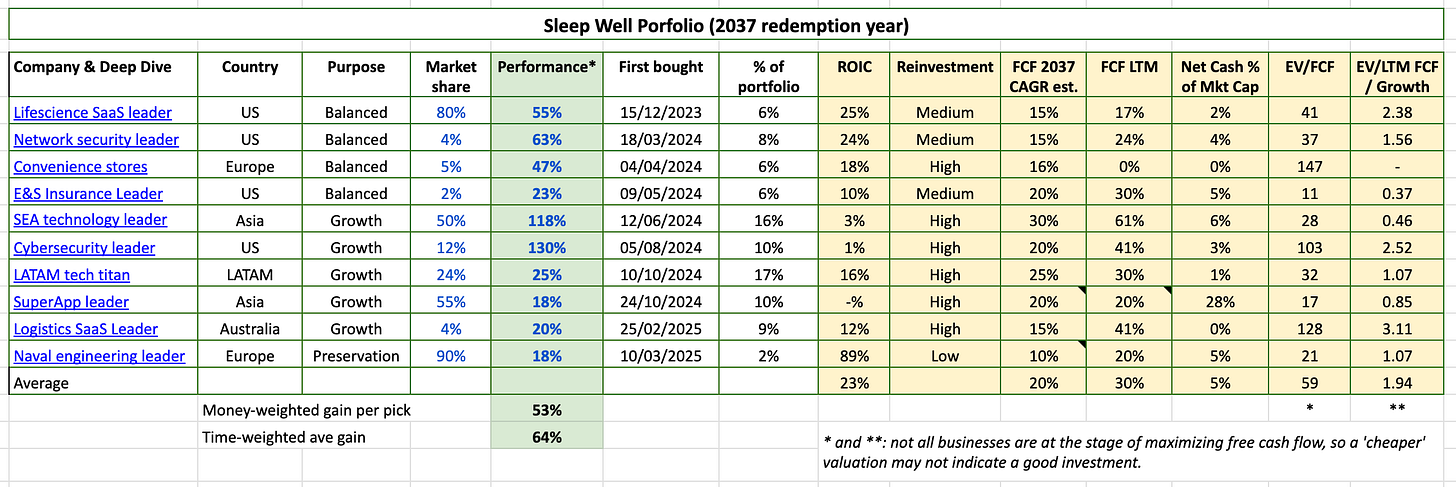

Portfolio results in August

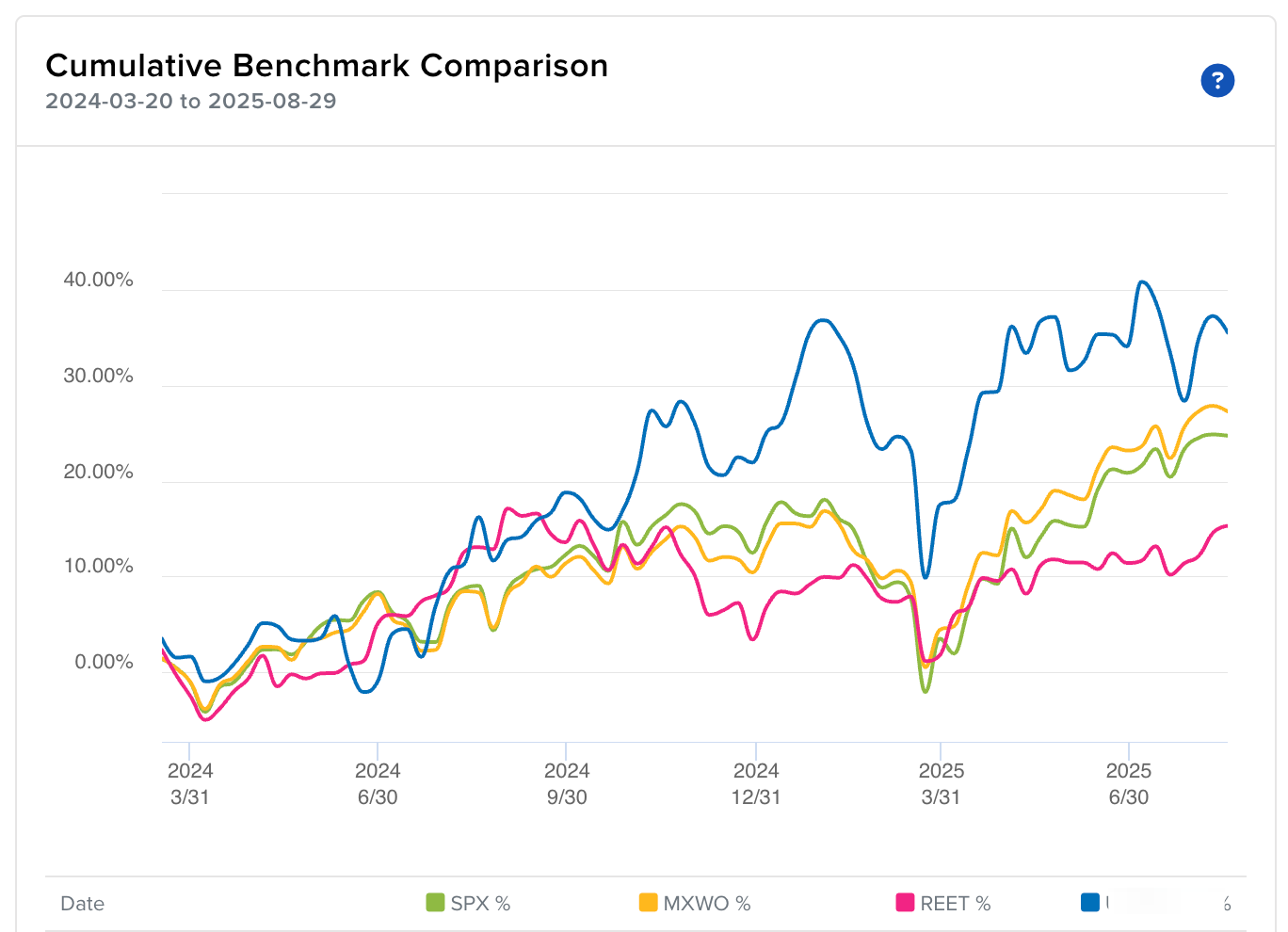

Picks’ annualized return is now 50%, compared to 46% in July, 61% in June, 64% in May, 51% in April, and 38% in March.

NO Loser status is now lost, with 11/12 making money, and 26/28 transactions were correct decisions.

2025 Year-to-date return was 14% vs. S&P500 9%: ~5% outperformance.

Return from inception was 35% vs. S&P500 24%: ~11% outperformance.

How did we capitalize on the two buys in August? Read the following articles

20th sleep well - [deep dive, 2nd buy, 1st buy, Q2’25 update]

Buying plan for the 20th and 21st pick

Adding to my top position [deep dive, 4th buy, 3rd buy, 2nd buy, 1st buy, tariff review, Q2’25, Q1’25, Q4’24, Q3’24, Q2’24 update]

In July and Aug, we reviewed Q2’25 results:

VAT Group - Shares nearing an attractive point

18th Sleep Well H1’25 - Hidden growth

20th Sleep Well Q2’25 - Likely Adding More

Sea Limited Q2’25 - The best is yet to come

21st Pick Q2’25 - The market doesn’t understand

Mercado Libre Q2'25 - Shopee's Success Is Causing Troubles

New to SWI?

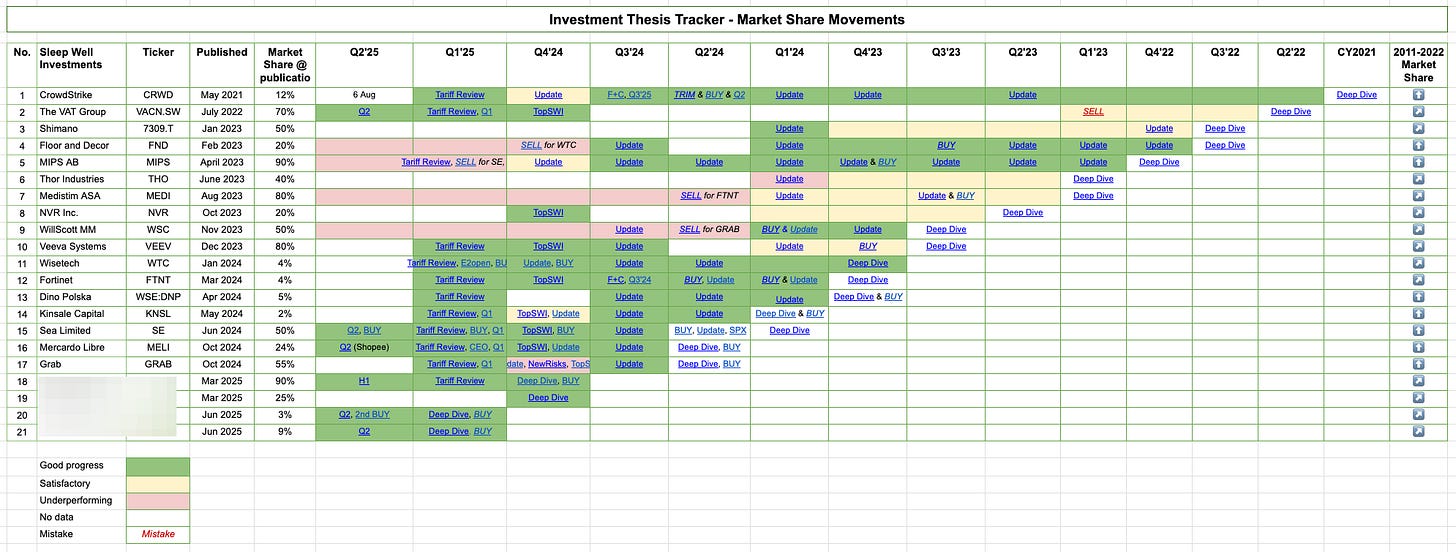

If you are an annual premium member, all essential write-ups on our picks are on this tracking sheet.

**The spreadsheet contains all the links to thesis updates, buy-and-sell, and deep dives.

Current portfolio - 1 loser

Previously, July 2025 - 2 losers

Previously, June 2025

Previously, May 2025

Previously, April 2025

Previously, Mar 2025

Transactions with notes below:

Performance reporting since inception 35% vs 24% S&P500 - Interactive Brokers:

Expanding investment universe

You will only see me buying businesses that I thoroughly know (see the deep dives below). I’ll expand the list when I find ones that pass the Sleep Well Investments checklist.

Thesis tracking updates - linked in spreadsheet

One key reason for my impressive investment decision record so far is the tracking system I employ. You can track the table and notes in the spreadsheet linked next. However, it’s only for annual premium readers.

**Links to thesis updates, buy-and-sell, and deep dives are all in the Sleep Well Portfolio spreadsheet. (Annual Sub only)

Businesses I am currently considering and Sleep Well Picks to add now.

A basket of luxury (LMVH, Hermes, Kering, Brunello, Ferrari), ASML, Evolution Gaming, Airbnb, Ferguson, TerraVest, IES Holdings, Teqnion AB, Manhattan Associates, Grupo Aeroportuario del Centro Norte, Uber, Veralto, Nekkar, Subaru, Axon, TMO.

See the Sleep Well Portfolio spreadsheet (Annual Sub only) for a complete list and reasoning of what and why (and why not) I am studying them.

Sleep well picks that are good buys right now.

As I write, I believe the following businesses are still good buys.

Please review the deep dives and updates before considering a purchase of these businesses. If you don’t know what you own, you won’t know what to do with your shares when the market overreacts.

20th sleep well - Supply Chain Network leader [deep dive, 2nd buy, 1st buy, Q2’25 update]

21st sleep well - Public Safety SaaS leader [deep dive, 1st buy]

Mercado Libre - most impressive execution amid political uncertainties.

[The Most Sleep Well Investment Of LATAM, Tariff Review, Top pick for 2025, Q4’24, Q3’24, Buy Alert]

Grab - steady market share gains and profitability amid local competition.

[deep dive, Tariff Review, Q4’24, local competition, buy alert, Q3’24 update]

Veeva Systems - no viable alternative within the life science SaaS, Salesforce + IQVIA partnership is a disjointed solution. [deep dive part 1, part 2, Tariff Review, Q3’24, CRM+ IQVIA]

Sea Limited - Return of growth in the former core segment (gaming), with the e-commerce arm starting to become profitable, driven by low-cost logistics, the fintech arm generating significant profits, and advertising just getting started. [deep dive, 4th buy, 3rd buy, 2nd buy, 1st buy, tariff review, Q2’25, Q1’25, Q4’24, Q3’24, Q2’24 update]

Logistics Leader - less expensive given the leadership instability (a temporary issue, in my opinion). [deep dive, Tariff Review, Buy alert 1, Buy alert 2, H125 update, CEO update, FY24 update]

Naval Engineering gold standard - indisputable leader and a good candidate to preserve wealth. [deep dive, BUY, Tariff Review]

VAT - pick and shovels of the semiconductor and AI mega trend. [Q2’25, Q1’25, Tariff Review, Top pick beyond 2025, Deep dive]

Sleep Well Portfolio reviews

How can Sleep Well Investments help you?

High success rate stock picks—50% annualized time-weighted. Only 1/12 are losers.

High-quality research and detailed follow-up. Buy and verify.

Free samples of deep dives, tracking updates, and buy alerts.

Free knowledge of the investment framework to help find quality companies and execute with discipline.

Free book reviews on Pulak Prasad’s, Terry Smith's (15% CAGR), Scott Fraser's (19% CAGR), Ralph Wanger's (16% CAGR), and Peter Lynch's (29% CAGR) teaching.